Japan's Antitrust Update: Navigating the Invoice System and Abuse of Superior Bargaining Position

TL;DR

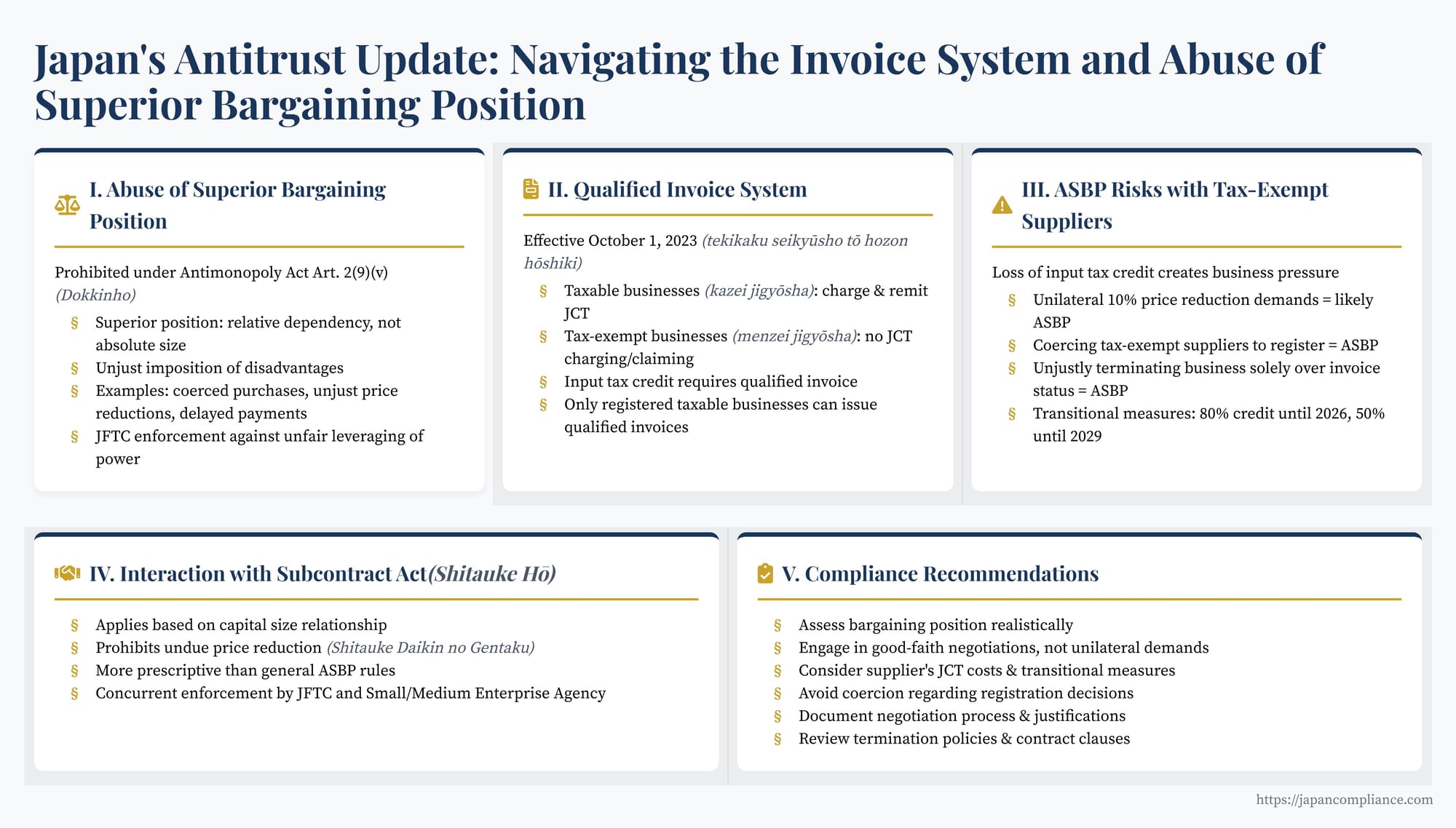

Japan’s new Qualified Invoice System makes purchases from tax-exempt SMEs costlier for taxable buyers. Demanding automatic 10 % price cuts or coercing suppliers to register as taxable businesses may breach the Antimonopoly Act’s “Abuse of Superior Bargaining Position” (ASBP) rules—and, for smaller subcontractors, the Subcontract Act. Negotiate in good faith, document cost-sharing, and avoid retaliation to stay compliant.

Table of Contents

- Understanding Abuse of Superior Bargaining Position (ASBP)

- The Japanese Consumption Tax & the Qualified Invoice System

- Invoice System Impact & ASBP Risks with Tax-Exempt Suppliers

- Interaction with the Subcontract Act (Shitauke Hō)

- Compliance Recommendations for International Businesses

- Conclusion: Ensuring Fair Play in a Changing Tax Landscape

Japan's Antimonopoly Act (Dokkinho) plays a crucial role in ensuring fair competition, and one area receiving significant attention, particularly for companies dealing with suppliers and subcontractors, is the prohibition against Abuse of Superior Bargaining Position (yuetsu-teki chii no ran'yo). This concept, which prevents companies with stronger negotiating power from imposing unfair disadvantages on their business partners, has recently come into sharp focus due to systemic changes in Japan's Consumption Tax (JCT) system – namely, the introduction of the Qualified Invoice System.

For US and other international businesses operating in Japan, understanding the nuances of Abuse of Superior Bargaining Position (ASBP) and its intersection with the new invoice system is vital for maintaining compliant and healthy relationships with Japanese suppliers, distributors, and other counterparties. Failure to navigate these rules carefully can lead to investigations, corrective orders, and reputational damage under the watchful eye of the Japan Fair Trade Commission (JFTC). This article explores the concept of ASBP under the Dokkinho, explains the impact of the Qualified Invoice System, and provides practical guidance for businesses to mitigate compliance risks.

Understanding Abuse of Superior Bargaining Position (ASBP)

ASBP is prohibited under Article 2(9)(v) of the Antimonopoly Act. Unlike cartel or monopolization provisions that focus on market structure or explicit collusion, ASBP targets the conduct within a specific bilateral business relationship where one party holds a position of relative strength over the other.

Key Elements:

To establish ASBP, three core elements generally need to be present:

- Superior Bargaining Position: The company allegedly engaging in the abuse must hold a superior bargaining position relative to the counterparty. This isn't about absolute size but about the counterparty's dependence. Factors considered include:

- Significant difference in business scale.

- The counterparty's degree of dependence on transactions with the company (e.g., high percentage of revenue derived from the company).

- The company's position in the market (e.g., dominant brand, essential facility).

- The difficulty for the counterparty to switch to alternative business partners.

- The essential nature of the goods or services provided by the company to the counterparty's business operations.

It's a relative assessment based on the specific relationship.

- Unjust Imposition of Disadvantage: The company must leverage its superior position to impose terms, conditions, or requests that are disadvantageous to the counterparty and deviate from normal, fair commercial practices.

- Causal Link: The disadvantage imposed must be a result of the company utilizing its superior bargaining position.

Common Examples of ASBP:

The JFTC provides guidelines outlining typical examples of ASBP. While not exhaustive, these include:

- Coerced Purchases/Use of Services: Forcing a counterparty to buy products or use services they don't need.

- Requesting Provision of Economic Benefits: Demanding contributions, dispatch of employees without compensation, or other economic benefits unrelated to the core transaction.

- Unjust Returns: Returning goods without justifiable reason (e.g., defects).

- Unjust Price Reductions: Demanding retroactive or unreasonable price cuts without legitimate grounds like cost savings.

- Delayed Payments: Unjustifiably delaying payment beyond standard terms.

- Forcing Transaction Terms: Imposing disadvantageous terms regarding intellectual property, requiring disclosure of confidential information, or setting unfair targets.

- Retaliatory Measures: Treating a counterparty disadvantageously because they reported potential violations to the JFTC or Small and Medium Enterprise Agency.

The Japanese Consumption Tax & The New Qualified Invoice System

A significant regulatory change impacting buyer-supplier relationships and potentially triggering ASBP concerns is the full implementation of the Qualified Invoice System (tekikaku seikyūsho tō hozon hōshiki) for Japanese Consumption Tax (JCT), effective October 1, 2023. Understanding this system is crucial to grasp the related antitrust risks.

- JCT Basics: Japan has a value-added tax system similar to many countries. The standard rate is currently 10% (with a reduced rate of 8% for certain items like food and beverages, excluding alcohol and dining out).

- Taxable vs. Tax-Exempt Businesses: Businesses are categorized as either:

- Taxable Businesses (kazei jigyōsha): Generally, businesses with taxable sales exceeding ¥10 million in their base period (usually two years prior). They charge JCT on their sales and remit the net amount (JCT collected minus JCT paid on purchases) to the government.

- Tax-Exempt Businesses (menzei jigyōsha): Businesses with taxable sales at or below the ¥10 million threshold. They do not charge JCT on their sales and cannot remit JCT. Many small businesses, sole proprietors, and freelancers fall into this category.

- Input Tax Credit (Shiire Zeigaku Kōjo): The core mechanism for avoiding tax cascading. Taxable businesses can deduct the JCT they paid on their business purchases (inputs) from the JCT they collected on their sales when calculating their tax liability.

- The Pre-Invoice System Issue: Before October 1, 2023, taxable businesses could generally claim input tax credits for purchases even from tax-exempt businesses. Although tax-exempt suppliers weren't remitting JCT, the system allowed buyers to credit the JCT amount notionally included in the purchase price. This created a situation where some JCT collected by taxable businesses wasn't fully remitted, sometimes referred to as ekizei (literally "profit tax," though a simplification of a complex issue).

- The Qualified Invoice System (Post-Oct 1, 2023): This system was introduced primarily to ensure accurate tax calculation (especially with multiple rates) and address the ekizei issue.

- Only businesses registered with the tax authorities as "Qualified Invoice Issuers" can issue a "Qualified Invoice."

- To register as a Qualified Invoice Issuer, a business generally must be a Taxable Business. Tax-exempt businesses cannot issue qualified invoices.

- Crucially, for a buyer (taxable business) to claim an input tax credit for a purchase made on or after October 1, 2023, they must receive and retain a Qualified Invoice from the supplier.

Invoice System Impact & ASBP Risks with Tax-Exempt Suppliers

The inability of tax-exempt suppliers (menzei jigyōsha) to issue qualified invoices creates a direct financial impact on their taxable business customers (kazei jigyōsha).

- Loss of Input Tax Credit: When a taxable business purchases goods or services from a tax-exempt supplier after October 1, 2023, they cannot receive a qualified invoice. Therefore, they cannot claim the input tax credit for the JCT nominally included in that purchase price. This effectively increases the net cost of purchasing from tax-exempt suppliers for the taxable buyer. (Note: Transitional measures allow partial credits – 80% until September 30, 2026, and 50% until September 30, 2029 – even without a qualified invoice, but the full credit is lost).

- Pressure on Suppliers: This loss of input tax credit naturally creates pressure for buyers to:

- Demand price reductions from tax-exempt suppliers to offset the lost tax credit.

- Urge tax-exempt suppliers to voluntarily register as taxable businesses (and thus become Qualified Invoice Issuers), potentially increasing the suppliers' own tax and administrative burdens.

- Shift business away from tax-exempt suppliers towards taxable suppliers who can issue qualified invoices.

This is where the risk of ASBP under the Antimonopoly Act becomes acute. The JFTC has issued guidance and addressed consultation cases (including one similar to that mentioned in the Jurist source, published around June 2022) clarifying its stance:

- Price Reductions: Requesting a price reduction from a tax-exempt supplier due to the lost input tax credit is not, in itself, illegal. However, if a company with a superior bargaining position unilaterally demands a price reduction equivalent to the full JCT rate (e.g., 10%) without proper negotiation, this is likely to be considered ASBP.

- Rationale: Genuine negotiation is required. The buyer must consider that the tax-exempt supplier still incurs JCT on its own inputs and cannot claim credits for them. Furthermore, the buyer wasn't necessarily receiving the full 10% "benefit" before the system change due to market pricing dynamics. A fair negotiation should consider the actual impact on both parties. Demanding the supplier absorb the entire impact without discussion is deemed unjust.

- Forcing Registration: Using a superior bargaining position to coerce a tax-exempt supplier into registering as a taxable business against their will can constitute ASBP. Registration involves significant changes for the supplier (tax payments, bookkeeping burdens), and the decision should be theirs.

- Refusal to Deal/Termination: Unjustly terminating business relations with a supplier solely because they choose to remain tax-exempt and cannot issue a qualified invoice can also be problematic under ASBP rules, especially if the buyer holds a superior position. While buyers can choose their suppliers, termination must not be an unfair leveraging of dominant power.

Interaction with the Subcontract Act (Shitauke Hō)

Related to ASBP is Japan's Subcontract Act (Act against Delay in Payment of Subcontract Proceeds, Etc., to Subcontractors, Shitauke Daikin Shiharai Chien tō Bōshi Hō). This law provides specific protections for smaller subcontractors against unfair practices by larger "parent enterprises" (defined based on capital size).

- Overlap with ASBP: Many actions prohibited under the Subcontract Act (like undue price reductions, coerced purchases, unjust returns, delayed payments) also constitute ASBP under the Dokkinho. However, the Subcontract Act applies based on the specific capital relationship between the parties and contains more prescriptive rules and shorter payment terms.

- Undue Price Reduction (Shitauke Daikin no Gentaku): The Subcontract Act specifically prohibits parent enterprises from unduly reducing the subcontract price after the order has been placed, without a reason attributable to the subcontractor. The JFTC has explicitly warned that demanding a price cut from subcontractors (who may be tax-exempt) solely because of the invoice system, without full consultation, likely violates this provision.

- Concurrent Enforcement: The JFTC and the Small and Medium Enterprise Agency enforce the Subcontract Act. Violations related to the invoice system transition could lead to action under both the Antimonopoly Act (ASBP) and the Subcontract Act if the relationship qualifies.

Compliance Recommendations for International Businesses

To navigate the transition to the Qualified Invoice System and mitigate risks under the Antimonopoly Act and Subcontract Act, companies doing business in Japan should consider the following:

- Assess Bargaining Position: Realistically evaluate whether your company holds a superior bargaining position relative to its Japanese suppliers, particularly smaller or highly dependent ones. Consider factors like transaction volume share, switching costs, and market position. If superiority exists, extra caution is needed.

- Engage in Good-Faith Negotiations: If adjustments related to the invoice system are deemed necessary for transactions with tax-exempt suppliers, initiate open and thorough discussions well in advance. Explain the impact of the system change clearly but avoid unilateral demands.

- Understand Supplier Costs: Try to understand the supplier's perspective, including the JCT they incur on their own inputs. A fair negotiation considers the impact on both parties, not just the buyer's lost input tax credit. Remember the transitional measures (80%/50% credits) can also factor into the calculation.

- Avoid Coercion: Do not pressure tax-exempt suppliers to register as taxable businesses. Respect their decision, which may be based on valid considerations regarding their overall tax burden and administrative capacity.

- Justify Price Changes: Any agreed price reduction should be justifiable based on mutual understanding and negotiation, not a unilateral imposition of the full tax amount. Document the negotiation process and the basis for any agreement reached.

- Review Termination Policies: Ensure that decisions to terminate relationships with suppliers are based on legitimate business reasons (performance, quality, overall cost-effectiveness after fair negotiation) and not solely on their tax-exempt status or refusal to issue qualified invoices, especially if a superior position exists.

- Check Contract Clauses: Review standard purchasing agreements and terms to ensure they do not contain clauses that could be interpreted as facilitating ASBP (e.g., clauses allowing arbitrary price reductions).

- Internal Training: Educate procurement, sales, and finance teams about the risks of ASBP and the specific issues arising from the JCT invoice system. Ensure they understand the importance of fair negotiation and avoiding coercive tactics.

- Consider Subcontract Act Applicability: Determine if any supplier relationships fall under the scope of the Subcontract Act (based on capital size criteria). If so, be mindful of its stricter requirements, particularly regarding price reductions and payment terms.

- Consult Legal/Tax Counsel: The intersection of tax law changes and antitrust regulations is complex. Seek advice from experienced Japanese legal and tax professionals regarding specific supplier negotiations, contract reviews, and overall compliance strategy related to the invoice system transition.

Conclusion: Ensuring Fair Play in a Changing Tax Landscape

The implementation of Japan's Qualified Invoice System presents operational and financial adjustments for nearly all businesses. For companies holding a superior bargaining position over their suppliers, it also introduces heightened antitrust risks related to Abuse of Superior Bargaining Position and potential violations of the Subcontract Act. While seeking price adjustments or discussing registration status with tax-exempt suppliers is not inherently illegal, the manner in which these discussions are conducted is critical. Unilateral demands, coercion, and a failure to engage in good-faith negotiations based on mutual understanding can lead to significant legal trouble with the JFTC. By proactively understanding the rules, assessing their relative bargaining power, engaging suppliers fairly, and documenting negotiations, international businesses can navigate this transition successfully, ensuring compliance and maintaining strong, sustainable relationships within their Japanese supply chains.

- Playing a Leading Role? Japan’s Antitrust Surcharge Enhancements for Cartel Facilitators

- Understanding Exclusionary Practices Under Japan’s Antimonopoly Act

- Antitrust Considerations in Japan: Beyond Cartels, Cooperatives, ESG and Human Rights

- JFTC – Guidelines Concerning Abuse of Superior Bargaining Position under the Antimonopoly Act