Playing a Leading Role? Japan's Antitrust Surcharge Enhancements for Cartel Facilitators

TL;DR

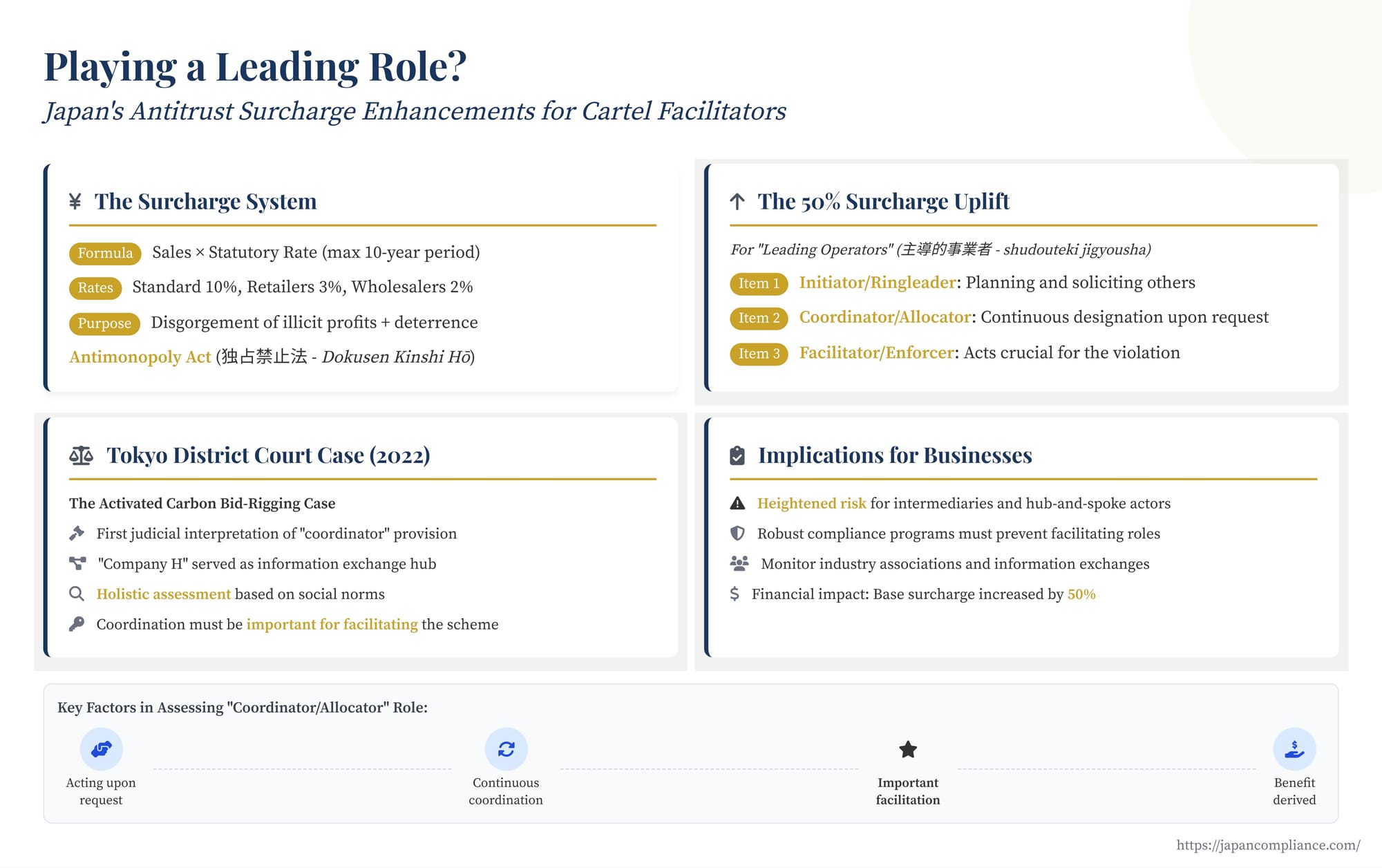

- Japan’s Antimonopoly Act allows a 50 % surcharge uplift for companies deemed “leading operators” in cartels or bid-rigging schemes.

- The Tokyo District Court’s 2022 Activated Carbon decision clarifies how courts decide whether a coordinator/facilitator meets this test.

- Key factors include continuous coordination at others’ request and the importance of that role in enabling the cartel.

- Intermediaries and hub-and-spoke actors face heightened liability; robust compliance programs are essential.

Table of Contents

- The Surcharge System under the Antimonopoly Act (AMA)

- The 50% Surcharge Uplift for "Leading Operators"

- Case Study: Tokyo District Court, September 15, 2022 (Reiwa 4) – The Activated Carbon Case

- Analysis and Implications

- Conclusion

Japan's Antimonopoly Act (Act Concerning Prohibition of Private Monopolization and Maintenance of Fair Trade, commonly known as 独占禁止法 - Dokusen Kinshi Hou or Dokkinhou) rigorously prohibits unreasonable restraints of trade, such as price cartels and bid-rigging (Article 3). Enforcement by the Japan Fair Trade Commission (JFTC or 公正取引委員会 - Kousei Torihiki Iinkai) is active, and violators face significant administrative fines known as surcharges (課徴金 - kachoukin).

A critical, and potentially costly, aspect of this regime is the provision for enhanced surcharges for companies found to have played a "leading role" (主導的事業者 - shudouteki jigyousha) in the anticompetitive conduct. This enhancement can significantly increase the financial penalty, typically by 50%. A recent Tokyo District Court decision interpreting this provision provides valuable insight into how Japanese courts assess such roles, particularly for companies acting as coordinators or facilitators within a cartel, even if they are not the primary actors or initiators. Understanding this framework is vital for businesses operating in Japan to fully grasp their potential antitrust exposure.

The Surcharge System under the Antimonopoly Act (AMA)

When the JFTC finds that companies have engaged in prohibited conduct like cartels or bid-rigging that affects prices, it typically issues a cease-and-desist order and orders the payment of surcharges. The surcharge system aims to claw back illicit profits gained through the anticompetitive conduct and deter future violations.

The basic surcharge amount is calculated by multiplying the total sales (or purchase amount, depending on the violation) of the relevant goods or services during the violation period (up to a maximum look-back period, currently 10 years) by a statutory percentage rate. The standard rate for unreasonable restraints of trade is 10%, although different rates apply to retailers (3%) and wholesalers (2%), and small-to-medium enterprises receive a reduced rate.

The 50% Surcharge Uplift for "Leading Operators"

Recognizing that certain companies play a more central or egregious role in initiating, organizing, or maintaining cartels, the AMA incorporates provisions to increase the surcharge rate by 50% for such "leading operators." This enhancement was introduced in 2009 to more effectively deter conduct that significantly facilitates or sustains anticompetitive schemes.

The relevant provision (currently Article 7-3, Paragraph 2 of the AMA; Article 7-2, Paragraph 8 under the version applicable to the case discussed below) outlines several types of conduct that can trigger this enhancement. These broadly fall into categories such as:

- Initiator/Ringleader: A company that planned the violation and solicited others to participate or coerced them into compliance (Item 1).

- Coordinator/Allocator: A company that, upon request from others, continuously designated the counterparty for transactions, allocated market share, or otherwise coordinated the core aspects of the violation (Item 2).

- Facilitator/Enforcer: A company that engaged in other specific acts crucial for facilitating the violation, such as demanding others comply, requesting non-cooperation with investigations, or concealing the violation (Item 3 under the old law; expanded in current Items 3 & 4).

The recent court decision focused specifically on the interpretation of Item 2, the "coordinator/allocator" role.

Case Study: Tokyo District Court, September 15, 2022 (Reiwa 4) – The Activated Carbon Case

This case involved a JFTC finding that several suppliers of activated carbon had engaged in bid-rigging for tenders issued by local public entities in the East Japan and Kinki regions. The JFTC issued cease-and-desist orders and surcharge payment orders against the participating companies.

The Role of "Company H":

One company ("Company H") was found by the JFTC to have played a unique and central role. While other suppliers ("15 Eastern Japan companies") directly exchanged information regarding bids, they reportedly did so through Company H, allegedly due to their own internal compliance concerns about direct communication. Company H acted as a hub, collecting intended bid winners' preferences, relaying information about competitors' intentions, and coordinating adjustments when preferences overlapped to ensure a single designated supplier for specific tenders.

Although Company H did not necessarily manufacture or directly supply the activated carbon in all instances, it allegedly benefited financially by being inserted into the commercial chain (between the winning bidder and the end customer) for a large majority of the affected contracts, effectively receiving a commission for its coordinating role.

Based on this conduct, the JFTC designated Company H as a "leading operator" under the former AMA Article 7-2, Paragraph 8, Item 2 (the coordinator/allocator provision) and applied the 50% surcharge enhancement. Company H challenged the JFTC's findings, disputing both the existence of the violation itself and its designation as a leading operator.

The Court's Interpretation of a "Leading Operator" (Item 2):

The Tokyo District Court upheld the JFTC's decision, including the leading operator designation. This decision marked the first time a Japanese court provided a detailed interpretation of this specific provision (former Item 2). The court established the following standard for assessment:

- Holistic Assessment: Determining whether a company acted as a coordinator/allocator under Item 2 requires a comprehensive evaluation based on societal norms (社会通念 - shakai tsuunen). It's not a purely formalistic check.

- Key Factors: The assessment should consider:

- The background and circumstances leading to the violation.

- The relationship between the alleged leading operator and the other participants.

- The specific nature, manner, and extent of the alleged leading operator's involvement (the "designation" or coordination activities).

- Crucial Element: Facilitation and Importance: A critical factor is whether the designation/coordination activities performed by the alleged leading operator were important for facilitating the overall anticompetitive scheme.

Application to Company H:

Applying this standard, the court found that Company H indeed met the criteria for a leading operator under Item 2:

- Requested Role: The other 15 companies, due to compliance concerns, specifically requested and relied on Company H to act as the central intermediary for information exchange and bid allocation.

- Continuous and Substantive Coordination: Company H actively and continuously engaged in coordination across numerous tenders (288 identified). This involved more than passive message relay; it included collecting preferences, communicating conflicting interests, and actively adjusting allocations to ensure the scheme functioned smoothly.

- Importance for Facilitation: The court explicitly found that Company H's coordinating actions were "important" for facilitating the overall bid-rigging agreement among the 15 suppliers. Without this central hub, the coordination would likely have been much more difficult or impossible given the participants' stated reluctance to communicate directly.

- Leverage and Benefit: Company H's coordinating role was not gratuitous. It secured a position in the sales channel for over 200 contracts, deriving revenue as a direct result of its coordinating activities. This benefit gave Company H leverage, making it difficult for the other participants to ignore its proposals or adjustments.

Based on the comprehensive consideration of these factors, the court concluded that Company H, acting alone upon the request of the other participants, continuously designated the intended suppliers (供給予定者 - kyoukyuu yoteisha) for the specific tenders, thereby fulfilling the requirements of Item 2.

Other Key Findings:

- Duration of Conduct: The court clarified that the leading operator conduct does not need to persist throughout the entire duration of the underlying violation. Engaging in such conduct during part of the violation period is sufficient to trigger the surcharge enhancement for the entire calculation base (relevant sales during the full violation period).

- Hub-and-Spoke Liability: The court also affirmed that Company H, despite its intermediary role and not always being the direct supplier, was a party to the illegal bid-rigging agreement itself, given its active coordination and the benefits received, rejecting any argument that it was merely an outside facilitator.

Analysis and Implications

This Tokyo District Court decision provides crucial clarification on the application of Japan's leading operator surcharge enhancement.

Substantive Assessment is Key: The judgment firmly establishes that designating a company as a leading operator, particularly under the coordinator/allocator provision (Item 2), requires more than simply observing coordination activities. Courts will undertake a substantive, holistic assessment, focusing on the importance of the company's role in facilitating the overall anticompetitive conduct. This moves the analysis beyond a tick-box exercise based on the statutory text.

The Role of "Importance": The court's emphasis on whether the coordinating acts were "important for facilitating" the violation is central. While the statutory text of the former Item 2 did not explicitly mention "importance" (unlike Item 3, which covers "important" facilitating acts), the court integrated this concept into its holistic assessment for Item 2. This interpretation recognizes that coordination can range from minor administrative support to essential orchestration; only the latter warrants the significant surcharge uplift.

Blurring the Lines? Some commentary suggests that by requiring "importance" for Item 2 conduct, the court might be blurring the distinction between Item 2 (coordinator/allocator) and Item 3 (other important facilitating acts). An alternative view might be that the specific requirements of Item 2 – acting "upon request from others" and "continuously" – inherently imply a level of importance, perhaps even creating a rebuttable presumption. The court, however, opted for a unified approach demanding a showing of importance within the overall factual context, regardless of the specific item number.

Heightened Risk for Intermediaries: The most significant practical implication is the heightened risk for companies acting as intermediaries, hubs, or coordinators in industries prone to collusion. Even if a company does not initiate the cartel or directly fix prices/allocate markets itself, actively facilitating such arrangements by coordinating information exchange, managing allocations, or playing a central communication role can expose it to the 50% surcharge enhancement. This is particularly true if the company derives a clear benefit from its coordinating role, giving it influence over the other participants.

Compliance Program Considerations: This ruling underscores the need for robust antitrust compliance programs that address not only direct participation in cartels but also facilitating roles. Employees should be trained to recognize and avoid situations where the company might, even unintentionally, become a hub for anticompetitive information exchange or market coordination requested by competitors. Due diligence on industry associations, joint ventures, and information exchange programs is critical.

Conclusion

The Dokkinhou's surcharge enhancement mechanism for "leading operators" represents a significant financial risk for companies found to have played a central, facilitating role in cartels or bid-rigging. The Tokyo District Court's 2022 decision clarifies that this assessment is not merely procedural but requires a substantive evaluation of the company's contribution to enabling the anticompetitive conduct. Acting as a coordinator or hub, especially when requested by others and receiving benefits for the role, can trigger the 50% surcharge uplift, even if the company isn't the primary violator. For businesses operating in or interacting with Japanese markets, understanding this interpretation and ensuring rigorous compliance protocols that prevent both direct participation and facilitation of anticompetitive schemes is more crucial than ever.

- Understanding Exclusionary Practices Under Japan's Antimonopoly Act

- Antitrust Considerations in Japan: Beyond Cartels—Cooperatives, ESG, and Human Rights

- Raising the Stakes: Enhanced Surcharges and Penalties Under Japan's Amended Premiums and Representations Act

- Japan Fair Trade Commission (JFTC) – 公正取引委員会