M&A Antitrust Alert: Japan's Merger Control and the JFTC's Stance on Sub-Threshold Transactions

TL;DR

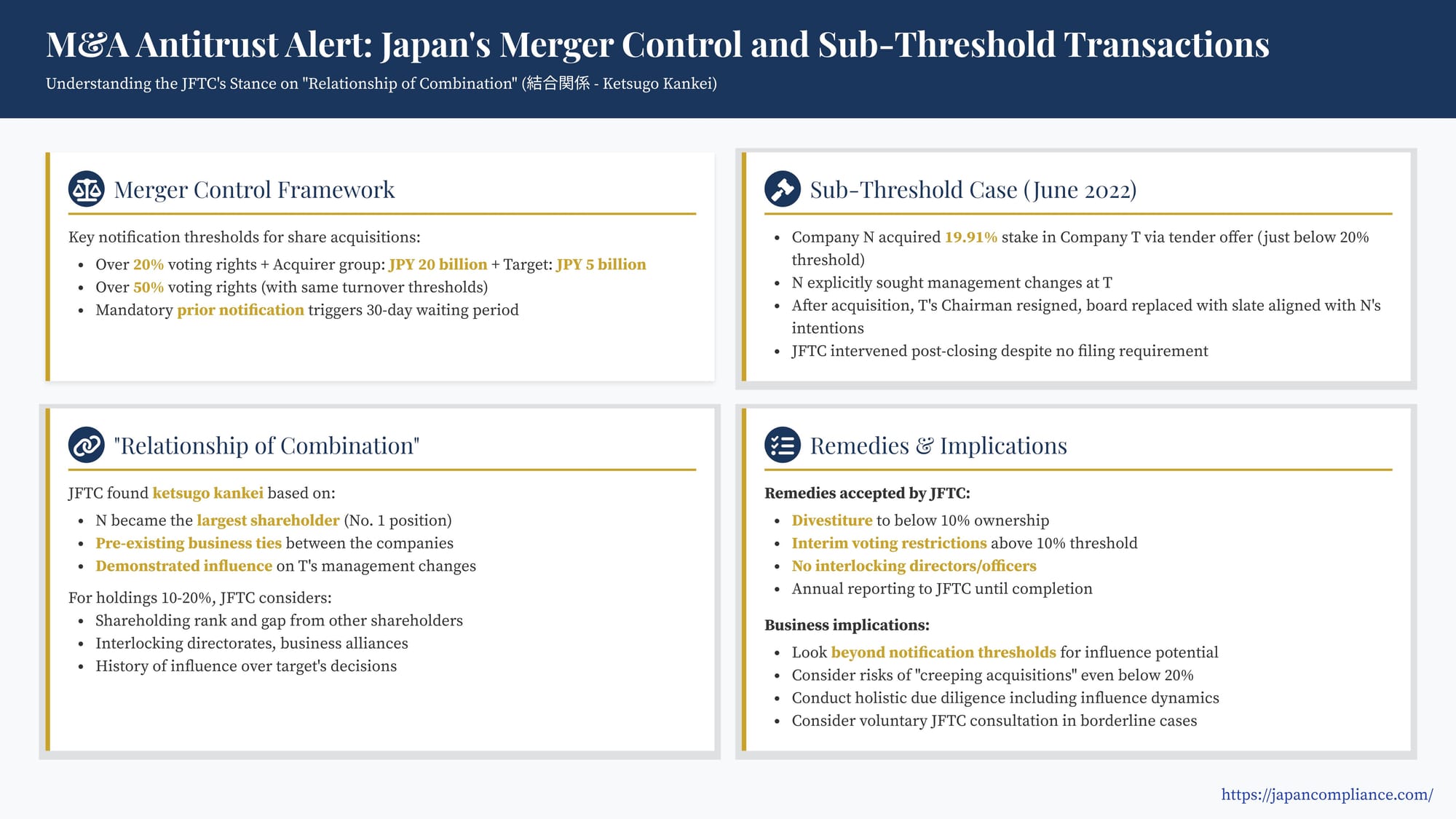

Japan’s Antimonopoly Act not only triggers pre-notification at 20 %+ shareholdings; the JFTC can still intervene below that line when a “relationship of combination” (ketsugo kankei) forms. A June 22 2022 case forced a 19.91 % investor to divest below 10 % and freeze voting rights because it had secured decisive influence over the target’s management. Sub-threshold stakes—especially 10-20 % as top shareholder—need antitrust risk analysis, voluntary consultation and possible remedies.

Table of Contents

- Japan's Merger Control Framework: An Overview

- The JFTC Case: Combination Found Below Notification Threshold

- Understanding Ketsugo Kankei (Relationship of Combination)

- Resolution and Remedies

- Implications and Takeaways for US Businesses

- Conclusion

Merger control regulations are a critical consideration in any cross-border M&A transaction. In Japan, the Antimonopoly Act (AMA - 独占禁止法, Dokusen Kinshi Ho) mandates prior notification to the Japan Fair Trade Commission (JFTC - 公正取引委員会, Kosei Torihiki Iinkai) for transactions exceeding certain thresholds. However, compliance doesn't end with simply checking if a notification is required. A JFTC case published on June 22, 2022, serves as a crucial reminder that the JFTC can, and does, scrutinize transactions below the standard notification thresholds if it believes a "relationship of combination" has been formed that could potentially harm competition.

Japan's Merger Control Framework: An Overview

The AMA generally prohibits transactions, including share acquisitions, mergers, and business transfers, that would result in a substantial restraint of competition in any particular field of trade. To enforce this, the AMA establishes a system of mandatory prior notification and review for deals meeting specific criteria.

For share acquisitions, notification is typically required if:

- The acquiring company group plans to hold over 20% of the target's voting rights post-acquisition, AND the aggregate domestic turnover of the acquirer group exceeds JPY 20 billion AND the aggregate domestic turnover of the target company and its subsidiaries exceeds JPY 5 billion.

- The acquiring company group plans to hold over 50% of the target's voting rights post-acquisition, under the same turnover conditions.

Similar thresholds exist for mergers, business transfers, etc. The key point is that these thresholds trigger a mandatory prior notification obligation, typically involving a 30-day waiting period during which the transaction cannot be closed while the JFTC conducts its initial review.

The JFTC Case: Combination Found Below Notification Threshold (June 2022)

The case published in June 2022 involved a share acquisition via a tender offer that strategically aimed to stay below the 20% notification threshold but still resulted in JFTC intervention and required remedies.

Facts of the Case

- The Parties: "Company N," a major corporation, launched a tender offer for shares in "Company T" in January 2021. Company N already held 9.91% of Company T's voting rights .

- The Offer: The tender offer was structured with a cap to acquire an additional 10% of voting rights, bringing Company N's total intended holding to 19.91% – just below the 20% notification threshold .

- Stated Rationale: Company N publicly stated its objective was to address perceived management and governance failures at Company T, which it believed were causing poor performance. Company N aimed to prompt changes in T's leadership and governance structure. Company T's board opposed the tender offer .

- Offer Success & Aftermath: Company N successfully completed the tender offer in March 2021, reaching the 19.91% ownership level . Shortly thereafter, significant management changes occurred at Company T:

- T's Chairman resigned from the board (effective March 31, 2021).

- T's board proposed a new slate of directors and an auditor for the June 2021 annual shareholders' meeting, with all incumbent directors scheduled to retire upon conclusion of the meeting. The JFTC's summary explicitly notes that this new management structure was in line with Company N's intentions .

- The new slate was approved by shareholders in June 2021 .

- JFTC Intervention: After the tender offer closed and these management changes took effect, the JFTC stepped in. Despite the shareholding remaining below the 20% notification threshold, the JFTC concluded that a "relationship of combination" (ketsugo kankei - 結合関係) had been formed between Company N and Company T .

JFTC's Finding of a "Relationship of Combination"

The JFTC based its finding not solely on the share percentage but on a comprehensive assessment of various factors :

- Shareholder Position: Company N, at 19.91%, became the largest (No. 1) shareholder, with a significant gap between its holding and that of the next largest shareholders.

- Pre-existing Relationships: There were existing business ties between the two companies, including raw material transactions and joint R&D activities.

- Influence on Management: This was a critical factor. The JFTC noted that Company N had previously tried, unsuccessfully, to encourage management changes at T. The tender offer was explicitly conducted to achieve this goal. The actual realization of these management changes, aligning T's leadership with N's wishes immediately following the successful tender offer, demonstrated N's ability to exert decisive influence over T's governance.

Considering these factors in totality, the JFTC determined that a ketsugo kankei had been formed, warranting antitrust scrutiny even without a mandatory pre-merger notification.

Understanding Ketsugo Kankei (Relationship of Combination)

This case highlights a core concept in Japanese merger control that extends beyond simple notification thresholds. The JFTC's Merger Guidelines (企業結合審査に関する独占禁止法の運用指針 - Kigyo Ketsugo Shinsa ni Kansuru Dokusen Kinshi Ho no Unyo Shishin) clarify that the JFTC's substantive review focuses on whether a proposed or completed transaction forms, maintains, or strengthens a ketsugo kankei.

A ketsugo kankei signifies a relationship where multiple companies, through shareholding or other means, come to conduct their business activities in a wholly or partially unified manner . The concern is that such unification can alter market structure non-competitively.

While crossing certain thresholds (like 20% or 50% voting rights plus turnover thresholds) automatically triggers JFTC review because a ketsugo kankei is presumed likely, the guidelines explicitly state that situations below these thresholds can still form such a relationship . Specifically:

- Holdings below 10% or where the acquirer is ranked 4th or lower among shareholders are generally not considered to form a ketsugo kankei.

- Holdings between 10% and 20%, especially where the acquirer becomes the No. 1, 2, or 3 shareholder, are assessed on a case-by-case basis .

The JFTC considers factors such as :

- The acquirer's shareholding ratio and rank.

- The gap between the acquirer's ratio and other large shareholders.

- The presence of interlocking directorates (役員の兼任関係 - yakuin no ken'nin kankei).

- Existing business alliances, joint ventures, or contractual relationships.

- Historical examples of the acquirer influencing the target's decisions.

In the reviewed case, Company N's 19.91% stake, No. 1 position, existing business ties, and, critically, its demonstrated success in achieving its stated goal of influencing management changes, collectively led the JFTC to conclude that a ketsugo kankei existed, despite remaining below the 20% notification line.

Resolution and Remedies

Because the JFTC identified a ketsugo kankei formed through a transaction that hadn't undergone prior review, remedial action was necessary to address potential competition concerns. Company N proposed, and the JFTC accepted, the following measures to dissolve the problematic relationship :

- Divestiture: Company N committed to selling down its shareholding in Company T to below 10% (returning to its original 9.91% level).

- Timing: The sell-down was to be conducted "as soon as possible," but the JFTC acknowledged that the timing could reasonably consider market conditions (selling above the tender offer price) and alignment with Company T achieving corporate value recovery – the ultimate stated goal of N's initial intervention.

- Interim Voting Restriction: Until the sell-down was complete, Company N agreed not to exercise the voting rights associated with the shares exceeding the 10% threshold.

- Interim Governance Restrictions: During the sell-down period, Company N committed not to have interlocking directors/officers with Company T and not to nominate individuals from Company N for positions on T's board.

- Reporting: Company N agreed to report annually to the JFTC on the progress of the share sale and its remaining holding status until the sell-down was complete.

The JFTC evaluated these measures as adequate to eliminate the ketsugo kankei. The divestiture directly addressed the structural link, while the interim voting and governance restrictions effectively neutralized Company N's potential influence during the transition period. This resolution allowed the JFTC to close its review without issuing a formal cease-and-desist order .

Implications and Takeaways for US Businesses

This JFTC case provides several important lessons for US companies involved in M&A or strategic investments concerning Japanese entities:

- Look Beyond Notification Thresholds: The most critical takeaway is that JFTC merger control is not solely dictated by the numerical thresholds for mandatory prior notification. Acquisitions resulting in holdings between 10% and 20%, particularly if they make the acquirer the largest shareholder, can attract JFTC scrutiny if accompanied by other factors suggesting significant influence or integration (ketsugo kankei).

- "Creeping Acquisitions" and Influence: Strategically building stakes below the 20% threshold does not guarantee immunity from review. If such stakes lead to substantial influence over the target's management or strategy (especially if this influence was an intended outcome), the JFTC may intervene post-closing based on the ketsugo kankei concept. Pre-existing business relationships can amplify this risk.

- Tender Offer Strategy Considerations: When launching a tender offer capped below notification thresholds, consider the potential competitive landscape and whether the resulting stake, combined with other factors, could be viewed by the JFTC as creating a problematic ketsugo kankei. The acquirer's stated intent and the actual post-acquisition impact on the target's governance are relevant.

- Holistic Due Diligence: M&A due diligence should extend beyond financials to include a thorough analysis of the target's shareholder structure, the potential influence dynamics created by the proposed acquisition, and any existing commercial relationships between the acquirer and target that might contribute to a finding of ketsugo kankei.

- Potential Need for Remedies Post-Closing: Be aware that if the JFTC identifies concerns after a transaction closes (even one not requiring pre-notification), remedies such as divestiture or behavioral commitments (like voting restrictions or governance firewalls) may be necessary to resolve the issue. This case shows the JFTC is willing to accept negotiated solutions.

- Consider Voluntary Consultation: In borderline cases – for example, acquiring a stake just under 20% that makes you the clear No. 1 shareholder, especially if intending to influence management – voluntary consultation with the JFTC before or shortly after closing might be a prudent risk mitigation strategy, even if formal notification isn't mandatory.

Conclusion

The JFTC's handling of the sub-threshold tender offer case underscores that Japan's merger control regime operates on both formal notification triggers and the substantive assessment of whether a "relationship of combination" (ketsugo kankei) is formed. While notification thresholds provide clear procedural lines, companies must recognize that shareholdings between 10% and 20%, particularly when combined with factors like being the top shareholder, having existing business ties, or demonstrably influencing management, can lead to post-closing JFTC scrutiny and potentially require remedies. For US businesses involved in investments or acquisitions in Japan, this necessitates a strategic approach that looks beyond simple percentages and considers the holistic impact of a transaction on market structure and corporate influence.

- Playing a Leading Role? Japan's Antitrust Surcharge Enhancements for Cartel Facilitators

- Director Liability in Japan: A Case Study Involving Attorney Directors and M&A

- Antitrust Considerations in Japan: Beyond Cartels—Cooperatives, ESG and Human Rights

- JFTC Merger Review Guidelines (企業結合審査ガイドライン)

- 2019 Revision Outline of the Merger Guidelines (公取委資料)

- Antimonopoly Act – English Translation (Japanese Law Translation)