Deadlock & Court-Ordered Dissolution in Japan: Article 833 Guide for US-Owned Subsidiaries

TL;DR

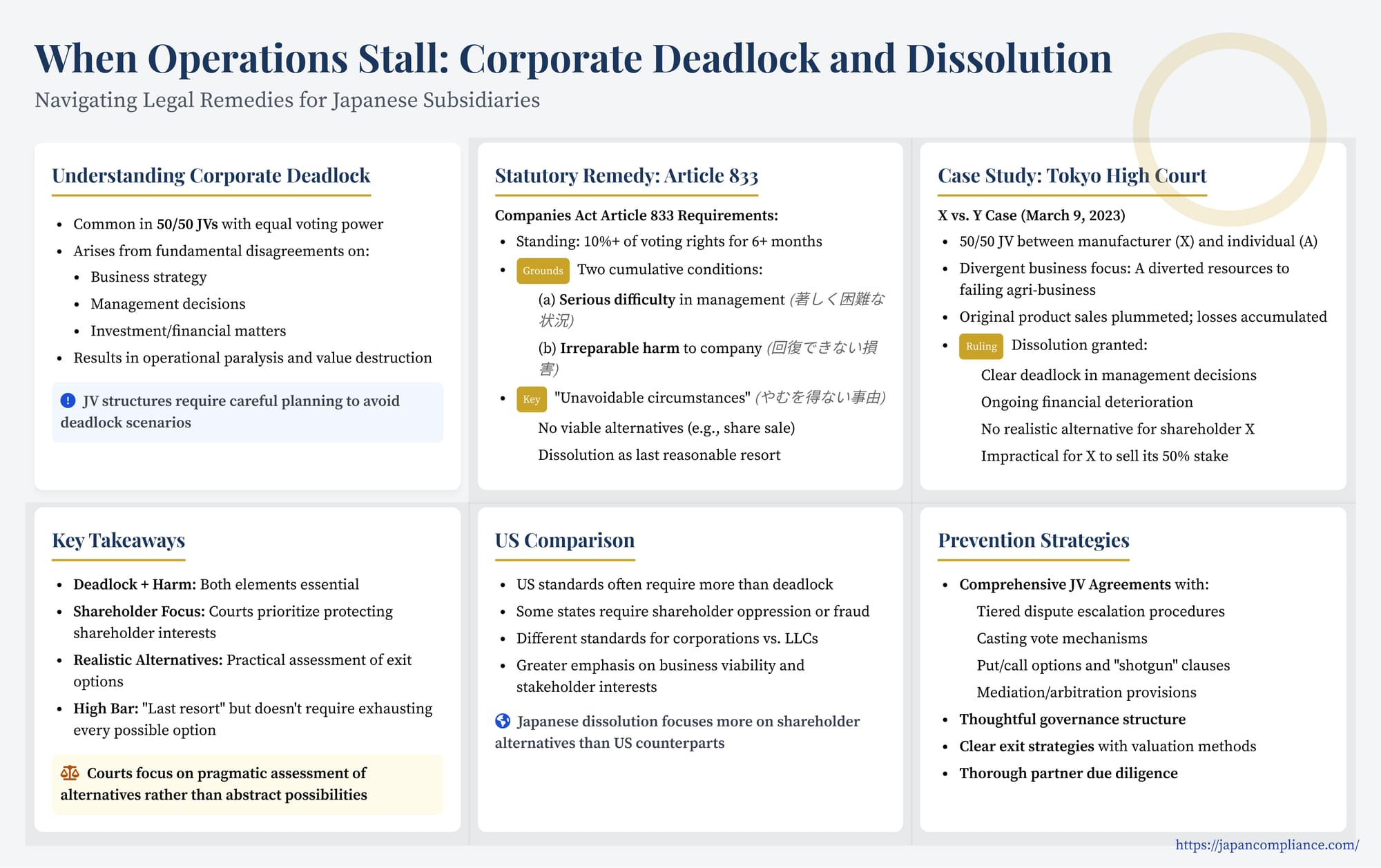

- Japan’s Companies Act Article 833 lets deadlocked shareholders dissolve a subsidiary if stalemate creates serious harm and no realistic exit exists.

- A 2023 Tokyo High Court case confirms courts apply the remedy when 50/50 paralysis and asset erosion leave dissolution as the only practical option.

- US joint-venture partners should pre-plan robust deadlock clauses, exit routes and governance structures to avoid value-destroying litigation.

Table of Contents

- Understanding Corporate Deadlock in Japan

- The Statutory Remedy: Dissolution under Companies Act Article 833

- Case Illustration: The X vs. Y Deadlock Dissolution (Tokyo High Court, March 9 2023)

- Key Takeaways from Japanese Practice

- Comparison with US Approaches (Briefly)

- Preventing and Managing Deadlock: Strategies for US Companies

- Conclusion

Joint ventures (JVs) and subsidiaries are common structures for US companies entering the Japanese market, often involving partnerships with local entities or shared ownership structures. While potentially synergistic, arrangements with evenly split control, such as 50/50 shareholdings, carry the inherent risk of corporate deadlock – a situation where management becomes paralyzed due to fundamental disagreements between opposing factions, preventing crucial business decisions. When contractual deadlock resolution mechanisms fail or are absent, Japan's Companies Act (会社法 - kaisha hō) provides a statutory, albeit drastic, remedy: a court-petitioned dissolution under Article 833.

Understanding the grounds and procedures for judicial dissolution is crucial for US companies operating or investing in Japanese entities, particularly those with shared control structures. A recent Tokyo High Court decision affirming a dissolution order for a deadlocked company offers valuable insights into how Japanese courts approach these challenging situations.

Understanding Corporate Deadlock in Japan

Corporate deadlock typically arises in companies with an even number of shareholders or directors holding equal voting power, most commonly in 50/50 JVs or subsidiaries. When fundamental disagreements emerge regarding strategy, management, finances, or the continuation of the business itself, and neither faction can secure a majority to implement its vision, the company's operations can grind to a halt.

Common triggers for deadlock include:

- Loss of trust between JV partners.

- Fundamental disagreements on business strategy or new ventures.

- Failure or decline of the company's core business.

- Disputes over profit distribution or further investment.

- Inability to elect directors or pass necessary shareholder resolutions.

Without effective resolution mechanisms, deadlock can lead to operational paralysis, financial deterioration, and ultimately, the destruction of corporate value.

The Statutory Remedy: Dissolution under Companies Act Article 833

Recognizing the potential harm caused by intractable deadlock, Japan's Companies Act provides a judicial remedy in Article 833. This allows shareholders meeting certain criteria to petition a court to order the dissolution of the company.

Who Can Petition?

A petition can be filed by shareholder(s) who have continuously held 10% or more of the total voting rights (or 10% or more of the total issued shares, if applicable) for at least six months.

Grounds for Dissolution (Article 833, Paragraph 1):

The petition must be based on one of the following grounds:

- Item 1 (Deadlock & Harm): This is the most relevant ground for deadlock situations. It requires demonstrating two cumulative conditions:

- (a) Serious Difficulty: The company faces a "seriously difficult situation in the management of its affairs" (業務の執行において著しく困難な状況に至り - gyōmu no shikkō ni oite ichijirushiku konnan na jōkyō ni itari). This typically involves situations where essential corporate decisions cannot be made due to opposing votes (e.g., inability to elect directors, approve budgets, or determine business strategy). A persistent 50/50 split on fundamental issues often satisfies this prong.

- (b) Irreparable Harm: This difficult situation causes or is likely to cause "irreparable harm" to the company (回復することができない損害が生じ又は生ずるおそれがある - kaifuku suru koto ga dekinai songai ga shōji matawa shōzuru osore ga aru). Harm is not limited to imminent insolvency but includes significant business stagnation, ongoing operational losses, depletion of assets, or damage to corporate creditworthiness stemming from the deadlock. Case law suggests courts may assess this prong somewhat more leniently once severe management deadlock is established, recognizing that paralysis itself inevitably leads to harm over time.

- Item 2 (Improper Management): When the management or disposition of company property is "grossly improper" (著しく失当 - ichijirushiku shittō) and threatens the company's existence. This ground is less typically invoked in pure deadlock cases, relating more to mismanagement or asset stripping.

The Overarching Requirement: "Unavoidable Circumstances"

Critically, even if the grounds under Item 1 or Item 2 are met, Article 833(1) allows the court to order dissolution only when there are "unavoidable circumstances" (やむを得ない事由 - yamu o enai jiyū). This serves as a significant limiting principle, emphasizing that judicial dissolution is a remedy of last resort.

Courts interpret "unavoidable circumstances" by examining whether less drastic, viable alternatives exist to resolve the deadlock or protect the petitioning shareholder's interests. The primary alternative considered is typically the ability of the petitioner to exit the investment by selling their shares to the opposing shareholder(s) or a third party at a fair price. If such an exit is practically impossible or highly improbable (e.g., no willing buyers, inability to agree on valuation, contractual restrictions), the "unavoidable circumstances" requirement is more likely to be met. The focus is on whether dissolution is the only reasonably available path forward for the petitioner.

Case Illustration: The X vs. Y Deadlock Dissolution (Tokyo High Court, March 9, 2023)

This recent case provides a clear example of Article 833's application in a deadlock scenario.

Background:

Company Y was established years prior as a 50/50 venture between Company X (a manufacturer) and Mr. A (who became Y's Representative Director). Y initially focused solely on selling X's products. However, A later initiated a new, unrelated agri-business within Y, diverting resources and attention. Sales of X's products plummeted, while the agri-business failed to become commercially viable even after a decade, leading Y to incur losses and deplete its cash. X, disagreeing with A's focus on the failing agri-business and the cessation of its original, profitable business line (X had terminated the agency agreement), faced a complete deadlock with A on Y's future direction. With no way to resolve the 50/50 impasse and Y having no viable ongoing business, X petitioned for dissolution under Article 833.

The Court's Findings (Affirming Dissolution):

- Deadlock & Irreparable Harm Found (Art. 833(1)(1) Satisfied): The High Court (affirming the District Court) easily found the first ground met. The 50/50 ownership split clearly paralyzed essential management decision-making regarding Y's future. Furthermore, Y's original core business had ceased, the new venture was unproven and loss-making after many years, and the company was demonstrably burning through its remaining cash reserves. This constituted a "seriously difficult situation" risking "irreparable harm."

- "Unavoidable Circumstances" Found: The High Court focused squarely on the lack of alternatives for petitioner X. It noted the difficulty X would face in selling its 50% stake in Y – a deadlocked, loss-making company with no clear business prospects – to either A or an external third party. Given this practical inability for X to exit its investment or otherwise break the stalemate, the court concluded that court-ordered dissolution and subsequent liquidation was the only reasonable means available to protect X's legitimate interests and rights as a shareholder concerning Y's remaining assets.

- Societal Loss Argument Rejected: Company Y argued that dissolution would result in societal loss, particularly concerning patents it held related to the agri-business. The High Court dismissed this, stating that the disposition of assets like patents is a matter to be addressed during the liquidation process following dissolution, and does not negate the existence of "unavoidable circumstances" justifying the dissolution order itself.

Key Takeaways from Japanese Practice

The X vs. Y case and established jurisprudence reveal several important aspects of how Japanese courts handle deadlock dissolution petitions:

- Deadlock + Harm is Essential: Petitioners must clearly demonstrate both the paralysis in management decision-making and the resulting (or highly probable) irreparable harm to the company's financial health or operational viability.

- Focus on Realistic Alternatives: The "unavoidable circumstances" test is practical. Courts scrutinize whether the petitioning shareholder has any realistic way out other than dissolution, primarily focusing on the feasibility of selling their shares at a reasonable valuation. Impasse alone might not be enough if a fair exit is possible.

- "Last Reasonable Resort": While often called a remedy of "last resort," case law suggests "unavoidable circumstances" doesn't strictly mean every conceivable alternative must be exhausted, but rather that dissolution is the only reasonably practicable solution left. In deadlock situations where exit is blocked, this condition is often presumed met unless specific counterarguments prevail.

- Shareholder Protection Prioritized: While acknowledging potential third-party impacts (creditors, employees), the core judicial analysis under Article 833 appears to prioritize resolving the intractable conflict between shareholders and protecting their legitimate interests when no other reasonable means exist. Broader societal impacts are generally considered secondary at the dissolution decision stage, being more pertinent to the subsequent liquidation procedures.

- Statutory Backstop: Article 833 provides an essential safety valve when JVs or subsidiaries descend into paralysis and lack effective, pre-agreed contractual mechanisms to resolve the situation.

Comparison with US Approaches (Briefly)

While US state corporate laws also provide for judicial dissolution, the standards and emphasis can differ:

- Grounds: Many US statutes require showing more than just deadlock, often needing proof of shareholder oppression, fraud, illegality, or corporate waste, which might not be present in a simple strategic disagreement leading to deadlock. Some states, however, do allow dissolution based purely on deadlock preventing the business from being conducted advantageously.

- LLCs vs. Corporations: Dissolution standards and procedures can differ significantly between corporate and LLC structures in the US.

- Focus: US courts might engage in a broader equitable analysis, potentially giving more weight to the viability of the ongoing business or the interests of non-shareholder constituents compared to the apparent primary focus on shareholder alternatives under Japan's "unavoidable circumstances" test.

Preventing and Managing Deadlock: Strategies for US Companies

Given the potentially disruptive nature of a court-ordered dissolution, proactive planning is essential for US companies entering 50/50 or similarly balanced JVs or subsidiaries in Japan. Strategies include:

- Comprehensive Shareholder/JV Agreements: This is the most critical preventative measure. Do not rely solely on the Companies Act. Agreements should include bespoke deadlock resolution mechanisms, such as:

- Tiered Escalation: Procedures requiring disputes to be escalated through management levels before triggering formal mechanisms.

- Casting Vote: Designating a chairman (potentially independent) with a casting vote on certain matters.

- External Mediator/Arbitrator: Mandatory mediation or binding arbitration for specific types of disputes.

- Put/Call Options: Allowing one party to buy out the other under pre-agreed terms or valuation formulas.

- "Shotgun" (Buy-Sell) Clauses: Allowing one party to offer to buy the other's shares at a specific price, with the receiving party having the option to either sell at that price or buy the offering party's shares at the same price.

- Pre-Defined Dissolution Triggers: Agreeing on specific events or prolonged deadlock periods that automatically trigger voluntary dissolution.

- Thoughtful Governance Structure: Carefully design the board composition, quorum requirements, and voting thresholds for key decisions to minimize the likelihood of complete paralysis. Consider independent directors.

- Clear Exit Strategies: Define exit routes (buyouts, third-party sales, IPOs) and associated valuation methodologies within the foundational agreements.

- Thorough Partner Due Diligence: Understand potential partners' long-term objectives, financial capacity, management style, and potential areas of strategic conflict before committing.

- Active Monitoring and Communication: Regularly monitor the Japanese entity's performance and maintain open communication channels with partners to address potential disagreements early, before they escalate into intractable deadlock.

Conclusion

Corporate deadlock is a significant risk in evenly balanced joint ventures and subsidiaries in Japan. While Japan's Companies Act Article 833 offers a judicial path to dissolution, it is a remedy intended for situations where management is paralyzed, irreparable harm is occurring or imminent, and no other reasonable alternative exists for the shareholders. The process can be lengthy, uncertain, and value-destructive. As the recent Tokyo High Court decision illustrates, courts will scrutinize the practical realities of the deadlock and the feasibility of exit options. Therefore, the most effective strategy for US companies is prevention: investing time and resources upfront to negotiate comprehensive shareholder or JV agreements with clear governance structures and robust, tailored deadlock resolution mechanisms is paramount to ensuring the stability and success of their Japanese ventures.

- Director Liability and Corporate Donations in Japan: Balancing Philanthropy and Fiduciary Duty

- Shareholder Activism in Japan: The Rise of Derivative Lawsuits and Director Liability

- International Tax Risks in Japan: PE, Transfer Pricing, CFC & Pillar Two Guide for US Companies

- Ministry of Justice – Companies Act (Japanese full text)

- METI Guide to Joint Ventures and Governance (Japanese PDF)