Director Liability for JFTC Antitrust Surcharges in Japan — What Boards Must Know

TL;DR

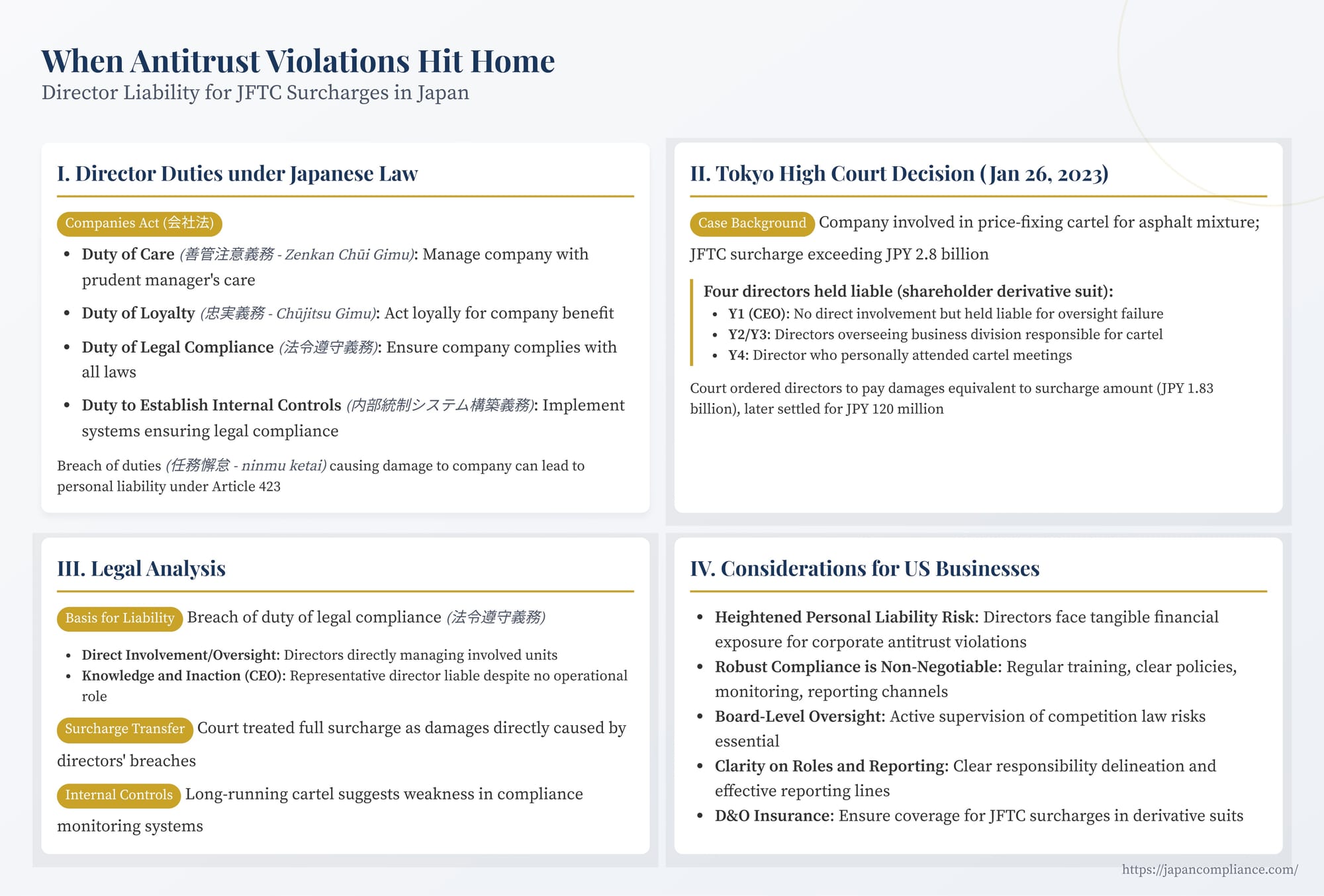

- The Tokyo High Court (Jan 26 2023) confirmed that company directors can be personally liable for 100 % of a JFTC surcharge imposed on the corporation for cartel conduct.

- Liability was grounded in breaches of the duty of legal compliance and inadequate internal controls under Japan’s Companies Act.

- Even a CEO not directly involved operationally was held liable because he “knew or should have known” and failed to act.

- The decision signals heightened personal risk for directors of Japanese companies—including foreign executives—and makes robust antitrust compliance programs non-negotiable.

- Boards should review oversight processes, reporting lines and D&O insurance coverage immediately.

Table of Contents

- Director Duties and Antitrust Compliance under Japanese Law

- The Tokyo High Court Decision (January 26 2023)

- Legal Analysis and Implications

- Considerations for US Businesses and Directors

- Conclusion

Antitrust compliance is a critical concern for companies operating globally, and Japan is no exception. The Japan Fair Trade Commission (JFTC) actively enforces the Antimonopoly Act (独占禁止法 - Dokusen Kinshi Hō), often imposing significant administrative surcharges (課徴金 - kachōkin) on companies found to have engaged in violations like cartels or bid-rigging. While these surcharges directly penalize the corporation, a crucial question arises: can the directors who oversaw the company during the violation period be held personally liable for the financial damage caused by these penalties?

A recent landmark decision from the Tokyo High Court, affirming director liability in a shareholder derivative lawsuit stemming from a major JFTC surcharge order, underscores the significant personal risks directors face in Japan for corporate antitrust failings. This case provides valuable lessons for directors and the companies they serve, including US corporations with operations or subsidiaries in Japan.

Director Duties and Antitrust Compliance under Japanese Law

The foundation for director liability in Japan rests within the Companies Act (会社法 - Kaishahō). Key duties include:

- Duty of Care (善管注意義務 - Zenkan Chūi Gimu): Directors have a general duty to manage the company with the care of a prudent manager (Art. 330, referring to Civil Code Art. 644).

- Duty of Loyalty (忠実義務 - Chūjitsu Gimu): Directors must perform their duties loyally for the benefit of the company (Art. 355).

- Duty of Legal Compliance (法令遵守義務 - Hōrei Junshu Gimu): Embedded within the duty of care and loyalty is the obligation to ensure the company complies with all applicable laws and regulations, including the Antimonopoly Act.

- Duty to Establish Internal Control Systems (内部統制システム構築義務 - Naibu Tōsei Shisutemu Kōchiku Gimu): For large companies, the board of directors (and specifically representative directors for certain aspects) has a legal duty to decide on the basic policies for establishing systems necessary to ensure that the execution of duties by directors and employees complies with laws and the articles of incorporation (Art. 362(4)(vi), Art. 416(1)(e)). This explicitly includes building effective compliance regimes.

A breach of these duties (任務懈怠 - ninmu ketai) that causes damage to the company can lead to personal liability for the directors under Article 423 of the Companies Act. Shareholders can enforce this liability on behalf of the company through a shareholder derivative lawsuit (株主代表訴訟 - kabunushi daihyō soshō).

In the antitrust context, a breach of duty can arise from:

- Direct participation in or authorization of illegal conduct (e.g., a cartel).

- Knowledge of illegal conduct by subordinates coupled with a failure to take corrective action.

- Negligent failure in oversight, including neglecting to establish or maintain an adequate antitrust compliance program (breach of the duty to establish internal controls).

The Tokyo High Court Decision (January 26, 2023)

This recent case provides a stark illustration of how these principles apply when a company faces JFTC surcharges.

Case Background:

- A large, publicly listed Japanese company ("Company Z"), involved in construction and materials manufacturing, was found by the JFTC to have participated in a price-fixing cartel for asphalt mixture over several years. Employees attended regular meetings with competitors (the "9-Society Meetings") where pricing strategies were discussed and coordinated.

- The JFTC issued a cease-and-desist order and a substantial surcharge payment order against Company Z, exceeding JPY 2.8 billion (though part of this was contested).

- A shareholder holding shares for the requisite period filed a derivative lawsuit against four former directors ("Directors Y1-Y4") who served during the period of the violation. The suit sought damages equivalent to the undisputed portion of the surcharge (approximately JPY 1.83 billion), alleging breaches of their duties.

- The directors had varying roles:

- Y1: Served as CEO/Representative Director during part of the relevant period; previously held finance and internal control roles but had no direct operational role in the division responsible for the cartel activity during his CEO tenure.

- Y2: Served as director and head of the business division directly responsible for the asphalt mixture business and the cartel participation.

- Y3: Served as director and deputy head of the relevant business division.

- Y4: Served as director and head of the specific product department within the relevant division; personally attended the cartel meetings.

The Court Rulings:

- Tokyo District Court (March 28, 2022): The District Court found all four directors liable.

- Directors Y2, Y3, and Y4 were found to have breached their duty of legal compliance through their direct involvement in, or leadership roles overseeing, the division and department engaged in the cartel. Y4's attendance at the meetings was a key factor.

- Director Y1 (the former CEO) was also found liable. The court determined that despite not being directly involved operationally, Y1 was aware, or should have been aware given his position and prior roles, of the existence and nature of the cartel agreement and had implicitly approved or overlooked the continuation of the illegal conduct by failing to take corrective measures.

- The court ordered the directors to collectively pay damages to Company Z equivalent to the undisputed surcharge amount (approx. JPY 1.83 billion), allocated based on their respective periods of service during the violation.

- Tokyo High Court (January 26, 2023): The High Court upheld the District Court's decision in its entirety. It affirmed the factual findings regarding the directors' involvement and knowledge (or imputed knowledge in the case of the CEO) and confirmed that their actions (or inaction) constituted a breach of the duty of legal compliance owed to the company. Critically, it endorsed the lower court's conclusion that the JFTC surcharge represented the damages suffered by the company as a direct result of the directors' breaches of duty.

(Subsequent Settlement): It is noteworthy that, following the High Court decision, a settlement was reportedly reached in June 2023 where the directors agreed to pay a significantly smaller sum (JPY 120 million) to the company. This highlights the practical realities of complex litigation and potential difficulties in recovering the full amount from individual directors.

Legal Analysis and Implications

This case, being the first published decision explicitly affirming director liability for the full amount of a JFTC surcharge in a derivative suit, carries significant weight. Several points merit analysis:

1. Basis for Director Liability:

The courts clearly established liability based on a breach of the duty of legal compliance (法令遵守義務), a core component of the general duty of care. The liability wasn't uniform; it reflected the directors' specific roles and knowledge:

- Direct Involvement/Oversight: Directors directly managing the business units involved (Y2, Y3, Y4) were held responsible for the illegal activities occurring under their watch. Direct participation (Y4) provided clear grounds.

- Knowledge and Inaction (CEO): The finding against the CEO (Y1) is particularly significant. It suggests that even without direct operational involvement, a representative director with overall responsibility can be found liable if evidence indicates they knew, or reasonably should have known, about serious legal violations like a long-running cartel within the company and failed to intervene. This underscores the oversight responsibilities inherent in top executive positions.

2. Transferability of JFTC Surcharges as Damages:

The courts treated the JPY 1.83 billion surcharge amount as the quantum of damages directly caused by the directors' breaches. This aligns with a general trend in Japanese case law allowing penalties imposed on a company due to director/employee misconduct (e.g., fines for legal violations) to be claimed back from the responsible directors as damages. The rationale centers on deterrence and ensuring directors bear responsibility for preventable corporate wrongdoing.

However, the automatic "transfer" (転嫁 - tenka) of administrative surcharges, particularly JFTC surcharges, is debated among legal scholars in Japan:

- Arguments Against Transfer: Some argue that surcharges, being administrative penalties calculated based on corporate turnover and potentially influenced by factors like leniency applications, differ in nature from compensatory damages. Transferring the full amount to individuals, whose ability to pay is vastly different from the corporation's, might be disproportionate or undermine the objectives of the surcharge system (which targets corporate behavior and disgorges corporate gains). Concerns are also raised about the potential chilling effect on directors' willingness to utilize the JFTC's leniency program if they fear personal liability for the remaining surcharge.

- Arguments For Transfer (Court's Approach): The courts in this case prioritized director accountability and deterrence. By linking the surcharge directly to the directors' failure to ensure legal compliance, the decision reinforces the idea that directors must safeguard the company from such penalties.

The debate often touches upon the dual nature of JFTC surcharges – partly punitive and partly aimed at disgorging illicit gains (不当利得 - futō ritoku). Some scholars suggest that, at most, only the punitive element should be transferable, or that the illicit gain portion should be offset against the company's damages (損益相殺 - son'eki sōsai). The courts here did not engage in such an offset, opting for a direct transfer of the surcharge amount as damages.

3. The Role of Internal Controls (内部統制 - Naibu Tōsei):

While the court's reasoning focused primarily on the duty of legal compliance and knowledge/inaction, the case implicitly highlights the importance of effective internal control systems. The existence of a long-running cartel within a major company suggests potential weaknesses in compliance monitoring and reporting structures. Although not the central legal basis in this specific ruling, failure to establish and maintain an adequate antitrust compliance program is a well-recognized ground for finding a breach of the duty to establish internal controls, which can independently lead to director liability. Directors must ensure systems are in place not only to educate employees about antitrust law but also to detect and prevent potential violations.

Considerations for US Businesses and Directors

This Japanese case carries important lessons for US companies with subsidiaries or significant operations in Japan, as well as for individuals serving as directors on those boards (including parent company executives with oversight roles):

- Heightened Personal Liability Risk: Directors of Japanese companies face tangible personal financial risk arising from corporate antitrust violations. This risk extends beyond those directly involved to potentially include senior executives and representative directors who fail in their oversight functions.

- Robust Compliance is Non-Negotiable: Implementing, maintaining, and actively overseeing a robust antitrust compliance program tailored to the Japanese legal environment is crucial. This includes regular training, clear policies, effective monitoring, and accessible reporting channels.

- Board-Level Oversight: Boards must actively oversee competition law risks. This involves receiving regular reports on compliance activities, understanding the specific risks faced by the business in Japan, and ensuring management takes appropriate action to mitigate those risks. Ignorance stemming from inadequate oversight systems is unlikely to be a successful defense.

- Clarity on Roles and Reporting: Clear delineation of responsibilities and effective reporting lines that ensure potential compliance issues reach senior management and the board are vital.

- D&O Insurance: Ensure Directors & Officers (D&O) liability insurance policies adequately cover risks associated with antitrust investigations and litigation in Japan, including potential liability stemming from JFTC surcharges in derivative suits.

Conclusion

The Tokyo High Court's January 2023 decision sends a clear message: directors in Japan can be held personally liable for the substantial financial consequences of corporate antitrust violations, including JFTC surcharges. While the subsequent settlement reduced the final payout, the legal precedent establishing liability for the full surcharge amount remains significant. This underscores the critical importance for all directors serving Japanese companies – regardless of their nationality or location – to prioritize and actively oversee antitrust compliance. Failure to do so not only exposes the company to significant penalties but also places the directors' personal assets at considerable risk. Proactive implementation and diligent oversight of effective internal control systems are paramount.

- Playing a Leading Role? Japan's Antitrust Surcharge Enhancements for Cartel Facilitators

- Defining "Sales Amount" for Surcharges: Japan's Supreme Court on the 2005 Machinery Insurance Cartel Case

- Antitrust Considerations in Japan: Beyond Cartels – Cooperatives, ESG and Human Rights

- Japan Fair Trade Commission – Overview of the Surcharge System (English PDF)