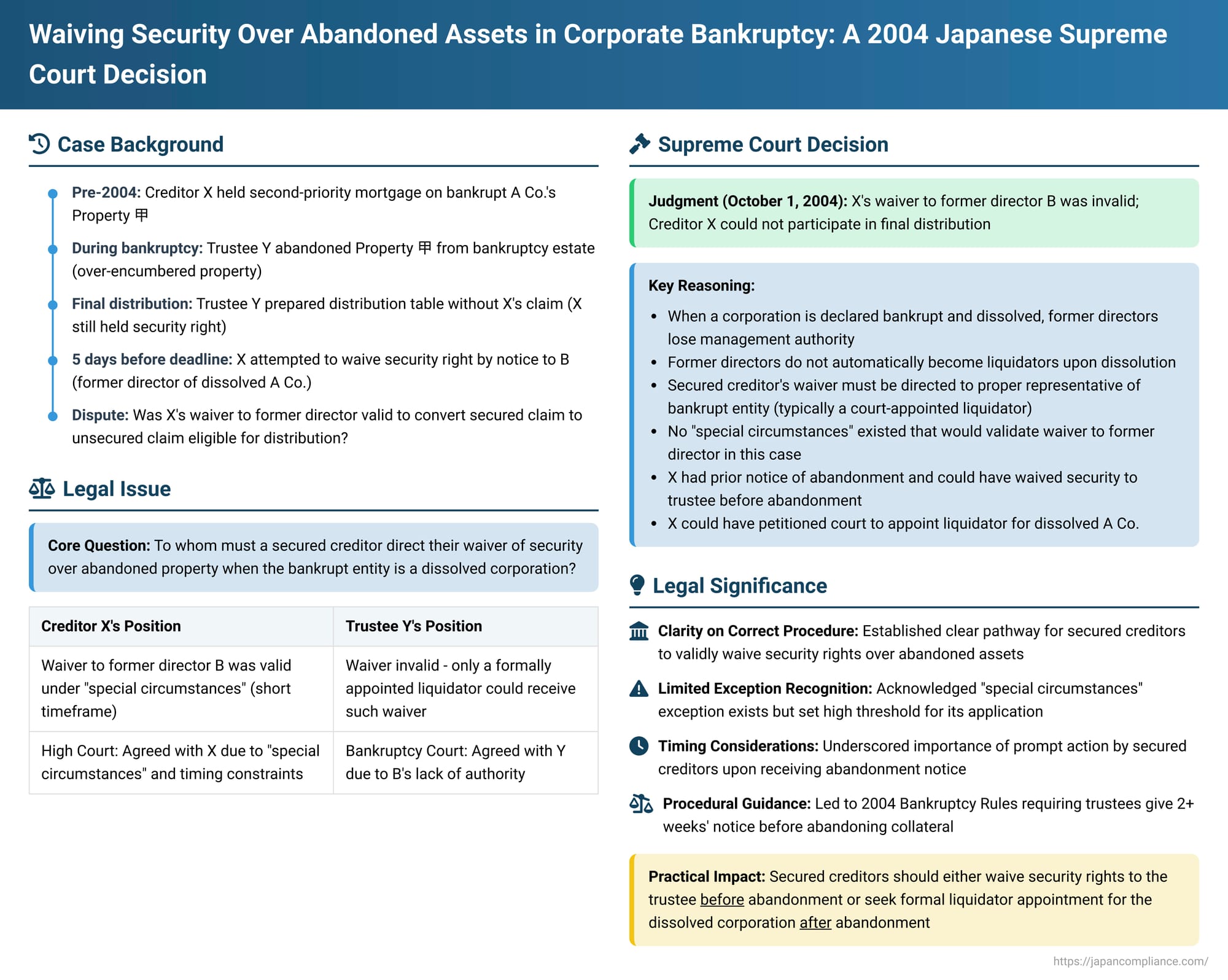

Waiving Security Over Abandoned Assets in Corporate Bankruptcy: Who is the Right Recipient? A 2004 Japanese Supreme Court Decision

In Japanese bankruptcy proceedings, a secured creditor holds a "right of separation" (別除権 - betsujoken), allowing them to satisfy their claim from specific collateral outside the general distribution to unsecured creditors. However, these secured creditors can only participate in general bankruptcy distributions for any deficiency remaining after realizing their security (the "deficiency liability principle" - 不足額責任主義 fusokugaku sekinin shugi). If a secured creditor chooses to waive their right of separation, or if the collateral is valueless or formally "abandoned from the bankruptcy estate" (破産財団からの放棄 - hasan zaidan kara no hōki) by the trustee (e.g., because it's over-encumbered or worthless to the estate), the creditor can then participate in distributions with their full claim as an unsecured bankruptcy creditor.

A critical procedural question arises when the collateral is abandoned from the estate of a bankrupt corporation (which is typically dissolved upon bankruptcy). To whom must the secured creditor direct their formal declaration of waiver of their security interest for it to be legally effective, allowing them to join the ranks of unsecured creditors for distribution? Specifically, is a former director of the now-dissolved bankrupt corporation a proper recipient, or must the waiver be made to a formally appointed liquidator? The Supreme Court of Japan addressed this nuanced issue in a decision on October 1, 2004.

Factual Background: Abandoned Collateral and a Disputed Waiver

The case involved A Co., a company that had been declared bankrupt, with Y appointed as its bankruptcy trustee. X was a creditor of A Co. and held a second-priority basic mortgage (neteitōken) on certain real property (Property 甲) owned by A Co. as security for X's claim.

During the bankruptcy proceedings, it became apparent that Property 甲 was likely over-encumbered (e.g., by a first-priority mortgage holder who had already initiated foreclosure proceedings). Consequently, trustee Y decided that Property 甲 held no value for the general bankruptcy estate and proceeded to abandon it from the estate. Y provided written notice to X (and other secured creditors) of this intended abandonment. Twelve days after the notice, Y, with the permission of the bankruptcy court, formally abandoned Property 甲. However, trustee Y did not physically transfer or hand over the abandoned property to B, who was the former representative director of A Co. (which was now bankrupt and legally dissolved).

Subsequently, trustee Y submitted a final distribution table to the bankruptcy court for approval. This table did not include X's claim for distribution, as X was still technically a secured creditor who had not yet effectively waived its security right over the (now abandoned) Property 甲 or otherwise proven a deficiency. The bankruptcy court set the bar date (exclusion period) for participation in this final distribution at 15 days after the public notice of the proposed distribution.

Just five days before this bar date was due to expire, X attempted to waive its right of separation over Property 甲. X did this by sending a formal declaration of waiver to B, the former representative director of the bankrupt and dissolved A Co. X then notified trustee Y that this waiver had been made. Based on this purported waiver, X filed an objection to the trustee's distribution table, arguing that its claim should now be included for a pro-rata distribution as an unsecured bankruptcy claim.

The bankruptcy court (Osaka District Court, acting as the court of first instance for this procedural matter) dismissed X's objection. It held that the waiver declared to B, a former director, was invalid because B lacked the authority to receive such a declaration on behalf of the dissolved A Co. X appealed this decision.

The Osaka High Court, however, reversed the bankruptcy court's decision. The High Court found that "special circumstances" (tokudan no jijō) existed in this case which made it extremely difficult for X to secure the appointment of a formal liquidator for A Co. and then declare the waiver to that liquidator, all within the very short 15-day bar period for the final distribution. The High Court also noted that trustee Y had, in its view, created an "abnormal situation" by abandoning Property 甲 from the estate without ensuring it was handed over to a proper manager or liquidator (such as B). Therefore, by analogizing to provisions in the Civil Code (Article 654, concerning an agent's authority to take urgent necessary measures after the termination of a mandate) via the old Commercial Code (Article 254, paragraph 3), the High Court deemed X's waiver to former director B to be valid under these specific circumstances. It remanded the case to the bankruptcy court to revise the distribution table. Trustee Y then appealed this High Court ruling to the Supreme Court, having obtained permission to do so.

The Legal Issue: Proper Addressee for Waiving Security Over Abandoned Corporate Assets

When collateral securing a debt is formally abandoned by the bankruptcy trustee from the estate of a bankrupt corporation (which is dissolved by the bankruptcy), who has the legal authority to receive a secured creditor's subsequent declaration of waiver of their security interest over that abandoned property?

- Is a former director of the now-dissolved bankrupt corporation a proper recipient for such a legally significant declaration?

- Or must a formal liquidator (清算人 - seisan'nin) be appointed for the dissolved corporation (if one is not already in place) and the waiver directed to that liquidator?

The answer determines whether the secured creditor can successfully convert their claim into an unsecured one eligible for participation in the final bankruptcy distribution.

The Supreme Court's Ruling: Waiver Generally Must Be to a Liquidator, Not a Former Director

The Supreme Court, in its decision of October 1, 2004, reversed the High Court's ruling and reinstated the original bankruptcy court's decision, which had dismissed X's objection. The Supreme Court held that the waiver declared by X to B (the former director) was invalid under the circumstances presented.

The Court's reasoning was structured as follows:

I. General Principles Regarding the Proper Addressee:

- The Supreme Court first reiterated a principle from its earlier 2000 decision (Heisei 11 (Kyo) No. 40): when property subject to a right of separation is abandoned from the bankruptcy estate, the party to whom the secured creditor should normally direct their waiver of that right is the bankrupt entity itself. This principle applies whether the bankrupt is an individual or a corporation.

- Status of Former Directors of a Bankrupt Corporation: The Court then addressed the specific situation of a bankrupt corporation. It cited a 1968 Supreme Court precedent (Showa 42 (O) No. 124) to affirm that when a corporation is declared bankrupt, it is legally dissolved (under provisions like old Commercial Code Article 404, item 1, and Article 94, item 5). The individuals who were representative directors at the time of the bankruptcy declaration generally lose their authority to manage and dispose of the company's property; they do not automatically become liquidators of the dissolved company by virtue of old Commercial Code Article 417, paragraph 1 (which deals with directors becoming liquidators in other dissolution scenarios).

- No Regained Authority Over Abandoned Property: Even if property that was once part of the bankruptcy estate (and subject to a right of separation) is subsequently abandoned by the trustee, there is no legal basis to conclude that the former directors thereby regain management or disposal authority over that specific abandoned property.

- Role of the Liquidator: Therefore, any acts involving the management or disposal of such abandoned property—which would include formally receiving a secured creditor's declaration of waiver of their security interest and undertaking related procedures like assisting with the cancellation of mortgage registrations—should properly be performed by a duly appointed liquidator of the dissolved bankrupt corporation. Such a liquidator would either be one designated by the company's articles of incorporation or by a shareholders' resolution (Commercial Code Article 417, paragraph 1, proviso), or, more commonly in such situations, one appointed by the court upon petition by interested parties (Commercial Code Article 417, paragraph 2).

- Conclusion on This Point: Based on these principles, the Supreme Court concluded that if the bankrupt is a corporation, a waiver of a right of separation over property abandoned by the bankruptcy trustee, when declared by the secured creditor to a former director of that bankrupt and dissolved corporation, is legally invalid, UNLESS "special circumstances" (tokudan no jijō) exist that would exceptionally justify recognizing its validity.

II. Application to the Present Case – No "Special Circumstances" Found:

- The Supreme Court then examined whether such "special circumstances" existed in X's case.

- Short Bar Period Not a Special Circumstance: The Court found that the 15-day period between the public notice of the final distribution and the bar date for objections, while short, was within the range permitted by the (then) Bankruptcy Act (Article 273). This short timeframe, in itself, did not constitute a "special circumstance" that would excuse X from following the proper procedure for waiver.

- No Other Justifying Facts: The Court found no other facts in the record that would amount to special circumstances justifying the waiver to former director B.

- Conclusion for the Case: Therefore, X's declaration of waiver to B, who lacked the legal authority to manage or dispose of A Co.'s property (including receiving such a waiver), was invalid. Consequently, X's claim could not be added to the distribution table as an unsecured bankruptcy claim.

- No Unfair Prejudice to the Secured Creditor (X): The Supreme Court specifically addressed the High Court's concern about fairness to X. It pointed out that X was not unduly harmed by this conclusion because:

- Trustee Y had provided X with prior written notice of the intention to abandon Property 甲 from the bankruptcy estate.

- X therefore had the opportunity, before the formal abandonment occurred, to declare a waiver of its security interest directly to trustee Y (who, at that point, still had management authority over the property).

- Alternatively, after the property was abandoned, X had the legal option to petition the court for the appointment of a liquidator for the dissolved A Co. (under Commercial Code Article 417, paragraph 2) and then make a valid declaration of waiver to that duly appointed liquidator.

X had not pursued these proper avenues for waiver.

The "Special Circumstances" Exception and Its Narrow Scope

The Supreme Court's acknowledgment of a "special circumstances" exception, where a waiver to a former director might be upheld, is important, though the bar for meeting this exception appears to be very high.

- The PDF commentary references a 2002 Supreme Court decision where such "special circumstances" were found to exist. In that earlier case, the trustee had reportedly failed to notify the secured creditor of the abandonment and had improperly handed over the abandoned property directly to a former director, essentially leaving the secured creditor with no clear or proper party to whom they could direct their waiver.

- In contrast, in the present 2004 case, the Supreme Court emphasized that trustee Y had provided prior notice of the intended abandonment to X. This notice gave X the opportunity to act appropriately. The availability of the statutory procedure to petition for a liquidator's appointment also meant X was not left without a proper avenue to effect a valid waiver, even after the property was abandoned.

- The PDF commentary further notes that the current Bankruptcy Rules (specifically, Rule 56, latter part, which was enacted in October 2004—after the operative facts of this case but before the final Supreme Court judgment) now impose a clearer obligation on bankruptcy trustees. When a bankrupt entity is a corporation, the trustee must give secured creditors at least two weeks' written notice before formally abandoning collateral from the bankruptcy estate. This rule is designed to give secured creditors a clear window to assess their options and, if they choose, to declare a waiver to the trustee before abandonment, or to prepare for other measures (like seeking a liquidator's appointment) if they intend to waive after abandonment. Coupled with potentially more streamlined procedures for appointing liquidators in modern practice, the PDF commentary suggests that the "special circumstances" justifying a waiver to a former director are likely to be recognized only in very rare and truly exceptional situations, such as a complete failure by the trustee to provide the legally required notice.

Practical Guidance for Secured Creditors

This case, along with the current Bankruptcy Rules, offers practical guidance for secured creditors whose collateral might be abandoned from a bankrupt corporate estate:

- Monitor Trustee Communications: Pay close attention to any notices from the bankruptcy trustee regarding the potential abandonment of collateral.

- Act Promptly: Upon receiving such notice, promptly evaluate whether to waive the security interest or pursue other options.

- Waiver Before Abandonment: If the decision is to waive, the simplest route is often to declare the waiver directly to the bankruptcy trustee before the trustee formally abandons the asset.

- Waiver After Abandonment (for a Dissolved Corporation): If the waiver is to be made after the collateral has been abandoned from the estate of a dissolved bankrupt corporation:

- Do not direct the waiver to the corporation's former directors, as they generally lack authority.

- The proper course is to petition the competent court for the appointment of a liquidator for the dissolved corporation.

- Once a liquidator is appointed, the waiver should be formally declared to that liquidator.

- Maintain Communication: Keep open lines of communication with the bankruptcy trustee regarding the status of the collateral, any intentions to abandon it, and the timelines for final distribution.

Concluding Thoughts

The Supreme Court's October 1, 2004, decision clarifies an important procedural point for secured creditors in the bankruptcy of a Japanese corporation. To effectively waive a right of separation over collateral that the bankruptcy trustee has abandoned from the estate, particularly when aiming to participate in the final distribution as an unsecured creditor, the waiver must generally be directed to a legally authorized representative of the (now dissolved) bankrupt corporation. In most circumstances, this means a formally appointed liquidator, not merely a former director who typically loses management and disposal authority upon the company's bankruptcy and dissolution. While a narrow "special circumstances" exception exists, the Court's ruling, especially when read in conjunction with current procedural rules mandating trustee notification before abandonment, underscores the importance for secured creditors to understand and follow the correct legal channels to ensure their waiver is valid and their rights in the final distribution are preserved.