Japan’s Wage Increase Promotion Tax Credit (Chin’age Sokushin Zeisei): FY 2024-26 Incentives & Compliance Guide

TL;DR

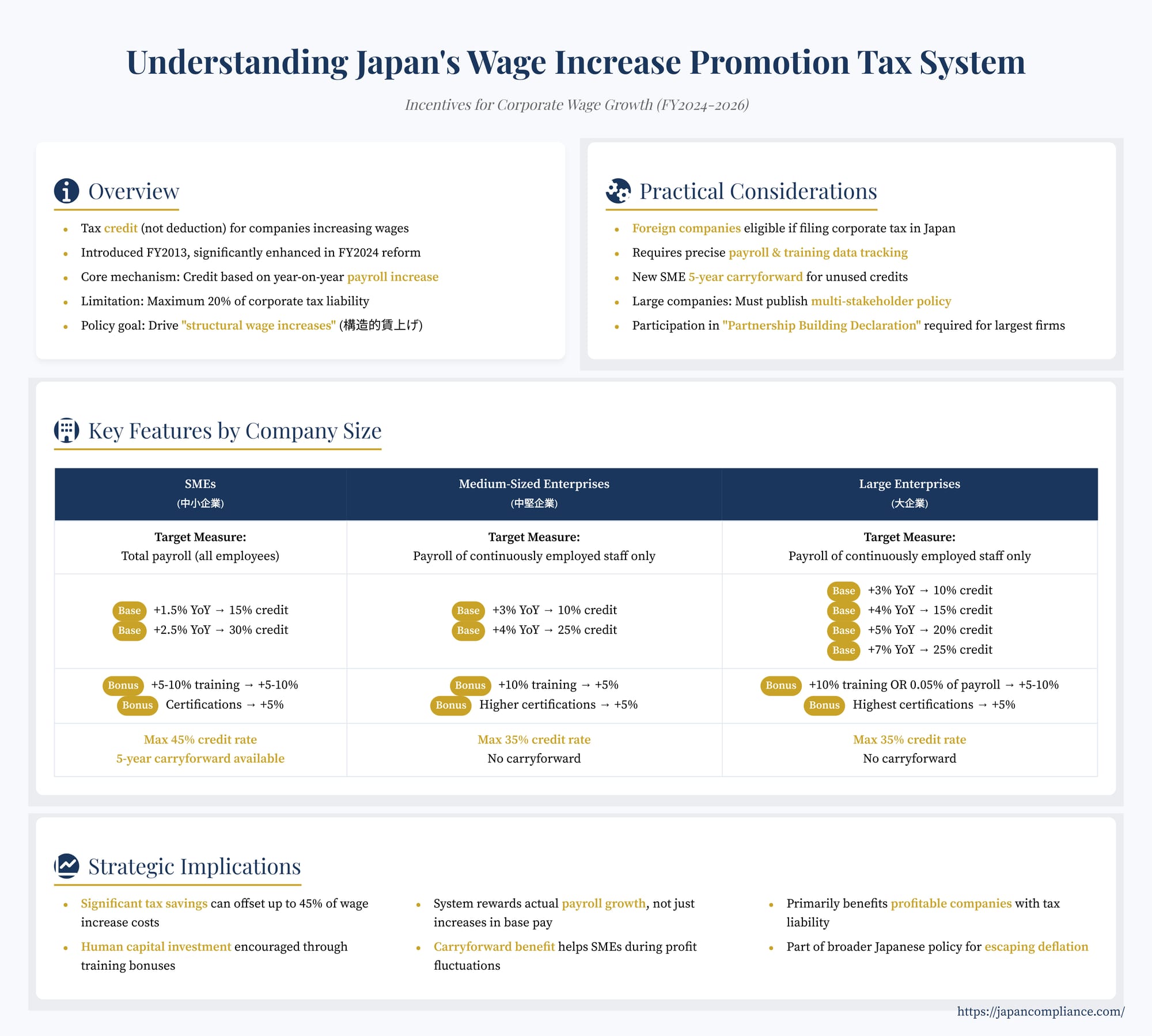

- Japan rewards companies that boost payroll with a tax credit up to 45 % (SMEs) under the Wage Increase Promotion Tax System.

- The FY 2024-26 reform adds higher rates, size-based tiers and a 5-year carry-forward for SMEs.

- Accurate payroll data, certification for training / diversity, and a public multi-stakeholder policy (large firms) are critical for compliance.

Table of Contents

- Introduction: Japan Tackles Wage Stagnation with Tax Measures

- Overview: How the Tax System Works

- Key Features of the FY 2024-2026 System

- Practical Considerations and Implications

- Conclusion: A Key Tool in Japan's Wage Growth Strategy

Introduction: Japan Tackles Wage Stagnation with Tax Measures

For nearly three decades, Japan experienced a period of remarkably stagnant wage growth, standing in stark contrast to sustained increases seen in many other developed economies. While corporate profits and retained earnings reached record highs, this prosperity was not consistently translating into higher pay for employees. Recently, driven by rising inflation and a strong government policy push, significant nominal wage increases have begun to appear, but the challenge of achieving sustainable real wage growth remains a top national priority.

A key pillar of the government's strategy to encourage companies to share their gains with employees is the Wage Increase Promotion Tax System (賃上げ促進税制, chin'age sokushin zeisei). First introduced in fiscal year (FY) 2013 and revised almost annually since, this system provides corporate tax credits to companies that increase their overall payroll compared to the previous year. The government views this tax incentive as a crucial tool to support businesses, especially Small and Medium Enterprises (SMEs), in securing the necessary resources for wage hikes, ultimately aiming to create a virtuous cycle of income growth and consumption.

The system underwent a significant enhancement in the FY2024 (Reiwa 6) tax reform, effective for fiscal years beginning between April 1, 2024, and March 31, 2027. These changes introduce more differentiation based on company size, increase potential credit rates, and add important new features like tax credit carryforwards for SMEs. For foreign companies operating in Japan through subsidiaries or branches, understanding the mechanics, eligibility requirements, and potential benefits of this evolving tax system is essential for effective financial planning and human resource strategy.

Overview: How the Tax System Works

The fundamental concept behind the Wage Increase Promotion Tax System is straightforward: companies that increase their qualifying payroll expenses above a certain threshold compared to the prior fiscal year can deduct a percentage of that increase directly from their corporate income tax liability.

- Core Mechanism: Tax Credit based on Payroll Increase.

- Policy Goal: To incentivize companies, particularly profitable ones, to allocate resources towards raising employee compensation, thereby supporting broader economic growth and helping wages catch up with inflation. The government frames this within a goal of achieving "structural wage increases" (構造的賃上げ, kōzōteki chin'age), implying a desire for lasting changes beyond temporary bonuses, though the system itself primarily measures overall payroll changes.

- Tax Credit, Not Deduction: It's important to note this is a tax credit (税額控除, zeigaku kōjo), which directly reduces the final tax owed, making it generally more valuable than a tax deduction, which only reduces taxable income.

- Limitations: The total credit amount is capped at 20% of the company's corporate income tax liability for the fiscal year (with a new carryforward rule for SMEs, discussed below). This means the system primarily benefits companies that are profitable and have sufficient tax liability to utilize the credit.

Key Features of the FY2024-2026 System

The latest iteration of the system introduces a more nuanced structure, differentiating requirements and credit rates based on company size. It identifies three main categories: SMEs (中小企業, chūshō kigyō), Medium-Sized Enterprises (中堅企業, chūken kigyō - a newly defined category), and Large Enterprises (大企業, daikigyō - effectively the default for those not meeting SME or Medium criteria).

(Note: Definitions generally depend on capital amount and/or employee numbers. SMEs are typically defined as corporations with capital of JPY 100 million or less, or corporations/individuals without capital having 1000 or fewer employees. Medium-Sized Enterprises are those not qualifying as SMEs but having 2000 or fewer employees. Precise definitions should be confirmed based on official tax guidance.)

1. Rules for Small and Medium-Sized Enterprises (SMEs) (中小企業向け)

SMEs receive the most generous potential benefits, reflecting the policy focus on supporting smaller firms often facing greater challenges in raising wages.

- Target Payroll: The calculation is based on the increase in total payroll for all domestic employees compared to the previous year. This broader base (compared to other categories focusing only on continuously employed staff) aims to incentivize not just wage hikes for existing staff but also overall employment expansion.

- Base Requirements & Credits:

- Increase total payroll by +1.5% year-on-year ⇒ 15% tax credit on the amount of the payroll increase.

- Increase total payroll by +2.5% year-on-year ⇒ 30% tax credit on the amount of the payroll increase.

- Additional ("Bonus") Credits: These rates are added to the applicable base credit rate (15% or 30%):

- Education & Training Investment:

- Increase education and training expenses (教育訓練費, kyōiku kunrenhi) by +5% year-on-year ⇒ Add +10% to the credit rate.

- Increase education and training expenses by +10% year-on-year ⇒ Add +10% to the credit rate. (Note: Official guides clarify the 5% threshold yields a 5% bonus, 10% yields a 10% bonus for SMEs).

- Childcare / Women's Participation Support: Obtain specific certifications from the Ministry of Health, Labour and Welfare (MHLW) related to supporting working parents or promoting women in the workplace ⇒ Add +5% to the credit rate. (Requires "Kurumin" certification or higher, OR "Eruboshi" certification level 2 or higher).

- Education & Training Investment:

- Maximum Credit Rate: Can reach 45% (30% base + 10% training + 5% childcare/women support) of the payroll increase.

- Tax Liability Cap: The total credit taken in a year cannot exceed 20% of the SME's corporate tax liability for that year.

- 5-Year Carryforward: Crucially, effective from FY2024, any portion of the calculated tax credit that cannot be used due to the 20% tax liability cap can be carried forward and applied against tax liabilities for up to five subsequent years. This significantly enhances the system's value for SMEs that may experience fluctuating profitability or temporary losses.

2. Rules for Medium-Sized Enterprises (中堅企業向け)

This new category targets companies larger than SMEs but smaller than traditional large enterprises (up to 2000 employees).

- Target Payroll: The calculation focuses on the increase in payroll for continuously employed domestic employees (継続雇用者, keizoku koyōsha) only. This typically excludes temporary staff or those employed for less than a year, focusing the incentive on raising pay for the core workforce.

- Base Requirements & Credits:

- Increase target payroll by +3% year-on-year ⇒ 10% tax credit on the amount of the target payroll increase.

- Increase target payroll by +4% year-on-year ⇒ 25% tax credit on the amount of the target payroll increase.

- Additional ("Bonus") Credits:

- Education & Training Investment: Increase education and training expenses by +10% year-on-year ⇒ Add +5% to the credit rate.

- Childcare / Women's Participation Support: Obtain higher-level MHLW certifications ⇒ Add +5% to the credit rate. (Requires "Platinum Kurumin" certification, OR "Eruboshi" certification level 3 or higher – stricter than SME requirements).

- Maximum Credit Rate: Can reach 35% (25% base + 5% training + 5% childcare/women support) of the target payroll increase.

- Tax Liability Cap: 20% of corporate tax liability.

- Carryforward: The 5-year carryforward provision does not apply to this category.

3. Rules for Large Enterprises (全企業向け)

This category applies to companies not meeting the SME or Medium-Sized criteria.

- Target Payroll: Also based on the increase in payroll for continuously employed domestic employees.

- Base Requirements & Credits (Tiered):

- Increase target payroll by +3% year-on-year ⇒ 10% tax credit.

- Increase target payroll by +4% year-on-year ⇒ 15% tax credit.

- Increase target payroll by +5% year-on-year ⇒ 20% tax credit.

- Increase target payroll by +7% year-on-year ⇒ 25% tax credit.

- Additional ("Bonus") Credits:

- Education & Training Investment: Requires either:

- Increase education and training expenses by +10% year-on-year ⇒ Add +5% to the credit rate; OR

- Education and training expenses constitute ≥ 0.05% of the total target payroll for the current year ⇒ Add +10% to the credit rate. (Companies choose the more beneficial calculation).

- Childcare / Women's Participation Support: Obtain the highest-level MHLW certifications ⇒ Add +5% to the credit rate. (Requires "Platinum Kurumin" certification OR "Platinum Eruboshi" certification).

- Education & Training Investment: Requires either:

- Maximum Credit Rate: Can reach 35% (25% base [@ +7% payroll increase] + 10% training + 5% childcare/women support).

- Tax Liability Cap: 20% of corporate tax liability.

- Multi-Stakeholder Policy Requirement: A significant additional requirement applies to large companies defined as having paid-in capital of JPY 1 billion or more AND 1,000 or more regular employees. These companies must publish a "multi-stakeholder policy" on their website, outlining their commitment to considering the interests of employees, suppliers, customers, etc., alongside shareholders. This policy must also confirm participation in the government's "Partnership Building Declaration" (パートナーシップ構築宣言) program. Failure to publish this policy, or having the Partnership Building Declaration revoked (e.g., due to findings of Subcontract Act violations), disqualifies the company from claiming the wage increase tax credit, regardless of its payroll increase.

Practical Considerations and Implications

Companies assessing the Wage Increase Promotion Tax System should consider several practical points:

- Eligibility for Foreign Companies: Foreign corporations operating in Japan through a subsidiary (which would be classified based on its own capital/employees) or a branch are generally eligible to apply the relevant rules based on the subsidiary's or branch's status, provided they file corporate income tax returns in Japan.

- Data Tracking and Calculation: Accurately calculating the year-on-year increase in the correct payroll base (total vs. continuously employed) requires precise HR and payroll data. Similarly, tracking the increase in eligible education and training expenses necessitates careful accounting. Companies need robust systems to support these calculations for tax filing purposes.

- Strategic Value: The potential tax savings can be significant, directly improving the company's bottom line. For SMEs achieving the maximum 45% credit rate, nearly half of the cost of the incremental wage increase could be offset by tax savings in that year (subject to the tax liability cap). This provides a tangible incentive to push for higher wage growth targets.

- SME Carryforward Advantage: The introduction of the 5-year carryforward transforms the system's utility for SMEs. Previously, unprofitable SMEs gained no benefit. Now, they can "bank" the credits earned during wage-increase years and use them to offset future tax liabilities when they return to profitability, making wage hikes less daunting during lean periods.

- Large Company Compliance: The multi-stakeholder policy and Partnership Building Declaration requirement adds a layer of public commitment and compliance risk for the largest firms. They must ensure their supplier relationships align with fair trade practices (particularly under the Subcontract Act) to maintain eligibility, linking tax benefits directly to broader responsible business conduct.

- Behavioral Impact – Real or Illusory? Does the system genuinely drive wage increases that wouldn't otherwise happen? Economic analysis, including studies reviewed by Japan's Ministry of Finance, suggests there is some positive impact, particularly noticeable as companies seem to bunch just above the minimum required thresholds (e.g., increasing payroll by slightly over 3% rather than slightly under). However, the analysis also suggested that the higher thresholds for bonus credits might not have significantly altered behavior for those already planning substantial increases. There's also a debate about whether the system incentivizes sustainable base pay increases or primarily rewards potentially temporary increases through bonuses, as both contribute to the total payroll calculation.

- Structural Limitations: As noted in policy commentary, the tax credit system primarily benefits profitable companies. It doesn't directly address deeper structural issues hindering wage growth across the entire economy, such as labor market rigidities or difficulties in passing costs through supply chains (though it aims to provide firms the capacity to overcome these). Its effectiveness may depend heavily on the broader economic climate and complementary government policies addressing these structural factors.

Conclusion: A Key Tool in Japan's Wage Growth Strategy

Japan's Wage Increase Promotion Tax System, especially with its FY2024 enhancements, represents a significant policy effort to break the cycle of wage stagnation. By offering potentially substantial tax credits linked to payroll growth and supplementary investments in human capital and diversity, the government aims to provide a powerful incentive for businesses to share profits more broadly with their workforce.

For companies operating in Japan, particularly SMEs benefiting from the new carryforward rules, the system offers a valuable opportunity to mitigate the costs associated with raising wages in the current inflationary environment. However, maximizing these benefits requires careful planning, accurate calculation, and adherence to all eligibility criteria, including the non-tax requirements related to multi-stakeholder policies for large corporations.

While the tax system itself may not be a panacea for Japan's long-term wage challenges, it serves as a clear signal of government priorities and provides tangible support for companies committed to investing in their employees. Businesses should evaluate how this evolving tax incentive aligns with their compensation strategies and overall financial planning in the dynamic Japanese economic landscape.

- Unlocking Japan's Corporate Tax Incentives: A Guide for US Subsidiaries

- Japan's Invoice System: A Must-Know for US Companies Doing Business in Japan

- Understanding Japan's Approach to the Global Minimum Tax (Pillar 2): Key Considerations for Multinationals

- FY 2024 Guidebook for Wage Increase Promotion Tax Credit (METI, PDF)

- Overview of 2024 Revisions to the Wage Increase Tax Credit (NTA, PDF)