Understanding Classes of Shares in Japanese Startups: A Deep Dive for Investors

Learn how Japanese startups structure common and preferred share classes, including liquidation preferences, anti‑dilution, redemption and governance rights—essential reading for venture investors entering Japan.

TL;DR

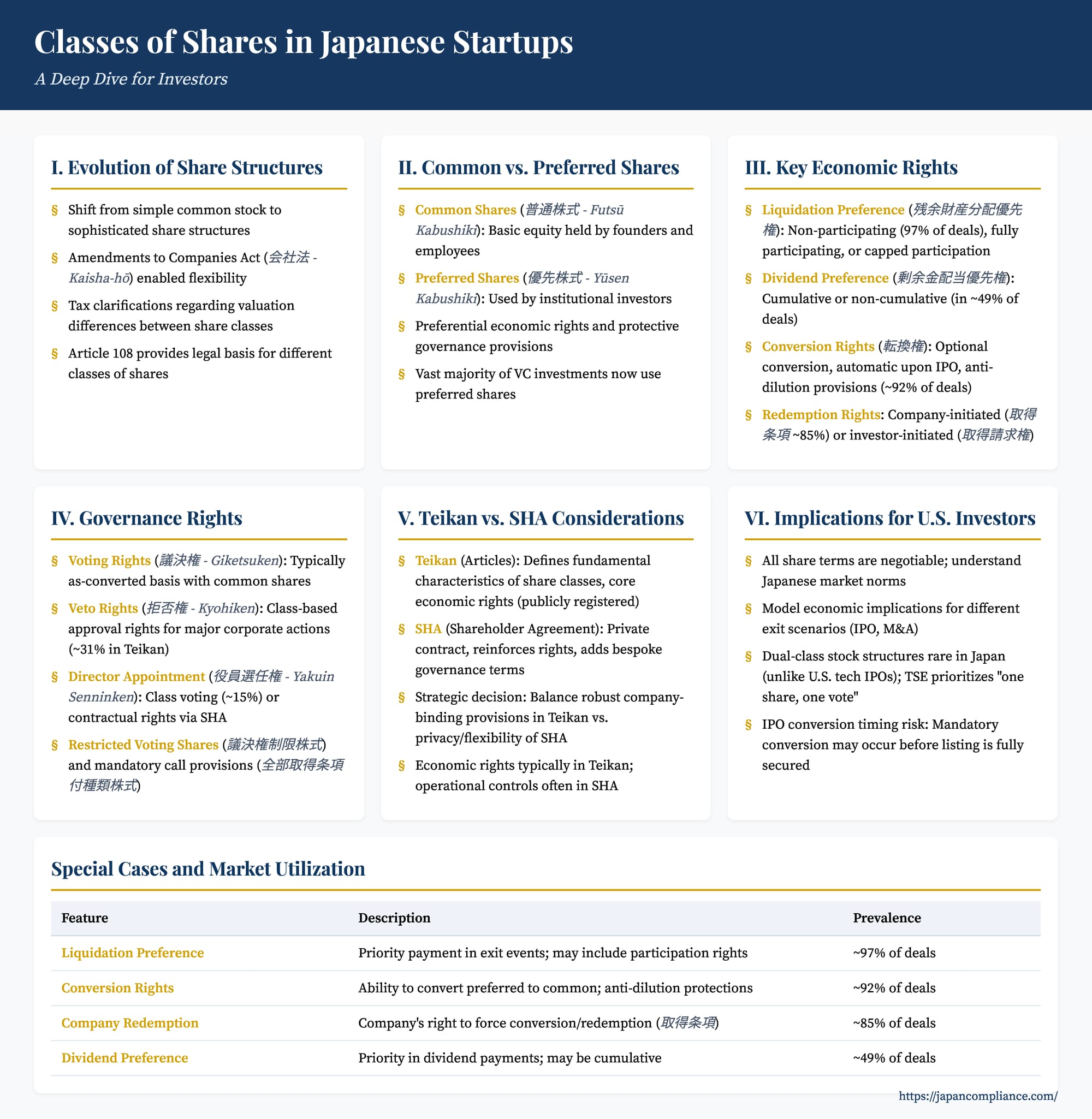

Japan’s Companies Act lets startups issue multiple share classes. Most venture deals now use preferred shares with liquidation preferences, conversion rights and other protections. Understanding how those rights interact with Articles of Incorporation (Teikan) and Shareholder Agreements is critical for U.S. investors to model exits and negotiate governance.

Table of Contents

- The Shift Towards Sophisticated Share Structures

- Common Shares (普通株式 - Futsū Kabushiki)

- Preferred Shares (優先株式 - Yūsen Kabushiki): The Investor's Toolkit

3.1 Key Economic Rights of Preferred Shares

3.2 Key Governance Rights Associated with Classes of Shares - The Interplay: Articles of Incorporation (Teikan) vs. Shareholder Agreements (SHA)

- Special Cases and Advanced Topics

- Practical Implications for U.S. Investors

- Conclusion

For U.S. investors navigating the burgeoning Japanese startup scene, a nuanced understanding of how capital structures are organized is paramount. While Japan's corporate law offers considerable flexibility, the use and structuring of different classes of shares (種類株式 - shurui kabushiki) carry specific implications for investment terms, governance, and exit strategies. This deep dive explores the common types of shares utilized in Japanese startups, their key features, and strategic considerations for investors.

The Shift Towards Sophisticated Share Structures

Historically, Japanese startup investments often relied on common stock. However, over the past two decades, mirroring global trends and facilitated by amendments to the Japanese Companies Act (会社法 - Kaisha-hō), there has been a significant shift towards more sophisticated share structures. Today, the vast majority of venture capital and growth equity investments in Japanese startups involve the issuance of various classes of preferred shares. This evolution was also spurred by important clarifications in tax regulations concerning the valuation differences between common and preferred stock, making structured investments more predictable and appealing.

The Companies Act, particularly Article 108, provides the legal basis for issuing different classes of shares, each with varying rights concerning dividends, distribution of residual assets, voting, and other matters. This flexibility allows startups and investors to tailor share terms to their specific needs and risk-reward profiles.

Common Shares (普通株式 - Futsū Kabushiki)

Common shares are the most basic form of equity, typically held by founders, early employees, and sometimes seed-stage investors. They generally carry voting rights (one vote per share) and the right to participate in residual profits and assets after preferred shareholders' claims are met.

Preferred Shares (優先株式 - Yūsen Kabushiki): The Investor's Toolkit

Preferred shares are the instrument of choice for most institutional investors in Japanese startups. They are designed to provide investors with preferential economic rights and, often, certain protective governance rights. Let's break down their common features:

Key Economic Rights of Preferred Shares

- Liquidation Preference (残余財産分配優先権 - Zanyo Zaisan Bunpai Yūsenken)

This is arguably the most critical economic right for preferred shareholders. It dictates the order of payout in a "liquidation event," which typically includes not only actual bankruptcy or dissolution but also "deemed liquidation events" (みなし清算条項 - minashi seisan jōkō) such as a merger, acquisition, or sale of substantially all company assets.- Non-Participating (非参加型 - Hi-sankagata): Preferred shareholders receive a pre-agreed amount (usually their original investment plus accrued but unpaid dividends, or a multiple of their investment) before common shareholders receive anything. After this preferential payment, the remaining assets are distributed solely among common shareholders.

- Fully Participating (完全参加型 - Kanzen Sankagata): After receiving their liquidation preference, preferred shareholders also share in the remaining proceeds with common shareholders on an as-converted-to-common-stock basis.

- Capped Participation (上限付参加型 - Jōgen-tsuki Sankagata): Preferred shareholders receive their preference and then participate with common shareholders up to a certain multiple of their original investment.

The choice between these types significantly impacts the return distribution at exit and is a key negotiation point. Data suggests that liquidation preferences are utilized in a very high percentage (around 97%) of Japanese startup investment deals involving preferred shares, often in conjunction with deemed liquidation clauses to ensure their application in M&A scenarios.

- Dividend Preference (剰余金配当優先権 - Jōyokin Haitō Yūsenken)

Preferred shares often carry a right to receive dividends in preference to common shares. These can be:- Cumulative (累積型 - Ruisekigata): If dividends are not paid in a given period, they accumulate and must be paid out before any dividends can be paid to common shareholders.

- Non-Cumulative (非累積型 - Hi-ruisekigata): Unpaid dividends do not accumulate.

While common in U.S. deals, dividend preferences are somewhat less emphasized in Japanese startups (utilized in around 49% of deals with preferred shares), as many startups are growth-focused and do not expect to pay dividends in their early years. The preference often serves more as a mechanism to affect liquidation payouts (if dividends are "accrued but unpaid") or as a negotiating lever rather than an expectation of actual cash flow.

- Conversion Rights (転換権 - Tenkanken)

Preferred shares are almost always convertible into common shares.- Optional Conversion: The preferred shareholder typically has the right to convert their shares into common stock at any time, usually at a pre-defined ratio (e.g., 1:1, subject to adjustments).

- Automatic Conversion: Preferred shares often automatically convert into common stock upon the occurrence of a "qualified IPO" (a public offering meeting certain size and price thresholds). This simplifies the capital structure for public markets.

- Anti-Dilution Provisions (希薄化防止条項 - Kihakuka Bōshi Jōkō): These adjust the conversion price of preferred shares to protect investors if the company issues new shares at a price lower than what the preferred shareholders paid (a "down round"). Common types include "broad-based weighted average" and, less frequently, "full ratchet" adjustments. Conversion rights, including anti-dilution features, are standard and see high utilization (around 92%) in Japanese preferred share deals.

- Redemption Rights (取得条項 / 取得請求権 - Shutoku Jōkō / Shutoku Seikyūken)

These provisions allow shares to be bought back by the company or, in some cases, give investors the right to demand a buyback.- Company's Right to Redeem (取得条項 - Shutoku Jōkō): This allows the company to redeem (buy back) the preferred shares, often at a price equal to the original investment plus accrued dividends. This is frequently used pre-IPO to force the conversion of preferred shares into common stock to simplify the capital structure for public listing. Such provisions are widely used (around 85% of deals). The timing of this mandatory conversion can be a critical point, as it may occur before the IPO is absolutely certain, exposing investors to risks if the IPO is subsequently delayed or cancelled.

- Investor's Right to Demand Redemption (取得請求権 - Shutoku Seikyūken): This gives preferred shareholders the right to require the company to redeem their shares, typically after a certain number of years if an exit event (like an IPO or M&A) has not occurred. This provides a potential, albeit often challenging, exit mechanism for investors if the startup stagnates.

Key Governance Rights Associated with Classes of Shares

While many governance rights are detailed in Shareholder Agreements (SHAs) for flexibility and privacy, some can be embedded as rights specific to a class of shares in the Articles of Incorporation (定款 - Teikan).

- Voting Rights (議決権 - Giketsuken)

Preferred shares usually vote on an "as-converted" basis alongside common shares for most matters. However, they may also have special class-based voting rights or veto rights over certain actions. - Veto Rights / Protective Provisions (拒否権 - Kyohiken)

The Articles of Incorporation can grant a specific class of shares (typically preferred shares) the right to approve or veto certain significant corporate actions, even if those shares do not represent a majority of the total voting power. These actions might include:- Altering the rights of that class of shares.

- Creating a new class of shares with rights senior to or on parity with the existing preferred shares.

- Authorizing a merger, sale, or liquidation of the company.

- Increasing or decreasing the authorized number of shares of that class.

While the Companies Act allows for such class-based veto rights, their utilization directly in the Teikan for a broad range of operational matters is observed to be less frequent (around 31%) than contractual veto rights in SHAs. This preference for SHAs is often driven by the desire to keep detailed control mechanisms private (as Teikan are publicly registered) and the ease of amending contractual agreements compared to formal Teikan amendments.

- Director Appointment Rights (役員選任権 - Yakuin Senninken)

The Companies Act allows for a class of shares to have the right to elect a certain number of directors (so-called "class voting" for directors, クラスボーティング - kurasu bōtingu). However, this mechanism is very rarely used in Japanese startup practice (around 15% utilization). Instead, director appointment rights for investors are almost exclusively handled contractually through SHAs. The reasons are similar to those for veto rights: privacy, flexibility, and the complexity of embedding such dynamic rights into the Teikan.

The Interplay: Articles of Incorporation (Teikan) vs. Shareholder Agreements (SHA)

- Teikan (Articles of Incorporation): Defines the fundamental characteristics of each class of shares, including their core economic rights (liquidation preference, dividend rights, conversion features if tied to the class itself) and any class-specific voting or veto rights that are intended to be binding on the company and all future shareholders of that class. These are publicly registered.

- SHA (Shareholder Agreement): A private contract that can create additional rights and obligations among its signatories. It can reinforce Teikan provisions or add bespoke governance terms (e.g., specific information rights, more detailed vetoes over operational matters, investor director nomination agreements that signatories promise to vote for). SHAs are not publicly filed and are easier to amend among the parties involved.

The strategic decision often involves balancing the robust, company-binding nature of Teikan provisions with the privacy and flexibility of SHAs.

Special Cases and Advanced Topics

- Shares with Restricted Voting Rights (議決権制限株式 - Giketsuken Seigen Kabushiki)

These shares may have limited or no voting rights on general matters but might retain voting rights on issues specifically affecting their class. - Shares Subject to Call by the Company (全部取得条項付種類株式 - Zenbu Shutoku Jōkō-tsuki Shurui Kabushiki)

These are shares that the company can forcibly acquire from all shareholders of that class upon the occurrence of a specified event, often against the delivery of cash or other shares (e.g., used in squeeze-out scenarios or for mandatory conversion). - Dual-Class Stock Structures (複数議決権株式 - Fukusū Giketsuken Kabushiki)

This structure, common for U.S. tech IPOs where founders retain control through super-voting shares, is exceptionally rare in Japan for publicly listed companies. The Tokyo Stock Exchange (TSE) prioritizes the "one share, one vote" principle and is highly restrictive. The leading (and virtually sole) example often cited is a robotics company that listed with a form of multiple voting rights, but this was approved under very specific circumstances and included stringent sunset clauses (provisions that terminate the super-voting rights after a certain period or event). U.S. investors accustomed to dual-class structures will find this a significant departure from their domestic market norms. For privately held startups, while theoretically possible to create such structures under the Companies Act, their utility is limited if the long-term goal is a traditional Japanese IPO.

Practical Implications for U.S. Investors

- Negotiation is Key: All terms of preferred shares are subject to negotiation. Understand the market norms in Japan but don't hesitate to negotiate for terms that align with your investment strategy and risk appetite.

- Market Norms: While some terms (like liquidation preferences) are standard, the specifics (e.g., participation rights, anti-dilution mechanics) can differ from U.S. market standards. Be prepared for these variations.

- Tax Implications: The structuring of shares can have tax consequences for both the investor and the company/founders. As noted earlier, clarifications regarding the tax treatment of valuation differences between preferred and common stock were a milestone in the broader adoption of preferred shares in Japan. Seek expert tax advice.

- Exit Scenarios: Model out how different share rights will play out in various exit scenarios (IPO, M&A at different valuations) to fully understand the economic implications.

- Balance Economic and Governance Rights: While strong economic protections are crucial, consider how governance rights will enable you to monitor your investment and influence key decisions without unduly stifling the startup's management.

Conclusion

The ability to issue different classes of shares under the Japanese Companies Act provides a flexible and powerful toolkit for structuring startup investments. For U.S. investors, a thorough understanding of common preferred share terms—from liquidation preferences and conversion rights to the less common but still possible governance rights embedded in share classes—is essential. By carefully negotiating these terms and understanding their interplay with the Articles of Incorporation and Shareholder Agreements, investors can effectively protect their capital, align interests with founders, and position themselves for successful outcomes in Japan's dynamic and growing startup ecosystem.

- Does the “4× Authorized Shares” Rule Apply When a Public Japanese Company Reduces Issued Shares via Share Consolidation?

- How Do Japanese Courts Determine “Fair Price” in Shareholder Appraisal Rights Cases?

- Fictitious Share Payments in Japan: Legal Consequences for Subscribers and Directors under the Amended Companies Act

- Japan’s Corporate Governance Code – Final Proposal (Financial Services Agency)