Triangular Set-Off in Japanese Civil Rehabilitation: Supreme Court Upholds Mutuality Requirement, Restricts Affiliate Set-Offs

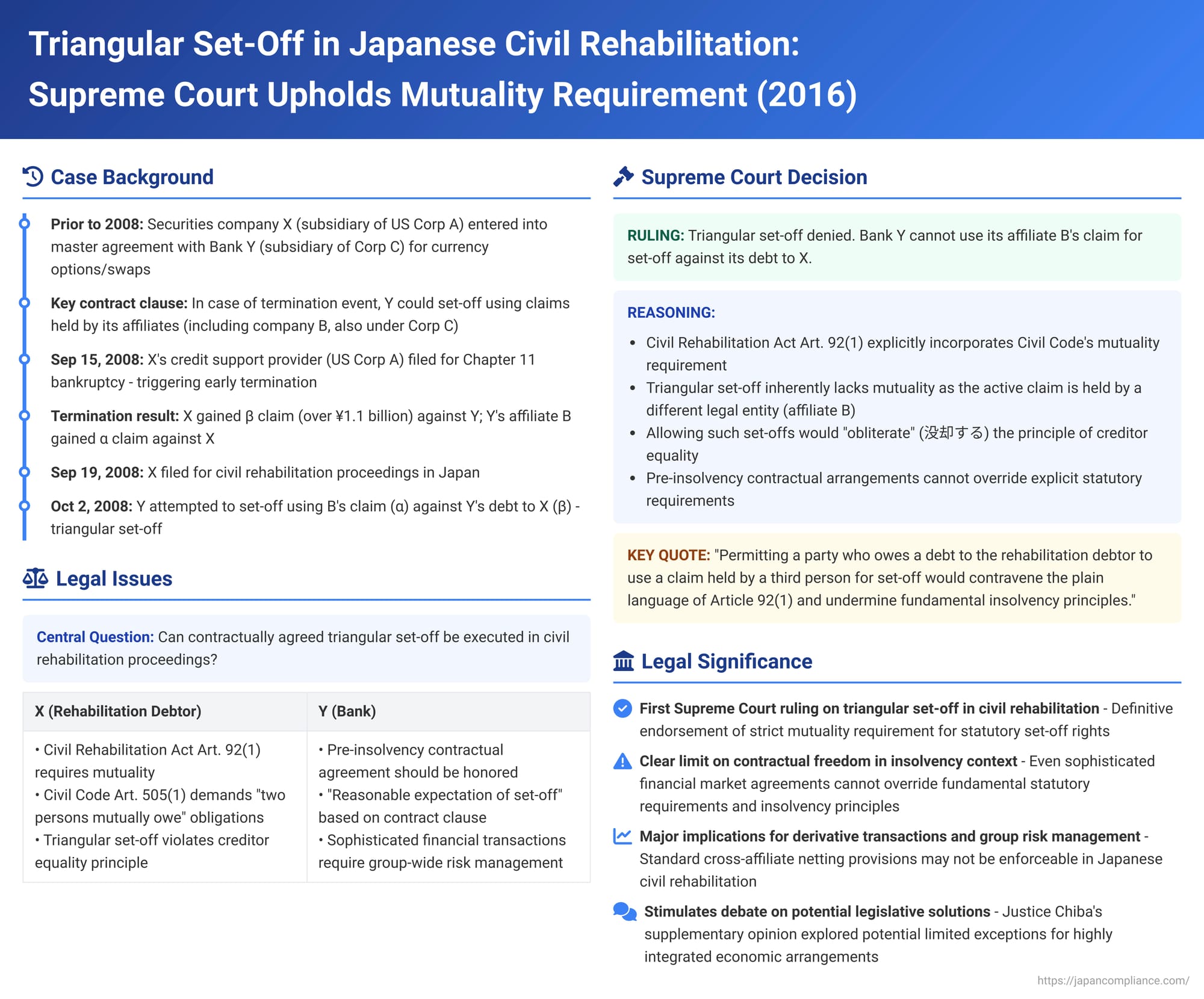

The right of set-off (相殺 - sōsai) in Japanese insolvency law provides a powerful mechanism for a creditor who also owes a debt to the insolvent entity to achieve a form of preferential recovery. However, this right is carefully circumscribed by statute to ensure fairness among all creditors. A significant point of contention has been the validity of "triangular set-off" (三者間相殺 - sanshakan sōsai) provisions often found in complex financial agreements, where a creditor seeks to set off its debt to an insolvent party using a claim held by an affiliate of the creditor against that same insolvent party. On July 8, 2016, the Supreme Court of Japan delivered a landmark decision that directly addressed the permissibility of such arrangements within civil rehabilitation proceedings, ultimately emphasizing a strict adherence to the traditional requirement of mutuality.

Factual Background: Derivative Trades, Affiliate Claims, and a Contractual Set-Off Clause

The case involved X, a securities company that was a subsidiary of a U.S. corporation (US Corp. A), and Y, a Japanese trust bank that was a wholly-owned subsidiary of Corporation C. Another Japanese securities company, B, was also a wholly-owned subsidiary of the same Corporation C, making B an affiliate of Y Bank.

X and Y Bank had entered into a master agreement governing their currency option and swap transactions. This master agreement contained several important clauses, including:

- An "early termination" clause, stipulating that if a specified termination event occurred with respect to one party (e.g., if its credit support provider filed for bankruptcy or similar relief), all existing transactions between X and Y under the master agreement would automatically terminate.

- A specific set-off clause ("the subject set-off clause"). This clause provided that if such an early termination event occurred and one party (say, X) subsequently entered civil rehabilitation proceedings, the other party (Y Bank) was entitled to set off not only its own claims against X but also any claims held by Y Bank's "affiliates" (defined as entities under common control with Y Bank, which would include company B) against X. This set-off by Y Bank (using its own and its affiliate B's claims as active claims) could be made against any debts owed by Y Bank (and its affiliates, though this part wasn't the focus) to X (the passive claims). This clause essentially purported to authorize a triangular set-off.

Separately, X also had a similar master agreement and derivative transactions with Y Bank's affiliate, B.

On September 15, 2008, US Corp. A, which was X's credit support provider under the X-Y master agreement, filed for Chapter 11 bankruptcy protection in the United States. This filing constituted an early termination event under both the X-Y master agreement and the X-B master agreement.

- As a result of the termination of the X-Y transactions, X (the securities company) ended up with a net claim (清算金 - seisankin, or net termination payment) against Y Bank amounting to over 1.1 billion yen (this is referred to as the "β claim").

- Simultaneously, the termination of the X-B transactions resulted in B (Y Bank's affiliate) acquiring a net claim against X that exceeded the amount of X's β claim against Y Bank (this is referred to as the "α claim").

Shortly thereafter, on September 19, 2008, X itself filed for civil rehabilitation proceedings in Japan, and these proceedings were formally commenced.

On October 2, 2008, Y Bank, invoking "the subject set-off clause" in its master agreement with X, sent a notice to X. In this notice, Y Bank declared its intention to set off the α claim (the claim held by its affiliate, B, against X, which Y Bank used as the active claim) against the β claim (the debt owed by Y Bank to X, which served as the passive claim). B, the affiliate, also notified X that it consented to Y Bank using B's α claim for this set-off. Y Bank contended that this set-off completely extinguished X's β claim against it.

X (now as the rehabilitation debtor) subsequently filed a lawsuit against Y Bank, seeking payment of the β claim (the net termination payment of over 1.1 billion yen plus damages). Y Bank defended by asserting the validity of the triangular set-off.

The Tokyo District Court (first instance) and the Tokyo High Court (on appeal) both ruled in favor of Y Bank. They upheld the validity of the triangular set-off, reasoning that although strict mutuality of debts between X and Y (for the active claim) was lacking, there existed a "reasonable expectation of set-off" based on the pre-existing contractual clause designed for group-wide risk management in sophisticated financial transactions, and that allowing it in this instance did not unduly harm the principle of creditor equality. X then had its petition for acceptance of appeal granted by the Supreme Court.

The Legal Issue: Mutuality of Debts and Contractual Triangular Set-Off in Civil Rehabilitation

The central legal question for the Supreme Court was whether such a contractually agreed-upon triangular set-off was permissible under Japanese civil rehabilitation law. Specifically:

- Civil Rehabilitation Act Article 92, paragraph 1: This provision allows a rehabilitation creditor who "owes a debt to the rehabilitation debtor" at the time rehabilitation proceedings commence to effect a set-off without being bound by the terms of the rehabilitation plan (i.e., they can achieve full satisfaction up to the amount of the debt they owe). Does this provision accommodate a scenario where the active claim used for set-off is held not by the party owing the debt to the rehabilitation debtor, but by an affiliate of that party?

- Civil Code Article 505, paragraph 1: This is the general provision for set-off in Japanese civil law, which requires that "two persons mutually owe to the other obligations." Is this fundamental requirement of "mutuality" strictly applied in the context of insolvency proceedings governed by the Civil Rehabilitation Act, or can it be overridden by a prior contractual agreement between the parties that permits a triangular (or multi-party) set-off?

- Creditor Equality vs. Contractual Freedom and "Reasonable Expectation of Set-Off": The case brought into sharp focus the tension between upholding the parties' pre-insolvency contractual arrangements (often designed for sophisticated risk management in financial markets, like the ISDA Master Agreement-based clause here) and the core insolvency law principle of ensuring fair and equal treatment among all general rehabilitation creditors. Could a "reasonable expectation of set-off," arising from such a contractual clause, justify a departure from strict mutuality?

The Supreme Court's Ruling: Triangular Set-Off Denied; Mutuality is a Key Statutory Requirement

The Supreme Court, in its judgment of July 8, 2016, partially modified the High Court's judgment. While the specifics of the monetary award involved other complex calculations related to the derivative close-outs not detailed in the provided summary, the core of the Supreme Court's decision was a rejection of the validity of the triangular set-off as asserted by Y Bank under Article 92, paragraph 1, of the Civil Rehabilitation Act.

The Court's reasoning was as follows:

- Article 92(1) of the Civil Rehabilitation Act Presupposes Mutuality: The Court began by analyzing the text of Article 92, paragraph 1. This provision grants a special right of set-off to a rehabilitation creditor who "owes a debt to the rehabilitation debtor." The Supreme Court interpreted this language as explicitly adopting and incorporating the fundamental requirement of mutuality as set forth in Article 505, paragraph 1, of the Civil Code—namely, that for a set-off to be valid, the two obligations must be owed between the same two parties.

- Triangular Set-Off Inherently Lacks Mutuality: The set-off attempted by Y Bank in this case clearly lacked this direct mutuality concerning the active claim. Y Bank (who owed the β claim to X) sought to use the α claim, which was held by a different legal entity (its affiliate, B), as the active claim against X. This is the essence of a triangular set-off.

- Permitting Such Triangular Set-Off Violates Statutory Language and Creditor Equality: The Supreme Court stated that allowing a party (Y Bank) who owes a debt to the rehabilitation debtor (X) to use a claim held by a third person (its affiliate B) against X for the purpose of set-off would be nothing less than permitting a set-off between parties who are not in a direct mutual debtor-creditor relationship with respect to the active claim. This, the Court held, directly contravenes the plain language of Article 92, paragraph 1. More fundamentally, it would "obliterate" (没却する - bokkyaku suru) the basic principle of ensuring fair and equal treatment among all rehabilitation creditors, which is a cornerstone of the Civil Rehabilitation Act. Such a set-off would allow Y Bank (and indirectly, its affiliate B) to achieve a preferential recovery of B's claim against X by using an asset (Y Bank's debt to X) that should otherwise have been available for distribution to all of X's creditors under the terms of X's rehabilitation plan.

- Prior Contractual Agreement Cannot Validate a Statutorily Non-Compliant Set-Off: The fact that X and Y Bank had a pre-existing contractual agreement ("the subject set-off clause") that purported to authorize such a triangular set-off did not render the set-off permissible under Article 92, paragraph 1, of the Civil Rehabilitation Act. The Court reasoned that the statutory requirements for exercising set-off rights within a civil rehabilitation proceeding, including the fundamental requirement of mutuality, cannot be overridden by private contractual arrangements if those arrangements lead to a result that conflicts with the basic principles of the Act, such as creditor equality. The provisions of the Civil Rehabilitation Act governing set-off take precedence.

Notably, as the PDF commentary points out, the Supreme Court in this decision did not invoke or rely on the doctrine of "reasonable expectation of set-off." In some other set-off cases (particularly those involving the "cause existing before" exception to set-off prohibitions), the Court has considered whether a creditor had a reasonable expectation of set-off based on their pre-crisis dealings. However, in this 2016 case, the fundamental lack of statutory mutuality appears to have been the dispositive factor, rendering further inquiry into "reasonable expectations" under Article 92(1) unnecessary for the majority.

Justice Chiba's Supplementary Opinion

The judgment included a detailed supplementary opinion by Justice Katsumi Chiba. While concurring with the outcome, Justice Chiba's opinion (as summarized in the PDF commentary) likely delved into the nuances of the "mutuality" requirement and explored whether there might be extremely limited and specific circumstances where a triangular set-off could be permissible by an analogous application of set-off rules. Such an exception might be considered if the economic substance of the arrangement very closely mirrors a direct two-party set-off—for example, if the affiliate is essentially an alter ego of the setting-off party, or if the claims are part of a highly integrated, pre-existing multilateral settlement mechanism where the parties are, for that specific set of transactions, effectively treated as a single economic unit. However, the majority opinion itself maintained a strict interpretation of mutuality for standard set-offs claimed under Article 92, paragraph 1.

Significance and Implications

This 2016 Supreme Court decision is of major importance:

- First Supreme Court Ruling on Triangular Set-Off in Civil Rehabilitation: It represents the Supreme Court's first direct and definitive ruling on the general permissibility of triangular set-offs (where a creditor uses an affiliate's claim) in the context of Japanese civil rehabilitation proceedings.

- Strong Endorsement of the Mutuality Requirement for Statutory Set-Off: The judgment strongly reaffirms that the traditional Civil Code requirement of mutuality—that the debts being set off must exist between the same two parties—is a core and indispensable element for a creditor to exercise the statutory right of set-off under Article 92, paragraph 1, of the Civil Rehabilitation Act.

- Significant Limits on Contractual Freedom in Insolvency: The decision clearly demonstrates that pre-insolvency contractual agreements, even sophisticated clauses commonly used in international financial markets (like those found in ISDA Master Agreements designed for group-wide risk management), cannot override the fundamental principles and prohibitions of Japanese insolvency law if their application would lead to results that are inequitable to the general body of creditors or contravene explicit statutory requirements like mutuality.

- Impact on Derivative Transactions and Group-Wide Risk Management: This ruling has significant implications for how financial institutions and corporate groups structure their risk management and collateral arrangements for derivative transactions, particularly those involving Japanese counterparties that might enter civil rehabilitation. Standard cross-affiliate netting and set-off clauses, if they rely on a triangular set-off mechanism lacking direct mutuality with the Japanese debtor, may not be reliably enforceable in a Japanese civil rehabilitation proceeding as a matter of statutory set-off right under Article 92(1).

- Stimulates Ongoing Debate and Potential Legislative Considerations: As the PDF commentary and Justice Chiba's supplementary opinion suggest, the debate over the precise scope and application of the "mutuality" requirement, and whether Japanese insolvency law should (or does) allow for more flexible interpretations or analogous applications of set-off rules in very specific and limited circumstances (e.g., within highly integrated payment or settlement systems, or between entities that are truly economically indistinguishable), is likely to continue. The decision may also spur further consideration of potential legislative clarifications or specific statutory provisions to address complex multi-party netting and set-off arrangements in the financial markets, balancing the needs of systemic risk management with the core principles of insolvency law.

Concluding Thoughts

The Supreme Court's July 8, 2016, decision sends a clear signal regarding the treatment of triangular set-off arrangements in Japanese civil rehabilitation proceedings. By strictly upholding the requirement of mutuality for set-offs claimed under Article 92, paragraph 1, of the Civil Rehabilitation Act, the Court has prioritized statutory compliance and the fundamental insolvency principle of creditor equality over private contractual attempts to create broader, cross-affiliate set-off rights. While pre-insolvency agreements are important, they cannot validate a set-off that fails to meet the core statutory criteria and would result in an inequitable distribution of the rehabilitation debtor's assets. This ruling significantly impacts the structuring of financial transactions and risk management strategies for parties dealing with Japanese entities that could potentially enter civil rehabilitation.