EU Battery Regulation: Global Impact on US-Japan Supply Chains

TL;DR: The EU Battery Regulation imposes cradle-to-grave rules—carbon footprint, recycled content, due-diligence and QR labelling—on every battery sold in the EU. U.S. and Japanese manufacturers must trace upstream materials, secure recycling capacity and update technical files well before phased deadlines in 2025-2030.

Table of Contents

- Introduction

- Scope and Timelines of the EU Battery Regulation

- Carbon-Footprint and Recycled-Content Requirements

- Mandatory Due-Diligence and Supply-Chain Audits

- Digital Battery Passport and Labelling Duties

- Impact on U.S. & Japanese Stakeholders

- Compliance Strategy and Next Steps

- Conclusion

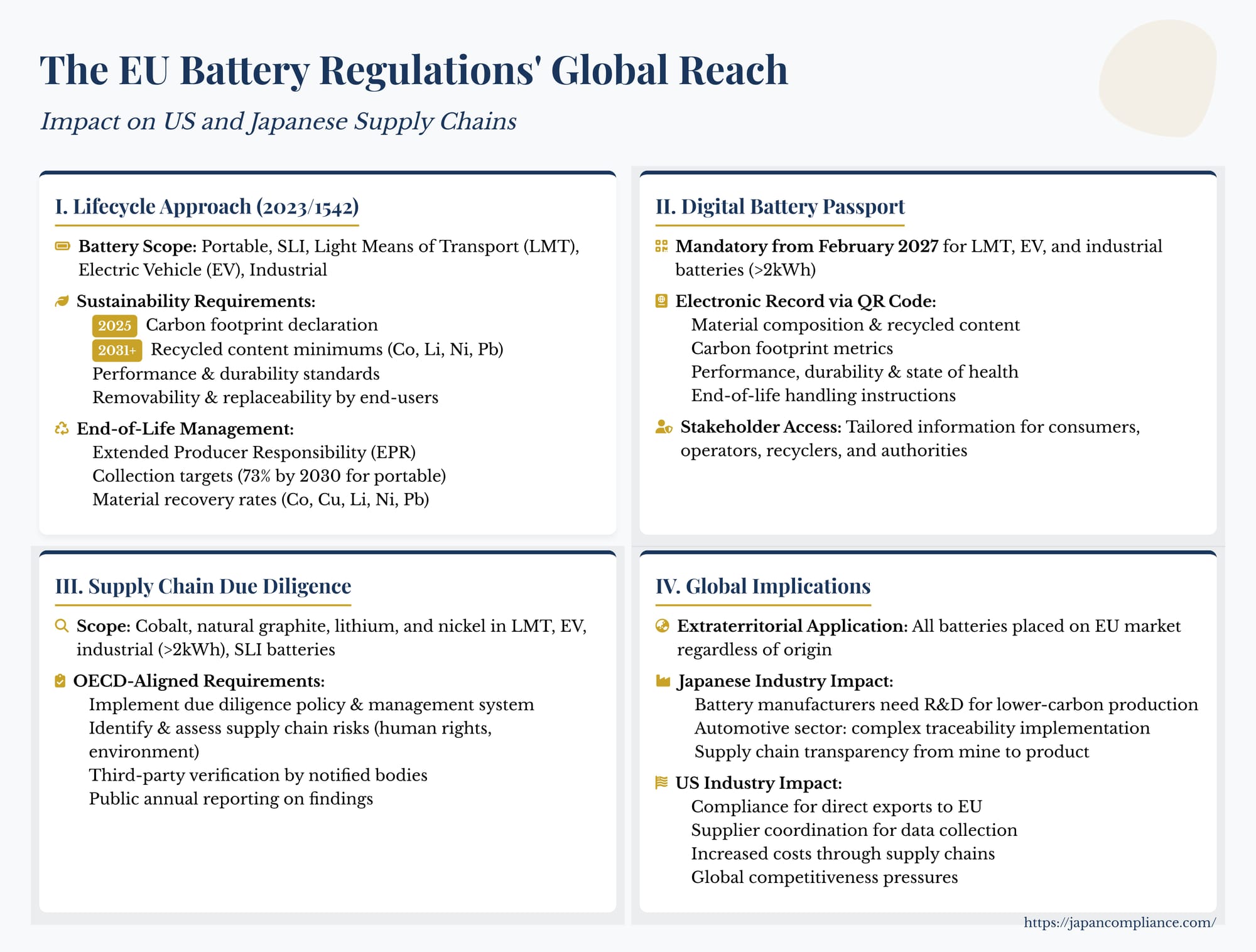

The European Union is forging ahead with ambitious environmental policies under its Green Deal and Circular Economy Action Plan. A landmark piece of this agenda, the EU Battery Regulation (EU) 2023/1542, entered into force in August 2023 and began applying from February 2024, replacing the older 2006 Battery Directive. Unlike its predecessor, the new regulation adopts a comprehensive lifecycle approach, setting demanding requirements for sustainability, performance, and transparency that extend far beyond the EU's borders.

This regulation is not merely an environmental measure; it's deeply intertwined with the EU's industrial strategy, aiming to boost competitiveness, enhance strategic autonomy in a critical sector, and foster a circular economy. Its implications are profound for global manufacturers, including those in Japan – a key player in battery technology and related industries like automotive and electronics – and consequently for US companies integrated into these international supply chains. Understanding the scope, requirements, and potential challenges of this regulation is essential for businesses navigating the evolving landscape of global trade and sustainability compliance.

A Lifecycle Approach: Overview of the EU Battery Regulation

The Battery Regulation sets a new standard by addressing the entire lifecycle of batteries, from the sourcing of raw materials to design, production, use, and end-of-life management. Its scope is broad, covering nearly all types of batteries placed on the EU market, categorized as:

- Portable batteries

- Starting, Lighting, and Ignition (SLI) batteries (primarily for vehicles)

- Light Means of Transport (LMT) batteries (e.g., for e-bikes, e-scooters)

- Electric Vehicle (EV) batteries

- Industrial batteries (including energy storage systems)

The regulation establishes a harmonized framework built on several key pillars:

1. Sustainability and Safety Requirements:

- Hazardous Substances: Restricts the use of mercury, cadmium, and lead beyond specified limits.

- Carbon Footprint: Mandates calculation and declaration of the carbon footprint throughout the battery's lifecycle for EV, LMT, and rechargeable industrial batteries (>2kWh). This involves phased implementation, starting with declarations (from Feb 2025/Aug 2025), followed by classification into performance classes (from Aug 2026/Feb 2027), and eventually adherence to maximum lifecycle carbon footprint thresholds (from Feb 2028/Aug 2029), dates depending on specific delegated acts.

- Recycled Content: Requires minimum levels of recycled cobalt, lead, lithium, and nickel to be recovered from manufacturing and consumer waste and incorporated into new LMT, EV, SLI, and industrial batteries. Specific targets are set for 2031 and increase significantly by 2036 (e.g., for cobalt: 16% by 2031, 26% by 2036). Documentation and verification are required.

- Performance and Durability: Sets minimum requirements for parameters like capacity, lifespan, and charge retention for portable batteries, rechargeable industrial batteries, LMT batteries, and EV batteries, to reduce early failures and waste.

- Removability and Replaceability: Mandates that portable batteries incorporated into appliances, as well as LMT batteries, must be designed so that end-users or independent operators can easily remove and replace them.

2. Labeling and Information Requirements:

- Batteries must bear labels providing general information (manufacturer, type, chemistry, capacity), capacity details, and information on hazardous substances.

- A crucial requirement is the QR code, which must be visibly affixed to LMT, EV, and industrial batteries (>2kWh). This code links to extensive information, including the Digital Battery Passport.

- Information on the state of health and expected lifetime must be accessible for EV batteries, LMT batteries, and industrial batteries.

3. End-of-Life Management:

- Extended Producer Responsibility (EPR): Producers (manufacturers, importers, distributors placing batteries on the market for the first time) bear financial and organizational responsibility for the collection, treatment, and recycling of waste batteries.

- Collection Targets: Sets ambitious collection targets for waste portable batteries (ramping up to 73% by end of 2030) and introduces specific targets for LMT batteries (61% by end of 2031).

- Recycling Efficiency and Material Recovery: Establishes targets for the overall efficiency of recycling processes and specific minimum recovery rates for valuable materials like cobalt, copper, lead, lithium, and nickel from waste batteries.

4. Supply Chain Due Diligence:

- Requires "economic operators" (excluding SMEs initially) placing industrial (>2kWh), LMT, SLI, or EV batteries on the EU market to develop and implement supply chain due diligence policies for specific raw materials: cobalt, natural graphite, lithium, and nickel.

- These policies must be consistent with internationally recognized frameworks like the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

- Obligations include establishing management systems, identifying and assessing risks (related to environment, human rights, labor, etc.) in the supply chain, implementing strategies to respond to these risks, undergoing third-party verification, and publicly disclosing their policies and findings.

5. The Digital Battery Passport (DBP):

- Mandatory from February 18, 2027, for LMT, EV, and industrial batteries (>2kWh).

- An electronic record linked via the QR code, providing dynamic information throughout the battery's lifecycle, including material composition, carbon footprint, recycled content, performance, durability, state of health, and end-of-life handling instructions.

The Digital Battery Passport (DBP): Enhancing Transparency

The DBP stands out as one of the regulation's most innovative and potentially transformative elements. Mandated from February 2027, it aims to create unprecedented transparency across the battery value chain.

Functionality: Accessed via the battery's QR code, the DBP will provide tailored information to different stakeholders:

- Consumers: General information, capacity, expected lifetime, charging requirements, information on separate collection, safety, and potentially state of health.

- Economic Operators & Repairers: More detailed technical information relevant for repair, repurposing (giving batteries a "second life" in applications like stationary storage), and dismantling.

- Recyclers: Information critical for safe handling and maximizing material recovery.

- Market Surveillance Authorities: Access needed for compliance checks.

Technology and Standards: The technical specifications for the DBP are still being developed through implementing acts but are expected to align with the framework set out by the Ecodesign for Sustainable Products Regulation (ESPR). This suggests a focus on interoperability, security, and data integrity, potentially leveraging technologies like secure databases or even blockchain for certain aspects to ensure data cannot be easily tampered with.

Challenges: Implementing the DBP presents significant hurdles. Securely managing vast amounts of data from disparate sources across complex global supply chains is a major technical and logistical challenge. Ensuring data accuracy and protecting commercially sensitive information while providing necessary transparency requires careful design and governance. The regulation explicitly states that access to information containing commercial secrets must be restricted, but how this will work in practice remains a key question for businesses concerned about exposing proprietary data to competitors or the public.

Supply Chain Due Diligence: Extending Responsibility Upstream

The Battery Regulation significantly extends corporate responsibility upstream by mandating supply chain due diligence for specific raw materials critical to battery production – cobalt, natural graphite, lithium, and nickel. This requirement applies to larger economic operators placing relevant batteries (LMT, EV, Industrial >2kWh, SLI) on the EU market, regardless of where the operator is based.

Alignment with International Standards: The due diligence framework is explicitly linked to the OECD Due Diligence Guidance and international standards concerning human rights and labor practices. This aligns the Battery Regulation with broader global trends in responsible sourcing and corporate accountability, including the EU's Corporate Sustainability Due Diligence Directive (CSDDD), although the Battery Regulation's specific requirements apply earlier and focus on the battery sector.

Obligations: Companies subject to these rules must:

- Adopt and communicate a supply chain due diligence policy.

- Establish strong internal management systems to support due diligence.

- Identify and assess actual and potential risks in their supply chain related to social and environmental issues (e.g., human rights abuses, forced labor, environmental degradation).

- Design and implement a strategy to respond to identified risks (prevent, mitigate, or remediate).

- Arrange for third-party verification of their due diligence practices by notified bodies.

- Publicly report on their due diligence policies and activities annually.

Impact: This places a significant burden on companies to achieve visibility deep into their supply chains, often down to the mine level. It requires robust systems for data collection, risk assessment, supplier engagement, and verification, demanding considerable investment and potentially reshaping sourcing strategies.

Global Implications: Reaching Beyond EU Borders

While an EU regulation, its effects are inherently global due to the international nature of battery supply chains.

Extraterritorial Application: The regulation applies to all batteries placed on the EU market, regardless of their origin. This means manufacturers in Japan, the US, China, South Korea, and elsewhere must comply with all relevant requirements – from carbon footprint declarations and recycled content minimums to DBP implementation and potentially due diligence – if they wish to sell their products in the sizable EU market.

Impact on Japanese and US Companies:

- Japanese Industry: Japan is a leader in battery technology and a major supplier to the global automotive and electronics industries. Japanese battery manufacturers and companies incorporating those batteries into their products (like automakers) will need to make significant adjustments to meet the EU's stringent requirements. This involves investing in R&D for lower-carbon production and higher recycled content, implementing complex traceability systems for the DBP, and establishing robust supply chain due diligence programs.

- US Industry: US companies are affected in multiple ways. Those directly exporting batteries or products containing batteries (like EVs) to the EU must comply. Furthermore, US firms relying on Japanese or other international suppliers for batteries or battery components will find their supply chains impacted. They may need to work closely with suppliers to ensure compliance data (e.g., for carbon footprint calculations or due diligence) is available and may face increased costs passed down the chain. US companies competing with EU or Japanese firms in the global market may also feel pressure to align with the sustainability benchmarks being set by the EU regulation.

Trade and Competitiveness Concerns: The regulation has raised concerns about potentially creating trade barriers or disadvantaging non-EU producers. The cost of compliance – implementing new technologies, tracking complex data, conducting due diligence, third-party verification – could be substantial, potentially favoring larger companies or those already operating within the EU's regulatory environment. Whether the requirements, particularly maximum carbon footprint thresholds or complex due diligence rules, could be challenged as disguised protectionism under WTO rules remains a point of discussion. The EU maintains the measures are non-discriminatory and necessary for environmental protection, but trade friction is a possibility.

Navigating the New Landscape: Compliance Strategies

Adapting to the EU Battery Regulation requires a proactive and strategic approach from businesses worldwide.

1. Understand the Details: Companies must closely monitor the phased implementation timeline and the development of crucial delegated and implementing acts that will specify many technical details (e.g., calculation methodologies for carbon footprint and recycled content, DBP data requirements).

2. Map and Assess Supply Chains: Deep visibility into the supply chain is paramount, especially for meeting due diligence obligations and collecting data for recycled content and carbon footprint reporting. This requires engaging suppliers at multiple tiers.

3. Invest in Data Management: Robust IT systems are needed to collect, manage, verify, and report the vast amounts of data required for compliance, particularly for the DBP and due diligence reporting. Ensuring data security and interoperability will be key.

4. Collaborate and Engage: Given the complexity, collaboration within industry associations and direct engagement with suppliers and customers will be vital for sharing best practices, developing common standards (where possible), and addressing challenges collectively.

5. Integrate Sustainability: The regulation reinforces the need to embed sustainability into core business strategy, product design (considering removability, durability, recycled content), procurement (responsible sourcing), and end-of-life management.

6. Leverage International Cooperation: Initiatives like the Japan-EU Green Alliance, which includes agreements on cooperation regarding battery supply chains and potentially aligning standards or sharing data, could offer pathways to streamline compliance for companies operating across both regions.

Conclusion: A New Benchmark for Global Industry

The EU Battery Regulation represents a paradigm shift in product regulation, moving beyond end-of-pipe waste management to encompass the entire lifecycle with a strong focus on sustainability, circularity, and supply chain responsibility. Its ambitious requirements, from carbon footprint limits and recycled content mandates to the innovative Digital Battery Passport and rigorous due diligence obligations, set a high bar for the global battery industry.

While aiming to create a greener and more competitive battery sector within the EU, the regulation's extensive reach inevitably impacts international trade and supply chains. Companies in Japan and the United States, deeply intertwined in the global battery ecosystem, face significant compliance challenges and strategic decisions. Successfully navigating this new regulatory environment will require proactive investment in technology, data systems, supply chain transparency, and a fundamental integration of sustainability principles into business operations. The Battery Regulation is not just an EU policy; it's a signal of the direction global product regulation is heading, demanding adaptation from businesses worldwide.

- Japan’s Evolving Platform Regulation Landscape

- Taxing the Digital Economy: Japan’s New Rules for Platform Taxation

- METI — Guidance on EU Battery Regulation for Japanese Exporters (JP)

https://www.meti.go.jp/policy/eco_battery/eu_battery_reg.html