Taxing the Digital Economy: Japan's New Rules for Platform Taxation

TL;DR: From October 2024 Japan deems large digital-platform operators the supplier for cross-border digital services, making them responsible for collecting and paying consumption tax. The new “specified platform” regime brings stricter registration, invoice and annual-report duties—foreign marketplaces must re-tool billing systems and audit seller data now.

Table of Contents

- Introduction

- Why Japan Changed Its Tax Approach to Digital Platforms

- Scope and Thresholds: Who Qualifies as a Specified Platform?

- Compliance Obligations and Deadlines

- Enforcement, Penalties and International Alignment

- Practical Implications for Global Businesses

Introduction

The rise of the digital economy has fundamentally reshaped global commerce, creating immense opportunities but also significant challenges for traditional tax systems. One major challenge faced by countries worldwide has been ensuring the fair and effective collection of consumption taxes (like Value Added Tax - VAT or Goods and Services Tax - GST) on cross-border sales of digital services – think apps, streaming, e-books, online games – supplied by foreign businesses directly to domestic consumers (B2C). Japan, with its significant digital market, has been actively grappling with this issue.

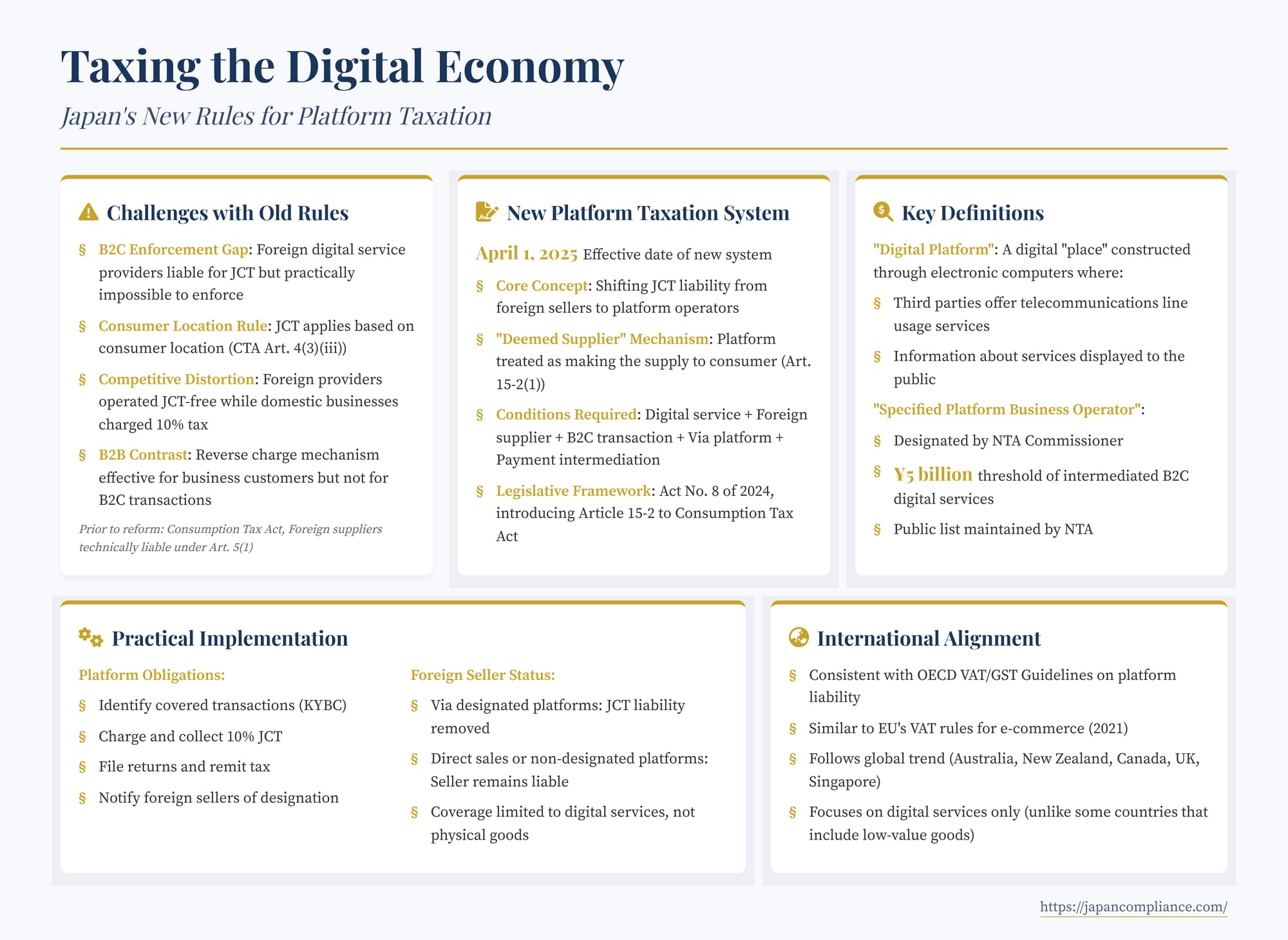

Historically, enforcing Japanese Consumption Tax (JCT) on numerous foreign digital service providers with no physical presence in Japan proved exceedingly difficult. This created a tax revenue gap and an uneven playing field disadvantaging domestic businesses required to charge JCT. In response, Japan included a major reform in its 2024 tax legislative package (Act No. 8 of 2024), introducing a new "Platform Taxation System" (platform kazei seido). Scheduled to take effect on April 1, 2025, this system shifts the JCT collection responsibility for certain B2C digital services from the foreign seller to the large digital platform operator facilitating the transaction.

This article provides an overview of Japan's new Platform Taxation System. It explains the problems with the previous approach, details how the new rules function, outlines which platforms and transactions are affected, discusses the implications for platform operators and foreign businesses selling into Japan, and places the reform within the context of global trends in digital economy taxation.

1. The Challenge: Taxing Cross-Border Digital Services under the Old Rules

To understand the new system, it's helpful to grasp the limitations of the previous framework for JCT on cross-border transactions.

- JCT Basics: Japan's Consumption Tax (currently 10%) is a broad-based indirect tax applied to most domestic transactions of goods and services, as well as the importation of goods.

- Place of Supply Rules for Digital Services: For services, JCT liability hinges on where the service is deemed supplied. Since a 2015 reform, the rule for electronically supplied services (like apps, streaming, cloud services, online advertising – categorized as "telecommunications line usage services" or denki tsushin riyou ekimu no teikyou) is generally based on the location of the consumer (Consumption Tax Act, Art. 4(3)(iii)). This means when a foreign business supplies such services to a consumer located in Japan, the supply is considered domestic, and JCT technically applies.

- Liability vs. Enforcement (The B2C Gap): Under the law (Art. 5(1)), the foreign supplier was legally liable for JCT on these B2C digital sales to Japanese consumers. However, enforcement was practically impossible for Japan's National Tax Agency (NTA). The NTA faced immense difficulties in:

- Identifying the vast number of foreign businesses (often small) selling digital services into Japan.

- Obtaining accurate sales data from these non-resident businesses.

- Compelling registration, filing, and payment from entities with no physical presence or assets in Japan. International tax collection assistance treaties often have limitations or are not in place with all relevant jurisdictions.

- Contrast with B2B: This situation differed significantly from B2B (business-to-business) supplies of digital services. For those, Japan employs a "reverse charge" mechanism (ribaasu chaaji houshiki), where the Japanese business customer is responsible for accounting for and remitting the JCT on the imported service (Art. 5(2)). This B2B mechanism functions relatively well.

- Consequences: The B2C enforcement gap led to significant uncollected tax revenue and created competitive distortions, as foreign digital service providers effectively operated JCT-free in the B2C market, disadvantaging domestic competitors who had to charge the tax. This situation spurred the need for reform, aligning with global efforts coordinated by organizations like the OECD.

2. Japan's Solution: The Platform Taxation System (Effective April 1, 2025)

The 2024 tax reform introduces Article 15-2 into the Consumption Tax Act, establishing the new Platform Taxation System. Its core principle is shifting the JCT liability from the underlying foreign seller to the facilitating platform operator under specific conditions.

- Core Concept: When certain conditions are met, the large digital platform operator that intermediates a B2C digital service transaction between a foreign seller and a Japanese consumer will be treated as the entity responsible for JCT.

- Mechanism: Deemed Supplier Rule (Art. 15-2(1)): The law employs a "deemed supplier" mechanism. The platform operator is legally deemed to have made the supply of the digital service to the Japanese consumer for JCT purposes. Consequently, the actual foreign supplier of the service is deemed not to have made that specific supply, thereby relieving them of the JCT obligation for transactions covered by the platform system.

- Conditions for Platform Liability: Platform liability under Article 15-2 is triggered only if all the following conditions are met:

- Transaction Type: The transaction involves the supply of "telecommunications line usage services" (i.e., digital services).

- Supplier Status: The underlying supplier is a foreign business (non-resident).

- Customer Status: The customer is a consumer in Japan (B2C transaction). Supplies to Japanese businesses remain under the reverse charge mechanism.

- Platform Involvement: The transaction is conducted via a "Digital Platform" as defined in the law (see below).

- Payment Intermediation: The platform operator acts as an intermediary for the payment from the consumer to the foreign supplier. Platforms that merely list services but do not handle payments are generally excluded.

- Designated Platform Operator: The platform operator must be formally designated as a "Specified Platform Business Operator" (tokutei platform jigyousha) by the NTA Commissioner.

3. Defining "Digital Platform" and "Specified Platform Business Operator"

The scope of the new rules hinges on these definitions:

- "Digital Platform" (dejitaru purattofoomu) (Art. 15-2(1)): Defined as "a place constructed through information processing using electronic computers, intended for use by unspecified and numerous persons, via which persons other than the provider of said place offer telecommunications line usage services, and where information pertaining to said services is normally displayed and provided to unspecified and numerous persons via telecommunications lines."

- This definition focuses on the platform as a digital "place" or environment facilitating third-party transactions. Legal commentators note this "place" concept differs slightly from the "service" (ekimu) definition used in other platform regulations like the Act on Improving Transparency and Fairness of Specified Digital Platforms (Torihiki Toumeika Hou).

- "Specified Platform Business Operator" (tokutei purattofoomu jigyousha) (Art. 15-2(2)-(4)): Liability is not imposed on all platforms meeting the definition above. It applies only to those designated by the NTA Commissioner.

- Designation Criteria: The primary criterion for designation is size. A platform operator intermediating payments is eligible for designation if the total value of consideration (excluding JCT) for relevant B2C digital services supplied by foreign businesses via its platform exceeded ¥5 billion (approximately USD $35-40 million, depending on exchange rates) in a specified preceding fiscal year.

- Rationale for Designation/Threshold: Limiting the obligation to large, designated platforms serves several purposes:

- Administrative Feasibility: Focuses enforcement resources on platforms with the largest transaction volumes and likely greater capacity for compliance.

- Compliance Capability: Larger operators are deemed more likely to possess the systems and resources needed to handle JCT calculation, collection, and remittance accurately.

- Reliance on Cooperation: Given the inherent difficulties in enforcing tax obligations on foreign-based entities, the designation system allows the NTA to target operators with whom a degree of reliable interaction and compliance can be expected. Non-compliance can lead to the revocation of the designation (Art. 15-2(11)).

- Public List: The NTA will publish and maintain a list of designated Specified Platform Business Operators online. This is crucial information for foreign businesses selling through platforms, as it determines whether they or the platform are liable for JCT.

4. How the Platform Taxation System Works in Practice

For transactions falling within the scope:

- Platform's Obligations: A designated Specified Platform Business Operator must:

- Identify Covered Transactions: Implement systems to identify B2C supplies of digital services by foreign businesses to Japanese consumers where it intermediates payment. This requires robust "know your business customer" (KYBC) processes to determine the supplier's residency status and mechanisms to identify the consumer's location. Distinguishing B2C from B2B transactions is also critical.

- Charge and Collect JCT: Collect the applicable JCT (currently 10%) from the Japanese consumer, typically by incorporating it into the final transaction price displayed on the platform.

- Remit JCT: File JCT returns with the NTA and remit the collected tax. Foreign platform operators designated under this system may need to register for JCT purposes in Japan, even if they have no physical presence.

- Notify Foreign Sellers: Inform the underlying foreign sellers using their platform when they become designated (or de-designated), as this directly impacts the sellers' own JCT obligations (Art. 15-2(5), (13)).

- Foreign Seller's Status:

- Selling via a Designated Platform: If a foreign business sells digital services to Japanese consumers through a designated Specified Platform Business Operator that intermediates payment, the foreign business is relieved of the JCT liability for those specific sales. The platform takes over the responsibility.

- Selling Directly or via Non-Designated Platforms: If the foreign business sells directly to Japanese consumers, or through a platform that is not designated (either because it's below the threshold or doesn't intermediate payment), the foreign business remains legally liable for JCT under the standard rules. However, the practical enforcement challenges for the NTA in these scenarios largely persist.

- Consumer Impact: Japanese consumers purchasing digital services from foreign sellers via designated platforms will see JCT consistently applied. This might lead to price increases for services where JCT was not effectively collected previously, but it ensures tax neutrality between domestic and foreign suppliers.

5. Alignment with International Trends and Outstanding Issues

Japan's adoption of platform liability for JCT aligns it with a significant global trend.

- OECD VAT/GST Guidelines: The OECD has developed extensive guidelines recommending that jurisdictions adopt rules making digital platforms liable for the collection of VAT/GST on B2C sales made through their platforms by non-resident vendors, particularly for digital services and low-value imported goods. Japan's new system is broadly consistent with these internationally endorsed principles for digital services.

- EU and Other Countries: The European Union implemented similar comprehensive rules for platforms regarding VAT on e-commerce transactions (both services and goods) starting in 2021. Numerous other countries (e.g., Australia, New Zealand, Canada, UK, Singapore) have also introduced variations of platform liability rules for VAT/GST on cross-border supplies. Japan's reform brings it in line with practices in many major economies.

- Current Scope Limitations: It is important to note the current limitations of Japan's system:

- Digital Services Only: It currently applies only to electronically supplied "telecommunications line usage services." It does not apply to platforms facilitating the sale of physical goods by foreign sellers to Japanese consumers. For imported goods, JCT is typically collected at customs based on import regulations (though low-value thresholds may apply). Some countries have extended platform liability to low-value imported goods, but Japan has not taken this step yet.

- B2C Focus: The system is specifically designed for B2C transactions. B2B supplies of digital services continue to be handled under the reverse charge mechanism.

- Practical Challenges: Implementation will involve challenges for designated platforms, such as accurately determining the tax residency of sellers, identifying the location of consumers, distinguishing B2C from B2B sales, and correctly classifying the diverse range of digital services offered. Clear guidance and practical solutions from the NTA will be essential for smooth operation.

Conclusion

Effective April 1, 2025, Japan's new Platform Taxation System fundamentally changes the JCT landscape for cross-border B2C digital services. By shifting the collection and remittance obligation from potentially numerous and hard-to-reach foreign suppliers to large, designated digital platform operators that facilitate these transactions, Japan aims to close a significant enforcement gap, ensure tax neutrality, and align its rules with evolving international standards for taxing the digital economy.

This reform carries major implications. Designated platform operators, including major global tech companies, face substantial new compliance responsibilities requiring significant system adjustments and ongoing diligence. Foreign businesses selling digital services into Japan need to understand the designation status of the platforms they use to determine their own JCT liabilities – liability is removed for sales via designated platforms but persists for direct sales or sales via non-designated platforms.

While practical implementation challenges remain, the introduction of this system underscores the global consensus that digital platforms have a crucial role to play as intermediaries in modern tax collection. Businesses engaged in cross-border digital commerce involving Japan must prepare for these imminent changes and closely monitor forthcoming NTA guidance for detailed operational rules and clarification.

- Japan’s 2024 FIEA Reforms: Key Changes to Takeover Bids and Large-Shareholding Reports

- Japan’s Evolving Platform Regulation Landscape: An Overview for Global Businesses

- Content Moderation and Intermediary Liability in Japan

- National Tax Agency — Q&A on Digital Platform Consumption Tax (JP)

https://www.nta.go.jp/publication/pamph/shohi/platform_tax_qa.htm