Takeover Defenses in Japan: Understanding Poison Pills and Shareholder Rights After Recent Court Rulings

TL;DR

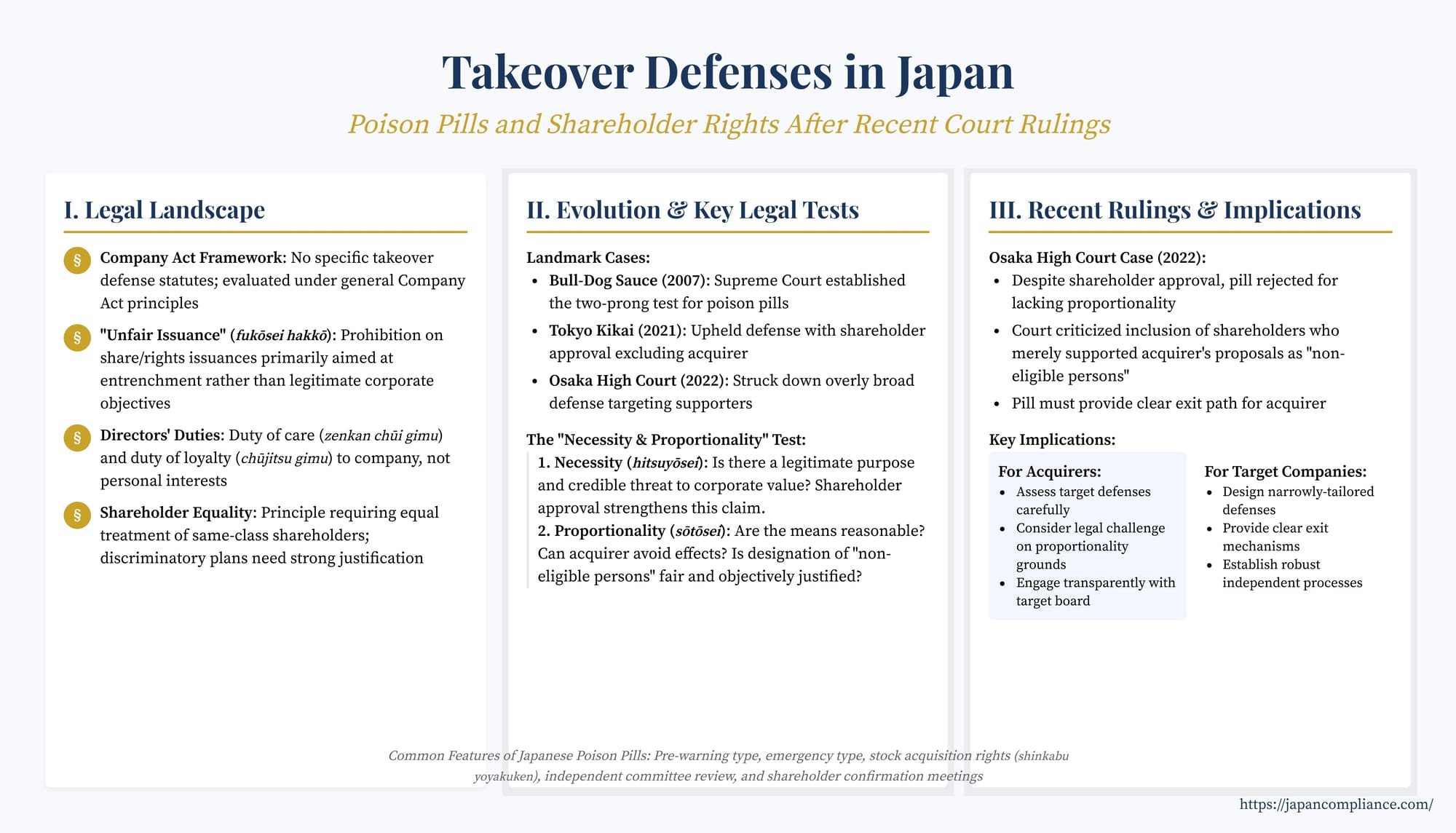

Japanese courts allow poison-pill takeover defenses only when (1) necessary to protect corporate value and common shareholder interests and (2) proportionate in design. Recent cases—including Osaka High Court 2022—show pills that unfairly trap acquirers or target dissenting shareholders will be struck down even if approved by a shareholder vote.

Table of Contents

- The Legal Landscape: Company Act and "Unfair Issuance"

- The Evolution of Japanese Poison Pills and Judicial Review

- The "Necessity and Proportionality" Test Explained

- Scrutinizing Proportionality: The Osaka High Court Case (July 2022)

- Common Features of Modern Japanese Poison Pills

- Implications for Acquirers, Investors, and Target Companies

- Conclusion: Permissible but Scrutinized

Japan's M&A landscape, while increasingly active, retains unique features, particularly concerning how companies respond to unsolicited takeover bids. Takeover defenses, especially "poison pills" implemented through the issuance of stock acquisition rights (shinkabu yoyakuken), are a common tool in the Japanese corporate playbook. However, their deployment is not unchecked; it's subject to rigorous judicial scrutiny under the Company Act, balancing the board's desire to protect corporate value against shareholder rights and the principle of shareholder equality.

Recent court decisions, including a notable Osaka High Court ruling in July 2022, continue to refine the standards governing the legality of these defenses. For international investors, potential acquirers, and companies operating in Japan, understanding the evolution of these standards, the key legal tests applied by courts, and the practical implications is essential for navigating acquisitions, investments, and shareholder relations effectively. This article examines the framework for takeover defenses in Japan, focusing on poison pills (rights plans) and the critical judicial tests of "necessity" and "proportionality," illuminated by recent case law.

The Legal Landscape: Company Act and "Unfair Issuance"

Unlike the US, Japan does not have specific statutes solely dedicated to takeover defenses. Instead, their legality is primarily assessed within the general framework of the Company Act, focusing on:

- Directors' Duties: Directors owe a duty of care (zenkan chūi gimu) and a duty of loyalty (chūjitsu gimu) to the company. Actions taken to entrench management rather than protect legitimate corporate interests can breach these duties.

- Issuance of Shares/Stock Acquisition Rights: The implementation of many poison pills involves issuing new shares or stock acquisition rights. The Company Act prohibits "unfair issuance" (fukōsei hakkō) of shares or rights (Article 210 regarding share issuance, often applied by analogy or through general principles to rights issuance). An issuance is considered unfair if its primary purpose is improper, such as maintaining management control or harming specific shareholders, rather than serving a legitimate corporate objective like raising capital or defending against an abusive takeover that threatens corporate value.

- Shareholder Equality: The principle of shareholder equality dictates that shareholders of the same class should be treated equally. Discriminatory rights plans, which treat an acquirer differently from other shareholders, inherently clash with this principle and require strong justification.

Challenges to takeover defenses often take the form of shareholders (typically the potential acquirer) seeking a provisional injunction (kari shobun) to halt the issuance of the defensive shares or rights, arguing it constitutes an unfair issuance.

The Evolution of Japanese Poison Pills and Judicial Review

The use and judicial review of poison pills in Japan have evolved significantly since the early 2000s:

- Early Days & The Nireco Case (2005): Early defenses often lacked clear guidelines. A key Tokyo High Court decision involving Nireco Corporation (May 31, 2005) established that defenses aimed at securing the "corporate value" or "common interests of shareholders" could be permissible, shifting the focus slightly from pure management entrenchment concerns.

- The Livedoor/NBS Saga (2005): This high-profile hostile takeover attempt saw Nippon Broadcasting System implement defenses, leading to further court battles and highlighting the practical complexities and legal uncertainties surrounding defensive measures.

- The Bull-Dog Sauce Case (Supreme Court, 2007): This remains a landmark decision. Steel Partners Japan Strategic Fund attempted a hostile takeover of Bull-Dog Sauce Co. Bull-Dog implemented a poison pill involving stock acquisition rights with discriminatory exercise conditions targeting the acquirer. The Supreme Court (August 7, 2007) upheld the defense, establishing the crucial two-pronged test: necessity (hitsuyōsei) and proportionality/reasonableness (sōtōsei). The court found the defense necessary to counter an "abusive acquirer" whose plan was deemed potentially harmful to corporate value (asset stripping concerns) and proportionate given the circumstances. This ruling validated the use of poison pills under specific conditions but emphasized the need for justification based on protecting shareholder common interests.

- Post-Bull-Dog Developments: Companies refined their pills, often incorporating features like pre-warning mechanisms, objective trigger conditions, involvement of independent committees, and requirements for shareholder approval ("shareholder confirmation meetings," kabunushi ishi kakunin sōkai) to bolster claims of necessity and proportionality.

- The Tokyo Kikai Seisakusho Case (Tokyo High Court, 2021): This case involved a defense against an activist fund that had rapidly acquired a significant stake. The target company implemented a poison pill with discriminatory rights, approved at a shareholder meeting where the acquirer was excluded from voting. The Tokyo High Court (November 9, 2021) upheld the defense, finding it necessary and proportionate to counter the perceived threat to corporate value posed by the acquirer's rapid accumulation of shares without sufficient explanation of its intentions. This decision reaffirmed the validity of shareholder-approved pills, even those excluding the acquirer from the approval vote, under certain circumstances.

The "Necessity and Proportionality" Test Explained

The Bull-Dog Sauce framework remains the cornerstone of judicial review for Japanese poison pills. Courts assess:

- Necessity (Hitsuyōsei):

- Legitimate Purpose: Is the defense genuinely aimed at protecting or enhancing corporate value or the common interests of shareholders? Permissible goals often include preventing coercive two-tiered bids, protecting against asset stripping, ensuring shareholders have sufficient time and information to evaluate a bid, or facilitating a fair auction process. A defense primarily aimed at management entrenchment is illegitimate.

- Existence of a Threat: Is there a credible threat to corporate value or shareholder interests posed by the potential acquirer or the specific bid? The nature and severity of the threat are considered.

- Shareholder Approval: Obtaining approval at a shareholder meeting (often a dedicated "shareholder confirmation meeting") significantly strengthens the argument for necessity, as it indicates shareholder endorsement of the defense against the specific threat. Courts tend to defer to shareholder will unless there are clear procedural flaws or evidence of coercion undermining the vote's validity.

- Proportionality / Reasonableness (Sōtōsei): Even if necessary, the means employed must be reasonable and proportionate to the legitimate purpose and the threat identified. This involves examining:

- Impact on Acquirer: Does the defense unduly penalize the acquirer? Is it overly coercive?

- Possibility of Withdrawal/Avoidance: Can the acquirer take reasonable steps to avoid the discriminatory effects of the pill (e.g., by withdrawing the bid, negotiating, or meeting certain conditions)? If avoidance is practically impossible, the pill is more likely to be deemed disproportionate.

- Fairness of Designation: If the pill discriminates against certain shareholders (designating them "non-eligible persons," fu-tekikaku-sha), is this designation fair and based on objective criteria related to the threat? Designating shareholders merely for disagreeing with management or supporting an acquirer's legitimate proposals raises serious proportionality concerns.

- Process: Was the decision made after careful deliberation? Was an independent committee involved in evaluating the threat and recommending the defense? While not legally required, the involvement of an independent committee can lend credibility to the board's decision, though courts will still examine the substance of the process.

The proportionality test is often where defenses falter, as courts scrutinize the actual mechanics and effects of the pill on the acquirer and other shareholders.

Scrutinizing Proportionality: The Osaka High Court Case (July 2022)

A recent decision by the Osaka High Court (July 21, 2022, later upheld by the Supreme Court on July 28, 2022) provides valuable insight into the application of the proportionality test.

- Background: An acquirer group built a stake exceeding 20% in a listed company. After the acquirer sought an extraordinary general meeting (EGM) to replace directors (which failed), the company's board activated a pre-existing poison pill policy. Crucially, the board designated not only the acquirer group but also shareholders who had submitted proxies supporting the acquirer's EGM proposals as "non-eligible persons" subject to discriminatory treatment under the rights plan. This plan was subsequently approved at a shareholder confirmation meeting. The acquirer sought an injunction.

- The Ruling: The Osaka High Court granted the injunction, finding the rights issuance constituted an "unfair issuance." While acknowledging the necessity criteria were likely met (reasonable stated purpose of providing time/information, shareholder approval obtained), the court found the measure lacked proportionality:

- Lack of Clear Exit for Acquirer: The mechanism for the acquirer group to avoid the pill's dilutive effects by "withdrawing" their large-scale purchase was deemed unclear and effectively impossible. The terms appeared to impose unreasonable long-term restrictions on their voting rights and ability to transfer shares, essentially trapping them.

- Overly Broad "Non-Eligible" Designation: The court strongly criticized the inclusion of shareholders who merely supported the acquirer's proposals at the earlier EGM in the "non-eligible" category. This was seen as potentially aimed at entrenching management by punishing dissenting shareholders, rather than addressing a direct threat from those specific shareholders. Such a broad designation was deemed disproportionate to the stated purpose of the defense. The court noted that the recommendation of an independent committee did not automatically cure this substantive flaw, especially as the committee's specific deliberations were unclear.

- Questionable Shareholder Vote: The court cast doubt on the validity of the shareholder confirmation meeting's outcome as a true reflection of support for management. It noted that shareholders might have felt pressured to vote in favor of the pill for fear of being labeled "non-eligible" themselves if they opposed it, thus undermining the argument that the vote demonstrated genuine shareholder intent to endorse the defense against the acquirer.

- Key Takeaway: This case underscores that even with shareholder approval, the specific design and application of a poison pill are subject to strict proportionality review. Courts will look closely at whether the pill provides a reasonable path for the acquirer to avoid harm and whether the scope of shareholders targeted for discriminatory treatment is fair and directly related to a credible threat, not just aimed at suppressing dissent. Targeting shareholders solely based on how they voted or supported legitimate proposals is highly likely to render a pill disproportionate and unlawful.

Common Features of Modern Japanese Poison Pills

While structures vary, many contemporary Japanese poison pills share common elements:

- Trigger: Usually activated when an acquirer crosses a certain ownership threshold (often 15% or 20%) without following pre-defined procedures or when the board deems a specific acquisition proposal harmful to corporate value.

- Types:

- Pre-Warning Type: The policy is adopted in advance by the board (often with shareholder approval for the policy itself) and outlines procedures an acquirer should follow (e.g., providing sufficient information about plans, sources of funds). The pill is triggered if these procedures are ignored or if the board (often based on an independent committee recommendation) deems the bid harmful.

- Emergency Type: Adopted quickly by the board in response to a specific, imminent threat, often without prior shareholder approval of the policy (though activation might still be subject to later shareholder confirmation). These face higher scrutiny regarding necessity and proportionality.

- Stock Acquisition Rights (Shinkabu Yoyakuken): The typical mechanism involves issuing rights to all shareholders. These rights usually allow shareholders (excluding the "non-eligible" acquirer) to purchase company shares at a significant discount upon a triggering event, massively diluting the acquirer's stake and making the takeover prohibitively expensive.

- Independent Committee: Increasingly common for companies to establish a committee composed primarily of outside directors and/or external experts to evaluate takeover proposals and make recommendations to the board regarding the activation of defenses. This aims to enhance the objectivity of the board's decision.

- Shareholder Confirmation Meeting: Many companies make the final activation of the pill contingent on approval at a general shareholder meeting, bolstering the "necessity" argument by demonstrating shareholder support. As seen in the Tokyo Kikai and Osaka High Court cases, the conduct and context of this meeting (e.g., whether the acquirer can vote, whether other shareholders face undue pressure) are critical.

Implications for Acquirers, Investors, and Target Companies

The legal framework and recent case law offer important lessons:

For Acquirers and Investors:

- Assess Defenses: Before accumulating a significant stake or launching a bid, thoroughly analyze the target company's articles of incorporation and any publicly disclosed takeover defense policies. Understand the trigger conditions, the nature of the pill, and the process for its activation.

- Transparency and Engagement: Clearly communicating intentions and plans to the target board and shareholders can sometimes mitigate the perceived threat and reduce the likelihood of a defensive reaction. Engaging with the board, including the independent committee if one exists, is often advisable.

- Legal Challenges: If a defense is activated, assess its compliance with the "necessity and proportionality" test. An injunction based on "unfair issuance" is the primary legal remedy. The Osaka High Court case shows that even shareholder-approved pills can be successfully challenged if disproportionately designed or applied, particularly if they unfairly target dissenting shareholders or lack a clear exit mechanism.

- Shareholder Support: Gaining support from other institutional and individual shareholders can be crucial, both in influencing the target board and in potentially defeating a defense at a shareholder confirmation meeting (if the acquirer is allowed to vote).

For Target Companies and Boards:

- Legitimate Purpose: Any defense policy must be grounded in protecting corporate value and shareholder common interests, not management entrenchment. This purpose should be clearly articulated.

- Proportionality is Key: Design the pill carefully. Ensure the discriminatory elements are narrowly tailored to address the specific identified threat. Avoid overly broad definitions of "non-eligible persons" that could capture ordinary dissenting shareholders. Provide a clear and achievable path for a bona fide acquirer to avoid triggering the pill or its discriminatory effects (e.g., through negotiation or meeting specific conditions).

- Robust Independent Process: Utilize an independent committee effectively. Ensure the committee has access to independent advisors, conducts thorough deliberations, and provides well-reasoned recommendations. Document the process carefully.

- Shareholder Communication: If seeking shareholder approval, communicate clearly and transparently about the perceived threat and the rationale for the defense. Ensure the voting process is fair and avoids any perception of coercion. The credibility of a shareholder confirmation vote can be undermined if shareholders feel pressured.

- Regular Review: Takeover defense policies should be reviewed periodically (e.g., every few years) and re-approved by shareholders to ensure they remain relevant and appropriate given the company's circumstances and the evolving legal and market environment.

Conclusion: Permissible but Scrutinized

Takeover defenses, particularly poison pills based on stock acquisition rights, remain a permissible tool for Japanese companies facing unsolicited bids. Landmark rulings like Bull-Dog Sauce established the governing "necessity and proportionality" test, allowing defenses aimed at protecting corporate value and shareholder common interests. However, subsequent case law, including the 2021 Tokyo Kikai Seisakusho decision and the 2022 Osaka High Court ruling, demonstrates that the application of this test is highly fact-specific and rigorous.

While shareholder approval lends weight to the necessity of a defense, courts will delve deeply into its proportionality – questioning whether the means are reasonable, whether the acquirer has a fair chance to avoid harm, and critically, whether the designation of shareholders for discriminatory treatment is justifiable and not merely a tool to stifle dissent or entrench management. The Osaka High Court's rejection of a pill that targeted shareholders for supporting an acquirer's proposals signals a strong judicial focus on protecting fundamental shareholder rights even within the context of takeover battles. For all players in the Japanese M&A market, careful consideration of these evolving legal standards is paramount.