TL;DR

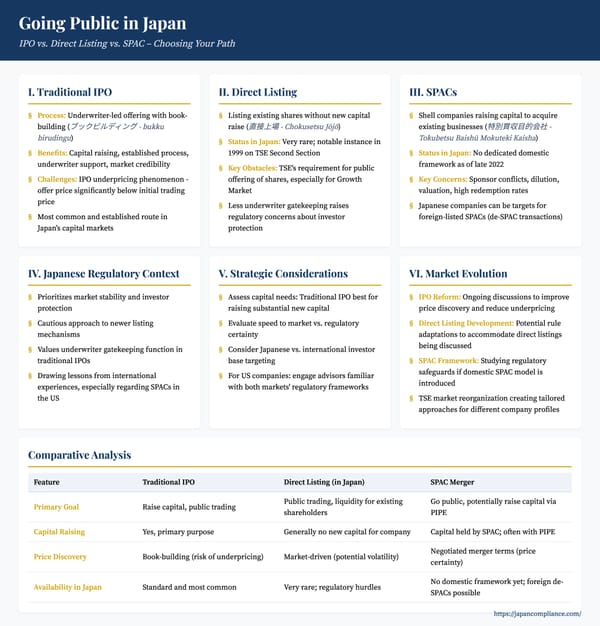

A Japanese IPO grants access to deep capital, brand prestige, and strategic partners—yet demands rigorous governance, J-SOX readiness, and mastery of TSE/FIEA rules. This guide maps the full journey: pre-IPO cleanup, TSE examination, book-building price tactics, alternative listing routes, and post-listing duties—equipping U.S. issuers