TL;DR

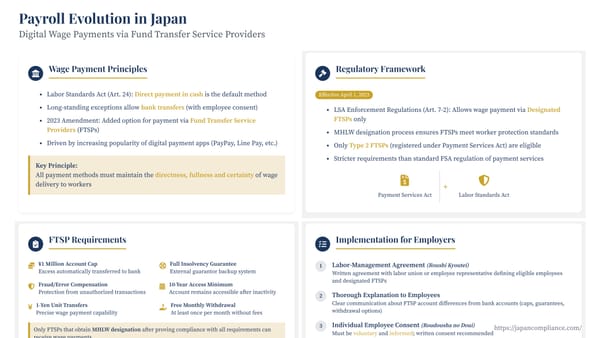

* From April 2023, Japanese employers may, with employee consent, deposit wages into accounts at MHLW-designated Fund Transfer Service Providers (FTSPs).

* Designated FTSPs must cap balances at ¥1 million, guarantee full repayment on insolvency, offer monthly fee-free cash access, and meet strict security and reporting standards.

* Employers must sign