TL;DR

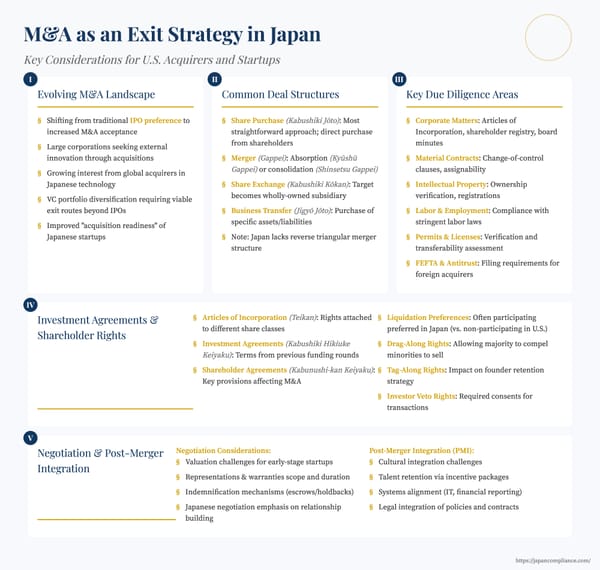

Japan’s startup ecosystem has matured rapidly, but successful U.S. investment still hinges on mastering Japanese legal frameworks—Companies Act, FEFTA compliance, share-class engineering, and culturally attuned deal terms such as share-repurchase obligations. This guide walks you through due diligence, preferred-share mechanics, governance rights, and common pitfalls