Subrogated Priority Claims in Japanese Insolvency: Two Key 2011 Supreme Court Rulings

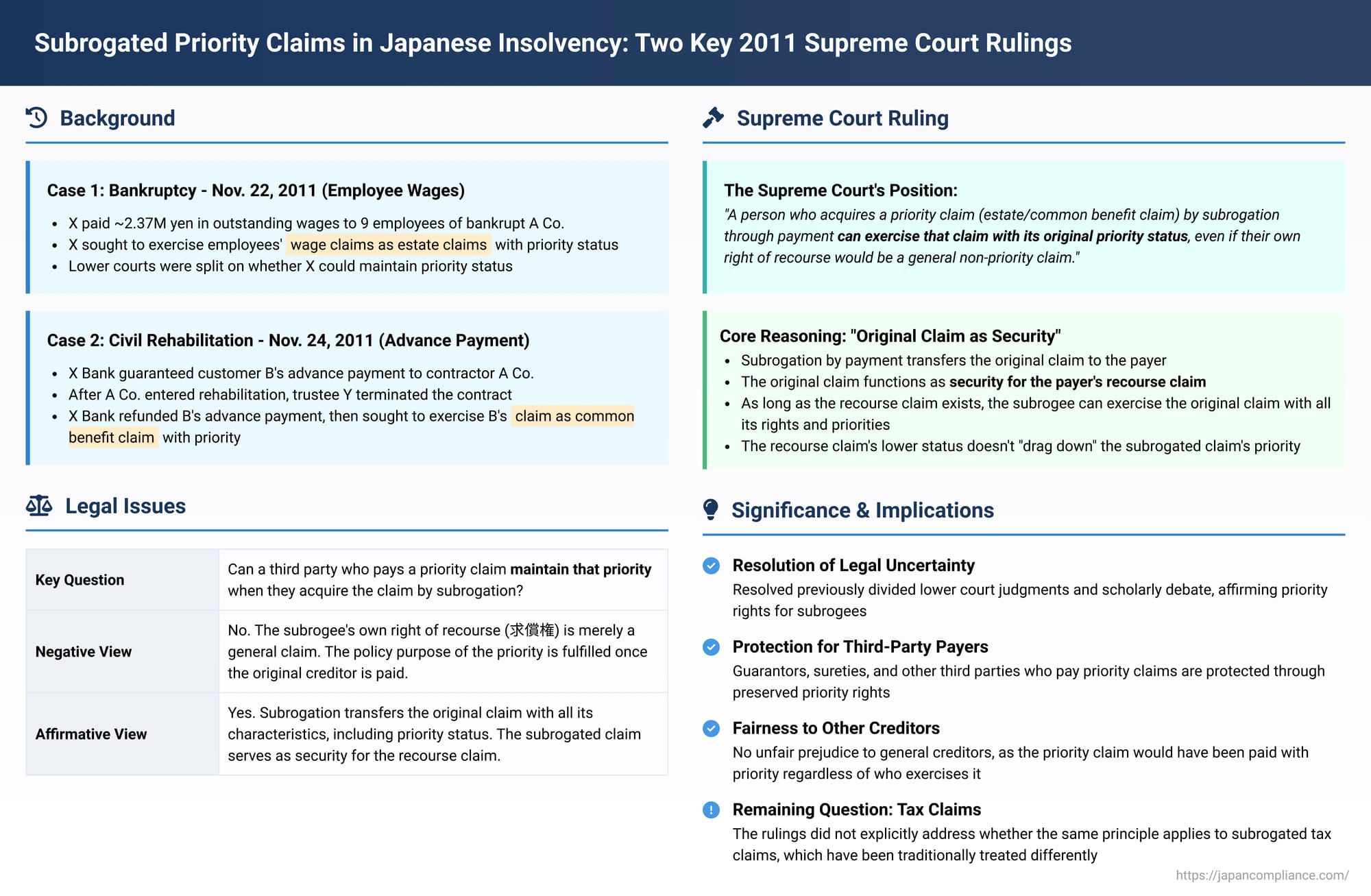

In Japanese bankruptcy and civil rehabilitation proceedings, certain types of claims are granted priority status, ensuring they are paid before general unsecured creditors. These include "estate claims" (財団債権 - zaidan saiken) in bankruptcy and "common benefit claims" (共益債権 - kyōeki saiken) in civil rehabilitation. A crucial question arises when a third party pays off one of these priority claims on behalf of the debtor and then, through the legal mechanism of subrogation (弁済による代位 - bensai ni yoru dai'i), steps into the shoes of the original priority creditor. If this third-party subrogee's direct claim for reimbursement from the insolvent debtor (their "right of recourse" - 求償権 kyūshōken) is merely a general, non-priority claim, can they still assert the original subrogated claim with its full priority status? Two landmark Supreme Court of Japan decisions, issued in November 2011, provided a clear affirmative answer for certain significant categories of priority claims.

The Legal Framework: Subrogation, Recourse, and Priority in Insolvency

When a third party (e.g., a guarantor or someone acting on the debtor's behalf) pays a debt owed by a debtor to an original creditor, the doctrine of subrogation by payment generally allows the payer (the subrogee) to acquire the original creditor's claim against the debtor, along with any associated security interests or priority rights. Separately, the payer also typically gains a direct "right of recourse" against the debtor for reimbursement of the amount paid.

In an insolvency context, a conflict can arise if the original claim held a priority status (like an estate claim for employee wages, which are paid with high priority from the bankruptcy estate) but the subrogee's own recourse claim against the now-insolvent debtor might only be treated as a general, non-priority bankruptcy or rehabilitation claim. Does the priority of the original claim survive the subrogation and benefit the subrogee, or is the subrogee limited to the (lower) status of their direct recourse claim when seeking payment from the insolvent estate? Prior to 2011, lower court judgments in Japan had been divided on this issue, leading to considerable legal uncertainty.

Supreme Court Decision 1 (Bankruptcy Case - Heisei 22 (Ju) No. 78 - Employee Wages) – Judgment of November 22, 2011

Factual Context

This case involved A Co., which subsequently entered bankruptcy. X, the plaintiff, at the request of A Co.'s representative, had paid outstanding July 2007 wage claims (totaling approximately 2.37 million yen) directly to nine of A Co.'s employees. Under Japanese bankruptcy law, certain employee wage claims qualify as high-priority "estate claims" (zaidan saiken), payable in full from the bankruptcy estate before most other debts. After A Co. was declared bankrupt, X, having acquired the employees' wage claims by subrogation, sued A Co.'s bankruptcy trustee. X asserted that these subrogated wage claims retained their status as estate claims and demanded their full payment outside the regular bankruptcy distribution process (which is characteristic of how estate claims are treated). The Osaka High Court had reversed a first instance judgment in X's favor, ruling that X could not exercise these wage claims with priority outside the bankruptcy proceedings.

Supreme Court's Ruling and Reasoning

The Supreme Court reversed the High Court's decision, ultimately ruling in favor of X. It held that a person who acquires an estate claim by subrogation through payment can exercise that estate claim with its priority status, outside the ordinary bankruptcy distribution procedures, even if their own direct right of recourse against the bankrupt is merely a general, non-priority bankruptcy claim.

The Court's core reasoning, which was also applied in the second case discussed below, was as follows:

- The legal mechanism of subrogation by payment is designed to secure the subrogee's right of recourse. It achieves this by operation of law, transferring the original creditor's claim against the debtor (the "original claim" or 原債権 - gen-saiken), along with any associated security or priority rights, to the subrogee. The original claim, thus transferred, effectively functions as a form of security for the subrogee's underlying recourse claim.

- Given this purpose, as long as the subrogee's recourse claim is substantively valid and exercisable, the subrogee should be able to exercise the subrogated original claim (with all its attendant rights) to secure that recourse.

- Even if the subrogee's direct recourse claim, when considered independently, would be subject to the limitations and procedural requirements of the insolvency proceeding (e.g., being treated as a general bankruptcy claim that only receives a pro-rata dividend), this does not mean that the subrogated original claim (if it inherently possessed a higher priority, such as being an estate claim) is dragged down to the lower status of the recourse claim. If the original claim itself was not subject to such restrictions for its exercise (e.g., an estate claim is payable outside the dividend distribution), then the subrogee's exercise of that original claim should not be subject to limitations merely because their separate recourse claim might be.

- Allowing the subrogee to assert the original priority does not unfairly harm other general bankruptcy creditors. These other creditors would have had to accept the priority payment of this claim even if the original creditor (the employees, in this case) had exercised it directly. The subrogee merely steps into the original priority creditor's shoes.

The Court concluded that these principles apply equally even if the estate claim in question is for employee wages. Therefore, X was entitled to demand full payment of the subrogated wage claims as estate claims from the bankruptcy trustee.

Supreme Court Decision 2 (Civil Rehabilitation Case - Heisei 22 (Ju) No. 1587 - Advance Payment Refund) – Judgment of November 24, 2011

Factual Context

This case involved A Co., a contractor, which had entered into a construction contract with a customer, B. X Bank had issued a guarantee to B, promising to refund an advance payment B had made to A Co. if the construction contract was terminated. A Co. subsequently entered civil rehabilitation proceedings, and a management order was issued, leading to the appointment of Y as A Co.'s supervisor/trustee. Y, exercising powers under Article 49, paragraph 1, of the Civil Rehabilitation Act, terminated the construction contract with B. This triggered X Bank's guarantee obligation, and X Bank duly refunded the advance payment to customer B.

Having made this payment, X Bank acquired by subrogation B's claim against A Co. for the return of the advance payment. Such claims for the refund of advance payments arising from the trustee's termination of a bilateral contract often qualify as "common benefit claims" (kyōeki saiken) in civil rehabilitation. Common benefit claims, like estate claims in bankruptcy, are paid with priority, typically in full and outside the terms of the rehabilitation plan that apply to general rehabilitation creditors. X Bank sued Y (A Co.'s trustee), asserting that its subrogated claim for the advance payment refund was a common benefit claim and demanded its full and immediate payment. The first instance court had dismissed X Bank's suit, but the Osaka High Court had reversed that, siding with X Bank.

Supreme Court's Ruling and Reasoning

The Supreme Court dismissed trustee Y's appeal, thereby upholding the High Court's decision in favor of X Bank. It held that a person who acquires a common benefit claim under the Civil Rehabilitation Act by subrogation through payment can exercise that common benefit claim with its priority status, outside the constraints of the rehabilitation plan, even if their own direct right of recourse against the rehabilitation debtor is merely a general rehabilitation claim that would be subject to modification under the plan.

The Court applied the same core "original claim as security for recourse" reasoning as in the bankruptcy (wage claim) case decided two days earlier. It specifically added that even if the subrogee's direct recourse claim might have its amount or repayment terms altered by a confirmed rehabilitation plan, the effect of such an alteration under the plan does not extend to or limit the exercise of the subrogated common benefit claim itself, which retains its independent priority character. The Court referenced Article 177, paragraph 2, of the Civil Rehabilitation Act, which generally provides that a rehabilitation plan does not affect rights against co-debtors or guarantors of the rehabilitation debtor (and by analogy, should not diminish distinct priority rights like common benefit claims acquired by subrogation). Once again, the Court noted that other general rehabilitation creditors are not unfairly prejudiced, as they would have had to accommodate the priority payment of this common benefit claim even if the original creditor (customer B) had asserted it.

Significance and Implications of the Twin Rulings

These two November 2011 Supreme Court judgments were highly significant as they provided clear and authoritative guidance on a previously unsettled area of Japanese insolvency law.

- Affirmation of Priority for Subrogees in Key Contexts: The decisions strongly affirmed the right of subrogees who pay off certain types of priority claims—specifically, employee wage claims qualifying as estate claims in bankruptcy, and advance payment refund claims qualifying as common benefit claims in civil rehabilitation—to step into the original creditor's shoes and assert that same priority status themselves.

- The "Original Claim as Security for Recourse" Rationale: The Supreme Court's consistent theoretical framing in both cases—viewing the subrogated original claim as functioning as a type of security for the subrogee's recourse claim—was instrumental. This rationale allowed the Court to treat the original claim's priority characteristics as persisting independently, even if the subrogee's direct recourse claim might, on its own, have a lower status in the insolvency hierarchy.

- Impact on Previous Debates: The rulings effectively sided with the affirmative view in a scholarly and lower-court landscape that had previously been divided. Arguments that the underlying policy purpose of the priority was "fulfilled" once the original creditor was paid by the subrogee, or that the recourse claim's limitations should "drag down" the status of the subrogated original claim, were not accepted by the Supreme Court for these types of claims.

- No Unfair Prejudice to Other General Creditors: A consistent theme in both judgments was that allowing the subrogee to exercise the original priority does not unfairly disadvantage other general creditors. This is because these priority claims would have been paid with priority anyway, regardless of whether the original creditor or the subrogee was the one exercising the right. The subrogee's payment simply changes who receives that priority payment, not the fact that such a priority payment is due from the estate.

Scope and Remaining Questions

It is important to note the scope of these decisions:

- Specific Claim Types: The rulings directly addressed (1) employee wage claims qualifying as estate claims in bankruptcy and (2) certain contract termination-related advance payment refund claims qualifying as common benefit claims in civil rehabilitation.

- Tax Claims Remain an Area of Discussion: The PDF commentary accompanying these cases points out that they did not explicitly resolve the treatment of subrogated tax claims. In previous lower court practice, priority status had generally been denied to third parties who paid off a debtor's tax liabilities and then sought to assert that priority in the debtor's insolvency. The Supreme Court's reasoning in the 2011 cases, particularly its "original claim as security for recourse" theory, might still leave room for a different outcome for tax claims if the nature of tax obligations (e.g., their inherent non-transferability in terms of priority status, or specific public policy considerations) is deemed fundamentally distinct. Indeed, a supplementary opinion by Justice Tahara in the bankruptcy (wage claim) case hinted at potential distinctions for tax claims.

Concluding Thoughts

The Supreme Court of Japan's twin decisions in November 2011 brought significant clarity and a degree of certainty to the rights of third parties who pay off priority claims in bankruptcy or civil rehabilitation proceedings. By establishing that such subrogees can generally exercise the original claim with its full priority status—based on the theory that the subrogated original claim serves as a security for their recourse claim—the Court has reinforced the value of third-party support mechanisms (like guarantees or direct payments on behalf of a struggling debtor) even in the shadow of insolvency. These rulings ensure that those who step in to satisfy priority obligations are not unfairly relegated to the status of general unsecured creditors with respect to the priority nature of the debt they paid, thereby promoting a degree of fairness and predictability for financiers, guarantors, and other stakeholders interacting with financially distressed entities.