Severance Pay, Mutual Aid Loans, and Trustee's Avoidance: Twin 1990 Supreme Court Rulings

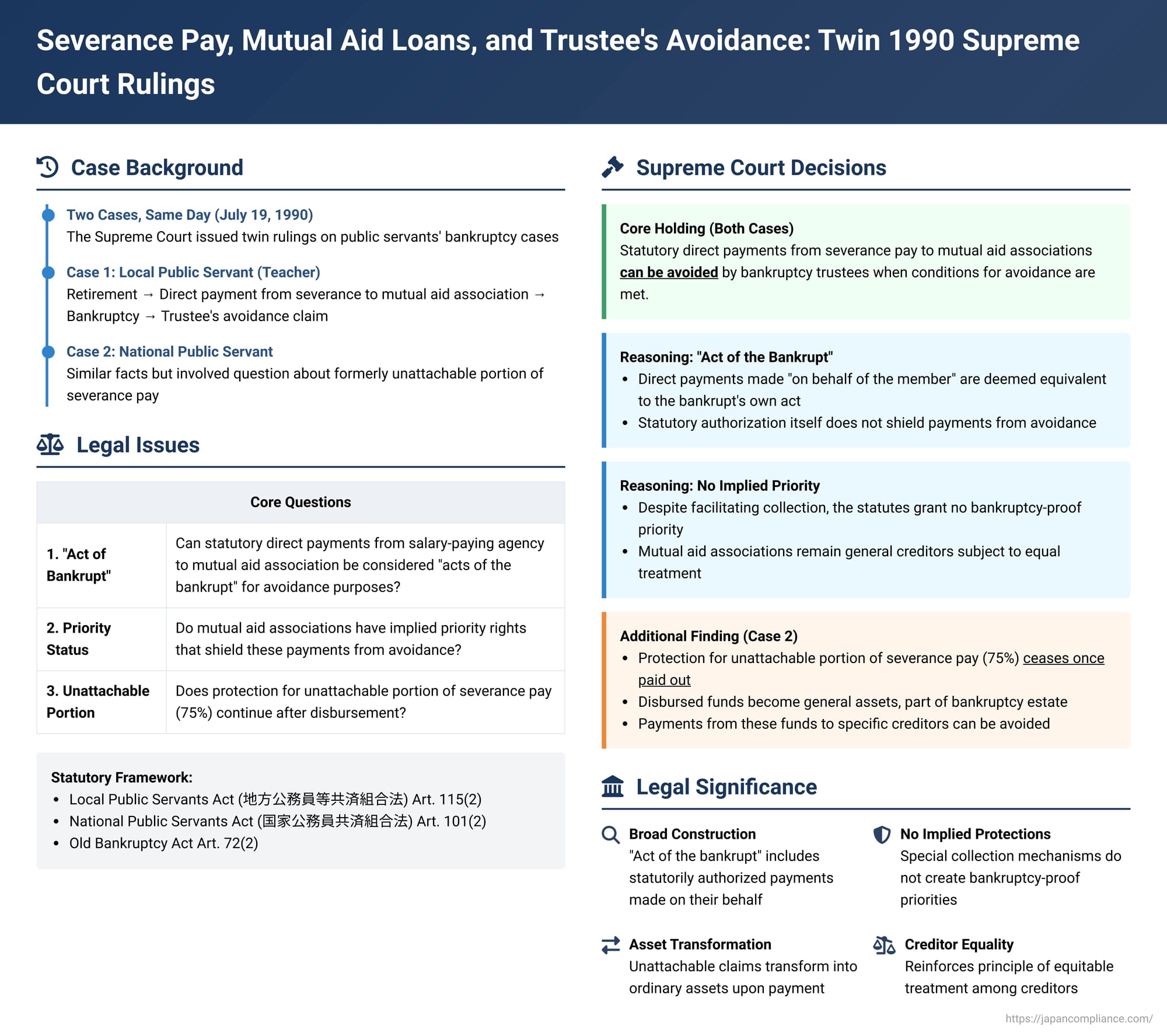

On July 19, 1990, the First Petty Bench of the Supreme Court of Japan delivered two significant judgments that addressed a contentious issue in personal bankruptcy cases involving public servants. The core question was whether direct payments made by a public servant's salary-paying agency from their severance pay to a mutual aid association (共済組合 - kyōsai kumiai), to satisfy outstanding loans owed by the servant to the association, could be subject to avoidance (否認 - hinin) by the servant's bankruptcy trustee. The Supreme Court, in both cases, affirmed the trustee's power of avoidance, clarifying key aspects of bankruptcy law concerning the "act of the bankrupt" and the status of formerly unattachable assets.

The Core Issue: Statutory Direct Payments and Avoidance in Bankruptcy

Many public servants in Japan are members of mutual aid associations, which often provide loans to their members. Specific laws, such as the Local Public Servants, etc. Mutual Aid Association Act (地方公務員等共済組合法 - Chikyōhō) and the National Public Servants, etc. Mutual Aid Association Act (国家公務員共済組合法 - Kokkyōhō), contained provisions (Article 115(2) of the Chikyōhō and Article 101(2) of the Kokkyōhō, respectively, at the time) authorizing the public servant's salary-paying agency to deduct amounts owed by the member to their mutual aid association from their salary or severance pay and remit these amounts directly to the association "on behalf of the member."

When a public servant with such outstanding loans entered personal bankruptcy around the time of retirement, a critical question arose: if such a direct payment from severance pay was made to the mutual aid association shortly before or around the time of the bankruptcy declaration, could the bankruptcy trustee later avoid this payment as a preferential or detrimental act? This hinged on two main sub-issues:

- Could these statutory direct payments be considered an "act of the bankrupt," a prerequisite for many types of avoidance actions under the (then old) Bankruptcy Act?

- Did these statutory provisions effectively grant the mutual aid associations a priority or security interest over other creditors that would shield such payments from avoidance?

Prior to these Supreme Court rulings, lower court decisions on this matter had been inconsistent, leading to significant legal uncertainty.

Supreme Court Judgment 1 (Local Public Servants - Chikyōhō Case - Showa 62 (O) No. 1083)

Factual Context

This case involved A, a teacher at a prefectural high school, who filed for personal bankruptcy and subsequently retired. At the time of retirement, A had an outstanding loan from Y1, the local public servants' mutual aid association. A's salary-paying agency, acting under Article 115(2) of the Chikyōhō, deducted the full amount of A's severance pay and transferred it directly to Y1 in satisfaction of the loan. This occurred at a time when Y1 was aware that A had already filed for bankruptcy. A was later formally declared bankrupt, and X1 was appointed as trustee. X1 sought to avoid this direct payment under Article 72, item 2 of the old Bankruptcy Act (a provision for avoiding acts made during the "crisis period" when the debtor was insolvent or had suspended payments and the act was detrimental to creditors), and claimed the return of the portion of the severance pay that would normally be attachable (one-quarter). The High Court had denied the trustee's claim, leading to X1's appeal to the Supreme Court.

Supreme Court's Ruling and Reasoning

The Supreme Court reversed the High Court's decision and ruled in favor of the trustee, X1.

- Direct Payment as Avoidable Act: The Court held that the act of a salary-paying agency deducting funds from a local public servant's salary or severance pay and remitting them to the mutual aid association "on behalf of the member," pursuant to Chikyōhō Article 115(2), is subject to avoidance by the bankruptcy trustee if the member is subsequently declared bankrupt and the conditions for avoidance are met.

- "On Behalf of the Member": The Court focused on the statutory language "on behalf of the member." It interpreted this to mean that the payment made by the salary-paying agency is essentially a substitute for, or an act of agency in carrying out, the member's own obligation to repay the loan. Therefore, for the purposes of avoidance law, such a payment could be deemed equivalent to an act by the bankrupt member themselves. This was a crucial finding, as the old Bankruptcy Act's avoidance provisions generally required an "act of the bankrupt."

- No Implied Priority: The Court reasoned that while Chikyōhō Article 115(2) was designed to ensure the reliable collection of loans by mutual aid associations and thereby secure their financial resources (while also considering general labor law principles of direct and full wage payment), the provision itself lacked any wording that would grant these direct payments priority over other creditors in a bankruptcy scenario. The statute did not create a security interest or a super-priority claim that would exempt such repayments from the general principles of creditor equality in bankruptcy.

- Statutory Basis Not a Shield: The fact that the payment was made pursuant to a statutory provision did not, in itself, shield it from the trustee's avoidance powers if it otherwise met the criteria for an avoidable act (e.g., being made during the crisis period to the detriment of other creditors).

Supreme Court Judgment 2 (National Public Servants - Kokkyōhō Case - Showa 63 (O) No. 1457)

Factual Context

This second case, decided on the same day, involved B, an official of the Ministry of Education working at a national university. B also filed for personal bankruptcy and then retired, owing a loan to Y2, the national public servants' mutual aid association. Similarly, B's salary-paying agency directly paid a portion of B's severance pay to Y2 to satisfy the loan, acting under Article 101(2) of the Kokkyōhō. B was later declared bankrupt, and X2 was appointed trustee. X2 sought to avoid this payment, claiming the return of the entire amount paid if it encroached upon the portion of the severance pay that was normally unattachable. The High Court had dismissed the trustee's claim.

Supreme Court's Ruling and Reasoning

The Supreme Court also reversed the High Court in this case and remanded it.

- Avoidability of Direct Payment under Kokkyōhō: The Court reached a conclusion parallel to the Chikyōhō case. It held that direct payments made by a salary-paying agency to a mutual aid association "on behalf of the member," pursuant to Kokkyōhō Article 101(2), are similarly subject to avoidance by the bankruptcy trustee under the same reasoning: they are effectively acts of repayment by the member, and the statute does not confer a bankruptcy-proof priority.

- Additional Key Finding – Payments Made from the (Formerly) Unattachable Portion of Severance Pay:

This judgment went further to address a specific argument concerning the source of the funds used for repayment. Under Japanese law (Civil Execution Act Article 152(2)), a significant portion (three-quarters) of a claim for severance pay is generally protected from attachment by creditors to ensure the retiree's livelihood. The question was whether a repayment made from this protected portion, if the severance pay had already been disbursed, could still be avoided.

The Supreme Court clarified:- Once severance pay is actually paid out to the retiree, the legal claim for severance pay is extinguished. The statutory protection against attachment, which applies to the claim for severance pay, no longer applies to the money itself once it has been paid.

- If the retiree is subsequently declared bankrupt, this disbursed severance pay, now in the form of cash or a bank deposit, becomes part of their general assets and thus constitutes part of the bankruptcy estate.

- Therefore, if the bankrupt individual then uses this money—even if it originated from the portion of the severance pay claim that would have been unattachable as a claim—to make a repayment to a specific creditor (like the mutual aid association) before being declared bankrupt, that repayment can be subject to avoidance by the trustee if it meets the general conditions for an avoidable act (e.g., a preferential payment made during the crisis period).

Key Principles Reaffirmed by the Supreme Court

These twin Supreme Court decisions established and reaffirmed several crucial principles:

- "Act of the Bankrupt" Broadly Construed: Statutory direct payments made "on behalf of" a debtor by a third party (like a salary-paying agency to a mutual aid association) can be treated as equivalent to acts of the debtor for the purposes of avoidance law, particularly where the statute describes the payment as being made in lieu of the debtor's own performance.

- No Implied Preferential Status for Mutual Aid Associations: The statutory mechanisms allowing direct deduction and payment of loans from public servants' salaries or severance pay to their mutual aid associations do not create a de facto security interest or a right of priority that would shield these payments from the trustee's avoidance powers in bankruptcy. Unless explicitly stated, such provisions do not override the fundamental bankruptcy principle of treating general creditors equally.

- Transformation of Unattachable Claims Upon Disbursement: The special protection from attachment afforded to certain types of claims (like three-quarters of a severance pay claim) ceases once the claim is satisfied and the funds are paid out to the debtor. Once disbursed, the money becomes part of the debtor's general property and, in the event of bankruptcy, part of the bankruptcy estate, fully subject to the rules governing avoidable transactions.

Implications and Current Relevance

These 1990 Supreme Court judgments were instrumental in resolving a period of conflicting lower court rulings and bringing uniformity to the treatment of such direct payments in public servant bankruptcies.

- While the cases were decided under the old Bankruptcy Act, the interpretative principles regarding what can constitute an "act of the bankrupt" for avoidance purposes, and the strict construction against implied priorities, remain highly relevant under the current Bankruptcy Act.

- The ruling on the transformation of unattachable claims into general assets upon payment is a principle of broader application, affecting how various types of exempt or protected funds are treated once they lose their character as specific claims and become part of a debtor's general pool of assets.

- Legal commentary suggests that concerns about the debtor's ability to maintain a basic standard of living, especially when a significant asset like severance pay is involved, can be appropriately addressed within the bankruptcy framework through mechanisms such as the "expansion of free property" (自由財産の拡張 - jiyū zaisan no kakuchō). This allows the bankruptcy court, on a case-by-case basis, to permit the bankrupt to retain certain assets that would otherwise form part of the estate, if deemed necessary for their rehabilitation.

Concluding Thoughts

The Supreme Court's clear stance in these twin 1990 decisions significantly strengthened the hand of bankruptcy trustees in ensuring equitable treatment among creditors. By confirming that direct payments from severance pay to mutual aid associations, despite their statutory authorization, are not immune from avoidance, the Court reinforced the supremacy of bankruptcy law's collective principles over specific sectoral collection mechanisms that lack explicit bankruptcy-proof priority. Furthermore, the clarification regarding the status of disbursed severance pay ensures that assets intended for the general creditor body are not improperly shielded due to their prior status as unattachable claims. These rulings continue to inform practice in personal bankruptcy cases involving public servants and their obligations to mutual aid associations.