Secured Creditor Repaid with Own Collateral: A 1966 Japanese Supreme Court Ruling on Bankruptcy Avoidance

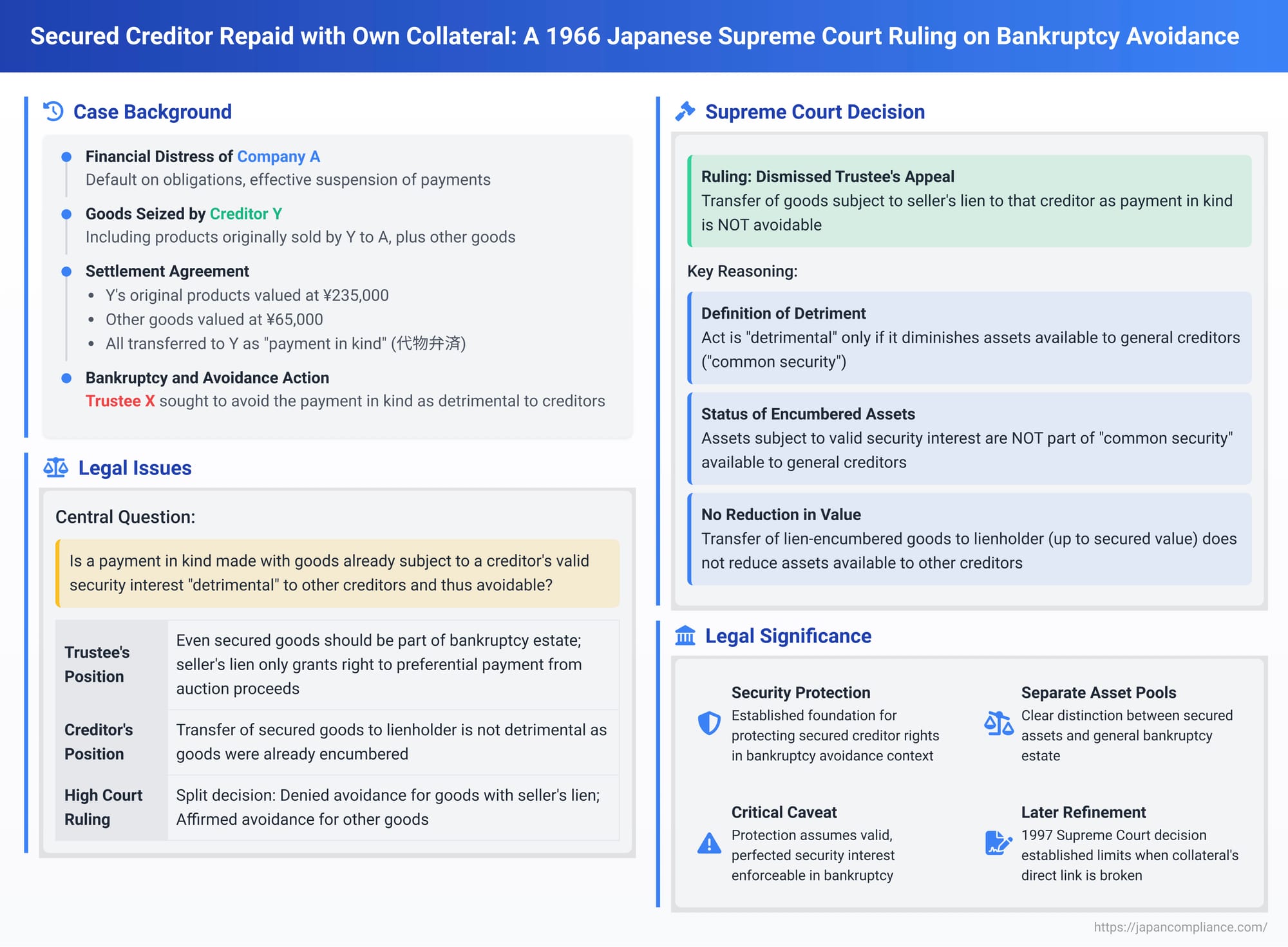

When a company faces bankruptcy, the trustee is empowered to "avoid" (否認 - hinin) certain pre-bankruptcy transactions that unfairly disadvantage the general body of creditors. A common scenario involves payments or transfers made to specific creditors shortly before insolvency. But what if the asset transferred to a creditor was already subject to that creditor's valid security interest? Is such a transfer still "detrimental" to other creditors and thus avoidable? A Japanese Supreme Court decision from April 14, 1966, addressed this very question in the context of a payment in kind made to a creditor holding a seller's statutory lien.

Factual Background: Distress, Seizure, and an Accord and Satisfaction

The case involved A Co., which was in financial distress. Y Co. was one of A Co.'s creditors, holding an accounts receivable claim. After A Co. defaulted on a promissory note and effectively suspended its payments (a key indicator of insolvency), Y Co. took action. Despite A Co.'s employees initially refusing, Y Co. removed a quantity of goods from A Co.'s office. These goods included products that Y Co. had originally sold to A Co., as well as products manufactured by other companies.

Subsequently, after Y Co. had filed a bankruptcy petition against A Co. (but before A Co. was formally declared bankrupt), a dispute arose concerning the ownership and rightful possession of these seized goods. To resolve this, A Co. and Y Co. entered into an agreement. Under this agreement:

- The goods that Y Co. had originally manufactured and sold to A Co. were valued at 235,000 yen (which was their original sale price).

- The goods manufactured by other companies (which Y Co. had also taken) were valued at 65,000 yen.

- It was agreed that all these goods, with a combined value of 300,000 yen, would be formally transferred to Y Co. as a "payment in kind" (代物弁済 - daibutsu bensai, an accord and satisfaction) in partial satisfaction of Y Co.'s total outstanding accounts receivable claim against A Co.

Following this agreement, A Co. was formally declared bankrupt under Japan's old Bankruptcy Act, and X was appointed as its bankruptcy trustee. Trustee X then initiated a lawsuit against Y Co. The trustee sought to avoid the aforementioned accord and satisfaction, arguing it was an act intended to harm other creditors, voidable under Article 72, item 1, of the old Bankruptcy Act. Since the specific goods were reportedly no longer in Y Co.'s possession, the trustee claimed monetary compensation for their value (initially asserting a value higher than the 300,000 yen agreed between A Co. and Y Co.).

The first instance court partially found in favor of trustee X. On appeal, the Tokyo High Court made a crucial distinction:

- For the portion of the goods that Y Co. had originally sold to A Co., and over which Y Co. therefore held a seller's statutory lien on movables (動産売買先取特権 - dōsan baibai sakidori tokken – a type of non-possessory lien securing the unpaid purchase price), the High Court denied the trustee's avoidance claim. Its reasoning was that these goods, being encumbered by Y Co.'s valid lien, would not have been available for distribution to general unsecured creditors anyway. Therefore, their transfer to Y Co. as payment in kind (up to the value of the secured claim) was not detrimental to other creditors.

- For the other goods (those manufactured by third parties, not subject to Y Co.'s seller's lien), the High Court affirmed the trustee's right to avoidance and ordered Y Co. to pay their value (approximately 260,000 yen) to the bankruptcy estate.

Trustee X appealed the High Court's decision concerning the non-avoidance of the transfer of Y Co.'s own products, arguing, among other points, that a seller's lien merely grants a right to preferential payment from the proceeds of an auction of the goods, not an outright right for the creditor to take the goods themselves as payment.

The Legal Issue: "Detriment" to Creditors When Secured Assets Are Used for Payment in Kind

A fundamental prerequisite for a bankruptcy trustee to avoid a pre-bankruptcy transaction is that the transaction must have been "detrimental" (有害 - yūgai) to the general body of bankruptcy creditors. This usually means the act diminished the total assets available for distribution to all creditors or unfairly preferred one creditor over others.

The central question in this appeal was: If a creditor holds a valid and perfected seller's statutory lien on specific goods, and those very goods are then transferred to that creditor as payment in kind for the secured debt (assuming the goods are valued appropriately, not exceeding the debt), does this act actually diminish the "common security" (共同担保 - kyōdō tanpo) available to other, unsecured creditors? Or are these assets already effectively set aside for the secured creditor?

The Supreme Court's Ruling: No Detriment if Collateral Matches Secured Debt

The Supreme Court largely dismissed trustee X's appeal on the main issue of avoidance (though it did modify the applicable interest rate on the monetary award for the portion of the transaction that was deemed avoidable by the High Court, an issue not central to the principle discussed here).

The Court affirmed the High Court's core finding: The transfer of goods (Y Co.'s own products), on which Y Co. held a valid seller's statutory lien on movables, valued at an amount equal to the secured claim (the original unpaid purchase price), as a payment in kind to Y Co., was NOT an act detrimental to the other bankruptcy creditors of A Co.

The Supreme Court's reasoning was as follows:

- Definition of a Detrimental Act: The Court stated that an act detrimental to bankruptcy creditors is one that diminishes the "common security"—the pool of assets that would otherwise be available for distribution to the general body of creditors.

- Encumbered Assets Are Not "Common Security": Assets that are subject to a valid and perfected security interest, such as Y Co.'s seller's lien in this case, are, up to the value of the debt secured by that lien, not considered part of the "common security" available to general, unsecured creditors. These assets are already effectively earmarked or encumbered in favor of the secured creditor.

- No Reduction in Value for General Creditors: The transfer of these specific lien-encumbered goods to Y Co. in satisfaction of its secured claim did not reduce the assets that would have been available for distribution to the general creditors. The general creditors would not have had a right to these particular goods (or their full value) over Y Co.'s prior statutory lien anyway. The Court also noted the High Court's factual finding that the value of these goods had not increased between the time of their original sale to A Co. and the time of the accord and satisfaction (meaning Y Co. did not receive an unfair windfall in value). Since the payment in kind extinguished A Co.'s debt to Y Co. to the extent of the value of these encumbered goods, there was no net loss to the potential pool of assets for other creditors from this part of the transaction.

The Supreme Court also briefly dismissed other arguments raised by the trustee, such as the potential priority of a landlord's lien or tax claims, noting that these had not been properly raised or substantiated in the lower court proceedings.

Broader Implications for Secured Creditors and Avoidance

This 1966 Supreme Court decision established an important principle regarding the treatment of payments in kind made with collateral to secured creditors in bankruptcy:

- General Principle: If a creditor holds a valid security interest that is effective against the bankruptcy estate, and the collateral securing their debt is transferred to them as payment in kind – provided the value of the collateral does not exceed the amount of the secured debt – such a transaction is generally not considered detrimental to other creditors and is therefore not avoidable merely on grounds of being a preferential payment or a fraudulent conveyance that diminishes the estate available to unsecured creditors. This principle has been applied to various forms of security, including mortgages, pledges, and other statutory liens, as well as non-typical security arrangements like retention of title or security assignments.

- Caveat on Validity of Security: This protection, of course, hinges on the underlying security interest being validly created, perfected, and enforceable against the bankruptcy trustee.

- Distinction from Later Case Law (Heisei 9 (1997) Supreme Court Decision): Legal commentary notes that a subsequent Supreme Court decision in 1997 did permit the avoidance of a payment in kind made to a seller's lienholder under different factual circumstances. In that later case, the goods had been sold by the bankrupt to a third party and then reacquired by the bankrupt before being transferred to the original seller who held the lien. This suggests that the principle from the 1966 ruling might not apply, or might apply differently, if the collateral's direct link to the original secured transaction is broken or made more complex, for instance, by its passage through third-party ownership before being used for the payment in kind.

Ongoing Scholarly Discussion (Especially for Seller's Liens on Movables)

Despite this 1966 ruling (and other subsequent judgments affirming similar outcomes for payments in kind to seller's lienholders), legal scholars continue to debate certain aspects, particularly concerning the practical enforceability of seller's statutory liens on movables.

- Some commentators argue that because actually enforcing such liens (e.g., through seizure and sale) can present practical difficulties (even after Civil Execution Act reforms in 2003 aimed at facilitating their execution), these liens might not always provide a realistic and guaranteed priority payment in practice.

- This leads to a perspective that the goods encumbered by such liens might, in some factual situations, still be considered part of the assets that general creditors could realistically hope to reach.

- These scholars often advocate for a more case-by-case analysis of "detriment," considering whether the specific seller's lienholder could have realistically and effectively enforced their priority claim against the goods in the absence of the payment in kind. The Supreme Court itself, in the aforementioned 1997 decision, did appear to consider whether the lienholder's priority was, in fact, realistically secured. Some legal experts even interpret the 1997 decision as having effectively modified or refined the broader applicability of the 1966 ruling, particularly for seller's liens on movables.

Concluding Thoughts

The Supreme Court's 1966 judgment provides a foundational principle in Japanese bankruptcy law: a payment in kind made to a secured creditor using their own collateral, where the value transferred is appropriate to the secured debt, is generally not deemed detrimental to the interests of other, unsecured creditors and is thus not avoidable on that ground alone. This ruling respects the pre-existing rights of secured creditors and acknowledges that assets already validly encumbered are not part of the "common security" available for general distribution. However, the application of this principle requires careful attention to the specifics of the security interest, the valuation of the collateral, and, as later case law and ongoing scholarly discussion suggest, potentially a more nuanced assessment of the practical realities of lien enforcement, especially for certain types of security like seller's liens on movable property.