Japan Supreme Court Narrows Workers’ Comp for Specially Enrolled Owners (2012)

Japan's top court limits workers' comp for specially enrolled owners to on‑site work covered by employee insurance, excluding sales and scouting trips.

TL;DR

Japan’s Supreme Court held that workers’ compensation for business owners who join the special enrollment scheme extends only to the same on‑site construction business unit covered for their employees, not to sales or future‑project scouting trips.

Table of Contents

- Factual Background: Construction Business, Special Enrollment, and a Fatal Trip

- Lower Court Rulings: Focus on Similarity to Employee Tasks

- Legal Framework: Special Enrollment and the Scope of “Business”

- The Supreme Court’s Analysis (February 24, 2012): Coverage Tied to Insured Business Unit

- Implications and Significance: Defining the Boundaries of Special Enrollment

- Conclusion

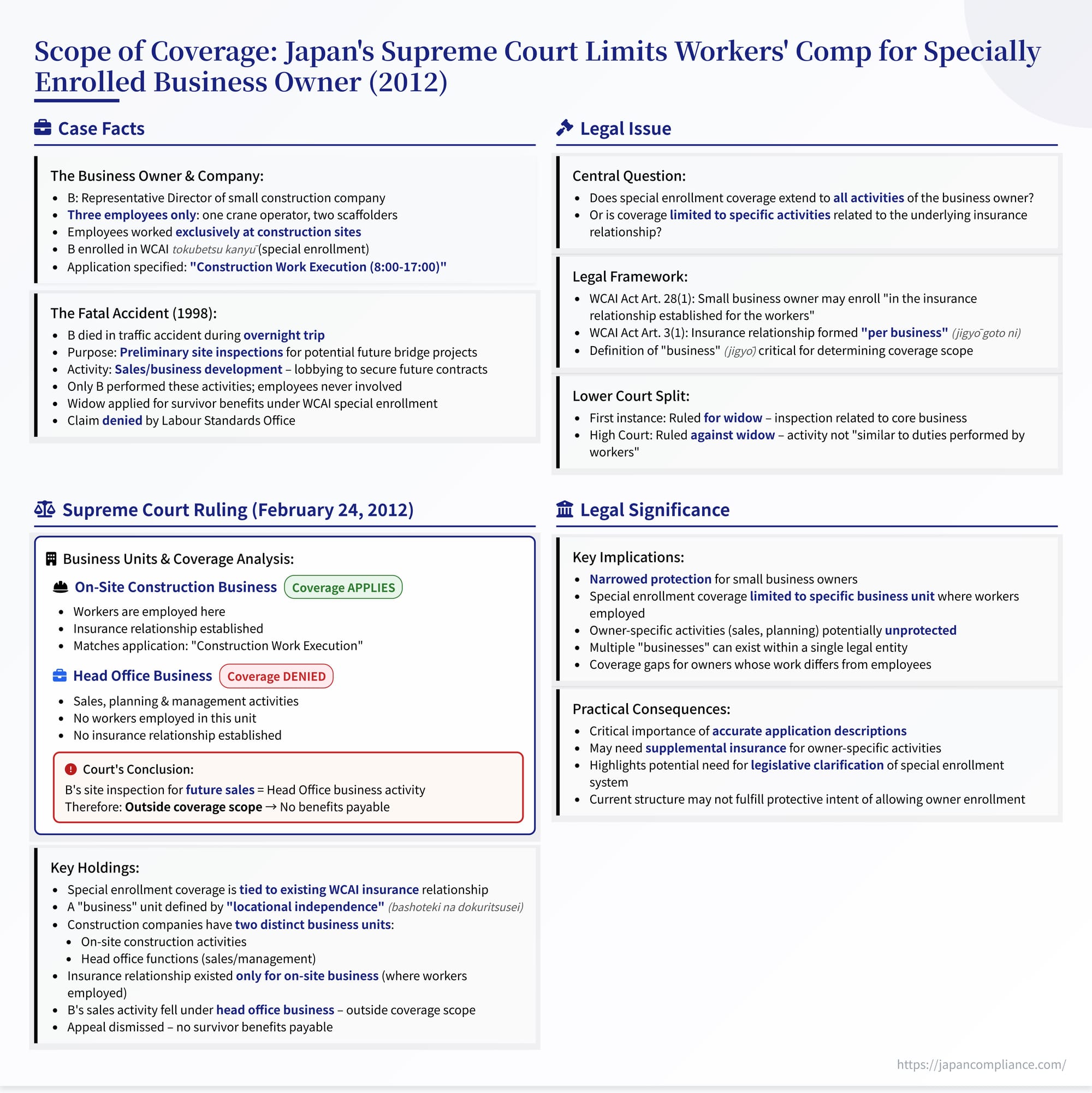

On February 24, 2012, the Second Petty Bench of the Supreme Court of Japan issued a significant ruling concerning the scope of coverage under the special enrollment system (tokubetsu kanyū) of the Workers' Accident Compensation Insurance Act (WCAI Act, or Rōsai Hoken Hō - 労災保険法) (Case No. 2010 (Gyo-Hi) No. 273, "Workers' Compensation Non-Payment Decision Revocation Case"). This system allows certain individuals who are not typically considered "workers," such as small business owners, to voluntarily enroll in the WCAI system for protection against work-related injuries. The case involved the representative director of a small construction company who died in an accident while scouting potential future work sites. The Court denied survivor benefits, holding that the owner's special enrollment coverage was tied specifically to the business activities for which his employees were covered (on-site construction), and did not extend to owner-exclusive activities like sales or securing future projects conducted outside that scope. This decision highlights the importance of understanding the precise linkage between special enrollment coverage and the underlying WCAI insurance relationship established for the business's regular workers.

Factual Background: Construction Business, Special Enrollment, and a Fatal Trip

The case revolved around the work structure of a small construction company and the activities of its owner:

- The Company and Personnel: Company A was a limited liability company based in Hiroshima engaged in construction contracting, primarily as a subcontractor for bridge projects. The company was small, with only three employees: one crane operator and two scaffolders (tobi shoku). These employees worked exclusively on active construction project sites. The deceased, B, was the representative director. B's wife, X (the appellant), and their daughter were also directors on paper, with X handling accounting duties.

- WCAI Special Enrollment: As a small business owner potentially working alongside employees, B was eligible for special enrollment in the WCAI system under Article 28, Paragraph 1 of the WCAI Act (applicable version pre-dating Heisei 12 [2000] amendments, based on Art. 27(1)). In April 1993, Company A applied for, and received, approval from the Hiroshima Labour Standards Bureau Chief for B's special enrollment. The application specified B's covered "specific work content" as "Construction Work Execution (8:00-17:00)" (建築工事施工 - kenchiku kōji sekō). This approval allowed B to be treated as a "worker" for WCAI purposes within the scope defined by the approval and the underlying insurance relationship.

- The Fatal Accident: In 1998, B died in a traffic accident in Shobara City, Hiroshima Prefecture. He lost control of his car, which fell into a pond, and he drowned.

- B's Activity at Time of Accident: At the time of the accident, B was on an overnight trip conducting preliminary site inspections (shitami) for four potential future bridge construction projects located in Shobara City. Company A hoped to secure subcontracts for these projects, but they were still in the early planning stages. B had limited information – knowing only that they were likely to commence within the next 2-3 years, but not the main contractor, contract timing, or project duration. B had been actively lobbying contacts (like a Diet member's secretary) to influence potential main contractors in favor of Company A.

- Division of Labor: Crucially, the facts established that within Company A, only B performed activities related to sales, business development, and preliminary site inspections for future projects. The company's three employees were engaged solely in on-site construction work at active project locations. They were not involved in sales, management, or scouting potential work. While employees occasionally accompanied B on site visits, this was only for the purpose of assisting with planning related to their upcoming site work.

- WCAI Claim Denial: Following B's death, his wife X applied for survivor compensation benefits and funeral expenses under the WCAI Act based on B's special enrollment status. The Hiroshima Central Labour Standards Inspection Office Director denied the claims ("the Dispositions"), reasoning that B's activity at the time of the accident (site inspection for future business development) did not fall within the scope of the approved work content ("Construction Work Execution") covered by his special enrollment.

Lower Court Rulings: Focus on Similarity to Employee Tasks

X challenged the denial. The first instance court ruled in favor of X, finding that the site inspection was not an owner-exclusive management decision but rather an activity related to the core construction business. However, the High Court (Hiroshima High Court) reversed this. It adopted a different standard, arguing that for a specially enrolled owner's activity to be covered, it must be "similar to the duties performed by workers" (rōdōsha ga okonau gyōmu ni junjita) within that specific business. Since A Ltd.'s employees only performed on-site construction and were not involved in site inspections for future sales, the High Court concluded B's activity was not "similar" and therefore fell outside the scope of his special enrollment coverage.

Legal Framework: Special Enrollment and the Scope of "Business"

The case required the Supreme Court to interpret the scope of coverage under the WCAI Act's special enrollment system for small business owners (中小事業主 - chūshō jigyō nushi).

- WCAI Act Art. 28(1): Allows the government, upon application from a small business owner whose business employs workers covered by WCAI, to approve the owner (or their representative) for special enrollment. This approval treats the owner as if they were a worker "in the insurance relationship established for the workers" (rōdōsha ni kanshi seiritsu shite iru... hoken kankei).

- WCAI Act Art. 3(1) & Labour Insurance Premiums Collection Act Art. 3: Establish that the underlying WCAI insurance relationship is formed on a "per business" (jigyō goto ni) basis where workers are employed.

- Defining "Business" (jigyō): The scope of the "business" for which an insurance relationship exists is crucial. Relevant regulations (like the Premiums Collection Act Enforcement Regs. Art. 16(1) and the WCAI Rate Application Table) suggest that a "business" unit is determined based on factors including the "place where the business is carried on" (jigyō no okonawareru basho) and the nature of the operations.

The central question was how narrowly to define the "business" covered by the workers' insurance relationship, as this would determine the scope of the owner's special enrollment coverage under Art. 28(1).

The Supreme Court's Analysis (February 24, 2012): Coverage Tied to Insured Business Unit

The Supreme Court dismissed X's appeal, upholding the denial of benefits, but based its reasoning on a structural analysis of the insurance relationship rather than solely on the similarity of tasks performed by the owner versus employees.

1. Special Enrollment Premised on Existing Worker Insurance: The Court began by emphasizing that the special enrollment system under Art. 28(1) is entirely dependent on an existing WCAI insurance relationship established for the workers employed in the business. The owner's coverage is essentially grafted onto this underlying relationship.

2. Defining the Unit of "Business": The Court then defined how the relevant "business" unit should be determined for establishing the insurance relationship, citing its previous ruling (Heisei 9 [1997] decision) and relevant regulations:

- The determination is made "per business" (jigyō goto ni).

- A "business" is typically identified based on "locational independence" (bashoteki na dokuritsusei) as the primary criterion.

- It represents "an integrated unit of operations performed interrelatedly under a specific organization at a specific location." (tōgai ittei no basho ni oite ittei no soshiki no moto ni sōkanren shite okonawareru sagyō no ittai o tan'i to shite kubun sareru).

3. Applying the "Business Unit" Concept to Construction: Applying this definition to construction enterprises, the Court concluded:

- On-site construction activities at individual project sites constitute one distinct type of "business."

- Head office functions, such as sales, business management, and other related activities based out of the main office, constitute a separate and distinct "business."

- A WCAI insurance relationship is established for each such business unit if, and only if, workers are employed specifically within that unit.

4. Identifying Company A's Insured Business Unit: Based on the established facts:

- Company A's employees (crane operator, scaffolders) were engaged exclusively in work at individual construction project sites.

- They were not involved in any activities based out of the head office (sales, management, etc.).

- Therefore, the WCAI insurance relationship for Company A was established only for the "business at each individual construction site related to its contracted construction work." (sono ukeoi ni kakaru kenchiku kōji ga kankei suru kokko no kenchiku no gemba ni okeru jigyō)

- No insurance relationship existed for the separate "business such as sales, etc., based at the head office." (honten-tō no jimusho o kyoten to suru eigyō-tō no jigyō)

5. Determining the Scope of B's Special Enrollment:

- Since B's special enrollment under Art. 28(1) was tied to the insurance relationship established for Company A's workers, B's coverage was limited to the scope of that relationship – i.e., the on-site construction business unit.

- The Court noted that Company A's original special enrollment application, specifying B's work as "Construction Work Execution," was consistent with seeking coverage only for activities related to this insured business unit.

6. Assessing B's Activity at the Time of Death:

- The Court determined that B's activity when the accident occurred – conducting preliminary site inspections for potential future projects – was clearly part of the sales and business development function, which pertains to the head office business unit, not the on-site construction execution unit.

Conclusion on Coverage: Because B died while engaged in activities (site inspection for future sales) related to a business unit (head office/sales) for which no underlying WCAI insurance relationship existed (as no workers were employed in that specific business unit), his death did not occur within the scope of activities covered by his special enrollment. Therefore, WCAI benefits were not payable to his survivor, X. The High Court's conclusion denying benefits was ultimately correct, even if its reasoning (focusing on similarity of tasks) differed from the Supreme Court's structural analysis based on the insured business unit.

Implications and Significance: Defining the Boundaries of Special Enrollment

This 2012 Supreme Court decision has significant implications for small business owners, particularly in sectors like construction where the owner's role often diverges from that of site employees:

- Coverage Linked to Insured Business Unit: It clarifies that WCAI special enrollment coverage for owners is not blanket coverage for all their business activities. It is fundamentally tied to the specific "business unit" where workers are employed and for which the underlying WCAI insurance relationship is established.

- Potential Gaps for Owners: Owners whose primary activities (e.g., sales, management, planning) occur within a business function or location separate from where their employees work (e.g., employees only on construction sites, owner mainly in office/on sales calls) may find their special enrollment coverage is limited or non-existent for those essential owner-specific tasks, even if they pay premiums.

- Importance of Application Details: The decision highlights the potential importance of accurately describing the "specific work content" in the special enrollment application, aligning it with the activities of the insured business unit where workers are employed. However, the Court's primary reasoning focused on the existence of an insurance relationship for the relevant business unit, suggesting that even a broader description might not help if no workers are employed in that functional unit (e.g., sales).

- Defining "Business" Units: The ruling reinforces the concept of potentially multiple "businesses" (for WCAI purposes) within a single legal entity, distinguished primarily by location and operational integration. This can be complex for businesses with varied functions or locations.

- Need for Clarification?: The decision might point to a need for legislative or administrative clarification regarding special enrollment coverage for owners whose necessary business activities inherently differ from their employees' tasks or occur in different locations (like head offices vs. work sites). The current structure, as interpreted by the Court, may not fully align with the protective intent of allowing owners to enroll.

Conclusion

The Supreme Court's February 24, 2012, judgment determined that a specially enrolled small business owner under the WCAI Act is only covered for activities related to the specific "business unit" for which a WCAI insurance relationship exists based on the employment of workers. In the context of a construction company where employees worked solely on-site, the owner's death during a preliminary site inspection trip for future projects – considered part of the separate head office/sales business unit where no workers were employed – was ruled outside the scope of his special enrollment coverage, which was linked to the insured "on-site construction execution" business. This decision underscores that the scope of WCAI special enrollment is defined not just by the owner's activities, but fundamentally by the boundaries of the underlying insurance relationship established for the business's workers.

- Workers’ Comp vs. Consolation Money: Japan’s Supreme Court Separates Financial and Non‑Financial Damages (1966)

- Navigating Japan’s Unique “Worker” Definition: Implications for Your US Business

- What Types of Damages Can Be Claimed and How Are They Calculated in Japanese Torts?

- Workers’ Compensation – Ministry of Health, Labour and Welfare