Raising the Stakes: Enhanced Surcharges and Penalties under Japan's Amended Premiums and Representations Act

TL;DR

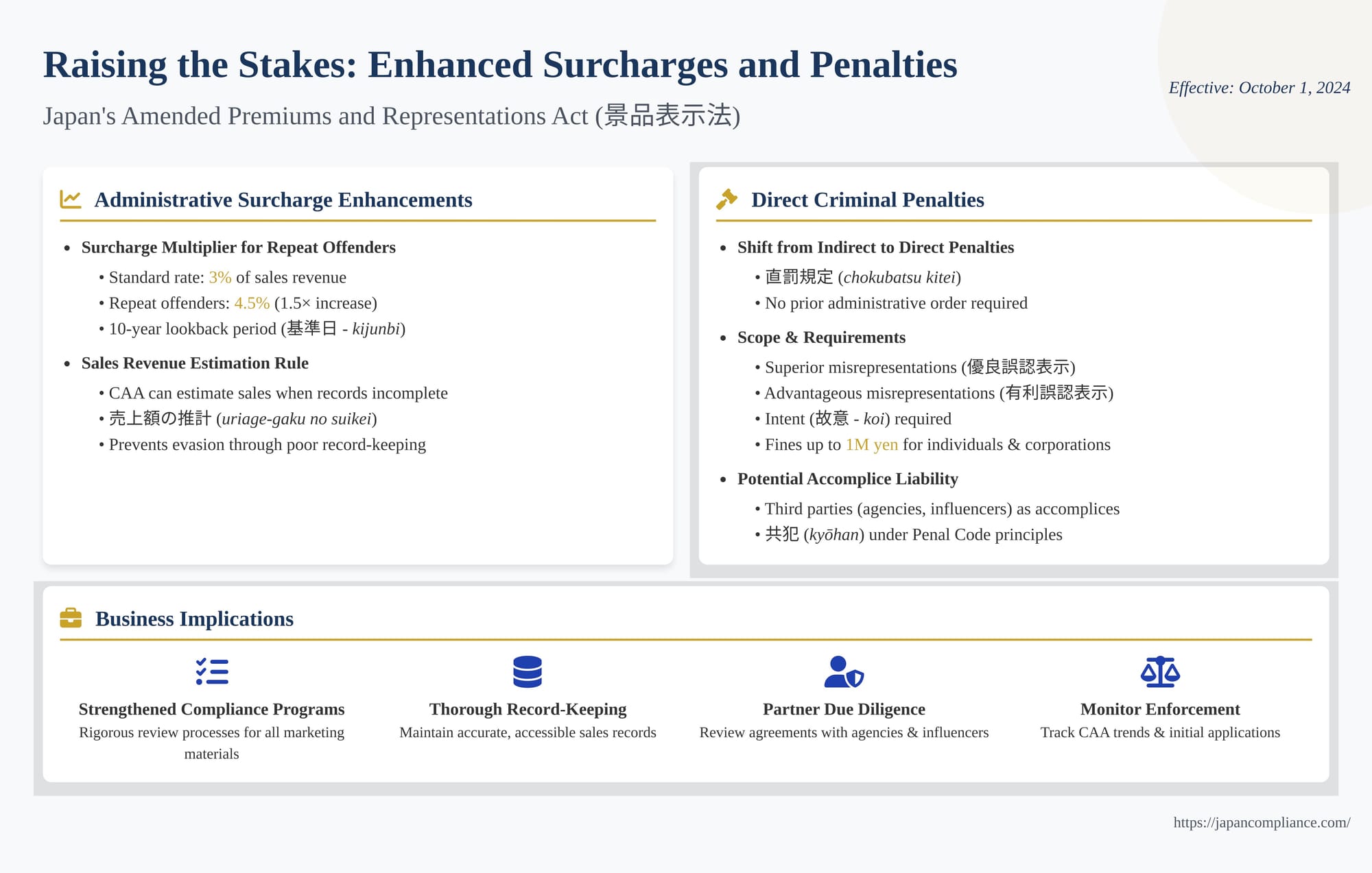

- The 2023 amendments to Japan’s Act against Unjustifiable Premiums and Misleading Representations (Keihyōhō) heighten risk: repeat surcharges jump from 3 % to 4.5 %; the Consumer Affairs Agency (CAA) may estimate sales when data are missing; and intentional core misrepresentations now draw direct criminal fines (up to ¥1 million) for companies and individuals.

- Third-party accomplice liability extends exposure to ad agencies and influencers.

- Robust claim-substantiation, record-keeping and partner due-diligence are now indispensable for anyone marketing to Japanese consumers.

Table of Contents

- Enhancements to the Administrative Surcharge System

- Introduction of Direct Criminal Penalties

- Combined Impact and Business Implications

- Conclusion

Japan's Act against Unjustifiable Premiums and Misleading Representations (景品表示法 - Keihin Hyōji Hō, or Keihyōhō) serves as the primary legislation governing fair advertising and marketing practices in the country. The comprehensive amendments enacted in May 2023, which largely took effect on October 1, 2024, significantly strengthen the Act's enforcement mechanisms. Businesses operating in the Japanese market, including foreign entities, need to be keenly aware of these changes, as they introduce heightened financial risks and potential criminal liability for non-compliance.

This article delves into two core components of this strengthened enforcement regime: the revised administrative surcharge system and the introduction of direct criminal penalties for certain violations.

1. Enhancements to the Administrative Surcharge System (課徴金制度 - Kachōkin Seido)

The Keihyōhō empowers the Consumer Affairs Agency (CAA) to impose administrative surcharges (課徴金 - kachōkin) on businesses engaging in specific types of misleading representations that impact consumer choice regarding core product/service characteristics or transaction terms. These are:

- Superior Misrepresentations (優良誤認表示 - Yūryō Gonin Hyōji): Misleading representations concerning the quality, standard, or other substantive aspects of goods or services (Keihyōhō Art. 5, Item 1).

- Advantageous Misrepresentations (有利誤認表示 - Yūri Gonin Hyōji): Misleading representations concerning price or other trade terms (Keihyōhō Art. 5, Item 2).

The surcharge system aims to claw back the economic benefit derived from such misleading practices. The standard calculation involves applying a 3% rate to the total sales revenue of the misrepresented goods or services during the period the violation occurred (up to a maximum of three years). The 2023 revision introduced two key changes to make this system more robust:

a) Surcharge Multiplier for Repeat Offenders (課徴金の割増 - Kachōkin no Warimashi)

To deter businesses from becoming repeat offenders, the amended Act introduces a significant surcharge increase for recidivism.

- The Rule: If a business is found to have committed a surchargeable violation (superior or advantageous misrepresentation) and has already been subject to a final and binding surcharge payment order within the preceding 10 years, the surcharge rate for the new violation is multiplied by 1.5, increasing it from the standard 3% to 4.5% of the relevant sales revenue.

- Lookback Period: The 10-year lookback period is calculated retroactively from a "reference date" (基準日 - kijunbi). This reference date is defined as the earliest of: (i) the date the CAA first requested reports or materials related to the suspected new violation, (ii) the date the CAA requested substantiation for the representation under the "non-substantiation rule" (Article 7(2)), or (iii) the date the CAA issued a notice for the opportunity for explanation (弁明の機会の付与 - benmei no kikai no fuyo) prior to issuing a potential surcharge order for the new violation.

- Scope: Importantly, the previous surcharge order triggering the multiplier does not need to relate to the same product, service, or type of misrepresentation as the new violation. Any Keihyōhō surcharge order within the 10-year timeframe counts.

- Rationale: This measure addresses concerns that the standard 3% rate might not be a sufficient deterrent for businesses that view occasional surcharges as merely a cost of doing business. The increased rate aims to impose a more substantial financial penalty on companies that fail to maintain compliance after being previously sanctioned.

b) Sales Revenue Estimation Rule (売上額の推計 - Uriage-gaku no Suikei)

Calculating the surcharge accurately depends on the availability of reliable sales data for the relevant goods/services during the violation period. Previously, enforcement could be hampered if a business failed to maintain or submit complete records.

- The Rule: The revised Act empowers the CAA to estimate the relevant sales figures for periods where the necessary data cannot be ascertained based on the business's submissions (or lack thereof). This power is triggered if the business fails to comply with a formal request from the CAA for reports or information necessary for the calculation (under Article 25(1) of the revised Act, formerly Article 29).

- Methodology: The CAA can use available information (e.g., partial records, industry data, information from third parties) to estimate the sales figures using a "reasonable method" (合理的な方法 - gōriteki na hōhō). The specifics of acceptable methodologies are expected to be detailed in subordinate regulations or guidelines.

- Rationale: This provision prevents businesses from evading or minimizing surcharges through deliberate or negligent failure to provide necessary sales data. It ensures that the surcharge can be calculated and imposed even in cases of incomplete record-keeping or non-cooperation.

(Note on Refund Flexibility)

While not a direct increase in penalties, the revision also made the related voluntary refund mechanism (whereby surcharges can be reduced by the amount refunded to consumers) more flexible by allowing refunds via third-party electronic payment instruments (like common e-money services), in addition to cash. This aims to make consumer redress more practical for businesses, potentially increasing its use and indirectly supporting the overall goal of consumer protection alongside the surcharge system.

2. Introduction of Direct Criminal Penalties (直罰規定 - Chokubatsu Kitei)

One of the most striking changes in the 2023 revision is the introduction of direct criminal penalties for certain Keihyōhō violations.

Shift from Indirect to Direct Penalties

Historically, criminal liability under the Keihyōhō was primarily indirect. Penalties (imprisonment up to 2 years and/or fines up to JPY 3 million for individuals; fines up to JPY 300 million for corporations) were generally reserved for cases where a business failed to comply with a finalized administrative cease-and-desist order issued by the CAA. The underlying act of making a misleading representation was not, in itself, directly subject to criminal prosecution under the Keihyōhō.

The revised Act changes this by introducing direct criminal penalties (chokubatsu kitei) for the act of making certain types of misleading representations, irrespective of whether a prior administrative order was issued or violated.

Scope of Direct Penalties

This new direct criminal liability applies specifically and exclusively to:

- Superior Misrepresentations (Article 5, Item 1)

- Advantageous Misrepresentations (Article 5, Item 2)

Other types of prohibited conduct under the Keihyōhō, such as violations related to premiums or other designated misleading representations (like stealth marketing under Article 5, Item 3), are not subject to these direct criminal penalties.

Requirements and Penalties

- Intent (故意 - Koi): Crucially, criminal liability under the new provisions requires intent. Prosecutors must prove that the individual or corporation knowingly and intentionally made the misleading representation, recognizing the facts that constituted the violation (e.g., knowing the product didn't have the claimed quality or that the price comparison was baseless). Mere negligence is insufficient for criminal liability under this provision.

- Burden of Proof: Unlike in administrative proceedings where the CAA can rely on the "non-substantiation rule" (Article 7(2)) to deem an unsubstantiated quality claim misleading, this rule does not apply in criminal proceedings. The prosecutor bears the full burden of proving beyond a reasonable doubt that the representation was actually false or misleading and that the defendant acted with the requisite intent.

- Penalties: If convicted, individuals face a fine of up to JPY 1 million. Corporations can also be subject to a fine of up to JPY 1 million under associated joint penalty provisions (両罰規定 - ryōbatsu kitei) when an employee or representative commits the violation in the course of business.

Significance and Implications

- Increased Deterrence: The introduction of direct criminal penalties significantly raises the potential consequences for engaging in deliberate, serious misrepresentations regarding core product features or transaction terms. The prospect of a criminal record, even if only resulting in a fine, carries substantial reputational weight in Japan.

- Targeting Malicious Conduct: This provision is likely intended for the most egregious cases involving clear intent to deceive consumers, rather than accidental errors or minor exaggerations.

- No Surcharge/Fine Adjustment: Unlike Japan's Antimonopoly Act, the revised Keihyōhō does not include provisions for adjusting administrative surcharges based on criminal fines imposed (or vice versa). Theoretically, both could be levied for the same underlying conduct, although how authorities will coordinate this in practice remains to be seen.

Potential Accomplice Liability for Third Parties (共犯 - Kyōhan)

A critical point for businesses, particularly those relying heavily on external marketing partners, is the potential scope of criminal liability. Government officials and legal commentators have indicated that third parties who are not the direct suppliers of the goods/services – such as advertising agencies, marketing consultants, or potentially even influencers – could be prosecuted as accomplices (under general principles of the Penal Code) if they knowingly assist the primary business in committing an intentional superior or advantageous misrepresentation that constitutes a direct criminal violation under the Keihyōhō. This underscores the importance of due diligence and clear contractual terms when engaging third parties in marketing activities in Japan.

3. Combined Impact and Business Implications

The changes to the surcharge system and the introduction of direct criminal penalties work in tandem to create a significantly stricter enforcement environment under the Keihyōhō. Businesses now face:

- Higher Surcharges for Repeat Violations: A clear financial disincentive against repeated non-compliance.

- Reduced Ability to Evade Surcharges: The sales estimation rule makes it harder to avoid surcharges through poor record-keeping.

- Potential Criminal Liability for Severe Violations: A new layer of risk involving fines and the stigma of a criminal conviction for intentional, core misrepresentations.

- Extended Risk to Third Parties: Potential criminal accomplice liability for agencies and partners involved in illegal campaigns.

These developments necessitate a proactive and robust approach to compliance for any business marketing goods or services to consumers in Japan:

- Strengthened Compliance Programs: Internal review processes for advertising materials must be rigorous, ensuring all claims, especially regarding quality, performance, price, and transaction terms, are accurate and adequately substantiated before publication. Employee training on Keihyōhō requirements is essential.

- Thorough Record-Keeping: Maintaining accurate and accessible sales records is crucial not only for business purposes but also to ensure accurate surcharge calculations should an issue arise.

- Due Diligence on Partners: Companies must exercise care when selecting and managing advertising agencies, influencers, and other marketing partners, ensuring they understand and adhere to Keihyōhō standards. Contractual clauses regarding compliance and indemnification should be reviewed.

- Awareness of Enforcement Trends: Monitoring CAA enforcement actions, guideline publications, and initial applications of the new penalty provisions will be important for understanding evolving compliance expectations.

Conclusion

The 2023 revision to Japan's Act against Unjustifiable Premiums and Misleading Representations marks a decisive step towards more stringent enforcement. By increasing administrative surcharges for repeat offenders, empowering the CAA to estimate sales figures, and introducing direct criminal penalties for intentional core misrepresentations, the law significantly elevates the risks associated with non-compliance. International businesses targeting the Japanese market must adapt to this heightened enforcement landscape by prioritizing robust compliance measures, ensuring the accuracy and substantiation of all marketing claims, and maintaining meticulous records. Failure to do so now carries potentially severe financial and criminal consequences.

- Key Changes in Japan's 2023 Premiums and Representations Act Revision

- A New Path for Resolution: Commitment Procedures under Japan’s Revised Act

- “Sutema” No More: Understanding Japan's Stealth-Marketing Regulations

- Consumer Affairs Agency – Surcharge & Criminal Penalty Q&A (JP)

- Consumer Affairs Agency – Guidelines on Sales Estimation Method (JP)