Posthumous Recognition and Inheritance Claims: Japan's Supreme Court Clarifies "Value of Estate" Under Article 910

Date of Judgment: August 27, 2019 (Reiwa 1)

Case: Supreme Court of Japan, Third Petty Bench, Case No. Heisei 30 (Ju) No. 1583 (Claim for Payment of Value After Estate Division)

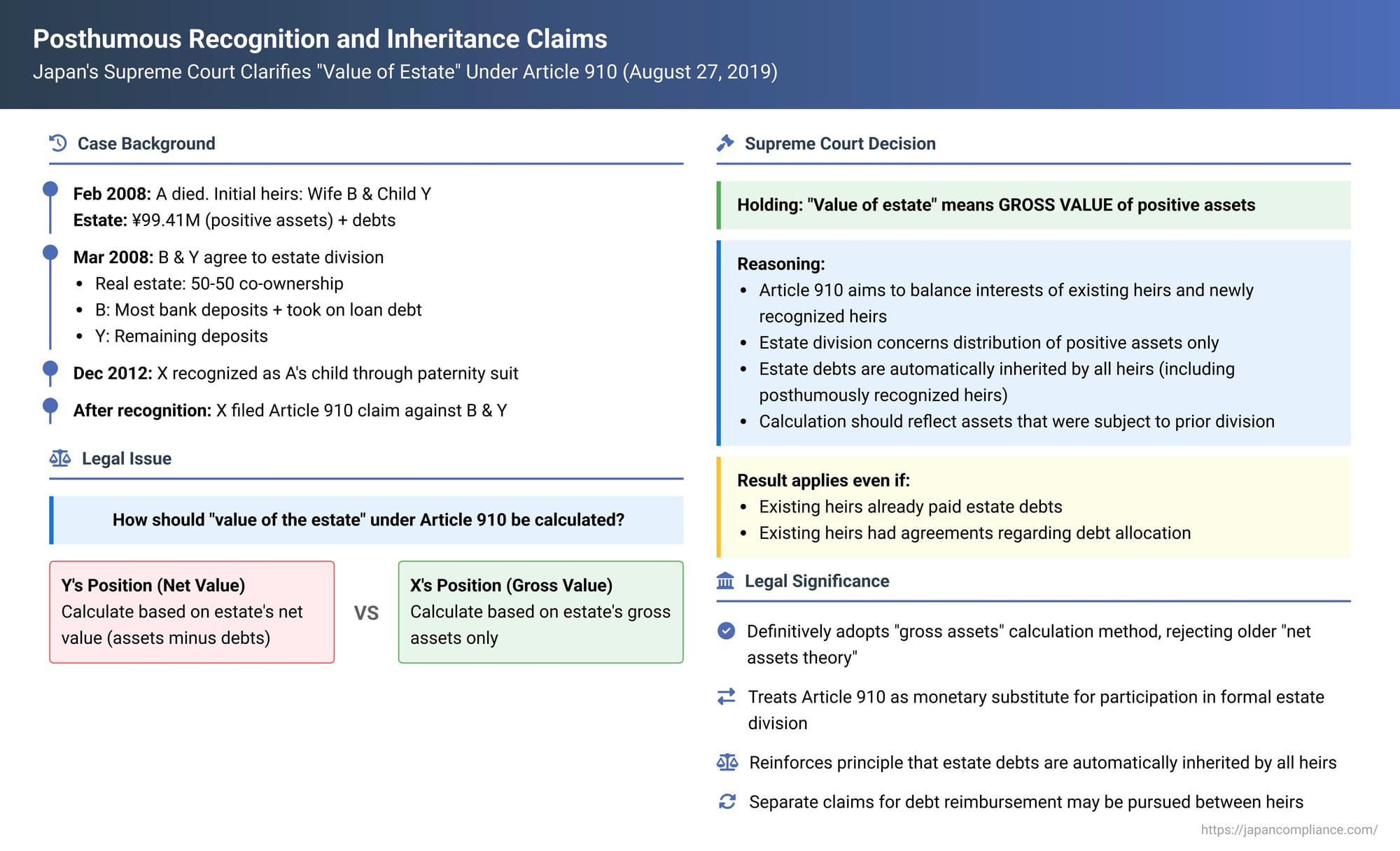

When an individual is legally recognized as a child of a deceased person after that person's death and after the existing heirs have already divided the estate, Japanese Civil Code Article 910 provides a specific remedy. Instead of re-opening the concluded estate division, the newly recognized heir is entitled to a monetary payment from the other co-heirs corresponding to the value of the inheritance share they would have received. A critical question in applying this provision is how the "value of the estate" should be calculated as the basis for this monetary claim: should it be based on the deceased's gross assets, or the net assets after deducting estate debts? The Supreme Court of Japan provided a definitive answer to this long-debated issue in its decision on August 27, 2019.

Facts of the Case: An Estate Divided, Then a New Heir Emerges

The case involved the estate of A, who passed away on February 3, 2008.

- Initial Heirs and Estate Division: A's initial legal heirs were his wife, B, and their child, Y. A's estate comprised positive assets (real estate including land lease rights, and bank deposits) valued at approximately ¥99.41 million. The estate also had liabilities, including a loan A owed to Y's wife, C (accounted for as ¥14 million in the estate division agreement, though Y later claimed it was ¥16.8 million), and unpaid local taxes of about ¥371,700 (which were not initially addressed in the division agreement).

On March 31, 2008, B and Y entered into an estate division agreement. Under this agreement:- B and Y would co-own the real estate in equal shares.

- B would receive the majority of the bank deposits (approx. ¥13.41 million).

- Y would receive the remaining bank deposits (¥3.5 million).

- Crucially, B agreed to "succeed" to (i.e., assume responsibility for) the loan debt A owed to C.

B subsequently paid the unpaid local taxes on June 26, 2008.

- Posthumous Recognition of Heir X: X was born out of wedlock to A and another woman, D. Following A's death, X pursued a posthumous paternity suit. A court judgment recognizing X as A's legal child became final and binding on December 14, 2012, several years after A's death and the estate division between B and Y. This recognition retroactively granted X the status of a co-heir.

- X's Lawsuit Under Article 910: As a newly recognized heir, X filed a lawsuit against B and Y, seeking a monetary payment for X's inheritance share pursuant to Article 910 of the Civil Code. (During the legal proceedings, B passed away. Y, along with C who was also B's adopted child, succeeded to B's position in the lawsuit. X later withdrew the specific claim against B's successors in their capacity as such, effectively continuing the claim primarily against Y as an original co-heir of A).

- The Central Dispute – Calculation Basis: The core legal battle was over the correct method for calculating the "value of the estate" to determine X's monetary claim. Should it be:

- The gross value of A's positive assets?

- Or, the net value of A's estate (i.e., positive assets minus estate debts)?

- Y's Argument (for Net Value): Y argued that the calculation must be based on the net value of the estate. Y contended that using gross assets would unfairly dismantle the foundation of the original estate division agreement, where B had agreed to take on estate debts in consideration of the assets she received. Furthermore, Y argued that a gross asset calculation would lead to procedural inefficiencies, as Y (or B's estate, having paid debts) would then be forced to separately sue X for reimbursement of X's proportional share of those estate debts.

- Lower Court Rulings (for Gross Value): Both the first instance court and the High Court ruled in favor of X, holding that the calculation of X's claim under Article 910 should be based on the value of A's gross (positive) assets. Their reasoning was that estate debts are, by law, automatically inherited by all co-heirs—including a later-recognized heir like X—according to their respective statutory inheritance shares. As such, debts are not considered an object of the estate division process itself, which primarily concerns the allocation of positive assets. The High Court did, however, permit Y to offset X's claim by X's proportionate share of the local taxes that B had already paid on behalf of the estate.

- Y's Appeal to the Supreme Court: Y appealed this ruling to the Supreme Court, reiterating the arguments for a net asset valuation and questioning the premise that all monetary debts are automatically divisible.

The Supreme Court's Decision: Affirming the "Gross Assets" Method

The Supreme Court dismissed Y's appeal, thereby upholding the lower courts' determination that the monetary claim under Article 910 is to be calculated based on the gross value of the positive assets in the estate.

The Court's reasoning was as follows:

- Purpose of Article 910: The Court began by reaffirming the purpose of Article 910 of the Civil Code. This provision is designed to strike a balance between the interests of the co-heirs who have already divided or otherwise disposed of the estate assets and the interests of a person who is subsequently recognized as an heir. It achieves this by upholding the legal validity of the prior division or disposition while granting the newly recognized heir a right to claim monetary payment for the value of the share they would have otherwise received. The Court referenced its prior decision in Heisei 28.2.26 (February 26, 2016) on this point. [cite: 1]

- Basis of Calculation – Value of Assets Subject to Prior Division: The Court reasoned that for the monetary payment under Article 910 to be equitable from the perspective of all parties involved, it should be calculated based on the value of the estate assets that were the actual subject of the prior division or disposition by the other co-heirs. [cite: 1]

- Estate Division Concerns Positive Assets; Debts are Separately Inherited: The Court then clarified a crucial distinction:

- The process of estate division (遺産の分割 - isan no bunkatsu) is concerned with the allocation of the positive (gross) assets of the estate. [cite: 1]

- Estate debts (消極財産 - shōkyoku zaisan), being negative assets, are automatically succeeded to by all co-heirs—including the later-recognized heir—according to their respective statutory inheritance shares. [cite: 1] Debts are not, as a general rule, objects to be "divided" in the estate division process in the same way assets are. [cite: 1]

- Conclusion on "Value of the Estate" in Article 910: Based on the above, the Supreme Court concluded that when a person becomes an heir through posthumous recognition and seeks monetary payment under Article 910 after other co-heirs have already divided the estate, the "value of the estate" to be used as the basis for calculating this payment is the value of the positive (gross) assets that were included in that prior division. [cite: 1]

- Unaffected by Debt Payments or Agreements: The Court explicitly stated that this conclusion remains unchanged even if:

- Estate debts have already been paid by the other co-heirs. [cite: 1]

- The other co-heirs had made agreements among themselves regarding who would bear the burden of specific estate debts (as B and Y did in this case regarding the loan to C). [cite: 1]

Such actions by the other co-heirs do not alter the principle that the Article 910 claim is calculated based on gross assets, nor do they extinguish the later-recognized heir's separate, underlying liability for their proportional share of the estate debts.

Legal Principles and Significance

This 2019 Supreme Court decision provides crucial clarification on the application of Article 910 and has significant implications:

- Definitive Adoption of the "Gross Assets" Method: This was the Supreme Court's first explicit ruling on whether the "value of the estate" in Article 910 refers to gross or net assets. It firmly established the "gross assets" approach, siding with what legal commentary describes as the prevailing recent academic view and some lower court trends. [cite: 1, 2]

- Rejection of the "Net Assets Theory" (控除説 - kōjosetsu): The decision implicitly (and by upholding the lower courts, effectively) rejected the older "net assets theory," which argued for deducting estate debts before calculating the recognized heir's claim. [cite: 2] The commentary notes that while this older theory aimed to protect estate creditors and simplify the immediate financial outcome of the Article 910 claim, it faced criticism for creating a special status for the recognized heir concerning debt liability and for introducing a form of debt settlement into the Article 910 valuation without clear theoretical or statutory backing. [cite: 2]

- Rationale for the "Gross Assets" Method:

- Article 910 as an Alternative to Full Estate Re-division: One underlying rationale, as suggested by legal commentary, is that Article 910 provides a monetary substitute for the recognized heir's participation in a full estate division. Since formal estate division primarily focuses on the distribution of positive assets, the monetary claim under Article 910 should reflect the value the recognized heir would have derived from those positive assets. [cite: 2]

- Maintaining Consistency with the Recognized Heir's Debt Liability: Another key rationale is to ensure consistency with the fundamental principle that all heirs, including one recognized posthumously, automatically inherit a proportional share of the deceased's debts. [cite: 1, 2] If estate debts were deducted from the Article 910 payment and the recognized heir was also separately liable to creditors for their share of these same debts, it could effectively lead to a "double burden" or an inequitable exoneration. The gross assets method ensures that the Article 910 payment addresses the asset side, while the recognized heir's liability for debts remains a separate (though related) matter. [cite: 2]

- Separate Handling of Estate Debts: The judgment strongly reinforces the principle that estate debts are automatically inherited by all heirs according to their statutory shares. [cite: 1] This means:

- The posthumously recognized heir (X) is also responsible for their share of A's debts.

- If other co-heirs (like B or Y) have paid more than their own proportional share of the estate debts (for example, by covering what would have been X's portion), they may have a separate claim for reimbursement against X (e.g., based on unjust enrichment or principles of joint obligation). This was acknowledged by the High Court's allowance of an offset for taxes paid by B. [cite: 1, 3]

- Agreements made only between the original co-heirs (B and Y) regarding the allocation of debt burdens do not bind the later-recognized heir (X), who was not a party to that agreement. [cite: 1, 3]

- Retroactive Effect of Paternity Recognition: The background of such cases involves the retroactive effect of a paternity recognition judgment (Article 784, main clause, of the Civil Code), which grants the recognized individual heir status from the time of the parent's death. [cite: 1] Article 910 serves to mediate the disruptive impact this retroactivity could otherwise have on already concluded estate settlements, by substituting a monetary claim for a claim to the actual assets. [cite: 1]

Conclusion

The Supreme Court's 2019 decision brings welcome clarity to the calculation of monetary claims under Article 910 of the Civil Code for posthumously recognized heirs. By mandating that the "value of the estate" for this purpose refers to the gross value of the positive assets that were subject to the prior division, the Court has provided a clear rule that aligns with the principle of separate inheritance of estate debts. While the recognized heir receives a claim based on the full value of assets they would have shared in, they remain independently liable for their portion of the estate's debts. Any payments of these debts by other co-heirs on behalf of the recognized heir may then be subject to separate claims for reimbursement or offset, ensuring a comprehensive, albeit potentially multi-stepped, balancing of all parties' rights and obligations. This ruling underscores the importance of distinguishing the process of asset distribution from the universal succession to debts in Japanese inheritance law.