Cost Pass-Through Under Japan’s Antimonopoly & Subcontract Acts: How to Avoid JFTC Scrutiny

TL;DR

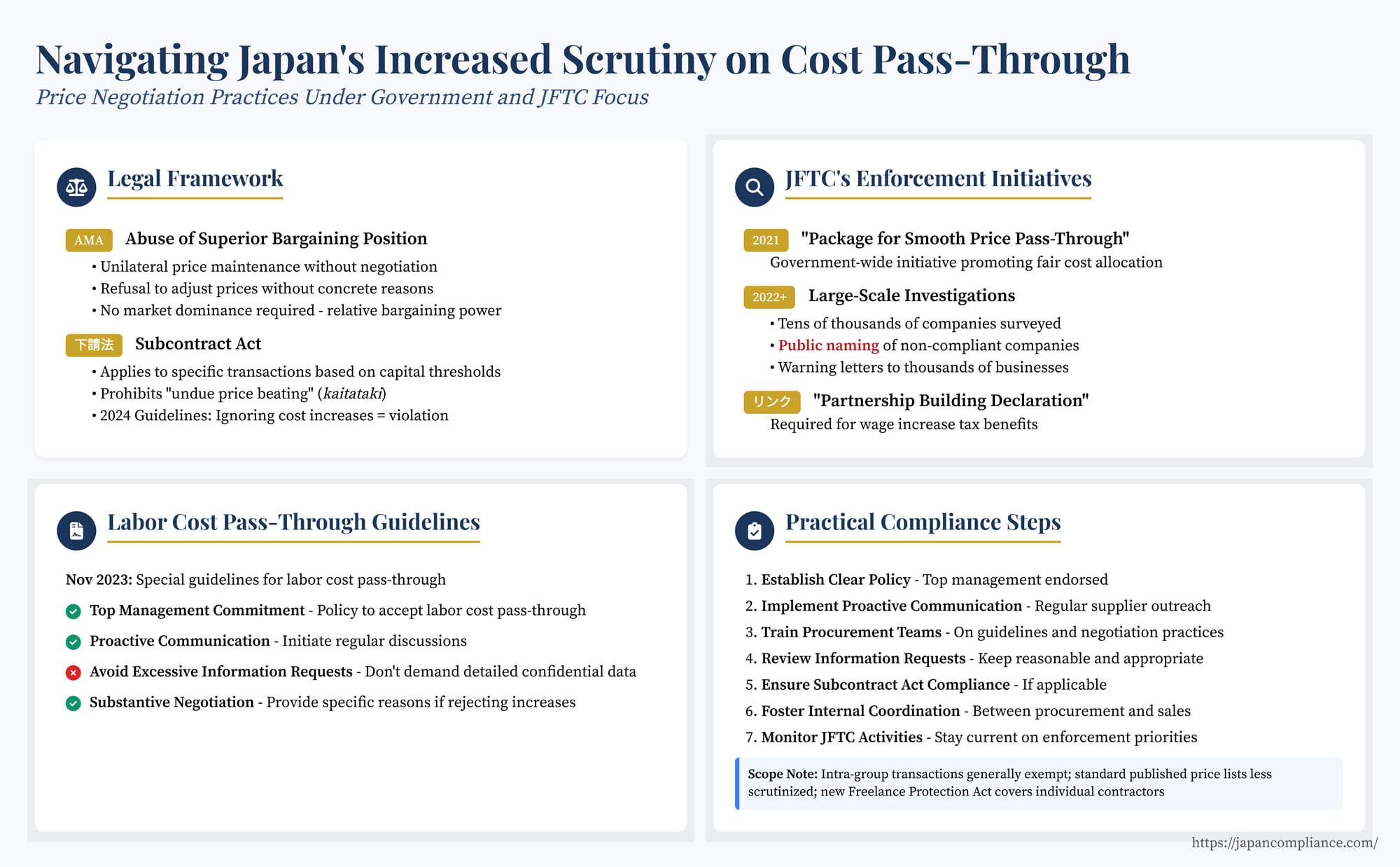

- Japan’s JFTC now treats passive refusal to discuss cost hikes—or rejecting supplier price-rise requests without reasons—as potential Abuse of Superior Bargaining Position.

- Both the Antimonopoly Act and the Subcontract Act have been re-interpreted through new guidelines, large-scale surveys and public “naming and shaming.”

- Buyers should adopt proactive negotiations, clear internal policies, and documented rationale to avoid reputational or legal risk.

Table of Contents

- Introduction: The Squeeze of Rising Costs and Wage Demands in Japan

- The Legal Framework: AMA and Subcontract Act

- JFTC's Enforcement Initiatives and Guidelines

- Practical Compliance Steps for Businesses (Especially Buyers)

- Considering the Scope

- Conclusion: Adapting to Japan's New Normal for Supplier Relations

Introduction: The Squeeze of Rising Costs and Wage Demands in Japan

Companies operating in Japan, like those in many parts of the world, are navigating a challenging economic environment marked by persistent inflation, volatile energy and raw material prices, and a strong societal and governmental push for significant wage increases. For decades, Japan experienced relative price stability and stagnant wages, but recent shifts have put immense pressure on businesses, particularly Small and Medium Enterprises (SMEs), to absorb rising input costs while simultaneously finding resources for higher pay.

Recognizing that sustainable wage growth requires companies to maintain profitability, the Japanese government has launched a concerted effort to facilitate the "pass-through" (価格転嫁, kakaku tenka) of increased costs – including labor, materials, and energy – along the supply chain. This policy push views fair cost allocation between businesses as crucial not only for individual corporate health but also for broader economic goals like overcoming deflation and enabling widespread wage hikes.

Central to this initiative is the role of Japan's competition authorities, primarily the Japan Fair Trade Commission (JFTC). The JFTC has significantly intensified its enforcement of the Antimonopoly Act (AMA) and the Subcontract Act, targeting practices by buyers seen as unfairly preventing suppliers from reflecting legitimate cost increases in transaction prices. For US companies operating as buyers or suppliers in the Japanese market, understanding this heightened regulatory focus and the evolving interpretation of fair trading practices is critical for compliance and effective negotiation.

This article examines the legal framework underpinning the JFTC's approach, key guidelines issued (including specific guidance on labor costs), problematic conduct identified by the authorities, and practical compliance steps businesses should consider.

The Legal Framework: AMA and Subcontract Act

The JFTC leverages two main statutes to address unfair practices related to cost pass-through:

1. Antimonopoly Act (AMA) – Abuse of Superior Bargaining Position (ASBP)

- The Concept: Article 2(9)(v) of the AMA prohibits undertakings from engaging in "unfair trade practices." One category of unfair trade practice is Abuse of Superior Bargaining Position (優越的地位の濫用, yūetsuteki chii no ranyō). This occurs when a business operator, by making use of its superior bargaining position relative to a transacting party, unjustly causes that party disadvantages in light of normal business practices. A "superior bargaining position" doesn't require market dominance; it exists if the counterparty finds it significantly difficult to refuse the operator's demands due to dependence on the transaction (e.g., high switching costs, reliance on a major customer).

- Traditional Application to Pricing: The JFTC's long-standing guidelines on ASBP acknowledge that unilaterally imposing excessively low prices or demanding post-contract price reductions without justification can constitute abuse. Key factors include whether sufficient negotiations occurred and the extent of the economic disadvantage imposed on the weaker party.

- Enhanced Interpretation for Cost Pass-Through (JFTC Q&A, Feb 2022): In the context of the government's price pass-through initiative, the JFTC issued crucial clarifications (via Q&A) highlighting two specific scenarios involving cost increases that could raise ASBP concerns:

- (Passive Rejection): A buyer unilaterally maintaining the existing transaction price without explicitly engaging in price negotiations with the supplier regarding the need to reflect increased costs (labor, materials, energy).

- (Unjustified Refusal): A buyer refusing a supplier's request for a price increase to cover cost hikes without providing concrete reasons for the refusal (e.g., via email or written document).

- Implications: This interpretation signaled a significant shift. It suggests that buyers in a superior position might have an affirmative obligation not just to consider price increase requests fairly, but potentially even to initiate discussions about cost impacts (Scenario 1) and always to provide substantive reasons for rejection (Scenario 2). While legal commentary has debated the precise legal basis for imposing such a proactive duty on buyers to discuss their own potential cost increases, the JFTC's enforcement stance clearly reflects this interpretation.

2. Subcontract Act (下請代金支払遅延等防止法, Shitauke Hō)

- Scope: This specialized law applies to specific types of transactions (manufacturing contracts, repair contracts, information-based product creation contracts, service contracts) between large "parent" contractors and smaller subcontractors, defined based on differing capital thresholds. It aims to prevent abuses of power by larger companies against their smaller suppliers.

- Prohibition on Undue Price Beating (買いたたき, kaitataki): Article 4(1)(v) of the Subcontract Act prohibits parent contractors from setting the subcontract price at an "unreasonably low level" compared to the price normally paid for the same or similar deliverables or services.

- Application to Cost Pass-Through: Refusing to negotiate or adjust subcontract prices despite demonstrably significant increases in the subcontractor's costs (raw materials, energy, etc.) necessary to fulfill the contract can constitute undue price beating.

- Recent Guideline Revision (May 2024): The JFTC further clarified this in revised Subcontract Act Guidelines. The revision explicitly states that if there are sharp increases in costs essential to the subcontracted work (verifiable through public data, etc.), and the parent contractor unilaterally maintains the original price without sufficient consultation, this conduct will be considered undue price beating. This removes ambiguity and strengthens the obligation on parent contractors to engage fairly when subcontractors face unavoidable cost hikes.

JFTC's Enforcement Initiatives and Guidelines

The JFTC's focus on cost pass-through isn't just theoretical; it has been backed by significant enforcement activity and detailed guidance since late 2021.

1. The "Package for Smooth Price Pass-Through" (December 2021)

This government-wide initiative established the policy backdrop, identifying cost pass-through as vital for enabling wage increases, particularly for SMEs, and positioning fair dealing as a key component of the "New Form of Capitalism" agenda. It mandated enhanced monitoring and enforcement by relevant agencies, with the JFTC taking a leading role under the AMA and Subcontract Act.

2. Large-Scale Investigations and Public Naming

Since 2022, the JFTC has conducted "emergency" and "special" large-scale investigations across numerous industries, surveying tens of thousands of companies (both buyers and suppliers) about their experiences with price negotiations and cost pass-through.

- Focus: These investigations aimed to identify sectors and companies where pass-through was proving difficult.

- Public Naming: Based on survey results and supplier feedback, the JFTC has taken the controversial step of publicly naming companies identified as potentially engaging in problematic practices (e.g., frequent refusal to negotiate, unilateral price setting). This "naming and shaming" occurs even without a formal finding of an AMA or Subcontract Act violation, based on the JFTC's published policy regarding companies frequently mentioned negatively by suppliers. While the JFTC frames this as promoting voluntary improvement, it carries significant reputational risk. Lists published in December 2022, December 2023, and March 2024 included major corporations across various industries.

- Warning Letters (注意喚起文書): Alongside public naming, the JFTC has sent thousands of "warning letters" (chūi kanki bunsho) to companies whose conduct raised concerns based on the surveys, urging them to improve their negotiation practices.

3. Guidelines on Passing Through Labor Costs (November 2023)

Recognizing the particular difficulty businesses face in justifying and negotiating increases specifically related to labor costs (including wage hikes), the JFTC, in coordination with the Cabinet Secretariat, issued detailed "Guidelines concerning Price Negotiations for Appropriate Pass-Through of Labor Costs" (労務費の適切な転嫁のための価格交渉に関する指針).

These guidelines elaborate on the expectations under the AMA's ASBP rules specifically for labor cost discussions:

- Buyer's Expected Actions:

- Top Management Commitment: Explicitly decide on a policy to accept labor cost pass-through requests and communicate this internally and externally (e.g., on the company website, potentially through the "Partnership Building Declaration" program mentioned below).

- Proactive Initiation of Talks: Even if not requested by the supplier, buyers should proactively initiate discussions about labor cost impacts on a regular basis (e.g., annually or semi-annually). The goal is to create an environment where suppliers feel comfortable raising the issue.

- Reasonable Information Requests: When a supplier requests an increase based on labor costs, the buyer should generally refrain from demanding detailed, confidential internal data (like specific wage scales, individual employee data, or detailed cost accounting). Instead, negotiations should, where possible, rely on publicly available data (e.g., industry wage trends, minimum wage increases, government labor statistics) or reasonable explanations from the supplier regarding the impact on their specific cost structure. Demanding excessive detail can itself be viewed as an attempt to obstruct negotiations and potentially fall under ASBP.

- Substantive Negotiation: Engage in good-faith negotiations. If rejecting a requested increase, provide specific, objective reasons.

- Supplier's Expected Actions: Prepare reasonable explanations for the necessity of passing through labor costs, potentially utilizing public data or industry indices to support their position.

4. The "Partnership Building Declaration" Link

The government actively promotes the "Partnership Building Declaration" (パートナーシップ構築宣言) program, where companies (primarily large buyers) publicly pledge to foster fair relationships with their supply chain partners, including facilitating price pass-through. For large companies (capital > JPY 1 billion and employees > 1000), publishing such a declaration has become a prerequisite for utilizing Japan's Wage Increase Promotion Tax System (discussed in another article in this series). Critically, if a company with a published declaration is found to have violated the Subcontract Act (as occurred with a major automotive company in early 2024), its declaration can be removed from the official portal, potentially jeopardizing its eligibility for the wage increase tax credits. This creates a strong incentive for large companies to ensure fair dealing.

Practical Compliance Steps for Businesses (Especially Buyers)

Given the heightened scrutiny and potential reputational/legal risks, businesses operating as buyers in Japan should consider the following compliance measures:

- Establish Clear Internal Policy: Ensure top management endorses and communicates a policy supporting fair price negotiations that account for supplier cost increases, including labor costs.

- Implement Proactive Communication: Don't wait for suppliers to ask. Institute a regular process (e.g., annual) to reach out to key suppliers, inquire about significant cost pressures (materials, energy, labor), and invite discussion on potential price adjustments. Document these outreach efforts.

- Train Procurement Teams: Educate procurement staff on the JFTC's guidelines (general ASBP, Labor Cost Guidelines, Subcontract Act where applicable). Emphasize the need for substantive negotiations and providing clear, documented reasons if rejecting price increase requests. Avoid unilateral decision-making.

- Review Information Request Practices: Ensure that requests for cost justification from suppliers are reasonable and avoid demanding overly sensitive internal data, particularly for labor cost increases, per the Labor Cost Guidelines.

- Ensure Subcontract Act Compliance: If the Subcontract Act applies (based on capital size and transaction type), strictly adhere to its provisions, including timely payment, clear documentation, and the prohibition on undue price beating, especially considering the revised guidelines on cost pass-through.

- Foster Internal Coordination: Bridge the gap between procurement and sales. Procurement teams need to understand the company's ability to pass costs downstream, while sales teams need awareness of rising input costs. A coordinated approach is vital for managing margins fairly.

- Monitor JFTC Activities: Keep abreast of JFTC announcements regarding investigations, public naming actions, guideline updates, and enforcement priorities related to price pass-through. Being prepared and demonstrating good-faith efforts can mitigate risk.

Considering the Scope

It's worth noting some scope considerations:

- Intra-group Transactions: Transactions between parent companies and wholly owned subsidiaries, or between sister companies under common control, are generally considered internal activities and not subject to ASBP regulations. However, unfair pricing pressure from a parent could indirectly affect the subsidiary's ability to negotiate fairly with its external suppliers.

- Supplier Price Lists: Transactions based on standard price lists published by the supplier and applicable to a wide range of customers are generally less likely to raise ASBP concerns related to price setting, as the price is not being unilaterally dictated by the buyer.

- Freelancers: While individual freelancers undoubtedly face rising living costs (analogous to labor costs), the direct application of the specific "Labor Cost Guidelines" to them might be complex. However, the recently enforced Freelance Protection Act imposes separate obligations on businesses regarding fair contract terms and payment, addressing power imbalances in that specific context.

Conclusion: Adapting to Japan's New Normal for Supplier Relations

The Japanese government and the JFTC have made it clear that facilitating the fair pass-through of costs, including vital wage increases, is a high priority. The intensified use of the Antimonopoly Act's provisions against Abuse of Superior Bargaining Position and the Subcontract Act's rules against undue price beating reflects a significant policy commitment.

For businesses operating in Japan, especially those in a position of relative strength vis-à-vis their suppliers, the regulatory landscape has shifted. There is now a clear expectation – backed by potential legal sanctions and significant reputational risk via public naming – for buyers to engage proactively and fairly in price negotiations when suppliers face legitimate cost increases. Ignoring requests, refusing without reason, or demanding excessive justification are practices carrying heightened risk. Implementing robust, documented processes for supplier communication and negotiation aligned with JFTC guidelines is now an essential element of effective compliance and sustainable supply chain management in Japan.

- Japan's Antitrust Update: Navigating the Invoice System and Abuse of Superior Bargaining Position

- Shunto and Minimum Wages: Understanding Japan's Dual Wage Setting Landscape

- Navigating Japan's "2024 Problem": Work Style Reforms and Their Impact on Business

- Guidelines for Price Negotiations to Appropriately Pass Through Labor Cost — JFTC (PDF)

- JFTC Overview of Price Pass-Through Surveys and Naming Policy