How Survivor Pensions Offset Tort Damages: Japan Supreme Court Grand Bench Clarifies Rule (2015)

Japan’s Supreme Court (2015) ruled WCAI survivor pensions offset the principal lost‑earnings award, not delay damages, clarifying tort calculations.

TL;DR

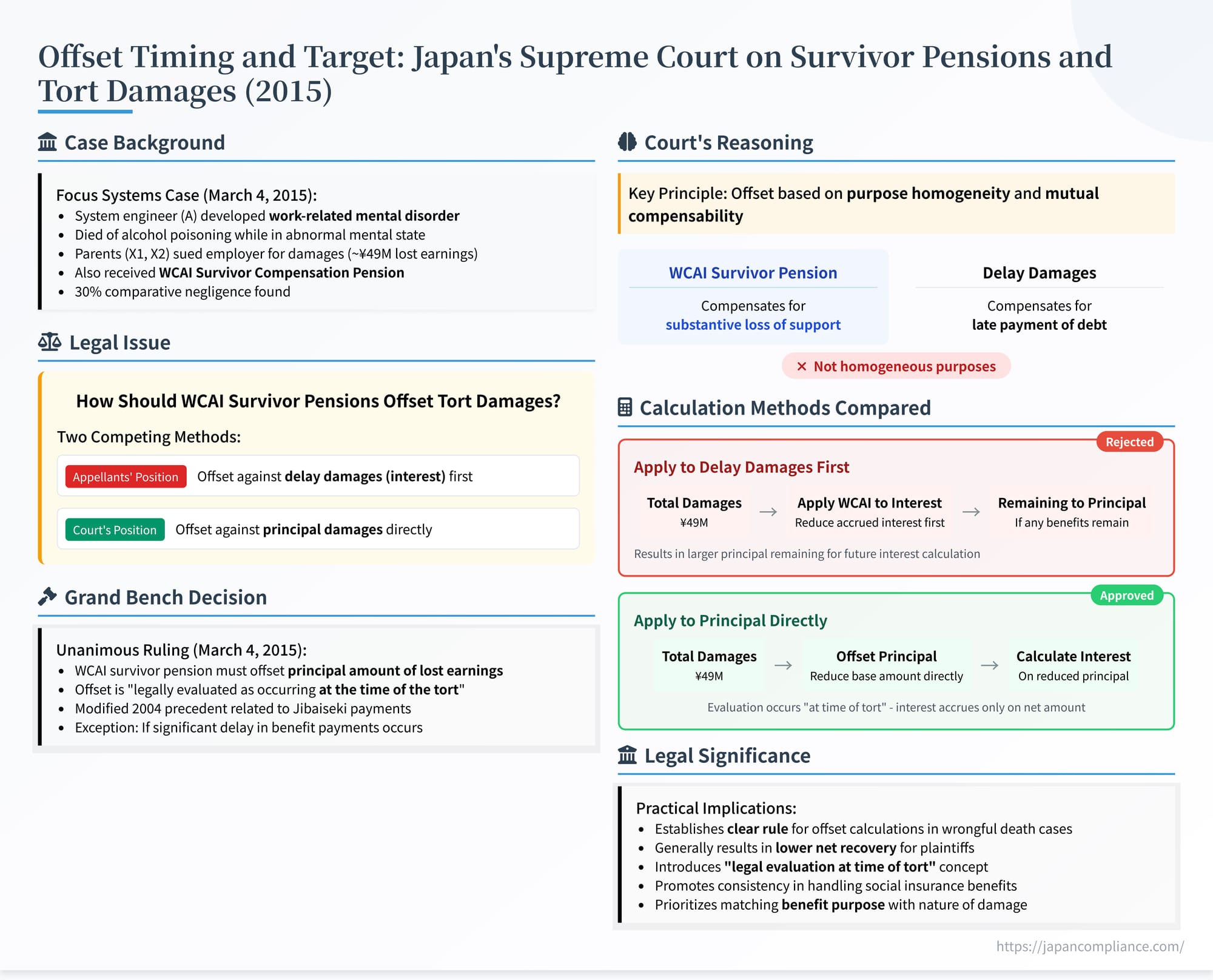

Japan’s Supreme Court Grand Bench (Mar 4 2015) held that Workers’ Accident Compensation Insurance (WCAI) survivor pensions must be offset against the principal amount of lost earnings as of the tort date—not against accrued delay damages—unless pension payments are extraordinarily delayed.

Table of Contents

- Factual Background: Overwork, Mental Illness, and Fatal Alcohol Poisoning

- Lower Court Ruling: Offset Against Principal Loss

- Legal Issue: Target and Timing of Pension Offset in Tort Damages

- The Supreme Court’s Analysis (March 4 2015 – Grand Bench)

- Implications and Significance: A Clearer Rule for Offset Calculations

- Conclusion

On March 4, 2015, the Grand Bench of the Supreme Court of Japan issued a major decision clarifying the method for applying the principle of son'eki sōsai (損益相殺 - offsetting gains and losses) when coordinating Workers' Accident Compensation Insurance (WCAI) survivor benefits with tort damages for wrongful death (Case No. 2012 (Ju) No. 1478, "Damages Claim Case". The Court addressed precisely how and when WCAI Survivor Compensation Pension payments received by heirs should be deducted from damages awarded for the deceased's lost earnings. Resolving conflicting interpretations stemming from earlier precedents, the Grand Bench held that these pension benefits should be offset against the principal amount of the lost earnings calculated as of the time of the tort (death), rather than being applied first to accrued delay damages (interest). This ruling significantly impacts the calculation of net damages in wrongful death cases involving work-related fatalities and WCAI benefits in Japan.

Factual Background: Overwork, Mental Illness, and Fatal Alcohol Poisoning

The case arose from the tragic death of a young system engineer and the subsequent claim against his employer:

- The Employee and Work Conditions: A (born 1980) was employed as a system engineer by the appellee, Y, a software development company. The facts established by the lower courts indicated that A experienced significant psychological stress (shinriteki fuka) due to work-related factors, including long overtime hours and changes in job duties following a transfer.

- Mental Illness and Death: As a result of this accumulated work stress, A developed a mental disorder (diagnosed as depression and dissociative fugue). While in this pathological mental state, lacking normal judgment, A left his home in Saitama City without notice on September 15, 2006, traveled to Kyoto, and engaged in excessive consumption of whiskey and other alcoholic beverages on a bench by the Kamo River. This resulted in acute alcohol poisoning leading to cardiac arrest, and A died around midnight on September 16, 2006.

- Employer Liability: The lower courts found that A's death was causally linked to the work-induced mental disorder. They determined that Y (the employer) was liable in tort (under employer liability principles, 民法715条 - Minpō 715-jō) for damages resulting from A's death, based on a breach of the duty of care (安全配慮義務違反 - anzen hairyo gimu ihan) owed by Y's employees (presumably supervisors) to A. However, the courts also found A contributorily negligent, assessing his fault at 30%.

- Damages and WCAI Benefits: A's parents, X1 and X2 (the appellants), were his sole heirs. The damages assessed included:

- A's lost earnings (逸失利益 - isshitsu rieki): 49,158,583 yen

- A's pain and suffering (慰謝料 - isharyō): 18,000,000 yen

- Parents' (X1 & X2) own pain and suffering: 2,000,000 yen each

- Funeral expenses incurred by X1: 1,500,000 yen

Separately, because A's death was recognized as work-related, X1 and X2 became entitled to benefits under the Workers' Accident Compensation Insurance Act (WCAI Act). By the close of oral arguments in the High Court (February 9, 2012), X1 had received (or was confirmed to receive) WCAI Funeral Expenses (葬祭料 - sōsairyo) of 689,760 yen and a total of 8,689,883 yen in WCAI Survivor Compensation Pension (遺族補償年金 - izoku hoshō nenkin). X2 had received (or was confirmed to receive) 1,516,517 yen in Survivor Compensation Pension.

Lower Court Ruling: Offset Against Principal Loss

The High Court calculated the total damages, applied the 30% reduction for A's comparative negligence, and then addressed the son'eki sōsai adjustment for the WCAI Survivor Compensation Pension benefits. The High Court deducted the amounts of survivor pension received or confirmed by X1 and X2 from the principal amount of A's lost earnings, before calculating delay damages (interest) on the remaining net principal sum.

X1 and X2 appealed to the Supreme Court, specifically challenging this method of offset. They argued, citing a Heisei 16 (2004) Supreme Court decision involving Jibaiseki (compulsory auto liability insurance) payments, that the survivor pension benefits should first be applied to offset any accrued delay damages (chien songaikin) on the lost earnings principal, and only then should any remaining benefit amount be deducted from the principal itself. Applying benefits to delay damages first would result in a larger remaining principal sum upon which future delay damages would accrue, increasing their total recovery.

Legal Issue: Target and Timing of Pension Offset in Tort Damages

The crucial legal question before the Grand Bench was: When WCAI Survivor Compensation Pension benefits are offset against tort damages for lost earnings under the son'eki sōsai principle, should the deduction be applied against:

- (a) The principal amount of the lost earnings, evaluated as of the date of the tort (death), OR

- (b) The accrued delay damages first, and then the principal?

This issue involves not only what is offset (principal vs. interest) but also the conceptual timing of when the loss compensated by the pension is deemed to be legally "covered" for the purpose of the offset calculation.

The Supreme Court's Analysis (March 4, 2015 - Grand Bench)

The Grand Bench unanimously rejected the appellants' argument and affirmed the High Court's method of offsetting the survivor pension against the principal amount of lost earnings. In doing so, it explicitly modified the 2004 precedent the appellants relied on.

1. Reaffirming Basic Principles of Offset and Homogeneity:

The Court started by restating the established framework for son'eki sōsai involving social insurance benefits and tort damages:

- Offset is required when an heir receives a benefit (like WCAI survivor pension) originating from the same cause (the death) as the tort damages claim (lost earnings), provided the benefit and the loss are homogeneous (dōshitsu) in nature and serve a mutually compensatory (sōgo hokansei o yūsuru) purpose. (Citing the Heisei 5 [1993] Grand Bench decision and other relevant cases).

- The Court reaffirmed that WCAI Survivor Compensation Pension, which aims to compensate for the loss of the deceased worker's financial support (loss of dependency interest - hiyō rieki no sōshitsu), is indeed homogeneous with and mutually compensatory to the lost earnings (passive damages) portion of the tort claim. Therefore, an offset must be made between these two items.

2. Determining the Target of the Offset: Principal, Not Delay Damages:

The Court then directly addressed whether the offset should target the principal loss or the accrued delay damages.

- Nature of Survivor Pension: The Court emphasized that the WCAI Survivor Compensation Pension is intended to compensate for the substantive loss – the loss of financial support the deceased would have provided.

- Nature of Delay Damages: Delay damages (chien songaikin), in contrast, are compensation for the debtor's (tortfeasor's) failure to pay the principal damages amount from the time the tort occurred (when the debt became due). Its purpose is distinct from compensating the underlying substantive loss.

- Lack of Homogeneity: Because the purposes differ, the Court concluded that the WCAI Survivor Compensation Pension (compensating substantive dependency loss) lacks homogeneity and mutual compensability with delay damages (compensating for payment delay).

- Conclusion on Target: Therefore, the survivor pension benefits should be offset against the principal amount of the lost earnings, not against the delay damages accrued on that principal.

3. Determining the Timing of Offset: Legal Evaluation "At the Time of Tort":

This was perhaps the most novel part of the judgment, addressing when the offset should be deemed effective for calculation purposes.

- Lost Earnings Calculated at Time of Tort: Tort damages for lost future earnings are calculated by estimating the total future loss and discounting it back to its present value as of the date of the tort (death). Delay damages then accrue on this principal amount from the tort date.

- Pension Payments are Periodic: WCAI Survivor Compensation Pensions are paid periodically over time, corresponding to the ongoing loss of support.

- The "Legal Evaluation" Approach: Despite the periodic nature of pension payments, the Court introduced a concept of "legal evaluation" for the purpose of the son'eki sōsai calculation within the tort claim. It reasoned:

- The WCAI system is designed to provide compensation as the loss of dependency occurs.

- If the system functions as intended (i.e., payments are made regularly without undue delay), then the portion of the loss covered by the pension can be "legally evaluated as having been compensated at the time of the tort" (fuhōkōi no toki ni tenpo sareta mono to hōteki ni hyōka shite).

- This legal evaluation allows the offset to be applied directly against the principal amount of lost earnings calculated as of the tort date, before delay damages begin to run on the net (post-offset) principal.

- Rationale: This approach is justified, the Court argued, by the "nature of damage calculation" (which involves predictions and legal fictions like discounting future losses to a present value at the tort date) and the need to ensure "fairness and promptness" in damage assessment while maintaining "legal stability." It provides a consistent method aligned with how the underlying principal damage is calculated.

- "Special Circumstances" Exception: The Court acknowledged an exception: this "evaluation at time of tort" approach applies "unless there are special circumstances such as significant delay in payment contrary to the system's design" (seido no yotei suru tokoro to kotonatte sono shikyū ga ichijirushiku chitai suru nado no tokudan no jijō no nai kagiri). In such exceptional delay cases, a different timing for the offset might be warranted (though the specifics were not elaborated).

4. Modifying the Heisei 16 (2004) Precedent:

The Court directly addressed the Heisei 16 precedent cited by the appellants, which had involved Jibaiseki insurance payments and suggested applying payments first to accrued interest/delay damages based on Civil Code Art. 489 (rules for allocating partial payments).

- The Grand Bench declared that the Heisei 16 judgment should be modified to the extent it conflicts with the present ruling regarding the treatment of WCAI Survivor Compensation Pensions.

- It essentially ruled that the Civil Code's payment allocation rules (Art. 489) do not govern the son'eki sōsai adjustment between tort damages and WCAI survivor benefits. The adjustment should follow the principles outlined in this Grand Bench decision: offset against the principal loss evaluated at the time of the tort.

Conclusion: The High Court's method – offsetting the received/confirmed WCAI survivor pension benefits against the principal amount of lost earnings before calculating delay damages – was correct and consistent with the principles affirmed by the Grand Bench. The heirs' appeal was therefore dismissed.

Implications and Significance: A Clearer Rule for Offset Calculations

This 2015 Grand Bench decision provides significant clarity and resolves prior uncertainty regarding the interaction between WCAI survivor pensions and tort damages:

- Definitive Offset Method: It establishes a clear and authoritative rule: WCAI Survivor Compensation Pensions are offset against the principal amount of lost earnings damages, not against accrued delay damages.

- Timing of Offset Clarified: Introduces the concept that, for calculation purposes within the tort claim, the offset is legally evaluated as occurring at the time of the tort, aligning the timing of the offset with the timing of the principal damage calculation (unless exceptional payment delays occur).

- Modification of Precedent: Explicitly modifies a potentially conflicting interpretation derived from the 2004 Supreme Court case involving Jibaiseki payments, thereby promoting consistency in how social insurance benefits aimed at dependency loss are treated in tort offsets.

- Impact on Damage Calculation: This method generally leads to a lower net recovery for plaintiffs compared to the alternative method of applying benefits first to delay damages, because it reduces the principal base upon which delay damages accrue from the outset (the date of the tort).

- Theoretical Basis: Provides a theoretical underpinning (the "legal evaluation at time of tort") for offsetting periodic future benefits against a lump-sum present damage calculation, aiming for fairness and consistency within the structure of tort damage assessment.

- Broader Applicability?: While focused on WCAI Survivor Compensation Pension, the reasoning based on homogeneity of purpose (livelihood/dependency loss vs. lost earnings) and the distinction from delay damages might potentially apply to other similar social insurance benefits, although each benefit type requires specific analysis.

Conclusion

The Supreme Court Grand Bench ruling of March 4, 2015, definitively settled how Workers' Accident Compensation Insurance Survivor Compensation Pension benefits should be adjusted against tort damages for lost earnings in wrongful death cases under the principle of son'eki sōsai. The Court held that these benefits must be offset against the principal amount of the lost earnings, with this offset being legally evaluated as taking effect at the time of the tort (unless exceptional delays in payment occur). This approach, which explicitly modifies a prior potentially conflicting precedent, prioritizes matching the nature of the benefit (compensation for substantive loss) with the nature of the damage (principal loss) and provides a clear, albeit potentially less favorable for plaintiffs than the alternative, method for calculating net recoverable damages in these complex cases.

- Japan Supreme Court 2023 Pension‑Cut Ruling: Balancing Sustainability and Recipient Rights

- Workers' Comp vs. Consolation Money: Japan's Supreme Court Separates Financial and Non‑Financial Damages (1966)

- Japan Supreme Court 2017 Survivor‑Pension Case: Why Age Rules for Widowers Survived an Equality Challenge

- Workers’ Compensation System – Ministry of Health, Labour and Welfare

- Supreme Court Case Database: Grand Bench Decision on Survivor Pension Offsets (Mar 4 2015)