News Platforms vs. Publishers in Japan: Competition Policy in the Digital News Market

TL;DR

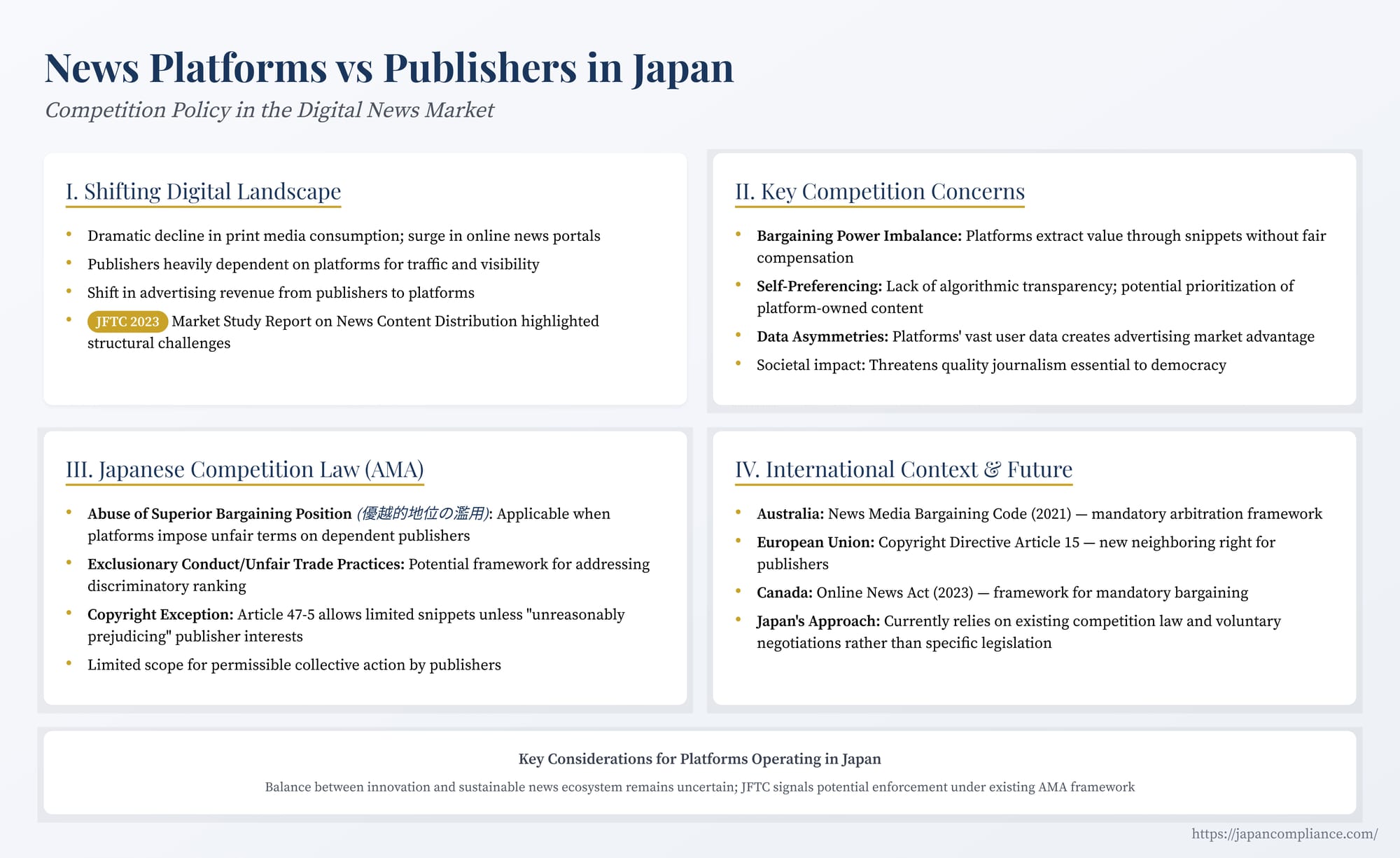

- Japan’s news ecosystem now depends heavily on a handful of digital platforms, creating bargaining-power imbalances and new antitrust risks.

- The JFTC’s 2023 market study flags low licence fees, self-preferencing and opaque algorithms as potential Abuse of Superior Bargaining Position or unfair trade practices.

- Publishers may pursue collective bargaining within AMA limits; platforms should bolster transparency and fair-payment schemes to avoid enforcement.

Table of Contents

- The Shifting Landscape: Digital Dominance and Publisher Dependence

- Key Competition Concerns

- Impact on Journalism and Media Pluralism

- Applying Japanese Competition Law (AMA)

- International Context and Potential Future Responses

- Conclusion

The rise of large digital platforms – search engines, news aggregators, and social media – has fundamentally reshaped how people access and consume news globally. While these platforms offer unprecedented reach and convenience for consumers, their growing dominance has created significant challenges for traditional news media publishers, raising complex competition policy questions in Japan and around the world.

Platforms often act as both crucial distribution channels for news content and, increasingly, as competitors to traditional publishers in the digital advertising market and for audience attention. This dual role, combined with immense market power held by a few major platforms, has led to concerns about fair compensation for news content, potential self-preferencing by platforms, and the long-term impact on the quality and diversity of journalism essential for a healthy democracy. Japan's Fair Trade Commission (JFTC) has been actively studying this area, and its findings highlight key competition policy considerations under the country's Antimonopoly Act (AMA).

The Shifting Landscape: Digital Dominance and Publisher Dependence

The transition from print to digital news consumption is stark in Japan, mirroring global trends. As highlighted in recent JFTC market studies (such as the September 2023 "Market Study Report on News Content Distribution"), the percentage of consumers relying on traditional print newspapers has drastically declined over the past decade, while reliance on online news portals and search engines has surged, becoming the primary news sources for a large segment of the population.

This shift has profoundly impacted the business models of news publishers. While digital avenues offer new reach, the decline in print circulation and associated advertising revenue has often not been fully offset by digital gains. Furthermore, digital revenue streams – whether from online advertising displayed alongside content or licensing fees from platforms – frequently depend heavily on the traffic driven by major platforms. Search engines and news portals act as critical gateways, directing vast numbers of users to news content. This creates a significant dependency, where publishers often feel they cannot afford not to have their content featured or indexed by dominant platforms, even if the terms are unfavorable.

Key Competition Concerns

This dynamic gives rise to several competition policy concerns:

1. Bargaining Power Imbalance and Fair Compensation

The most prominent issue is the significant imbalance in bargaining power between large, often global, digital platforms and individual news publishers, particularly smaller or regional ones. Platforms control access to vast audiences and user data, making them indispensable partners for publishers seeking visibility online. Publishers argue this leverage allows platforms to:

- Extract Value Without Fair Payment: Platforms display headlines, snippets (short excerpts), and sometimes aggregated summaries of news content within search results or news feeds. While this can drive traffic to the publisher's site (referral traffic), a significant portion of users may get the gist of the news directly from the platform without clicking through. Platforms benefit from this engagement through increased user time-on-site, enhanced data collection for targeted advertising across their ecosystem, and strengthening their position as indispensable information hubs. Publishers contend that the value platforms derive from using their content often far exceeds the value of the referral traffic they receive, yet platforms often pay little or nothing for this use, citing copyright exceptions or the implicit value of traffic.

- Impose Unfavorable Terms: Due to the perceived necessity of being present on major platforms, publishers may feel compelled to accept low licensing fees (in the case of news portals/aggregators hosting content) or disadvantageous terms regarding data usage or content presentation. The JFTC's 2023 market study found significant dissatisfaction among Japanese publishers regarding the level and calculation basis of licensing fees paid by major news portals, with many feeling they lacked the leverage to negotiate effectively.

Japan's Copyright Act includes an exception (Article 47-5) allowing search engines to reproduce content to the extent necessary for providing search results (often interpreted to cover snippets). However, this exception is limited and does not apply if it "unreasonably prejudices the interests of the copyright owner." If snippets become too extensive or effectively substitute for accessing the original article, arguments could be made that this exception is exceeded, potentially requiring licensing. However, the bargaining power imbalance makes negotiating such licenses difficult.

2. Self-Preferencing and Algorithmic Transparency

Concerns also arise when platforms operate competing services. Major search engines or tech companies often run their own news aggregation services or partner preferentially with certain publishers. This creates incentives and opportunities for self-preferencing:

- Search Results: A platform might prioritize links to its own news portal or partnered content over links to independent publishers' original articles in general search results or dedicated news sections.

- News Feeds/Portals: Algorithms curating news feeds on portals might favor content from specific sources (including the platform's own or those with favorable commercial terms) over others, limiting the visibility of diverse news sources.

The JFTC's reports have highlighted concerns about the lack of transparency in the algorithms platforms use to select and rank news content. Without clear, objective, and consistently applied criteria, it's difficult to determine if rankings are based on relevance and quality or influenced by the platform's own commercial interests, potentially disadvantaging competing publishers unfairly.

3. Data Asymmetries

Large platforms accumulate vast amounts of user data across their various services. This allows them to build detailed user profiles and offer highly effective targeted advertising, commanding a significant share of the digital advertising market. Individual news publishers, even those with substantial online traffic, typically lack this breadth and depth of user data, putting them at a competitive disadvantage in monetizing their audience through advertising. This further exacerbates the financial pressures on publishers.

Impact on Journalism and Media Pluralism

These competition concerns are not merely commercial disputes; they have broader societal implications. If publishers cannot secure fair remuneration for their content, their ability to invest in high-quality journalism – particularly resource-intensive investigative reporting, local news coverage, and specialized expertise – is diminished. This can lead to:

- Reduced quality and diversity of news available to the public.

- Increased reliance on easily replicable, low-cost content ("clickbait") over in-depth reporting.

- Weakening of the press's role as a check on power and a source of reliable information crucial for democratic discourse.

The purpose clause of Japan's AMA (Article 1) explicitly aims to promote the "democratic and wholesome development of the national economy." Arguably, ensuring a competitive and sustainable news media ecosystem falls within this broad objective, linking the competition policy issues directly to fundamental societal values.

Applying Japanese Competition Law (AMA)

The JFTC's investigations and reports suggest several potential avenues for addressing these concerns under the existing AMA framework:

- Abuse of Superior Bargaining Position (優越的地位の濫用 - yūetsuteki chii no ran'yō): Article 2(9)(v) of the AMA prohibits undertakings from unjustly utilizing their superior bargaining position over a counterparty to impose disadvantageous terms or make unjust demands. The JFTC's 2023 report explicitly noted that if a dominant news portal leverages its superior position to unilaterally set extremely low licensing fees or impose unfair conditions on publishers, it could constitute an abuse of superior bargaining position. Establishing "superior bargaining position" requires a fact-intensive analysis of dependency, platform market position, switching possibilities, and other factors, but the JFTC indicated major news portals likely hold such a position relative to at least smaller publishers.

- Exclusionary Conduct / Unfair Trade Practices: Practices like discriminatory algorithmic ranking or self-preferencing by dominant platforms could potentially be challenged as unfair trade practices aimed at excluding competing publishers, provided anti-competitive effects can be demonstrated. Proving such effects and the intent behind algorithmic choices can be difficult, however.

- Collective Action by Publishers: Recognizing the bargaining power imbalance, the JFTC has issued guidance suggesting that certain forms of collaboration among publishers might be permissible under the AMA. This could include joint fact-finding, developing common positions for negotiation principles (without fixing prices), or potentially forming collective negotiation bodies or utilizing trade associations to gather information and engage with platforms. The key limitation is that such collaborations must not cross the line into prohibited cartel activities (e.g., collectively agreeing on minimum license fees or boycotting platforms). The actual effectiveness of such collective action remains debated.

International Context and Potential Future Responses

Japan is not alone in grappling with these issues. Several other countries have implemented or are considering more direct regulatory interventions:

- Australia: Implemented the News Media Bargaining Code (NMBC) in 2021. This framework allows eligible news businesses to negotiate (individually or collectively) with designated digital platforms for payment for content made available on their services. If negotiations fail, it triggers a mandatory final-offer arbitration process. While no platform has been formally "designated" yet (as major platforms struck voluntary deals beforehand), the framework remains in place and the government recently proposed strengthening it to prevent platforms avoiding obligations by removing news.

- European Union: The 2019 Directive on Copyright in the Digital Single Market introduced a new neighboring right for press publishers (Article 15). This grants publishers the right to authorize or prohibit the online use of their press publications (e.g., reproduction of snippets beyond very short extracts or individual words) by information society service providers like news aggregators or search engines, creating a basis for demanding remuneration. Its effectiveness across member states has been varied and subject to ongoing debate and litigation. The DMA also imposes obligations on designated gatekeeper platforms regarding fair access and non-discrimination that could have relevance.

- Canada: Enacted the Online News Act in 2023. Similar in principle to the Australian model, it establishes a framework to regulate platforms and encourage fair commercial agreements with news businesses, including provisions for mandatory bargaining and arbitration if voluntary agreements are not reached.

Compared to these legislative interventions aimed specifically at compelling payment or structuring negotiations, Japan's current approach relies more on market studies, guidance under existing competition law (AMA), and encouraging voluntary negotiations. While the JFTC's reports signal potential for AMA enforcement, particularly regarding abuse of superior bargaining position, whether this will be sufficient to rebalance the market or if Japan will eventually consider more specific legislation remains an open question.

Conclusion

The relationship between large digital platforms and news publishers in Japan presents complex challenges at the intersection of technology, economics, copyright, and competition policy. The shift to digital consumption has created significant bargaining power imbalances, leading to concerns about fair compensation for content, algorithmic transparency, self-preferencing, and the long-term sustainability of quality journalism.

Japan's Fair Trade Commission is actively monitoring the situation and has indicated that existing tools under the Antimonopoly Act, particularly the prohibition against Abuse of Superior Bargaining Position, could potentially be applied. It has also provided guidance suggesting pathways for permissible collective action by publishers. However, compared to more direct regulatory interventions seen in Australia, the EU, and Canada, Japan's current approach is more reliant on existing competition law frameworks and encouraging negotiation. For US tech platforms operating in Japan, understanding the JFTC's perspective, the potential application of the AMA, and the global context of evolving regulations governing platform-publisher interactions is crucial for navigating this complex and strategically important market. The future likely holds continued debate and potential evolution in policy responses as Japan seeks to balance platform innovation with the need for a sustainable and diverse news ecosystem.

- Antitrust Enforcement in Japan’s Energy Sector: JFTC Lessons from Cartel & Collusion Cases

- False IP Takedowns on Japanese E-Commerce Platforms: UCPA Liability & Risk-Control Guide

- EU Data Act Compliance for US Firms with Japanese Links: Key Risks & Strategic Steps

- JFTC “Market Study Report on News Content Distribution” (Sep 2023, PDF – Summary) :contentReference[oaicite:2]{index=2}

- JFTC Press Release: Findings on News Content Distribution Market Study (21 Sep 2023) :contentReference[oaicite:3]{index=3}