Navigating the Deal: Board Duties Under Japan’s 2023 METI Takeover Guidelines

TL;DR

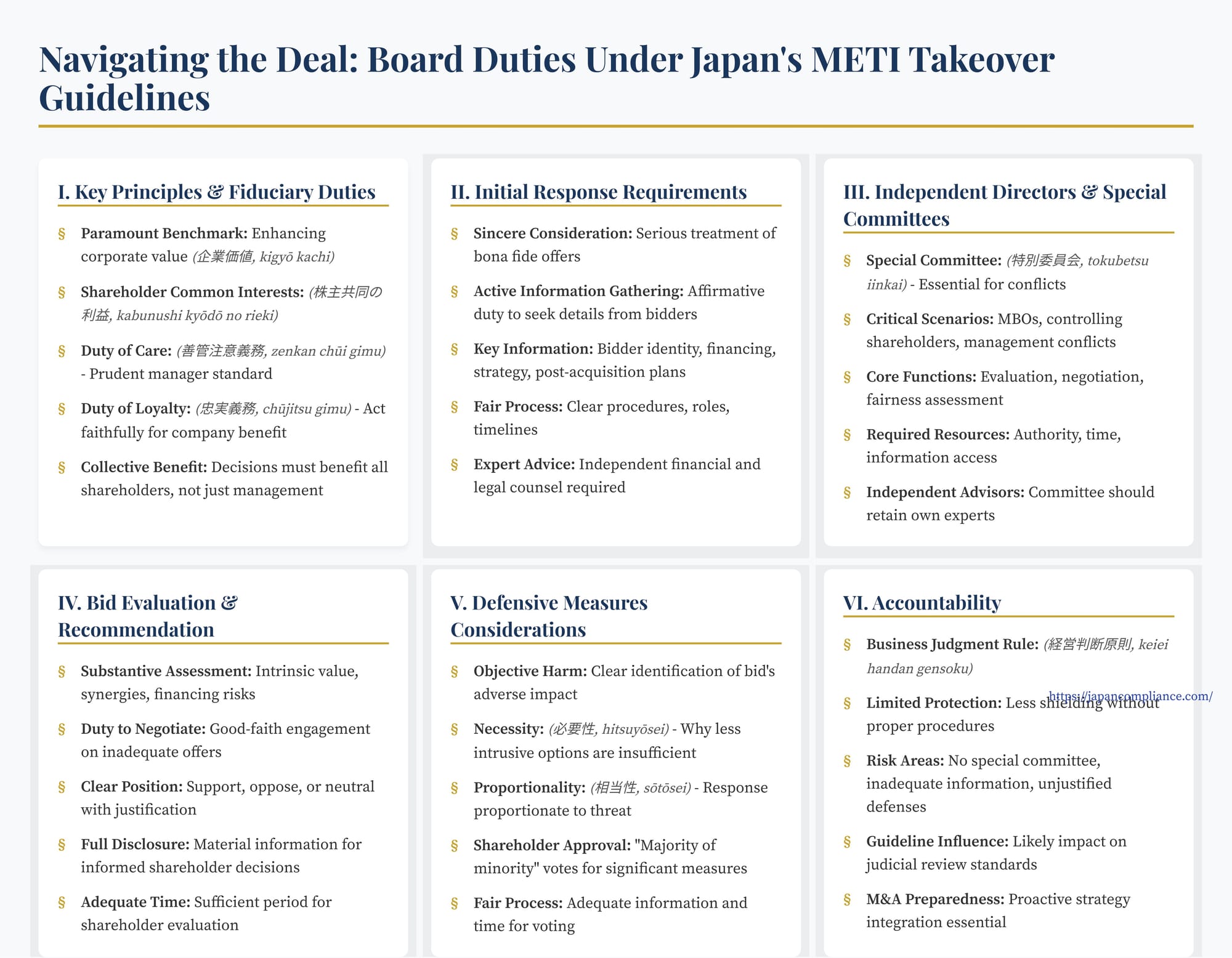

- METI’s 2023 takeover guidelines raise board-conduct standards: directors must centre every decision on corporate value and shareholder common interests.

- Independent-director special committees, full information-gathering and fair disclosure to shareholders are now baseline expectations.

- Defensive measures require concrete harm, proportionality and (ideally) a post-bid majority-of-the-minority vote, or directors risk breaching fiduciary duties.

Table of Contents

- The North Star: Corporate Value and Shareholder Common Interests

- Initial Response: Engagement and Information Gathering

- The Crucial Role of Independent Directors and Special Committees

- Evaluating the Bid, Negotiating, and Recommending

- Facilitating an Informed Shareholder Decision

- Considering Defensive Measures

- Accountability and the Business Judgment Rule

- Conclusion

When a company becomes the target of a takeover bid, its board of directors (取締役会, torishimariyakukai) faces one of its most critical challenges. Balancing the interests of the company, shareholders, management, and other stakeholders requires careful navigation. Japan's Ministry of Economy, Trade, and Industry (METI) released its "Guidelines for Corporate Takeovers" in August 2023, providing significant clarification on the expected conduct and fiduciary duties of target company boards during these high-stakes situations. This post delves into the key principles and expectations set forth for boards under this influential new framework.

The North Star: Corporate Value and Shareholder Common Interests

The METI Guidelines establish a clear benchmark for board conduct during takeovers: enhancing corporate value (企業価値, kigyō kachi) and securing the common interests of shareholders (株主共同の利益, kabunushi kyōdō no rieki). This principle serves as the lens through which all board actions—from initial evaluation to final recommendation and any potential defensive measures—should be viewed and justified.

This aligns with the fundamental fiduciary duties directors owe to the company under Japan's Company Act:

- Duty of Care (善管注意義務, zenkan chūi gimu): The duty to act with the care of a prudent manager.

- Duty of Loyalty (忠実義務, chūjitsu gimu): The duty to act faithfully for the benefit of the company.

The Guidelines interpret these duties in the takeover context to mean that directors must make informed decisions, free from conflicts of interest, that are reasonably believed to maximize the sustainable value of the company for the benefit of its shareholders collectively. Actions benefiting only management, specific shareholder groups, or other stakeholders at the expense of overall corporate value and shareholder common interests are inconsistent with these duties.

Initial Response: Engagement and Information Gathering

Upon receiving a takeover proposal, whether solicited or unsolicited, the target board cannot remain passive. The Guidelines emphasize several initial duties:

- Duty to Sincerely Consider: The board must treat any bona fide offer seriously and dedicate sufficient time and resources to its evaluation. Summary rejection without proper consideration is inappropriate.

- Active Information Gathering: The board has an affirmative duty to gather necessary information to make an informed assessment. This includes seeking details from the bidder regarding their identity, financing certainty, strategic rationale, post-acquisition plans (for the business, employees, etc.), and any potential legal or regulatory issues.

- Establishing a Fair Evaluation Process: From the outset, the board should establish clear procedures for evaluating the bid. This involves defining roles and responsibilities, setting realistic timelines, and crucially, identifying and managing potential conflicts of interest among directors and management. Obtaining independent expert advice from financial advisors and legal counsel specializing in M&A is strongly recommended and generally considered essential for fulfilling the duty of care.

The Crucial Role of Independent Directors and Special Committees

The Guidelines place significant emphasis on the role of independent oversight, particularly through independent outside directors (shagai torishimariyaku) and Special Committees (特別委員会, tokubetsu iinkai).

- Why Independent Oversight?: Takeover situations are often rife with potential conflicts of interest. Management may prioritize job security, major shareholders might have divergent interests from minority shareholders, or directors might have personal relationships influencing their judgment. Independent directors are expected to provide objective scrutiny focused solely on corporate value and the common interests of all shareholders.

- Special Committees: The Guidelines strongly recommend (effectively setting a best practice standard) the establishment of a Special Committee composed entirely or predominantly of independent directors to handle the takeover response. This is seen as particularly vital in:

- Management Buyouts (MBOs).

- Takeovers by controlling shareholders.

- Situations where management has a significant potential conflict.

- Even in arm's-length transactions, if the board is contemplating significant defensive measures.

- Functions of the Special Committee: The committee should be empowered to:

- Evaluate the takeover proposal objectively.

- Negotiate terms with the bidder if appropriate.

- Assess the fairness of the offer from the perspective of general (minority) shareholders.

- Consider alternative transactions.

- Make recommendations to the full board regarding its response and any potential countermeasures.

- Resources and Authority: To be effective, the Special Committee must be granted sufficient authority, adequate time, access to necessary information, and the ability to retain its own independent financial and legal advisors.

Evaluating the Bid, Negotiating, and Recommending

The core task for the board (often guided by the Special Committee) is to evaluate the substance of the bid:

- Substantive Assessment: Does the offer price fairly reflect the company's intrinsic value and future prospects? What are the potential synergies or dis-synergies? What are the risks associated with the bidder's plans or financing? How does the offer compare to the value likely generated by remaining independent or pursuing alternative strategies? Fairness opinions from financial advisors play a key role here.

- Duty to Negotiate: If the initial offer is deemed inadequate, or if there are concerns about conditionality or post-acquisition plans, the board generally has a duty to engage in good-faith negotiations with the bidder to seek improvements that would benefit shareholders.

- Formulating a Recommendation: Based on this thorough evaluation and negotiation process, the board must formulate a clear position—whether it supports the offer, opposes it, or remains neutral—and provide a detailed, reasoned explanation for its stance to shareholders. Simply stating neutrality without justification is generally insufficient.

Facilitating an Informed Shareholder Decision

Respecting the shareholders' ultimate right to decide requires the board to ensure they have the necessary tools:

- Full and Fair Disclosure: The board must provide shareholders with all material information needed to make an informed decision. This includes the board's recommendation, the detailed reasons behind it, summaries of financial analyses or fairness opinions obtained, any significant conflicts of interest identified, and information about alternative options explored.

- Sufficient Time: Shareholders must be given adequate time between receiving the necessary information and the end of the tender offer period to properly consider the proposal.

Considering Defensive Measures

If the board, after careful evaluation (ideally by a Special Committee), concludes that a bid is genuinely harmful to corporate value or shareholder common interests (e.g., coercive, significantly undervaluing), it may consider defensive measures. However, the Guidelines impose strict limits (as discussed in the previous post):

- Justification: The specific harm must be clearly identified and objectively demonstrable.

- Necessity and Proportionality: The chosen measure must be necessary and proportionate to address that specific harm, not preclusive of all offers.

- Shareholder Approval (MoM): Crucially, significant countermeasures should ideally be subject to a specific shareholder vote after the bid emerges, requiring approval from a "majority of the minority" shareholders.

The board's fiduciary duties extend to ensuring any shareholder vote on defensive measures is conducted fairly, with adequate information and time.

Accountability and the Business Judgment Rule

While the Guidelines are soft law, they set clear expectations for board conduct that are likely to influence judicial review. The Business Judgment Rule (keiei handan gensoku), which generally shields directors from liability for decisions made reasonably and in good faith, may offer less protection if a board fails to adhere to the procedural and substantive standards outlined in the Guidelines. For example, failing to establish a Special Committee in a clear conflict situation, neglecting proper information gathering, or implementing defenses without adequate justification or shareholder support could expose directors to claims of breaching their duty of care or loyalty.

Conclusion

The METI Takeover Guidelines significantly clarify and arguably elevate the standards for board conduct during M&A in Japan. Directors are expected to act diligently, loyally, and transparently, guided by the principles of enhancing corporate value and securing the common interests of all shareholders. This requires a proactive approach to information gathering, objective evaluation, managing conflicts (often through robust Special Committees), negotiating effectively, and ultimately, facilitating an informed decision by shareholders. While hostile situations remain complex, the Guidelines provide a clearer roadmap for boards navigating these critical junctures, aiming to ensure the takeover process serves the long-term health of Japanese companies and the interests of their owners. Boards, and those advising them, must integrate these principles into their M&A preparedness and response strategies.

- Japan’s New M&A Playbook: How METI’s 2023 Takeover Guidelines Reshape Deals and Defences

- Rethinking Defensive Measures: Hostile Takeovers Under Japan’s 2023 METI Guidelines

- Lessons from a Japanese Conglomerate Delisting: Governance Failures, Activist Battles & Take-Private Exit

- METI – Guidelines for Corporate Takeovers (Japanese PDF)

- FSA Corporate Governance Code – 2021 Revision (PDF)