Navigating M&A in Japan: Key Legal Considerations for US Companies

TL;DR

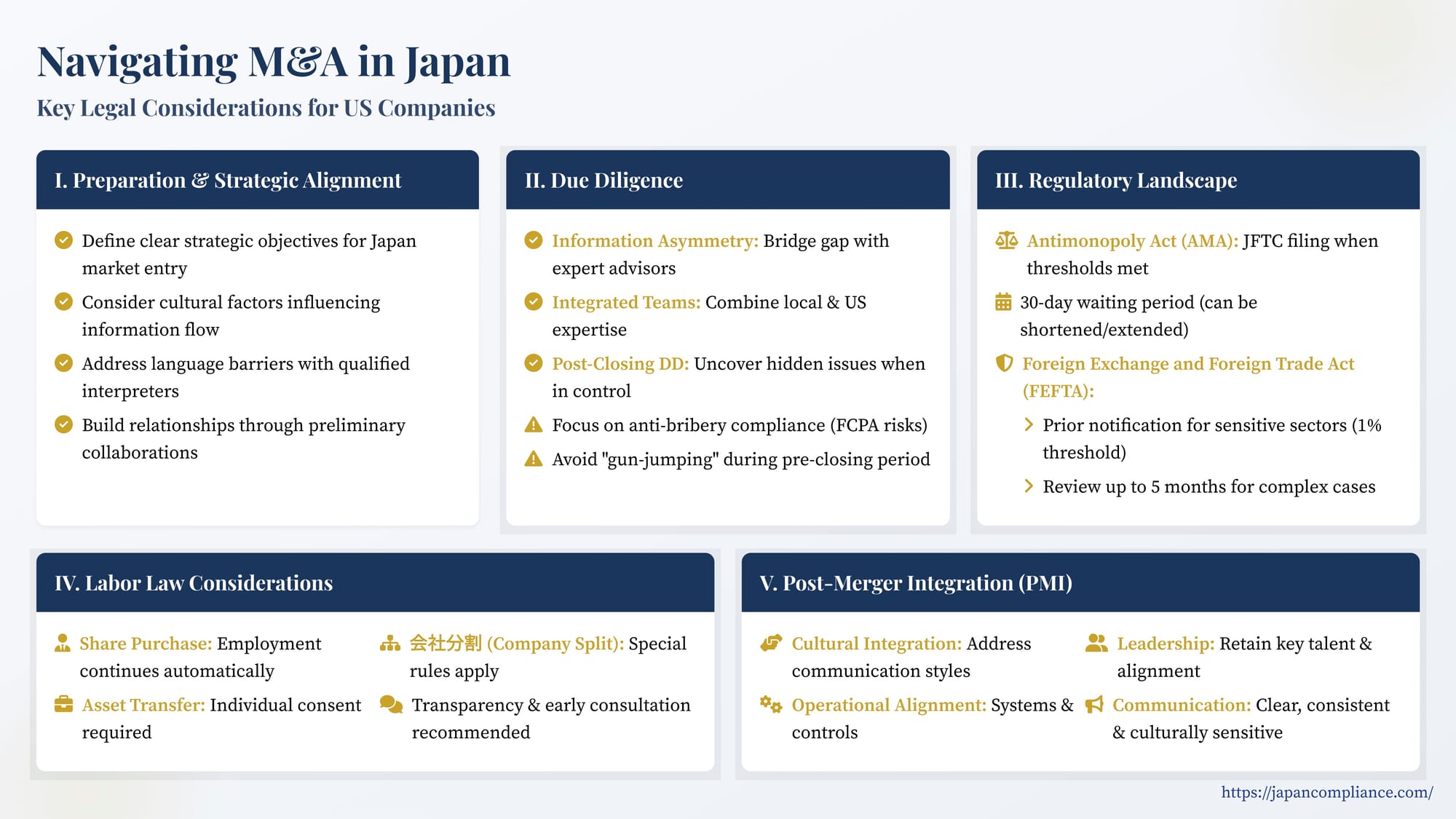

US acquirers must bridge Japan-specific information gaps, clear Antimonopoly Act and FEFTA screenings, respect labor-transfer rules, and plan culture-sensitive post-merger integration. Early, integrated advisor teams and post-closing due diligence are critical to capture value and avoid regulatory or compliance surprises.

Table of Contents

- Preparation and Strategic Alignment

- Due Diligence: Bridging the Information Gap

- Regulatory Landscape: Key Approvals

- Labor Law Considerations

- Post-Merger Integration (PMI)

- Conclusion

Japan's mergers and acquisitions (M&A) landscape has shown notable dynamism in recent years. While outbound deals by Japanese companies have seen fluctuations, inbound acquisitions by foreign entities, alongside domestic consolidation, have marked an upward trend. For US companies looking to enter or expand within Japan's mature and technologically advanced market, M&A presents a compelling strategic pathway, offering access to established operations, skilled personnel, and valuable local networks.

However, executing successful M&A deals in Japan requires navigating a distinct set of challenges compared to domestic US transactions. These include differences in legal frameworks, corporate governance norms, cultural nuances in negotiation and integration, and significant information asymmetry. Understanding these unique aspects is crucial for mitigating risks and maximizing deal value.

Preparation and Strategic Alignment

Successful M&A hinges on meticulous preparation and a clear strategic vision. Before engaging potential targets, US companies should define their objectives for entering the Japanese market – whether it's acquiring technology, accessing new customer segments, achieving economies of scale, or establishing a regional hub. This strategic clarity guides the target selection process.

Developing a comprehensive understanding of the target company and its market environment is paramount, yet challenging due to language barriers and cultural factors that can obscure information flow. Initial steps involve creating broad lists of potential candidates (longlists) and then refining these into a shortlist of companies offering strong strategic fit and potential synergies.

Preliminary information gathering can involve engaging consultants for market analysis and background screening of target companies and their principals. Building relationships through initial top-level discussions or even preliminary business collaborations can also yield valuable insights and foster trust before formal M&A discussions commence.

Due Diligence: Bridging the Information Gap

Due diligence (DD) is a cornerstone of any M&A transaction, but its importance is magnified in cross-border deals involving Japan due to inherent information asymmetry. A comprehensive DD process should encompass legal, financial, commercial, HR, and compliance aspects, increasingly including Environmental, Social, and Governance (ESG) factors as well.

Addressing Asymmetry: Language remains a practical hurdle. Furthermore, sellers may be less accustomed to the extensive disclosure typical in US deals or may be reluctant to reveal information perceived as negative. Effectively bridging this gap requires:

- Expert Advisors: Engaging experienced Japanese legal counsel, financial advisors, and potentially industry consultants is essential. They possess the local knowledge to identify risks specific to the Japanese context.

- Integrated Advisory Teams: Relying solely on local advisors might miss nuances stemming from differences between Japanese and US law or business practices. Integrating Japanese advisors with US-based counsel ensures that advice considers both perspectives, facilitating better risk assessment, contract negotiation, and planning for post-acquisition governance.

- Post-Closing Due Diligence: Given the limitations of pre-closing DD (time constraints, information access), conducting a thorough Post-Closing DD is a valuable practice. This allows the acquirer, now in control, to perform deeper dives through management and employee interviews, detailed examination of books and records, and site inspections. Post-Closing DD can uncover previously unidentified risks, such as off-balance-sheet liabilities, compliance breaches, or operational inefficiencies, enabling prompt remediation. It also strengthens the ability to make timely claims under indemnification clauses in the acquisition agreement, which typically have time limits.

Specific DD Focus Areas:

- Anti-Bribery Compliance: The US Foreign Corrupt Practices Act (FCPA) has extraterritorial reach, applying to conduct with even minimal US nexus (e.g., using US banking systems for payments). DD must rigorously assess the target's compliance environment, especially if operating in sectors or regions with higher perceived corruption risks (referencing metrics like the Transparency International Corruption Perceptions Index can be helpful). Assess the target’s relationships with third-party agents, intermediaries, and any interactions with government officials. The discovery of potential violations during DD necessitates careful consideration of remediation steps, potential self-disclosure to authorities (like the US Department of Justice and SEC), and potentially making such disclosure a closing condition. Post-acquisition, swift integration of the acquirer's compliance policies, training for target employees, and follow-up audits are crucial to mitigate successor liability risks.

- Competition Law & Gun-Jumping: Pre-closing coordination between merging parties, particularly competitors, carries significant risk under competition laws globally. "Gun-jumping" refers to acting as a merged entity before receiving necessary regulatory clearances. This includes premature integration efforts or, critically during DD, the inappropriate exchange of competitively sensitive information (e.g., future pricing, customer-specific terms, strategic plans). While enforcement might be perceived differently across jurisdictions, authorities in major economies actively scrutinize pre-closing conduct. Implementing clean teams and strict information exchange protocols during DD is vital to avoid violations of Japan's Antimonopoly Act (AMA) and potentially other relevant competition regimes.

Regulatory Landscape: Key Approvals

Navigating Japan's regulatory environment is a critical phase demanding careful planning and scheduling.

- Antimonopoly Act (AMA) – Merger Control: The Japan Fair Trade Commission (JFTC) reviews M&A transactions that meet specific thresholds, primarily based on the domestic turnover of the acquiring group and the target group. If thresholds are met (e.g., acquirer group domestic turnover exceeding JPY 20 billion and target group exceeding JPY 5 billion, linked to acquiring voting rights over 20% or 50%), a prior notification to the JFTC is mandatory. A statutory waiting period (typically 30 days, though often shortened or sometimes extended for complex cases) applies, during which closing is prohibited. The JFTC assesses whether the transaction may substantially restrain competition in a particular field of trade. Complex reviews, especially in horizontal mergers, may involve detailed economic analysis and could lead to the JFTC requiring remedies, such as divestitures, before granting clearance. Certain transaction structures might trigger multiple filing requirements. Early assessment of filing requirements and potential substantive issues is crucial for transaction timing.

- Foreign Exchange and Foreign Trade Act (FEFTA) – National Security Screening: Echoing a global trend, Japan has significantly strengthened its foreign investment screening regime under FEFTA to protect national security. Foreign investors acquiring shares in Japanese companies operating in designated sensitive sectors (e.g., critical infrastructure, defense, advanced technologies, potentially data-related businesses) may trigger a mandatory prior notification requirement. The threshold for listed companies in these sectors can be as low as acquiring 1% of voting rights. Even acquisitions in non-designated sectors might require prior notification if they involve certain types of control or influence. The review process involves relevant ministries alongside the Ministry of Finance. Like the JFTC process, there's a waiting period (typically 30 days, but potentially extendable up to five months). Authorities can impose conditions or, in rare cases, recommend halting the transaction. Recent amendments have further expanded the scope of review and narrowed exemptions, particularly concerning access to non-public technology or sensitive data, and influence over core business decisions. Investments not requiring prior notification generally necessitate an ex-post facto report. Given the complexity and evolving nature of FEFTA, early analysis of its applicability is vital for any inbound M&A deal.

- Broader Regulatory Awareness: While focusing on Japan, companies should maintain awareness of other relevant regulations. For instance, the EU's Foreign Subsidies Regulation introduces notification requirements for companies benefiting from significant non-EU government subsidies when engaging in large M&A deals within the EU. This could potentially impact deals involving Japanese targets if the US acquirer or the target itself has substantial EU operations and has received relevant foreign subsidies.

Labor Law Considerations

Employee-related matters are often central to M&A success in Japan, where employment is traditionally stable.

- Transfer Mechanisms: In a share purchase, the target company's legal entity remains the employer, and employment contracts continue automatically. However, subsequent changes to terms and conditions require careful handling under Japanese labor law. In an asset or business transfer, employees do not automatically transfer; their individual consent is generally required to move to the acquiring entity.

- Kaisha Bunkatsu (Company Split): This specific restructuring method under the Companies Act has dedicated rules in the Labor Contracts Succession Act. It generally involves automatic transfer for employees primarily engaged in the transferred business, alongside specific notification and consultation rights for employees (both transferring and non-transferring) and labor unions. Failure to follow these procedures can impact the validity of employment transfers.

- Due Diligence & Consultation: Thorough HR due diligence is essential to understand existing employment terms, working rules (shugyo kisoku), collective bargaining agreements, pension liabilities, and potential risks (e.g., historical unpaid overtime). While formal consultation requirements vary by deal structure (most stringent for company splits), engaging with employees or labor unions early and transparently, even when not legally mandated (like in some business transfers), is often advisable to ensure a smoother transition and integration. Guidelines from the Ministry of Health, Labour and Welfare (MHLW) often encourage consultation and information provision.

- Post-Acquisition Changes: Harmonizing terms and conditions or implementing restructuring post-acquisition must comply with stringent Japanese labor laws regarding changes to employment conditions and dismissals.

Post-Merger Integration (PMI)

Successfully integrating the acquired Japanese entity is arguably the most critical factor for realizing long-term deal value, yet it is frequently underestimated. PMI planning should commence early in the M&A process, not as an afterthought post-closing.

Key challenges often revolve around:

- Cultural Integration: Differences in communication styles (direct vs. indirect), decision-making processes (top-down vs. consensus-based, including concepts like nemawashi – informal consensus building), hierarchy, risk tolerance, and general corporate culture can create significant friction if not managed proactively.

- Operational Alignment: Integrating IT systems, reporting structures, operational processes, and internal controls requires careful planning and execution.

- Leadership and Talent Retention: Aligning leadership styles and retaining key management and employees in the target company are crucial for continuity and achieving synergies. Uncertainty during the integration phase can easily lead to attrition of valuable talent.

- Communication: Maintaining clear, consistent, and culturally sensitive communication throughout the integration process is vital for managing employee morale and expectations.

Conclusion

M&A in Japan offers significant strategic opportunities for US companies but demands a nuanced approach sensitive to the unique legal, regulatory, and cultural environment. Overcoming information asymmetry through rigorous due diligence, leveraging integrated teams of local and home-country advisors, and employing tools like Post-Closing DD are essential. Proactive navigation of regulatory hurdles like AMA merger control and FEFTA foreign investment screening is critical for deal certainty and timing. Furthermore, careful attention to labor law requirements and a well-planned, culturally attuned PMI strategy are indispensable for capturing the intended value of the transaction. Thorough preparation and expert guidance are the keys to successfully navigating the complexities of Japanese M&A.