Japan M&A Guide 2025: Legal Essentials & Practical Tips for U.S. Companies

TL;DR

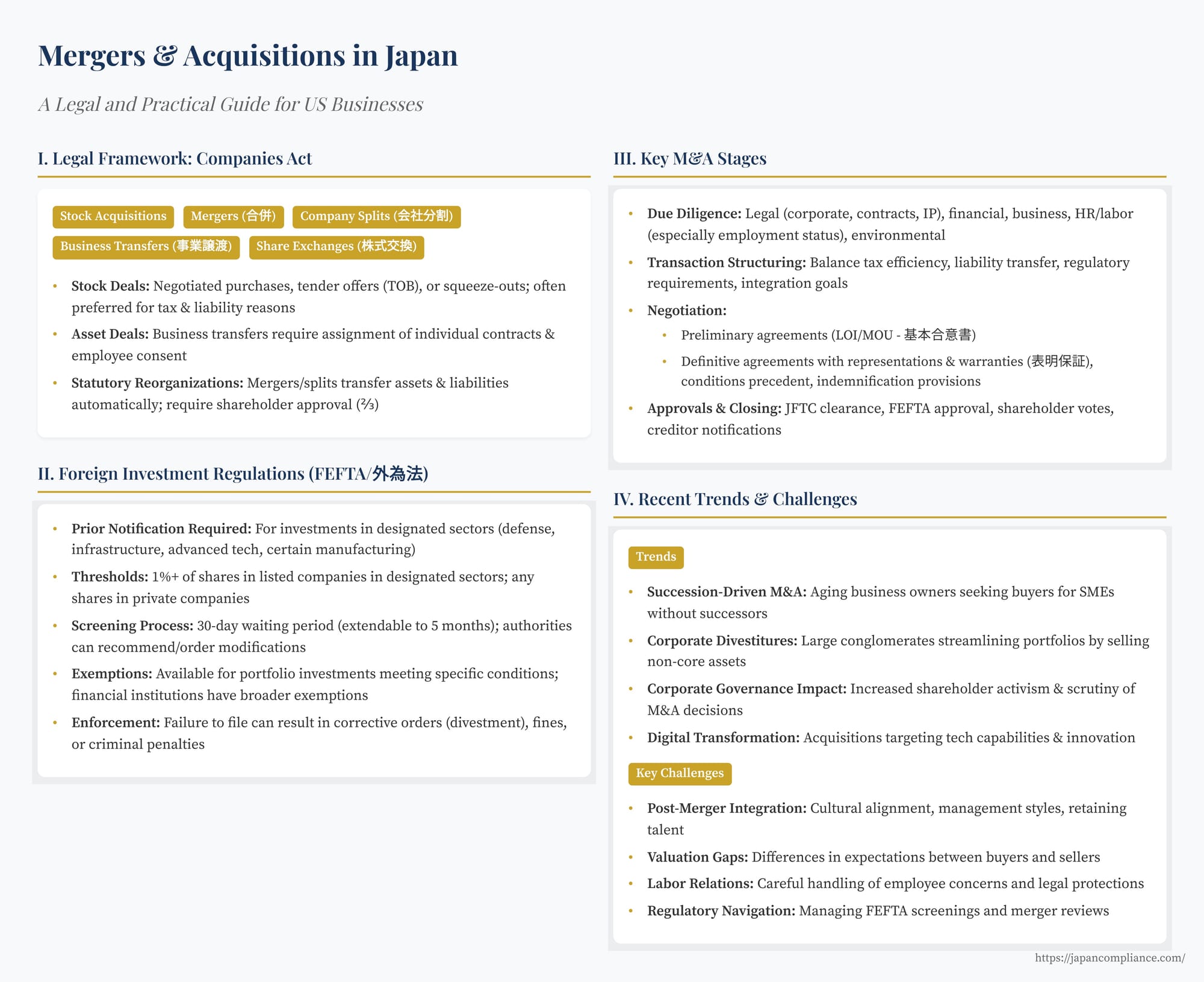

This 2025 guide walks U.S. companies through Japan-specific M&A structures, FEFTA foreign-investment screening, JFTC merger control, labor-transfer rules and post-merger integration pitfalls—offering practical checkpoints for deal certainty and value creation.

Table of Contents

- I. The Legal Framework for M&A in Japan

- A. The Companies Act (会社法 – Kaisha Hō)

- B. Financial Instruments and Exchange Act (FIEA)

- C. Antimonopoly Act (AMA)

- D. Labor Law Considerations

- II. Foreign Investment Regulations: The Foreign Exchange and Foreign Trade Act (FEFTA)

- A. Scope of “Foreign Investor” and “Inward Direct Investment”

- B. Prior Notification Requirement

- C. Exemptions from Prior Notification

- D. Post-Facto Reporting

- E. Enforcement

- III. Key Stages and Practical Considerations in Japanese M&A

- A. Due Diligence

- B. Structuring the Transaction

- C. Negotiation and Documentation

- D. Approvals and Closing

- IV. Recent Trends and Challenges in Japanese M&A

- Conclusion

Japan's Mergers & Acquisitions (M&A) landscape has become increasingly dynamic in recent years, presenting significant opportunities for US companies seeking growth, market entry, or strategic partnerships. Drivers include demographic shifts leading to succession challenges for small and medium-sized enterprises (SMEs), corporate restructuring by large Japanese conglomerates divesting non-core assets, and a growing openness to foreign investment. Navigating this environment, however, requires a thorough understanding of Japan's unique legal framework, regulatory requirements, and practical deal considerations. This article provides a guide to key aspects of undertaking M&A transactions in Japan.

I. The Legal Framework for M&A in Japan

Several key pieces of legislation govern M&A activities in Japan, dictating the available structures, required procedures, and regulatory approvals.

A. The Companies Act (会社法 - Kaisha Hō)

The Companies Act is the central statute governing corporate organization and transactions, including the primary M&A methods:

- Stock Acquisitions (株式取得 - Kabushiki Shutoku):

- Negotiated Purchases: Acquiring shares directly from existing shareholders through private negotiation. Requires target board approval for share transfer restrictions if applicable (common in private companies).

- Tender Offers (公開買付け - Kōkai Kaitsuke, TOB): Mandatory under the Financial Instruments and Exchange Act (FIEA) for certain acquisitions of listed company shares (e.g., exceeding specific ownership thresholds through off-market purchases). Involves strict disclosure and procedural rules.

- Squeeze-outs: Mechanisms exist under the Companies Act for acquiring 100% ownership after reaching a high ownership threshold (typically 90% or sometimes two-thirds), such as through a "special controlling shareholder's demand for share sales" or via structures like a cash-out merger or share exchange.

- Mergers (合併 - Gappei):

- Absorption-type Merger (吸収合併 - Kyūshū Gappei): One company absorbs another, with the absorbed company dissolving. Assets, liabilities, and contracts transfer automatically by operation of law.

- Consolidation-type Merger (新設合併 - Shinsetsu Gappei): Two or more companies dissolve, and a new company is established to succeed their rights and obligations. Less common than absorption mergers.

Mergers typically require special shareholder resolutions (usually a two-thirds majority vote) from each participating company and involve procedures to protect creditors (e.g., public notice and objection periods).

- Company Splits (会社分割 - Kaisha Bunkatsu):

- Allows a company to carve out a business division and transfer it to another existing company (Absorption-type Split - 吸収分割) or a newly established company (Incorporation-type Split - 新設分割). Can be structured to transfer assets, liabilities, contracts, and employees associated with the specific business. Requires shareholder approval and creditor protection procedures similar to mergers.

- Business Transfers (事業譲渡 - Jigyō Jōto):

- Essentially an asset deal where specific assets, liabilities, contracts, and goodwill constituting a business are transferred contractually. Unlike mergers or splits, transfers are not automatic; individual assignment of contracts and liabilities is typically required, often needing counterparty consent. Employee transfers also require individual consent unless structured carefully under related labor laws. Requires shareholder approval if transferring a substantial part of the business.

- Share Exchanges / Share Transfers (株式交換 / 株式移転 - Kabushiki Kōkan / Kabushiki Iten):

- Share Exchange: An existing company acquires all shares of another company, making it a wholly-owned subsidiary. Shareholders of the target receive shares (or cash) of the acquiring parent company.

- Share Transfer: One or more companies establish a new parent company, transferring all their shares to the new entity and becoming its wholly-owned subsidiaries.

Both require special shareholder resolutions and creditor protection procedures. Often used to create holding company structures or execute acquisitions where the target entity needs to be preserved.

Choosing the optimal structure depends heavily on tax consequences, handling of liabilities, employee transfers, need for counterparty consents, integration plans, and required approvals. Each method involves detailed procedural requirements under the Companies Act that must be strictly followed to ensure validity.

B. Financial Instruments and Exchange Act (FIEA) (金融商品取引法 - Kin'yū Shōhin Torihiki Hō)

FIEA governs securities transactions and disclosures. It is particularly relevant for:

- Tender Offers: Mandates TOBs and regulates their procedures, timing, and disclosure requirements for acquisitions of listed shares exceeding certain thresholds.

- Disclosure: Imposes ongoing disclosure obligations on listed companies and significant shareholders, which can impact M&A timing and strategy.

C. Antimonopoly Act (AMA) (独占禁止法 - Dokusen Kinshi Hō)

As discussed in a previous post, the AMA requires pre-merger notification to the Japan Fair Trade Commission (JFTC) for transactions exceeding certain domestic turnover thresholds. The JFTC reviews whether the transaction may substantially restrain competition. Obtaining JFTC clearance is a critical condition precedent for many deals.

D. Labor Law Considerations

Employee relations are a crucial aspect of M&A in Japan. Key considerations include:

- Labor Contract Succession Act (労働契約承継法 - Rōdō Keiyaku Shōkei Hō): Governs the transfer of employment contracts specifically in the context of Company Splits. Requires consultation with unions or employee representatives and provides certain protections for employees.

- Transfer of Employment: In mergers and company splits meeting statutory requirements, employment contracts generally transfer automatically. In business transfers (asset deals), employee consent is typically required for transfer. In stock acquisitions, the employer entity remains the same, but integration may lead to changes requiring consultation.

- Consultation and Communication: Even where not strictly mandated by law, early communication and consultation with employees or labor unions regarding the M&A and its potential impact on employment conditions are often crucial for smooth integration and maintaining morale. Changes to work rules or collective bargaining agreements post-acquisition require adherence to specific labor law procedures.

II. Foreign Investment Regulations: The Foreign Exchange and Foreign Trade Act (FEFTA / 外為法 - Gaitame Hō)

FEFTA imposes screening requirements on certain inbound investments by foreign investors to safeguard Japan's national security. Recent amendments (notably in 2019/2020) have significantly expanded the scope and scrutiny of this regime.

A. Scope of "Foreign Investor" and "Inward Direct Investment"

- Foreign Investor: Includes non-resident individuals, foreign corporations/entities, Japanese companies where 50% or more voting rights are held directly or indirectly by foreign investors, and certain partnerships/funds with significant foreign participation.

- Inward Direct Investment: Broadly covers acquiring 1% or more of the shares/voting rights of a listed Japanese company, acquiring any shares of a private Japanese company from a non-foreign investor, establishing a branch or subsidiary, providing significant loans, and consenting to substantial changes in the business objectives of certain companies.

B. Prior Notification Requirement

Foreign investors must file a prior notification with the Minister of Finance and the minister(s) with jurisdiction over the target's business (submitted via the Bank of Japan) and undergo a screening process before acquiring shares or interests in Japanese companies operating in designated business sectors.

- Designated Sectors: These are broadly defined and cover areas deemed critical to national security, public order, public safety, or the smooth management of Japan's economy. They include obvious sectors like defense, aerospace, nuclear energy, utilities (electricity, gas, water), telecommunications, broadcasting, and transportation (rail, air, maritime), but also extend to cybersecurity, critical technologies (semiconductors, advanced materials, robotics, AI), certain software development, agriculture, fisheries, oil, and even some aspects of general manufacturing and services if related to critical supply chains or infrastructure. The list is extensive and subject to updates.

- Screening Process: After filing, there is a statutory 30-day waiting period during which the investment is prohibited. This period can be shortened (often to 2 weeks) if no concerns arise, or extended (up to 5 months) if deeper review is needed. The authorities review whether the investment poses a threat to national security or related interests. If concerns exist, they may recommend or order modification or prohibition of the investment.

- Threshold: For listed companies in designated sectors, the prior notification threshold is triggered by acquiring 1% or more of the shares or voting rights. For private companies, acquiring even one share from a non-foreign investor triggers the requirement if the target operates in a designated sector.

C. Exemptions from Prior Notification

To mitigate the burden on routine investments, exemptions are available, particularly for acquisitions of listed shares:

- General Exemption: Available for investments in companies operating only in non-designated sectors OR for investments in designated sectors if the foreign investor complies with specific exemption criteria (e.g., not seeking board seats, not proposing transfers of sensitive business lines at shareholder meetings, not accessing non-public technology information). This exemption is generally available for portfolio investors.

- Exemption for Foreign Financial Institutions: Registered financial institutions are often subject to broader exemptions, even for investments in designated sectors (including "core" designated sectors, which have stricter rules), provided they adhere to specific conditions relevant to their regulated status.

- Thresholds within Exemptions: Even when relying on exemptions, acquiring 10% or more of a listed company's shares generally requires post-facto reporting (see below), and the exemption conditions must still be met.

Crucially, determining whether a target operates in a designated sector and whether an exemption applies requires careful analysis of the target's specific business activities and the nature of the foreign investor. Relying on an exemption incorrectly can lead to penalties.

D. Post-Facto Reporting

Investments that do not require prior notification (either because they are in non-designated sectors, fall below the 1% threshold for listed companies, or qualify for and utilize an exemption) are generally subject to a post-facto reporting requirement. This report must typically be filed via the Bank of Japan within 45 days of the investment.

E. Enforcement

Failure to file required prior notifications or comply with conditions of exemptions can result in corrective orders (including divestment of acquired shares), administrative fines, and potentially criminal penalties. The authorities have the power to investigate investments even after they are completed.

The FEFTA review process, especially the potential need for prior notification and screening, must be factored into M&A timelines and deal certainty assessments for foreign buyers.

III. Key Stages and Practical Considerations in Japanese M&A

Executing an M&A transaction in Japan involves several stages, each with practical considerations.

A. Due Diligence (デューデリジェンス - Dyū Derijensu)

Thorough due diligence is critical to identify risks and confirm valuation assumptions. The typical scope includes:

- Legal DD: Reviewing corporate structure, permits/licenses, material contracts, litigation, regulatory compliance, real estate, intellectual property. Particular attention should be paid to verifying share ownership/title, proper corporate minute-keeping, and potential off-balance-sheet liabilities.

- Financial & Tax DD: Analyzing financial statements, quality of earnings, debt, working capital, tax compliance, and potential tax exposures. Japanese accounting standards and practices may differ from US GAAP/IFRS.

- Business DD: Assessing market position, customer/supplier relationships, management team, operational processes, and synergy potential.

- HR/Labor DD: Reviewing employment contracts, work rules (就業規則 - shūgyō kisoku), collective bargaining agreements, pension/retirement liabilities, working hours compliance, and potential labor disputes. Understanding Japanese labor practices and employee sentiment is vital for post-merger integration (PMI).

- ESG DD: An increasingly important area, evaluating environmental compliance/liabilities, social impacts (labor practices, human rights in supply chains), and governance structures/practices.

Practical Challenges: Accessing information can sometimes be challenging due to language barriers or cultural reluctance to share sensitive data early in the process. Building trust and utilizing bilingual advisors are key.

B. Structuring the Transaction

As outlined under the Companies Act, various structures exist. The choice involves balancing factors like:

- Tax Efficiency: Different structures (e.g., stock vs. asset deal, merger type) have varying tax implications for buyer and seller.

- Liability Assumption: Mergers and company splits generally involve automatic succession of liabilities, while asset deals allow more selective assumption (but require more complex transfers).

- Third-Party Consents: Asset deals often require numerous consents to assign contracts, unlike stock deals or mergers.

- Integration Goals: Whether the target entity needs to be maintained or fully integrated influences the choice.

C. Negotiation and Documentation

- Preliminary Agreements: Letters of Intent (LOI) or Memoranda of Understanding (MOU) (基本合意書 - kihon gōisho) are common to outline key terms and grant exclusivity, though often non-binding on price.

- Definitive Agreements: Share Purchase Agreements (SPA - 株式譲渡契約書, kabushiki jōto keiyakusho), Merger Agreements (合併契約書 - gappei keiyakusho), etc. These are detailed contracts covering:

- Representations and Warranties (表明保証 - hyōmei hoshō): Seller's statements about the target's condition, forming the basis for potential indemnification. Scope is often heavily negotiated.

- Conditions Precedent (前提条件 - zentei jōken): Conditions that must be met before closing (e.g., regulatory approvals like JFTC/FEFTA, shareholder approvals, no Material Adverse Change - MAC).

- Indemnification (補償 - hoshō): Provisions detailing how losses arising from breaches of R&W or specific identified risks will be handled post-closing (caps, baskets, survival periods are key negotiation points).

- Negotiation Style: Japanese negotiation can sometimes be perceived as less direct or confrontational than in the US. Building relationships, demonstrating long-term commitment, and understanding consensus-based decision-making within the target company can be important.

D. Approvals and Closing

This phase involves obtaining all necessary internal and external approvals (shareholders, board, JFTC, FEFTA, other regulators if applicable), fulfilling creditor protection procedures (public notices, etc.), satisfying conditions precedent, and executing the final transfer of shares, assets, or completion of the merger/split.

IV. Recent Trends and Challenges in Japanese M&A

The Japanese M&A market exhibits several notable trends and persistent challenges:

- Succession-Driven M&A: A major driver, particularly for SMEs. With a large cohort of aging owner-managers lacking successors (reportedly over 60% in some surveys), selling the business to a third party (domestic or foreign) via M&A has become a vital solution to prevent closures and preserve jobs/technology. Government initiatives also support SME M&A.

- Corporate Divestitures: Large Japanese companies continue to streamline portfolios by selling non-core subsidiaries or business units, creating opportunities for buyers seeking specific assets or market positions.

- Inbound M&A Activity: Foreign buyers remain interested in Japan due to its stable economy, skilled workforce, advanced technology, and access to Asian markets. Private equity activity has also increased.

- Corporate Governance Impact: Ongoing corporate governance reforms emphasizing shareholder returns and board independence influence M&A dynamics. Shareholder activism is increasing, sometimes pushing companies towards M&A or challenging deal terms. Boards face greater scrutiny regarding the rationale for M&A decisions and the fairness of takeover defense measures. Courts have shown willingness to scrutinize the reasonableness of defense tactics invoked against hostile bids (e.g., a principle affirmed in an Osaka High Court decision dated July 21, 2022).

- Digital Transformation (DX) M&A: Acquisitions aimed at acquiring digital capabilities, technology talent, or innovative business models are prevalent across industries.

- Key Challenges:

- Post-Merger Integration (PMI): Bridging cultural gaps, aligning management styles, integrating IT systems, and retaining key talent remain significant hurdles, especially in cross-border deals.

- Valuation Gaps: Differences in valuation expectations between buyers and sellers can impede deal closures.

- Due Diligence Complexity: Uncovering hidden liabilities or fully understanding complex business practices can be difficult.

- Regulatory Hurdles: Navigating FEFTA screening and JFTC merger reviews adds complexity and potential delays.

- Labor Relations: Managing employee expectations and integration smoothly requires careful handling.

Conclusion

Japan presents a fertile ground for M&A activity, driven by compelling economic and demographic factors. However, success requires navigating a complex legal and regulatory environment, including the specific procedures under the Companies Act, the stringent requirements of FEFTA for foreign investors, and the nuances of competition law. Thorough due diligence, careful transaction structuring, effective post-merger integration planning, and sensitivity to cultural differences are paramount. Engaging experienced local legal, financial, and business advisors early in the process is critical for US companies looking to capitalize on M&A opportunities in the sophisticated Japanese market.

- Antitrust Oversight in Japanese M&A: Understanding Merger Control and the Role of Monitoring Trustees

- Minority Shareholder Squeeze-Outs in Japan: Navigating Fairness, Procedure, and Legal Challenges

- Q: How Are Contractual Relationships Examined During Legal Due Diligence in a Japanese M&A?

- JFTC Merger Review Portal