M&A Exits for Japanese Startups: A Practical Guide for U.S. Buyers and Founders

Discover how M&A is reshaping startup exits in Japan: deal structures, due‑diligence traps, shareholder‑agreement pitfalls, and integration tips for U.S. acquirers.

TL;DR

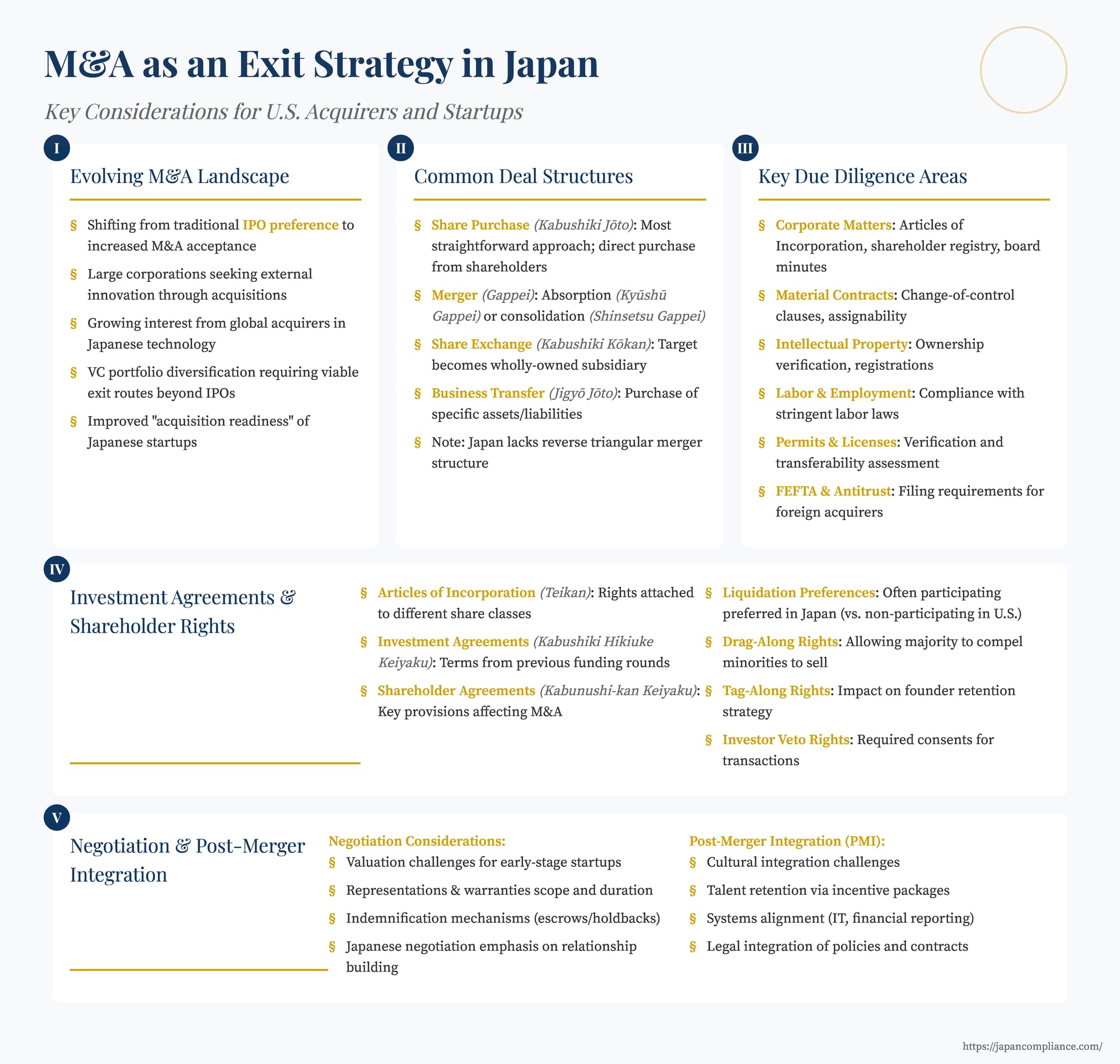

M&A has become a mainstream exit path for Japanese startups. This article explains why the market is shifting away from IPO‑only thinking, outlines the most common deal structures under Japanese law, flags the due‑diligence pitfalls U.S. acquirers face, and shows founders how to prepare for a smooth sale.

Table of Contents

- The Evolving Role of M&A in Japan's Startup Ecosystem

- Common M&A Deal Structures in Japan

- Key Legal Due Diligence Areas for Acquirers

- The Critical Role of Investment Contracts and Shareholder Agreements

- Negotiating the M&A Deal in Japan

- Post‑Merger Integration (PMI): The Key to Value Creation

- Strategic Considerations for Startups Seeking M&A

- Conclusion

While Initial Public Offerings (IPOs) often capture the headlines, Mergers and Acquisitions (M&A) represent a critically important, and increasingly utilized, exit pathway for startups in Japan. For founders and investors seeking liquidity, and for larger corporations (both domestic and international) aiming to acquire innovation and market share, understanding the nuances of the Japanese M&A landscape for startups is essential. This article explores the key considerations, deal structures, legal checkpoints, and strategic factors relevant to U.S. acquirers and Japanese startups contemplating an M&A exit, particularly those involving U.S. investors.

The Evolving Role of M&A in Japan's Startup Ecosystem

Historically, Japan's startup ecosystem exhibited a strong preference for IPOs as the primary exit route. Cultural factors sometimes led to a perception of M&A as "selling out" rather than a successful culmination of a venture. Large corporations, too, sometimes displayed a "not-invented-here" syndrome, preferring internal development over acquiring external innovation.

However, the landscape has been shifting significantly. Several factors are driving increased M&A activity involving Japanese startups:

- Search for Innovation: Large Japanese corporations are increasingly turning to M&A to acquire cutting-edge technologies, talent, and new business models developed by startups, fueling their own growth and transformation ("open innovation").

- Global Acquirer Interest: International companies, including many from the U.S., recognize the value in Japanese technology and market access, making Japanese startups attractive acquisition targets.

- VC Portfolio Management: As the venture capital market matures, VCs require viable exit routes beyond IPOs to return capital to their limited partners. M&A provides crucial liquidity options.

- Startup Readiness: Japanese startups are becoming more sophisticated in terms of corporate governance, financial reporting, and internal controls, making them more "acquisition-ready" and reducing perceived risks for potential buyers. Recent commentary suggests that earlier impediments related to target company readiness have lessened.

- Facilitating Legal Environment: The increased use of well-structured investment agreements, shareholder agreements, and different classes of shares (defining liquidation preferences, drag-along rights, etc.) has created a clearer legal framework that can facilitate smoother M&A transactions.

While IPOs remain a prominent goal, M&A is now firmly established as a vital and growing component of the Japanese startup exit ecosystem.

Common M&A Deal Structures in Japan

Several legal structures can be used to acquire a Japanese startup:

- Share Purchase (株式譲渡 - Kabushiki Jōto): This is the most straightforward and common method, especially for acquiring 100% ownership. The acquirer purchases the shares directly from the existing shareholders (founders, investors, employees). It keeps the target company's legal entity intact, which can be advantageous for preserving contracts, licenses, and employee relationships.

- Merger (合併 - Gappei):

- Absorption Merger (吸収合併 - Kyūshū Gappei): The target company is absorbed into the acquiring company and ceases to exist as a separate legal entity.

- Consolidation Merger (新設合併 - Shinsetsu Gappei): Both the acquirer and target merge into a newly created entity. This is less common. Mergers involve complex procedures under the Companies Act, including shareholder approvals and creditor protection steps.

- Share Exchange (株式交換 - Kabushiki Kōkan): The acquirer issues its own shares (or shares of its parent) to the target company's shareholders in exchange for all of the target's shares. The target company becomes a wholly owned subsidiary of the acquirer. This structure is often used when the acquirer wants to maintain the target as a separate operational entity.

- Business Transfer (事業譲渡 - Jigyō Jōto): The acquirer purchases specific assets, liabilities, contracts, and employees associated with a particular business or division of the target company, rather than the company entity itself. This allows acquirers to cherry-pick assets and avoid unwanted liabilities but can be complex regarding the transfer of individual contracts and employees (requiring consent).

Consideration:

While cash remains the most common form of consideration, stock-for-stock transactions are becoming more feasible, partly due to legal reforms facilitating share exchanges and triangular mergers (where a subsidiary of the acquirer uses parent company stock). However, challenges related to valuation, tax implications for selling shareholders, and the liquidity of the acquirer's stock (if unlisted) remain.

Note on Reverse Triangular Mergers: Unlike in the U.S., Japanese corporate law does not currently provide for a direct "reverse triangular merger" structure (where a subsidiary of the acquirer merges into the target, with the target surviving as a subsidiary of the acquirer). While its absence isn't typically a deal-breaker, it can sometimes complicate transactions, particularly if the target company holds specific licenses or permits that are difficult to transfer, requiring alternative structuring approaches.

Key Legal Due Diligence Areas for Acquirers

Conducting thorough due diligence is crucial before acquiring a Japanese startup. Beyond the standard financial, commercial, and technical reviews, legal due diligence should focus on:

- Corporate Matters: Articles of Incorporation, shareholder registry, board minutes, compliance with Companies Act procedures.

- Material Contracts: Agreements with key customers, suppliers, distributors, and partners; check for change-of-control clauses and assignability.

- Intellectual Property: Ownership verification, registration status (patents, trademarks), licensing agreements, freedom-to-operate analysis.

- Labor and Employment: Compliance with Japan's stringent labor laws (working hours, overtime pay, dismissals), employee contracts, social insurance contributions, potential unfunded pension liabilities. Employee transfers in asset deals require careful handling.

- Real Estate: Leases for office or facility space.

- Permits and Licenses: Ensuring the target holds all necessary permits for its operations and assessing their transferability.

- Litigation and Disputes: Any ongoing or potential legal conflicts.

- Data Privacy: Compliance with Japan's Act on the Protection of Personal Information (APPI).

- FEFTA Compliance: If the acquirer is foreign, confirming whether prior notification was required for any past foreign investments into the target and ensuring compliance for the acquisition itself.

- Antitrust: Assessing whether merger control filings are required with the Japan Fair Trade Commission (JFTC) based on domestic turnover thresholds.

The Critical Role of Investment Contracts and Shareholder Agreements

The terms agreed upon during previous funding rounds significantly impact M&A scenarios. Acquirers must carefully review:

- Articles of Incorporation (Teikan): Specifically, the rights attached to different classes of shares, particularly preferred shares held by investors.

- Investment Agreements (株式引受契約 - Kabushiki Hikiuke Keiyaku) and Shareholder Agreements (SHA) (株主間契約 - Kabunushi-kan Keiyaku): These contracts contain crucial provisions:

- Liquidation Preferences: As M&A transactions are often "deemed liquidation events," these clauses dictate how proceeds are distributed. Understanding whether preferred shares are participating or non-participating is vital. Japanese market practice has often leaned towards participating preferred, which means investors get their preference and share in the remaining upside with common shareholders. This differs from the more common non-participating structure in the U.S. This difference can significantly alter the payout split between investors and founders in an M&A scenario compared to an IPO (where preferred shares typically convert to common). It can sometimes lead to misalignment of interests, where investors might favor an M&A deal that guarantees their preference plus some participation, while founders might prefer an IPO even at a similar overall valuation if it offers them a larger share of the upside post-conversion.

- Drag-Along Rights: Essential for ensuring a clean exit by allowing the majority to compel minorities to sell. Acquirers usually prefer deals where drag-along rights can be effectively exercised.

- Tag-Along Rights: Allow minority investors to join a founder's sale, potentially impacting the acquirer's ability to retain key founders if not managed carefully.

- Investor Veto Rights: Investors may have consent rights over the sale of the company, requiring their approval for the deal to proceed.

Acquirers need to understand how these existing agreements affect the feasibility, structure, and economic distribution of the proposed M&A transaction.

Negotiating the M&A Deal in Japan

- Valuation: Valuing startups, especially pre-revenue ones, is inherently challenging. Bridging valuation gaps often requires creative solutions like earn-outs or performance-based consideration.

- Representations and Warranties (R&Ws): Acquirers seek comprehensive R&Ws from the sellers regarding the target's business and legal compliance. Sellers aim to limit their scope and duration. R&W insurance is becoming more common in Japan but is not yet as prevalent as in the U.S.

- Indemnification: Mechanisms for the acquirer to be compensated for breaches of R&Ws or undisclosed liabilities, often involving escrows or holdbacks.

- Cultural Nuances: Japanese negotiation often emphasizes relationship building, consensus, and indirect communication. U.S. parties should be prepared for a potentially longer negotiation process focused on establishing trust. Patience and cultural sensitivity are key.

- Closing Conditions: Standard conditions include regulatory approvals (FEFTA, antitrust), absence of material adverse changes, and accuracy of R&Ws.

Post-Merger Integration (PMI): The Key to Value Creation

Successfully integrating the acquired startup is critical for realizing the deal's strategic objectives. Key PMI challenges include:

- Cultural Integration: Merging potentially different corporate cultures, communication styles, and decision-making processes.

- Talent Retention: Retaining key founders, engineers, and other critical talent is often paramount. This requires carefully designed incentive and retention packages.

- Systems Alignment: Integrating IT systems, financial reporting, and operational processes.

- Legal Integration: Harmonizing employment policies, assigning key contracts (if necessary), and ensuring ongoing compliance.

Effective PMI requires careful planning starting before the deal closes and dedicated resources post-closing.

Strategic Considerations for Startups Seeking M&A

For startups considering M&A as an exit:

- Preparation is Crucial: Maintain clean corporate records, ensure IP is properly secured, have audited financials (if possible), and resolve any outstanding legal or compliance issues. Being "acquisition-ready" enhances value and deal certainty.

- Strategic Positioning: Understand what potential acquirers are looking for and position the company accordingly.

- Advisor Selection: Engage experienced M&A advisors (investment banks, legal counsel) familiar with the startup sector and potentially cross-border transactions.

- Founder Roles: Founders should consider their desired role (or departure) post-acquisition early in the process, as this is a key negotiation point for acquirers.

Conclusion

M&A has firmly cemented its place alongside IPOs as a primary exit strategy for Japanese startups. The ecosystem has matured, with both domestic and international acquirers actively seeking opportunities, and startups becoming better prepared for the acquisition process. While navigating Japanese corporate law, deal structures, and cultural nuances requires careful attention, particularly in cross-border transactions, M&A offers a powerful route for achieving liquidity for shareholders and accelerating growth through strategic consolidation. For U.S. acquirers, understanding the specific legal landscape, including the impact of existing investment agreements and the preference for participating preferred shares, is key to structuring and executing successful acquisitions in this dynamic market. Similarly, Japanese startups engaging with potential U.S. buyers benefit from understanding U.S. market expectations and preparing accordingly. With careful planning and expert advice, M&A can be a highly effective strategic tool for both buyers and sellers in Japan's vibrant innovation economy.

- M&A in Japan: Key Corporate Governance Considerations for US Acquirers or Targets

- How Does Japan's Anti‑Monopoly Act Impact M&A Transactions?

- Director Liability in Japan: A Case Study Involving Attorney Directors and M&A

- Guidelines for Corporate Takeovers — Ministry of Economy, Trade and Industry

- Guidelines to Application of the Antimonopoly Act Concerning Review of Business Combination — Japan Fair Trade Commission