Key Changes in Japan's 2023 Premiums and Representations Act Revision

TL;DR

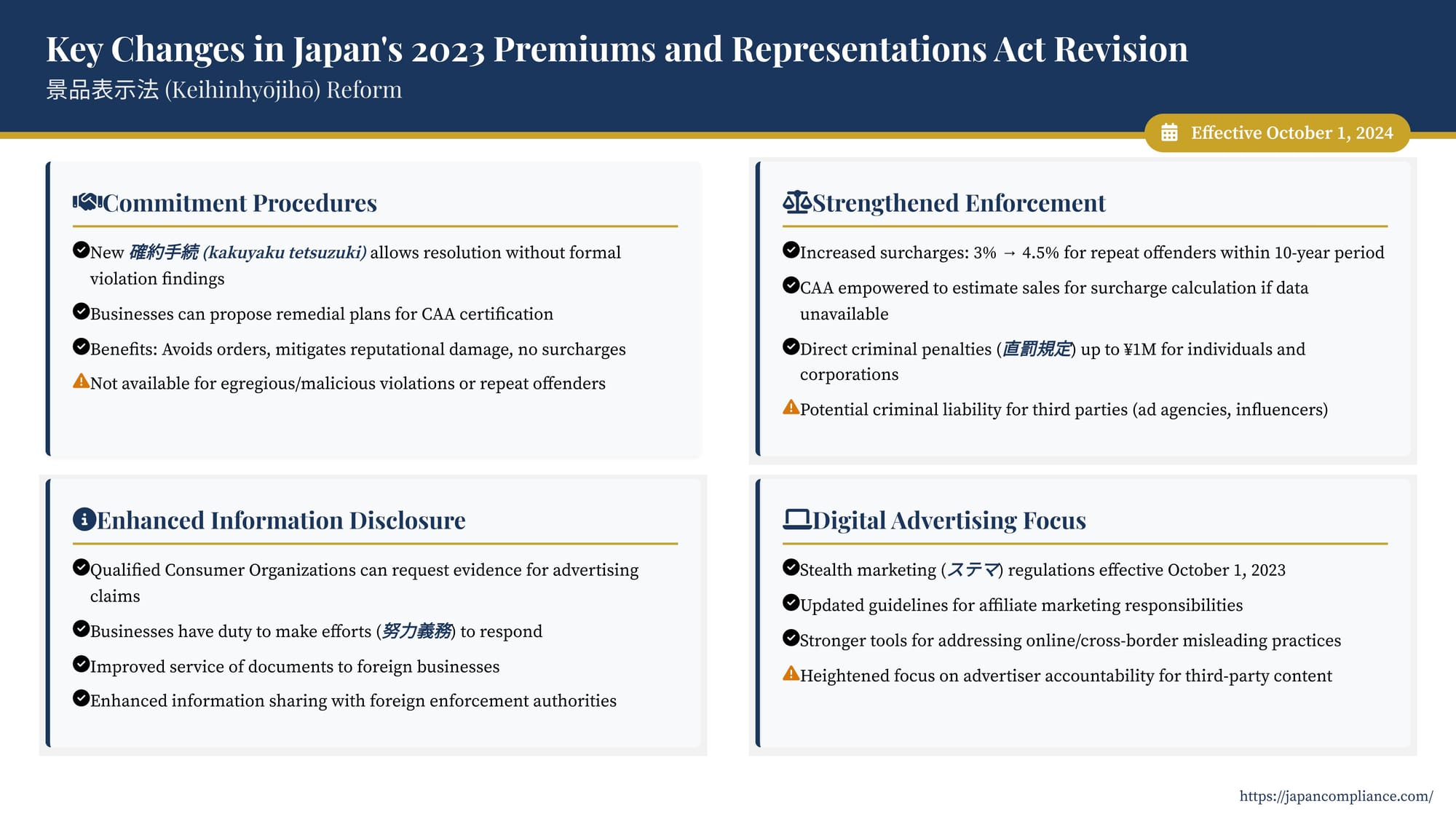

- Japan’s 2023 amendments to the Premiums and Representations Act (effective 1 Oct 2024) introduce a voluntary commitment procedure that lets companies avoid cease-and-desist and surcharge orders if a remedial plan is approved and fully executed.

- Repeat offenders face a higher surcharge rate of 4.5 % (up from 3 %) and turnover can be estimated, while intentional egregious misrepresentations now carry direct criminal fines of up to JPY 1 million for both companies and responsible individuals.

- New provisions grant qualified consumer groups the right to demand disclosure of substantiation data, expand international cooperation, and tighten oversight of digital advertising—especially stealth marketing and affiliate promotions.

Table of Contents

- Introduction of Commitment Procedures

- Strengthened Enforcement: Surcharges and Penalties

- Enhanced Information Disclosure and Cooperation

- Continued Focus on Digital Advertising

- Key Takeaways for Businesses

Japan's Act against Unjustifiable Premiums and Misleading Representations (Act No. 134 of 1962, commonly known as 景品表示法 - Keihin Hyōji Hō or Keihyōhō) stands as the cornerstone of regulating advertising and marketing practices to protect consumers. Enacted to prevent businesses from unfairly luring customers with excessive giveaways (premiums) or deceptive information (misleading representations), the Act plays a crucial role in maintaining fair competition and ensuring consumers can make informed choices.

Recognizing the evolving marketplace, particularly the rapid expansion of e-commerce and digital advertising, the Japanese Diet enacted significant amendments to the Keihyōhō in May 2023 (Act No. 29 of 2023). These revisions, primarily effective from October 1, 2024, aim to bolster consumer protection by enhancing regulatory tools, increasing deterrence against violations, and promoting voluntary compliance among businesses. For international companies operating or marketing in Japan, understanding these changes is vital for navigating the regulatory landscape effectively.

This article provides an overview of the key amendments introduced by the 2023 revision, focusing on their potential impact on businesses.

1. Introduction of Commitment Procedures (確約手続 - Kakuyaku Tetsuzuki)

Perhaps the most significant procedural change is the introduction of a "commitment procedure" system, mirroring similar mechanisms found in competition law regimes globally (such as EU/Japan antitrust commitment procedures or, conceptually, US FTC consent orders).

What are Commitment Procedures?

This system allows the Consumer Affairs Agency (CAA), the primary enforcement body, to resolve suspected Keihyōhō violations without issuing formal administrative orders (like cease-and-desist orders - 措置命令, souchi meirei, or surcharge payment orders - 課徴金納付命令, kachōkin nōfu meirei).

The process typically unfolds as follows:

- CAA Investigation & Notification: If the CAA suspects a violation (related to premiums or misleading representations) after initiating an investigation, it can notify the business of the suspected conduct and the relevant legal provisions. Crucially, this notification explicitly informs the business of the option to apply for the commitment procedure. This step occurs before a formal finding of violation.

- Business Application: The notified business can then voluntarily propose a "Commitment Plan" (確約計画 - kakuyaku keikaku) to the CAA. This plan must outline specific measures the business will take to cease the suspected violation and rectify its potential impact (e.g., correcting misleading ads, notifying consumers, implementing robust compliance programs).

- CAA Certification: The CAA reviews the proposed plan. If it deems the plan sufficient to address the suspected violation and its effects, and considers it likely to be implemented reliably, the CAA can certify the Commitment Plan (確約認定 - kakuyaku nintei).

- Resolution without Orders: Upon certification, the CAA will not issue cease-and-desist or surcharge payment orders regarding the specific conduct covered by the certified plan, provided the business adheres to the plan.

Scope and Limitations:

This procedure offers a path for businesses to resolve issues collaboratively and potentially more swiftly than through formal administrative proceedings. However, it's not available in all cases. The CAA retains discretion and is expected to exclude certain cases, particularly:

- Egregious or malicious violations, such as representations made with prior knowledge of their falsity.

- Repeat offenders who have previously been subject to Keihyōhō orders.

Implications for Businesses:

- Potential Benefits: Avoidance of formal violation findings, potentially mitigating reputational damage associated with public cease-and-desist orders. Avoidance of potentially hefty surcharges. Opportunity to proactively shape remedial measures.

- Considerations: Requires acknowledging the CAA's concerns and proactively developing a sufficient corrective plan. The certified plan and the company's identity are typically made public by the CAA, although the CAA has stated it will clarify that no formal violation was found. Failure to implement the certified plan can lead to its revocation and the resumption of formal enforcement procedures, including potential orders.

The introduction of commitment procedures adds a significant strategic dimension for companies facing Keihyōhō scrutiny, potentially allowing for more efficient resolutions but requiring careful consideration of the terms and public disclosure involved. The first application of this procedure was announced in early 2025, involving measures like a board resolution against recurrence, consumer notification, enhanced compliance, and partial refunds.

2. Strengthened Enforcement: Surcharges and Penalties

The 2023 revision significantly ramps up the financial consequences for violations, aiming to enhance deterrence.

Increased Surcharges for Repeat Offenses (課徴金の割増 - Kachōkin no Warimashi)

The Keihyōhō already includes an administrative surcharge system (課徴金制度 - kachōkin seido) applicable to specific types of misleading representations: superior misrepresentations (優良誤認表示 - yūryō gonin hyōji, misleading quality/standards) and advantageous misrepresentations (有利誤認表示 - yūri gonin hyōji, misleading price/transaction terms). The standard surcharge is calculated as 3% of the sales revenue generated from the goods or services related to the violation during the violation period (up to a maximum of 3 years).

The revision introduces a harsher penalty for recidivism. If a business receives a surcharge payment order and has previously received another surcharge payment order within the preceding 10 years (calculated from a specific "reference date" such as the start of the investigation), the surcharge rate for the subsequent violation is increased by 1.5 times, from 3% to 4.5% of the relevant sales. This targets businesses that fail to implement effective compliance measures after an initial sanction.

Sales Estimation for Surcharge Calculation (売上額の推計 - Uriage-gaku no Suikei)

Calculating the surcharge requires determining the relevant sales figures during the violation period. Previously, if a business failed to submit or retain adequate sales data upon request, it could sometimes hinder the CAA's ability to calculate and impose a surcharge.

The revision empowers the CAA to estimate the relevant sales figures for periods where data necessary for calculation cannot be ascertained (e.g., due to the business's failure to report upon request). While the specific methods for estimation will be detailed in subordinate regulations, this provision aims to prevent businesses from escaping surcharges due to poor record-keeping or non-cooperation, ensuring the surcharge system's effectiveness.

Introduction of Direct Criminal Penalties (直罰規定 - Chokubatsu Kitei)

A major development is the introduction of direct criminal penalties for certain violations. Previously, criminal liability under the Keihyōhō primarily arose only if a business failed to comply with a formal cease-and-desist order (an indirect penalty).

The revised Act now establishes direct criminal liability for engaging in superior misrepresentations (Article 5, Item 1) or advantageous misrepresentations (Article 5, Item 2). Individuals responsible can face fines of up to JPY 1 million. Furthermore, corporations can also be fined up to JPY 1 million under joint penalty provisions (両罰規定 - ryōbatsu kitei).

This "direct penalty" means that for particularly egregious cases (likely involving intentional deception), criminal prosecution can occur without the prerequisite of a prior administrative order. While the monetary amount might seem modest compared to potential surcharges, the stigma and consequences associated with a criminal conviction (even if resulting in only a fine) are significant in Japan.

Importantly, legal experts anticipate that third parties involved in creating or disseminating the misrepresentation, such as advertising agencies or potentially influencers, could potentially face criminal liability as accomplices (共犯 - kyōhan), even if they are not the direct supplier of the goods/services. This significantly broadens the scope of potential liability related to misleading advertising.

3. Enhanced Information Disclosure and Cooperation

The revision also includes measures aimed at improving transparency and facilitating enforcement, both domestically and internationally.

Disclosure Requests by Qualified Consumer Organizations (適格消費者団体による開示要請 - Tekikaku Shōhisha Dantai ni yoru Kaiji Yōsei)

Qualified Consumer Organizations (QCOs), which are certified non-profits authorized under the Consumer Contract Act to bring injunction actions against businesses for unfair practices, gain a new tool. Under specific circumstances where a QCO suspects a business is making superior misrepresentations (misleading quality claims) lacking a reasonable basis, the QCO can now request the business to disclose the supporting evidence or data (裏付けとなる合理的な根拠を示す資料 - urazuke to naru gōriteki na konkyo o shimesu shiryō).

While the business is only under a "duty to make efforts" (努力義務 - doryoku gimu) to comply with such a request, failure to provide a reasonable basis upon request could potentially be viewed negatively by the CAA or courts if subsequent enforcement actions or litigation arise. This mechanism aims to empower consumer groups to scrutinize potentially misleading quality claims more effectively.

International Enforcement Cooperation

Reflecting the rise of cross-border e-commerce and international marketing campaigns, the revision incorporates provisions to enhance international cooperation. These include:

- Improved Service of Documents: Streamlined procedures for serving documents like cease-and-desist orders on businesses located outside Japan (送達制度の整備 - sōtatsu seido no seibi).

- Information Sharing: Explicit provisions allowing the CAA to provide information to foreign enforcement authorities to aid in their investigations or enforcement actions concerning practices affecting Japanese consumers (外国執行当局に対する情報提供制度 - gaikoku shikkō tōkyoku ni taisuru jōhō teikyō seido).

These changes signal Japan's intent to address misleading practices originating from abroad more effectively and to participate more actively in global consumer protection networks.

4. Continued Focus on Digital Advertising

While the 2023 revision itself doesn't introduce sweeping new rules specifically targeting only digital advertising (reflecting a principle of regulating conduct regardless of medium), it operates within a context of increased regulatory focus on the online sphere. Notably:

- Stealth Marketing (ステマ - Sutema) Regulation: Just prior to the revision discussions, the CAA designated "representations that are difficult for general consumers to identify as being the Business Operator's Representation" as a prohibited misleading representation under Article 5, Item 3, effective October 1, 2023. While not subject to the new direct criminal penalties (which apply only to Article 5, Items 1 & 2), this targets undisclosed advertising or paid endorsements often prevalent online.

- Affiliate Marketing Guidelines: Updated guidelines clarify advertisers' responsibilities for representations made by affiliates.

The 2023 revisions, particularly the potential application of criminal accomplice liability and the enhanced international cooperation framework, provide the CAA with stronger tools to address misleading digital advertising practices, even those involving complex international structures or third-party marketers.

5. Key Takeaways for Businesses

The 2023 revision of Japan's Act against Unjustifiable Premiums and Misleading Representations introduces significant changes that businesses, including US companies active in the Japanese market, must understand:

- Increased Enforcement Tools: The CAA now has a broader toolkit, including commitment procedures for negotiated resolutions and direct criminal penalties for severe violations.

- Higher Financial Stakes: The risk of substantial surcharges is heightened, especially for repeat offenders. The ability of the CAA to estimate sales figures reduces the chance of escaping surcharges due to missing data.

- Emphasis on Substantiation: Businesses must ensure they have a reasonable, objective basis for all advertising claims, particularly those related to quality or performance, and be prepared to disclose supporting materials if requested by QCOs or the CAA.

- Digital Compliance is Crucial: While the law remains media-neutral, the practical application and recent regulatory actions (like the stealth marketing notice) highlight the need for careful management of online advertising, affiliate programs, and influencer marketing to ensure transparency and accuracy.

- International Reach: Businesses operating cross-border should be aware of the CAA's enhanced capabilities for extraterritorial enforcement and cooperation with foreign counterparts.

The revised Keihyōhō signals a clear move towards stricter enforcement and greater accountability in advertising and marketing. Proactive compliance, robust internal controls, and a clear understanding of the updated rules are essential for navigating this evolving regulatory environment in Japan.

- “Sutema” No More: Understanding Japan's Stealth-Marketing Regulations

- Antitrust Alert: Lessons from Japan's Fisheries Cooperative Case on Exclusive Dealing

- Data Flows Between Japan and the EU: Navigating the GDPR Adequacy Decision

- Consumer Affairs Agency – Q&A on Commitment Procedures (Japanese)

- Consumer Affairs Agency – Stealth-Marketing Notice (Japanese)