Japan’s New M&A Playbook: How METI’s 2023 Takeover Guidelines Reshape Deals and Defences

TL;DR

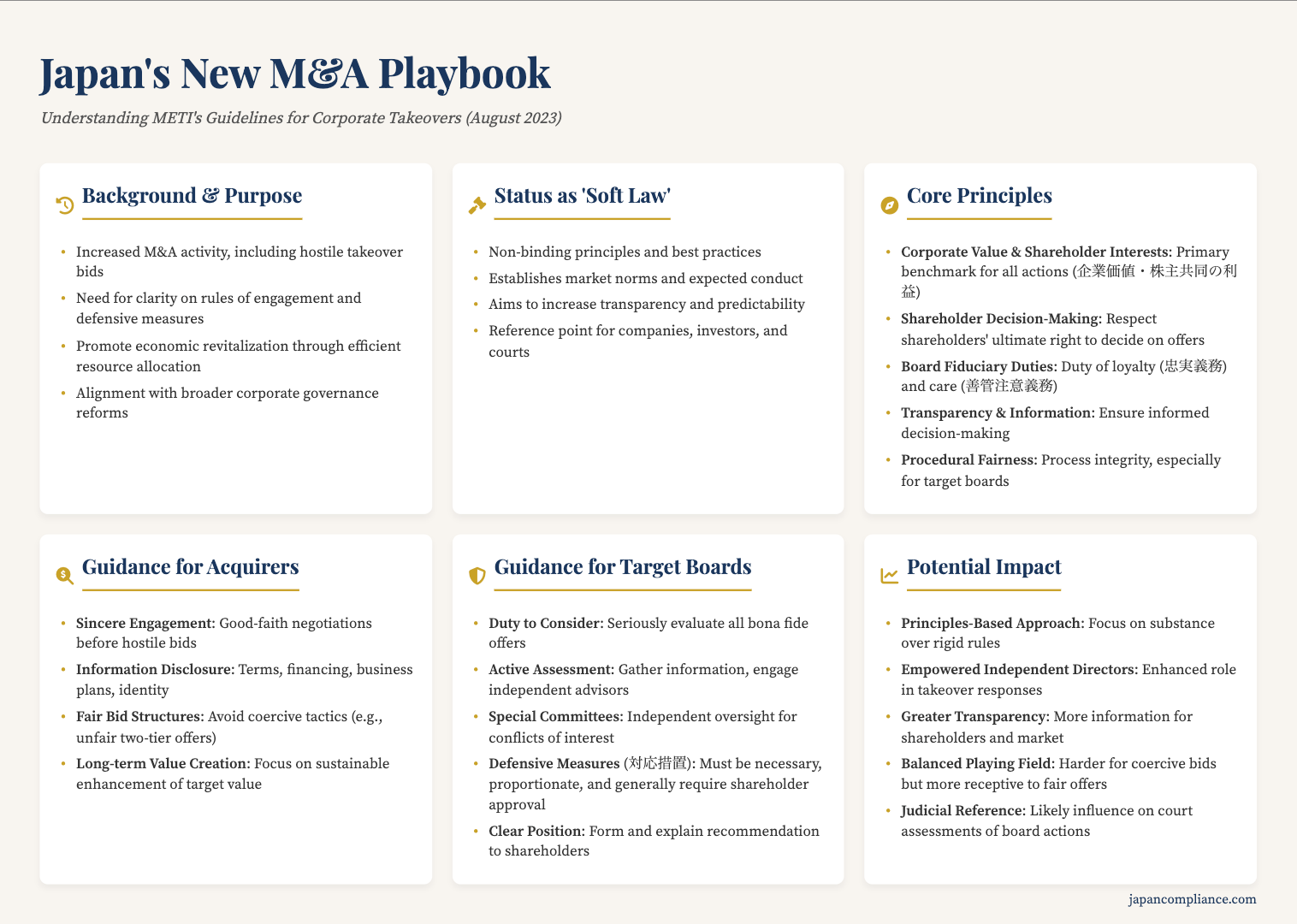

- METI’s August 2023 “Guidelines for Corporate Takeovers” introduce soft-law principles that prioritise corporate value and shareholder common interests.

- Boards must evaluate hostile bids seriously, disclose rationale, control conflicts via independent committees and seek shareholder approval before deploying defences.

- Bidders must engage transparently and avoid coercive structures; courts are likely to benchmark conduct against these principles going forward.

Table of Contents

- Background: Why New Guidelines Now?

- Status and Purpose of the Guidelines

- Core Principles Underlying the Guidelines

- Key Guidance for Acquirers and Target Boards

- Potential Impact and Considerations

- Conclusion

Mergers and acquisitions (M&A) are increasingly vital tools for corporate growth, restructuring, and revitalization in Japan. Recent years have seen a rise in M&A activity, including a noticeable increase in unsolicited or "hostile" takeover bids, sparking debates about fair rules of engagement and the role of defensive measures. Against this backdrop, Japan's Ministry of Economy, Trade and Industry (METI) released its highly anticipated "Guidelines for Corporate Takeovers - Enhancing Corporate Value and Securing Shareholders' Interests" (企業買収における行動指針―企業価値の向上と株主利益の確保に向けて) on August 31, 2023. These Guidelines represent a significant development aiming to shape a fairer and more value-enhancing M&A environment in Japan.

Background: Why New Guidelines Now?

The release of the Guidelines reflects several converging trends and objectives:

- Increased M&A Activity: Both friendly and hostile M&A deals have become more common as Japanese companies seek growth opportunities and face pressure to restructure.

- Debates on Takeover Practices: Concerns existed regarding practices employed by both bidders (e.g., coercive tactics) and target companies (e.g., opaque use of "poison pill" defensive measures).

- Economic Revitalization: Promoting efficient allocation of corporate resources through value-enhancing M&A is seen as key to boosting Japan's economic competitiveness.

- Alignment with Governance Reforms: The Guidelines build upon Japan's broader corporate governance reforms, including the principles outlined in the Corporate Governance Code and the Stewardship Code, emphasizing shareholder interests and board accountability.

Status and Purpose of the Guidelines

It is crucial to understand that the METI Takeover Guidelines are not legally binding statutes or regulations. They are considered "soft law" – principles and best practices intended to establish market norms and guide the conduct of parties involved in corporate takeovers.

Their primary purpose is to present a framework that fosters M&A contributing positively to "corporate value" (企業価値, kigyō kachi) and the "common interests of shareholders" (株主共同の利益, kabunushi kyōdō no rieki). The Guidelines aim to:

- Increase transparency and predictability in takeover situations.

- Ensure fair procedures for both bidders and target companies.

- Clarify the expected roles and fiduciary duties of target company boards.

- Establish principles for the appropriate use (or non-use) of defensive measures.

- Ultimately, encourage M&A activities that genuinely enhance long-term corporate value for the benefit of shareholders and the broader economy.

Despite being soft law, the Guidelines are expected to be highly influential. Companies, investors, financial and legal advisors, and potentially courts are likely to refer to them when structuring deals, formulating responses, evaluating conduct, and resolving disputes.

Core Principles Underlying the Guidelines

Several fundamental principles permeate the Guidelines:

- Primacy of Corporate Value and Shareholder Common Interests: This is the central benchmark. All actions by bidders and target boards should ultimately be judged against whether they enhance or detract from corporate value and the shared interests of shareholders. "Corporate value" is conceived broadly, encompassing future cash flows and considering various stakeholders (employees, communities), but with a primary focus on sustainable economic value accruing to shareholders over the long term. "Shareholder common interests" emphasizes fairness and equal treatment among shareholders, particularly protecting minority shareholders from coercion or disadvantage.

- Respect for Shareholder Decision-Making: As the owners of the company, shareholders generally have the ultimate right to decide whether to accept a takeover offer and sell their shares. Board actions should aim to facilitate an informed decision by shareholders, not unduly obstruct it.

- Board's Fiduciary Duties: The Guidelines explicitly connect board actions during takeovers to their fundamental fiduciary duties owed to the company under the Japanese Company Act – the duty of loyalty (chūjitsu gimu) and the duty of care of a prudent manager (zenkan chūi gimu). This means boards must act in good faith and make decisions reasonably believed to be in the best interests of enhancing corporate value and shareholder common interests.

- Importance of Transparency and Information: Informed decisions require adequate information. The Guidelines stress the need for sufficient disclosure from both the bidder (regarding its plans, financing, identity, etc.) and the target board (regarding its assessment of the bid, its rationale for recommending acceptance or rejection, potential conflicts of interest, and details of any defensive measures).

- Emphasis on Procedural Fairness: The process by which decisions are made is critical. The Guidelines emphasize the need for fair procedures, especially by the target board. This includes ensuring sufficient time for deliberation, obtaining independent expert advice (financial, legal), managing conflicts of interest effectively (particularly through independent committees), and providing shareholders adequate time and information to consider the offer.

Key Guidance for Acquirers and Target Boards

The Guidelines provide specific expectations for the main parties involved:

For Acquirers/Bidders:

- Sincere Engagement: Encouraged to attempt good-faith negotiations with the target board before launching an unsolicited or hostile bid.

- Information Disclosure: Expected to provide clear, detailed information about the offer terms, financing sources, post-acquisition business plans, intentions regarding employees and other stakeholders, and the identity of the ultimate acquirer.

- Fair Bid Structures: Discourages coercive bid structures, such as certain types of two-tier offers that pressure shareholders into tendering early out of fear of receiving less valuable consideration later.

For Target Company Boards:

- Duty to Seriously Consider Offers: Boards cannot dismiss a bona fide takeover proposal out of hand. They have a duty to sincerely evaluate its potential impact.

- Active Information Gathering & Assessment: Must actively seek necessary information from the bidder and other sources to thoroughly assess the bid's potential effects on corporate value and shareholder common interests. Engaging independent financial and legal advisors is often crucial.

- Good-Faith Negotiation: If a bid appears potentially beneficial or could be improved through negotiation, the board has a duty to engage constructively with the bidder.

- Forming a Position & Recommendation: Must carefully deliberate and form a clear opinion on the bid (e.g., support, opposition, neutrality) and clearly explain the rationale behind its recommendation to shareholders. Simply remaining passive or neutral without explanation is discouraged.

- Managing Conflicts of Interest (Special Committees): In situations with potential conflicts of interest – such as Management Buyouts (MBOs) or bids involving major shareholders or management members – the Guidelines strongly recommend establishing a Special Committee composed of independent directors to oversee the evaluation, negotiation, and recommendation process to ensure fairness.

- Responding to Bids (Including Defense): The board's response must be based on protecting corporate value and shareholder common interests. Defensive measures (対抗措置, taikō sochi) are viewed critically and should only be considered if the bid itself poses a clear threat to these interests (e.g., is coercive, significantly undervalues the company, threatens insolvency, or facilitates illegal activity). Any defensive measure must be necessary and proportionate to the threat, and crucially, should generally be subject to shareholder approval, ideally requiring a majority of the minority shareholders (excluding the bidder and potentially management) to endorse it. Pre-emptive "poison pills" adopted without shareholder approval are strongly discouraged.

Potential Impact and Considerations

The METI Guidelines, while formally non-binding, are poised to significantly shape Japan's M&A environment:

- Shift to Principles-Based Approach: They move away from rigid rules (especially regarding defenses) towards flexible principles requiring boards to exercise careful judgment and justify their actions based on substance, particularly the impact on corporate value and shareholder common interests.

- Enhanced Role for Independent Directors: The emphasis on independent evaluation and the recommendation to use Special Committees significantly empowers independent outside directors in overseeing takeover responses.

- Increased Transparency: The focus on information disclosure by both sides aims to make the takeover process more transparent for shareholders and the market.

- Potential Impact on Hostile Bids: The Guidelines likely make it harder for bidders to succeed with poorly explained, coercive, or clearly inadequate offers. Conversely, well-structured bids offering fair value, presented transparently and engaging sincerely with the target, might find a more receptive environment or at least a process focused on substantive evaluation rather than automatic defense.

- Guidance for Courts: Courts are expected to consider the Guidelines as a key reference point when assessing the reasonableness of board actions in takeover-related litigation, such as legal challenges to defensive measures.

- Promoting Dialogue: By setting clearer expectations for all parties, the Guidelines aim to foster more constructive dialogue between bidders, target boards, and shareholders.

Conclusion

METI's 2023 Guidelines for Corporate Takeovers mark a sophisticated effort to modernize Japan's M&A landscape. By centering the process around the enhancement of corporate value and shareholder common interests, clarifying board duties, and demanding procedural fairness and transparency, they aim to foster a market where takeovers genuinely contribute to economic efficiency and growth. While their "soft law" nature means direct legal enforcement is limited, their practical influence on corporate behavior, investor expectations, and potentially judicial interpretation is expected to be substantial. For US companies and investors engaging in or contemplating M&A involving Japanese companies, a thorough understanding of these new principles is now indispensable for navigating deals successfully and managing associated risks.

- Director Liability and Corporate Donations in Japan: Balancing Philanthropy and Fiduciary Duty

- Shareholder Activism in Japan: The Rise of Derivative Lawsuits and Director Liability

- Lessons from a Japanese Conglomerate Delisting: Governance Failures, Activist Battles & Take-Private Exit

- METI – Guidelines for Corporate Takeovers (Japanese PDF)

- FSA Corporate Governance Code – 2021 Revision (PDF)