Investor View: Japan’s 2023 Takeover Guidelines and the New Activism Playbook

TL;DR

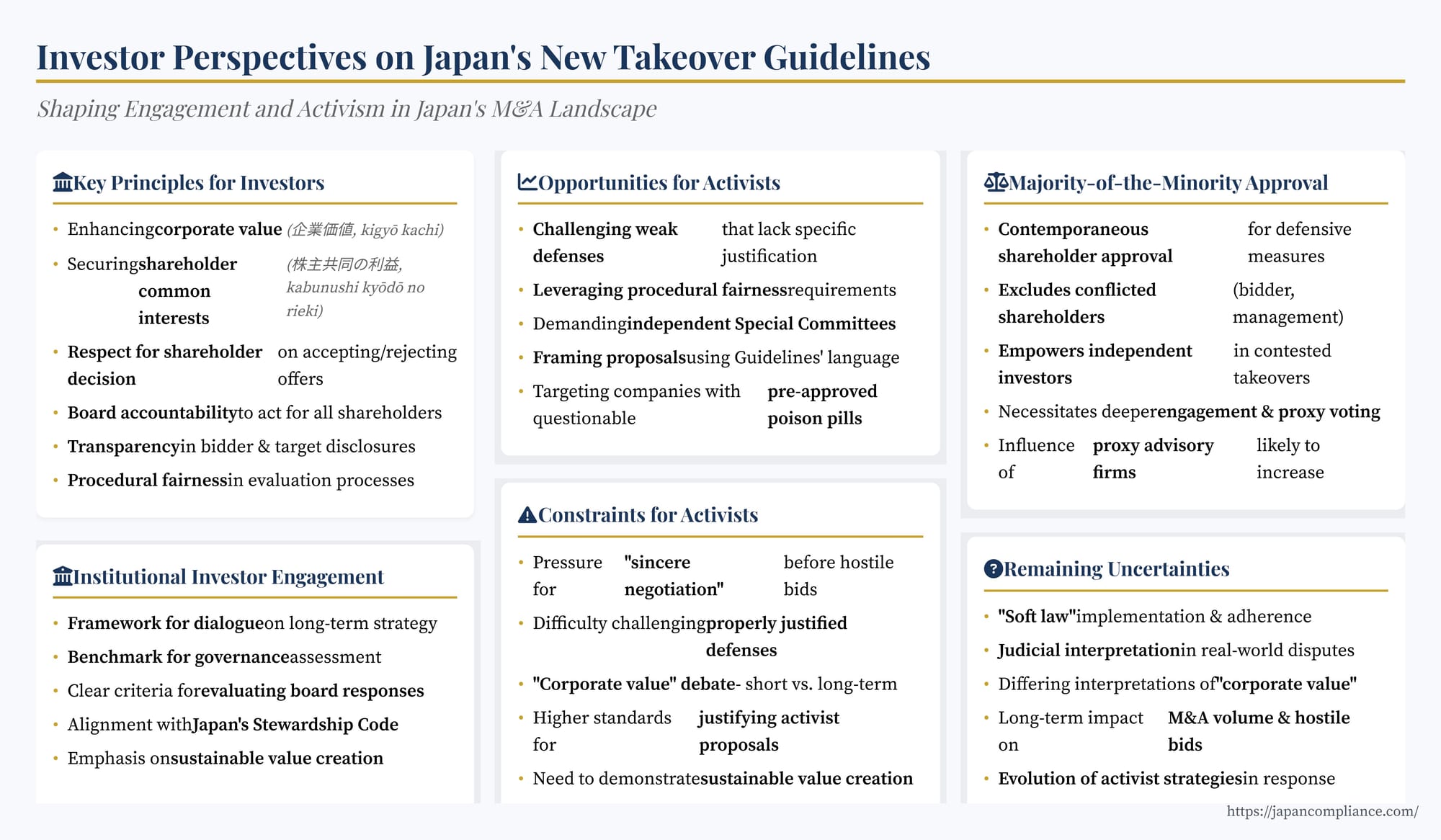

- METI’s 2023 takeover guidelines boost investor leverage by demanding transparent board processes and majority-of-the-minority (MoM) approval for key defences.

- Institutional investors gain clearer benchmarks for stewardship engagement, while activists can challenge weak boards but must show good-faith negotiations.

- Shareholder votes on defences will hinge on independent investors, making engagement and proxy strategies more critical than ever.

Table of Contents

- Setting the Stage: Corporate Value and Shareholder Interests

- Impact on Shareholder Engagement (Especially Institutional Investors)

- Reshaping the Landscape for Activist Investors

- The Power Shift: Majority-of-the-Minority (MoM) Approval

- Uncertainties Remain

- Conclusion

Japan's M&A landscape entered a new phase with the release of the Ministry of Economy, Trade and Industry's (METI) "Guidelines for Corporate Takeovers" in August 2023. Aimed at fostering value-enhancing transactions and ensuring fairer rules of engagement, these non-binding guidelines carry significant weight for all market participants. For investors – ranging from long-term domestic and international institutions to increasingly prominent activist funds – the Guidelines present both opportunities and new considerations, potentially reshaping shareholder engagement and the dynamics of takeover battles in Japan.

Setting the Stage: Corporate Value and Shareholder Interests

At the heart of the Guidelines lies a dual focus: enhancing "corporate value" (企業価値, kigyō kachi) and securing the "common interests of shareholders" (株主共同の利益, kabunushi kyōdō no rieki). This framing resonates positively with most investors, whose primary objective is typically long-term value creation and fair treatment. By establishing these principles as the benchmark for evaluating both takeover bids and board responses, the Guidelines provide investors with a clearer framework for assessing corporate actions.

Key principles particularly relevant to investors include:

- Respect for Shareholder Decision: Affirming that the ultimate decision to accept or reject a takeover offer generally lies with the shareholders.

- Board Accountability: Emphasizing the board's fiduciary duties to act in the best interests of corporate value and all shareholders, not just management or specific factions.

- Transparency: Calling for increased disclosure from both bidders and target boards to facilitate informed shareholder judgment.

- Procedural Fairness: Stressing the importance of objective evaluation processes, often involving independent committees, especially in conflict-of-interest situations.

Impact on Shareholder Engagement (Especially Institutional Investors)

The Guidelines are likely to influence how institutional investors engage with Japanese portfolio companies, particularly those adhering to Japan's Stewardship Code which encourages purposeful dialogue to enhance corporate value.

- A Framework for Dialogue: The emphasis on corporate value encourages boards to better articulate their long-term strategies and how they plan to achieve sustainable growth. This provides institutional investors with a more substantive basis for engaging with management and boards on strategy, capital allocation, and preparedness for potential M&A scenarios.

- Benchmark for Governance Assessment: Investors can use the Guidelines as a checklist to assess a company's governance practices related to M&A readiness. Does the board have sufficient independent directors? Are procedures in place for handling unsolicited offers? Is there a clear understanding of fiduciary duties in a takeover context? Engagement might focus on encouraging alignment with the Guidelines' best practices.

- Evaluating Board Responses to Bids: When a takeover bid occurs, the Guidelines provide institutional investors with clearer criteria for evaluating the board's response. If the board recommends rejecting an offer, investors can scrutinize whether the rationale genuinely reflects a higher standalone value or strategic plan, or if it appears driven by entrenchment, using the "corporate value / shareholder common interests" standard. Conversely, if the board supports a bid, investors can assess whether the process (e.g., use of a special committee, fairness opinion) met the Guidelines' standards for procedural fairness.

Reshaping the Landscape for Activist Investors

Activist investors, who seek to influence corporate strategy or governance often through acquiring significant stakes, may find the Guidelines impact their activities in several ways:

Potential Opportunities for Activists:

- Challenging Weak Defenses: The Guidelines significantly raise the bar for justifying defensive measures. Boards can no longer rely easily on pre-approved "poison pills" without specific, compelling reasons tied to protecting corporate value from a particular harmful bid, ideally backed by a majority-of-the-minority (MoM) shareholder vote. This makes companies with weak performance or governance, previously shielded by defenses, potentially more vulnerable to activist campaigns advocating for operational changes, asset sales, or a sale of the company itself. Activists can challenge defenses that appear designed primarily for managerial entrenchment, arguing they violate the Guidelines' principles.

- Leveraging Procedural Fairness: Activists can use the Guidelines' emphasis on fair process to hold boards accountable. They can demand the formation of independent Special Committees to evaluate bids or strategic alternatives, challenge potential conflicts of interest among directors, and insist on adequate information disclosure and sufficient time for shareholder consideration, potentially using litigation or proxy contests if boards fall short.

- Framing Activist Proposals: Activists seeking to acquire a company or push for its sale can strategically frame their proposals using the language of the Guidelines, arguing their plan offers superior "corporate value" or better serves "shareholder common interests" compared to management's strategy or resistance.

Potential Constraints and Considerations for Activists:

- Pressure for "Sincere Negotiation": The Guidelines encourage bidders to attempt good-faith negotiations before launching hostile bids. Activists pursuing unsolicited offers might face market or judicial criticism if they are perceived as having skipped reasonable attempts at dialogue.

- Justifying Opposition to "Justified" Defenses: While defenses are harder to implement, if a target board does successfully justify a defensive measure under the Guidelines' criteria (e.g., demonstrating a bid is coercive or clearly undervalues the company and secures MoM shareholder approval), activists challenging that defense will face a significant hurdle. They would need strong arguments to counter the board's justification and the demonstrated shareholder support.

- The "Corporate Value" Debate: The focus on long-term, sustainable corporate value could potentially be used by target boards to counter activist proposals viewed as prioritizing short-term financial gains over the company's broader, long-term health. However, the Guidelines primarily frame value in economic terms beneficial to shareholders, potentially limiting the effectiveness of purely "stakeholder-centric" arguments against financially compelling offers.

The Power Shift: Majority-of-the-Minority (MoM) Approval

A standout feature of the Guidelines is the strong recommendation that significant defensive measures require contemporaneous shareholder approval, ideally by a majority of the minority (MoM) vote. This mechanism excludes shareholders with clear conflicts of interest (the bidder, potentially management) from the vote, empowering independent shareholders.

- Investor Influence: This significantly increases the influence of institutional investors (both domestic and foreign) and retail investors in deciding whether a defense is warranted. Their collective decision becomes paramount.

- Engagement & Proxy Voting: It necessitates deeper engagement by institutional investors to analyze the specifics of the bid and the proposed defense against the Guidelines' principles. Proxy advisory firms will likely incorporate the Guidelines into their voting recommendations, further influencing institutional votes. The outcome of MoM votes will become crucial battlegrounds in contested takeovers.

Uncertainties Remain

Despite the clarity the Guidelines aim to provide, some areas remain subject to interpretation and future development:

- Practical Implementation: As "soft law," the degree to which companies voluntarily adhere and how consistently courts interpret the principles in real-world disputes will shape their ultimate impact.

- Defining Key Concepts: While defined, "corporate value" and "shareholder common interests" can still be interpreted differently in complex situations, leading to disagreements.

- Market Dynamics: The long-term effect on M&A volume, the prevalence of hostile bids versus negotiated deals, and the evolution of activist strategies in response are yet to be fully seen.

Conclusion

METI's 2023 Takeover Guidelines provide investors with a significantly enhanced framework for navigating the Japanese M&A market. By prioritizing corporate value and shareholder common interests, demanding greater board accountability and procedural fairness, and critically scrutinizing defensive measures (especially through the MoM mechanism), the Guidelines empower shareholders, particularly independent ones. For institutional investors, they offer clearer benchmarks for engagement and voting decisions. For activists, they present both new avenues to challenge entrenched management and higher standards for justifying their own actions. While uncertainties remain regarding implementation and interpretation, the Guidelines undeniably aim to foster a more transparent, fair, and ultimately value-driven M&A environment, requiring all investors active in Japan to adapt their strategies and expectations accordingly.

- Japan’s New M&A Playbook: How METI’s 2023 Takeover Guidelines Reshape Deals and Defences

- Rethinking Defensive Measures: Hostile Takeovers Under Japan’s 2023 METI Guidelines

- Navigating the Deal: Board Duties Under Japan’s 2023 METI Takeover Guidelines

- METI – Guidelines for Corporate Takeovers (Japanese PDF)

- FSA Corporate Governance Code – 2021 Revision (PDF)