Initial Public Offerings (IPOs) in Japan: Strategies for U.S. Companies & Investors

TL;DR

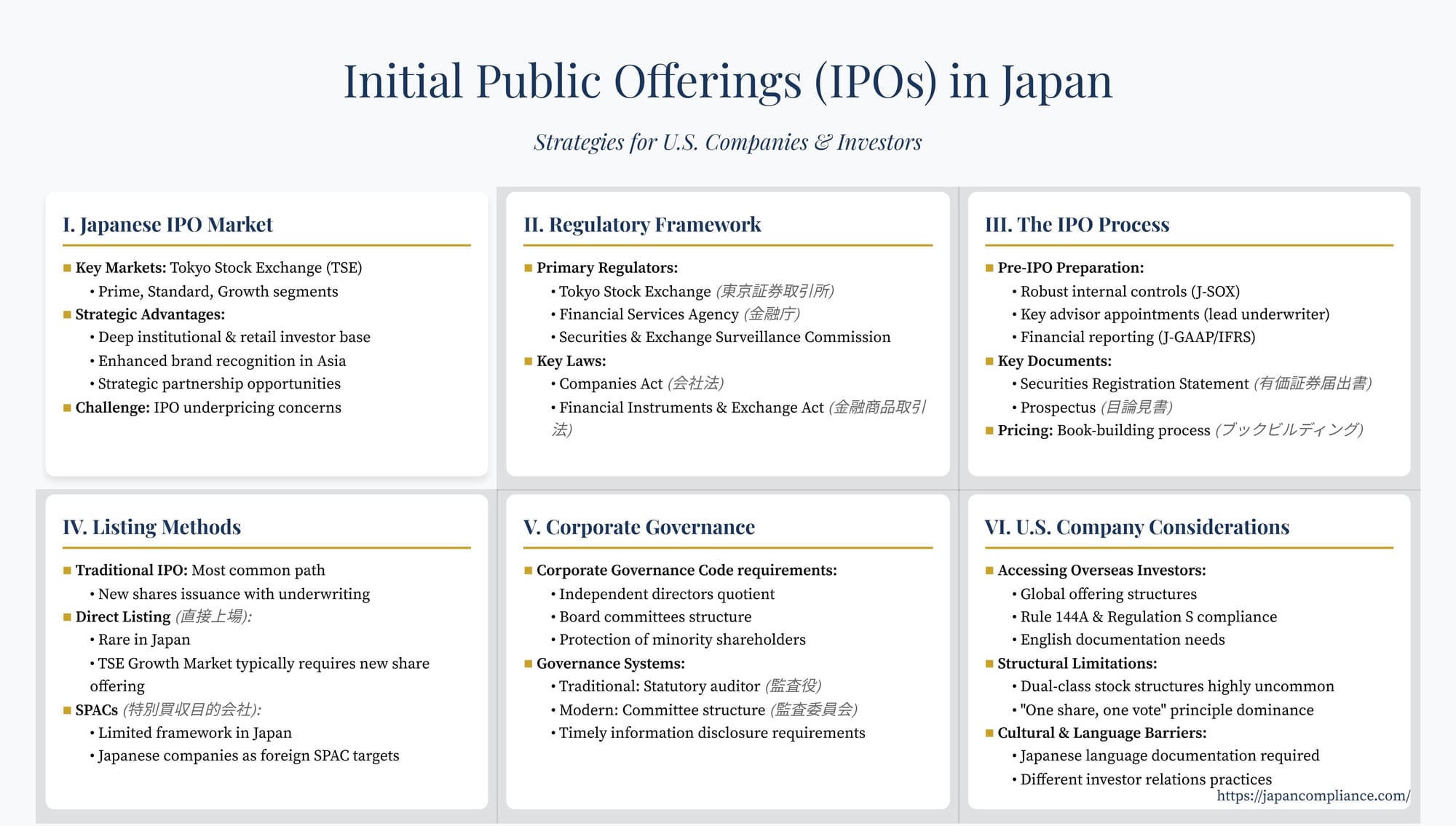

A Japanese IPO grants access to deep capital, brand prestige, and strategic partners—yet demands rigorous governance, J-SOX readiness, and mastery of TSE/FIEA rules. This guide maps the full journey: pre-IPO cleanup, TSE examination, book-building price tactics, alternative listing routes, and post-listing duties—equipping U.S. issuers and investors to capture upside while avoiding underpricing and governance pitfalls.

Table of Contents

- Why Consider a Japanese IPO?

- Key Regulatory Bodies and Legal Framework

- The IPO Process in Japan: A Step-by-Step Approach

3.1 Pre-IPO Preparations

3.2 Application & Examination by the TSE

3.3 Disclosure Documents

3.4 Pricing Process & Underpricing - Listing Methods: Beyond the Traditional IPO

4.1 Traditional IPO

4.2 Direct Listing (Chokusetsu Jōjō)

4.3 SPACs in Japan - Corporate Governance Post-IPO

- Special Considerations for U.S. Companies & Investors

- Recent Trends and Future Outlook

- Conclusion: Charting a Course for a Successful Japanese IPO

Japan, a global economic powerhouse, offers a robust and increasingly dynamic market for Initial Public Offerings (IPOs). For U.S. companies considering an expansion of their capital-raising horizons, or for investors looking to tap into Japanese innovation, understanding the intricacies of Japan's IPO landscape is essential. This guide provides a strategic overview of the Japanese IPO process, key regulatory frameworks, listing methods, and crucial considerations for U.S.-based entities.

Why Consider a Japanese IPO?

Launching an IPO on a Japanese exchange, such as the Tokyo Stock Exchange (TSE) with its Prime, Standard, and Growth markets, can offer several strategic advantages:

- Access to a Deep Investor Pool: Japan boasts a significant base of institutional and retail investors, providing a fresh source of capital.

- Enhanced Brand Recognition: Listing in Japan can significantly elevate a company's profile and credibility within the Japanese and broader Asian markets.

- Liquidity and Valuation: A public listing provides liquidity for existing shareholders and can lead to favorable valuations, particularly for companies with strong growth prospects in Asia.

- Strategic Partnerships: An IPO in Japan can facilitate strategic alliances and business development opportunities with Japanese corporations.

However, the Japanese IPO market also presents unique challenges, including a rigorous examination process, specific corporate governance expectations, and the ongoing issue of IPO underpricing.

Key Regulatory Bodies and Legal Framework

Navigating a Japanese IPO involves interacting with several key entities and adhering to a specific legal framework:

- Tokyo Stock Exchange (TSE) (東京証券取引所 - Tōkyō Shōken Torihikijo): The primary marketplace for IPOs in Japan. The TSE sets and enforces listing rules and conducts the examination of IPO candidates.

- Financial Services Agency (FSA) (金融庁 - Kin'yū-chō): The main financial regulator in Japan, overseeing securities markets and financial institutions.

- Securities and Exchange Surveillance Commission (SESC) (証券取引等監視委員会 - Shōken Torihiki-tō Kanshi Iinkai): Responsible for ensuring compliance with securities laws and investigating market misconduct.

- Companies Act (会社法 - Kaisha-hō): Governs the incorporation, governance, and operations of Japanese companies.

- Financial Instruments and Exchange Act (FIEA) (金融商品取引法 - Kin'yū Shōhin Torihiki-hō): The principal legislation regulating securities offerings, disclosure requirements, and market trading.

The IPO Process in Japan: A Step-by-Step Approach

The path to an IPO in Japan is a meticulous process that typically spans several years.

1. Pre-IPO Preparations: Laying the Groundwork

This is the most critical and time-consuming phase. Key activities include:

- Internal Controls and Corporate Governance: Establishing robust internal control systems (J-SOX compliance is a major focus), enhancing corporate governance structures to meet listed company standards (e.g., appointment of independent directors, establishment of audit committees or an audit & supervisory board).

- Appointing Key Advisors:

- Lead Underwriter (主幹事証券会社 - Shukanji Shōken Gaisha): Plays a central role in guiding the company through the IPO process, managing the offering, and conducting due diligence.

- Auditor (監査法人 - Kansa Hōjin): Required to audit financial statements for the past two fiscal years. Continuity of the same audit firm is generally preferred.

- Legal Counsel: To advise on legal compliance, due diligence, and drafting of offering documents.

- Financial Reporting: Ensuring financial statements are prepared in accordance with Japanese GAAP (J-GAAP) or, if permitted and appropriate, IFRS. U.S. GAAP reconciliation might be necessary for U.S. reporting purposes but J-GAAP or IFRS is primary for the Japanese listing.

- Capital Structure Reorganization: Simplifying the capital structure, often involving the conversion of preferred shares to common stock. This conversion timing can be a point of negotiation, as it's often required relatively early in the formal IPO process, potentially before the IPO is fully assured, posing risks for early investors if the IPO is delayed or aborted.

2. Application and Examination by the TSE

Once preparations are well underway, the company, through its lead underwriter, applies for listing on the desired TSE market segment. The TSE then conducts a rigorous examination focusing on:

- Formal Listing Criteria: Quantitative requirements related to shareholder numbers, tradable share volume and value, market capitalization, and years in business. These vary by market segment (Prime, Standard, Growth).

- Substantive Listing Criteria: Qualitative aspects such as the company’s business viability and growth potential, corporate governance effectiveness, compliance systems, and appropriateness of information disclosure.

3. Disclosure Documents

Comprehensive disclosure is required under the FIEA:

- Securities Registration Statement (有価証券届出書 - Yūka Shōken Todokede-sho): Filed with the Kanto Local Finance Bureau (acting for the FSA). This document contains detailed information about the company, its business, financial condition, risk factors, and the offering.

- Prospectus (目論見書 - Mokuromisho): Distributed to potential investors, largely based on the information in the Securities Registration Statement.

- English Documentation: For offerings involving overseas investors, an English-language Offering Circular is typically prepared, especially when marketing to U.S. qualified institutional buyers (QIBs) under Rule 144A or to non-U.S. persons under Regulation S of the U.S. Securities Act.

4. The Pricing Process and Addressing Underpricing

The offer price in a Japanese IPO is typically determined through a book-building (ブックビルディング - bukku birudingu) process:

- The lead underwriter, after discussions with the issuer and based on pre-marketing to institutional investors (including "information meetings" and "pre-deal research reports" while navigating pre-solicitation regulations), sets a provisional price range.

- Institutional and retail investors then submit indications of interest within this range.

- Based on the demand, the final offer price is determined.

IPO underpricing (where the initial trading price is significantly higher than the offer price) has been a persistent concern in Japan. This suggests that companies may be leaving significant capital on the table. Efforts to mitigate this include:

- More flexible application of the provisional price range.

- Encouraging greater participation by sophisticated overseas institutional investors who can contribute to more accurate price discovery. The role of cornerstone investors (anchor investors who commit to subscribing for shares pre-IPO, with their participation disclosed) is a relatively new but growing practice aimed at improving pricing and signaling market confidence.

- Shortening the period between pricing and the listing date to reduce market risk exposure.

Listing Methods: Beyond the Traditional IPO

While the traditional underwritten IPO remains the dominant method, alternative routes are subjects of ongoing discussion and development.

Traditional IPO

This is the most common path, involving the issuance of new shares (and/or sale of existing shares) underwritten by securities firms. It provides capital for the company and a structured market entry.

Direct Listing (直接上場 - Chokusetsu Jōjō)

In a Direct Listing, a company’s existing shares are listed on an exchange without a traditional underwritten offering of new shares to raise capital. This method has gained traction in the U.S. as a way to potentially achieve fairer pricing and avoid underwriter fees and lock-up periods.

- Status in Japan: Direct Listings are rare in Japan. A notable historical example occurred in 1999 on the TSE Second Section. A key challenge is that the TSE Growth Market, popular with startups, generally requires an offering of new shares at the time of listing to ensure a certain level of liquidity and to fund further growth. This requirement makes a pure Direct Listing (without a concurrent capital raise) difficult on this segment. Discussions on adapting rules for Direct Listings are ongoing, but it's not yet a common pathway.

Special Purpose Acquisition Companies (SPACs) (特別買収目的会社 - Tokubetsu Baishū Mokuteki Kaisha)

SPACs are shell companies that raise capital through an IPO with the purpose of acquiring an existing private company, thereby taking the target public (a "de-SPAC" transaction).

- Status in Japan: While SPACs have seen surges in popularity in the U.S. and other markets, Japan has been cautious. As of late 2022, a dedicated framework for domestic Japanese SPAC IPOs had not been fully established, although the TSE has been exploring possibilities. Japanese companies have, however, become targets for foreign-listed SPACs, achieving a public listing through a de-SPAC transaction on an overseas exchange. The primary attraction of a SPAC route is often the perceived speed and price certainty compared to a traditional IPO, though this is also subject to market conditions and regulatory scrutiny.

Corporate Governance Post-IPO: Meeting Japanese Standards

Listing on a Japanese exchange brings significant ongoing corporate governance obligations, largely guided by Japan's Corporate Governance Code. Key expectations include:

- Independent Directors: A certain number/proportion of independent outside directors on the board.

- Board Committees: While Japan traditionally used a statutory auditor (監査役 - kansayaku) system, many listed companies are transitioning to a structure with an audit committee (監査委員会 - kansa iinkai), nomination committee, and compensation committee, particularly larger companies on the Prime Market.

- Shareholder Rights: Ensuring fair treatment of all shareholders, including minority shareholders.

- Information Disclosure: Timely and accurate disclosure of material information in Japanese.

U.S. companies or those with strong U.S. influence must adapt their governance practices to align with these Japanese standards.

Special Considerations for U.S. Companies and Investors

Accessing Overseas Investors in a Japanese IPO

To enhance valuation and aftermarket performance, many Japanese IPOs actively seek participation from international institutional investors. This typically involves:

- Global Offering Structure: Allocating a portion of the shares for sale to investors outside Japan.

- Compliance with International Regulations: Adhering to rules like Rule 144A (for QIBs in the U.S.) and Regulation S (for non-U.S. offerings) under the U.S. Securities Act.

- English Documentation: Preparing an English Offering Circular.

- Targeted Roadshows: Marketing efforts in key international financial centers.

An alternative, less intensive method known as the "old temporary report method" (旧臨時報告書方式 - kyū rinji hōkokusho hōshiki) allows for sales to certain overseas institutional investors (excluding the U.S. QIB market) without a full English prospectus, relying primarily on Japanese disclosure documents, though this limits the investor pool.

Dual-Class Stock Structures

U.S. tech companies often utilize dual-class stock structures to allow founders to retain control post-IPO. In Japan, this is highly uncommon and faces significant hurdles. The TSE is generally restrictive, prioritizing the principle of "one share, one vote." While a notable robotics and cybernetics company (Cyberdyne) did list with a form of multiple voting rights, it was subject to very stringent conditions, including sunset clauses, and has remained an exceptional case rather than a precedent that opened the floodgates. Companies accustomed to dual-class structures in the U.S. will find this a significant difference in Japan.

Language and Cultural Aspects

All official documentation for a TSE listing must be in Japanese. Ongoing investor relations and shareholder communications will also primarily be in Japanese. Navigating cultural differences in business practices and communication styles is crucial for a smooth IPO process and successful post-IPO life.

Financial Reporting Standards

While IFRS adoption is increasing among Japanese listed companies, J-GAAP remains prevalent. Companies preparing for a Japanese IPO need to ensure their financial reporting can meet J-GAAP or IFRS requirements. U.S. companies using U.S. GAAP will need to assess the conversion or reconciliation efforts involved.

Recent Trends and Future Outlook

The Japanese government is actively promoting the startup ecosystem and looking for ways to make its capital markets more attractive. This includes initiatives to:

- Streamline listing procedures.

- Review regulations to foster innovation.

- Encourage investment into growth companies.

- Discussions around diversifying listing methods continue, although significant shifts from the traditional IPO model are gradual.

The focus on improving IPO price discovery and enhancing corporate governance is likely to continue shaping the market.

Conclusion: Charting a Course for a Successful Japanese IPO

An IPO in Japan can be a transformative event for a company, offering access to new capital, enhanced visibility, and strategic growth opportunities. However, it requires meticulous preparation, a deep understanding of the local regulatory and market environment, and careful navigation of its unique aspects, from pricing mechanisms to corporate governance norms. For U.S. companies and investors, a Japanese IPO is a significant undertaking that, with the right strategy and expert guidance, can unlock substantial value and pave the way for long-term success in one of the world's leading economies.

- Going Public in Japan: IPO vs. Direct Listing vs. SPAC – Choosing Your Path

- Holding Issuers Accountable: Liability for Financial Misstatements Under Japanese Law

- Expanding Horizons: A Legal Framework for U.S. Investment in Japanese Startups and IPOs

- Overview of Revision Proposals for the Financial Instruments and Exchange Act — Financial Services Agency (FSA)