"Inherit All" Wills and Estate Debts: Impact on Legally Reserved Portion Claims in Japan

Date of Judgment: March 24, 2009 (Heisei 21)

Case: Supreme Court of Japan, Third Petty Bench, Case No. Heisei 19 (Ju) No. 1548 (Claim for Co-ownership Share Transfer Registration Procedure)

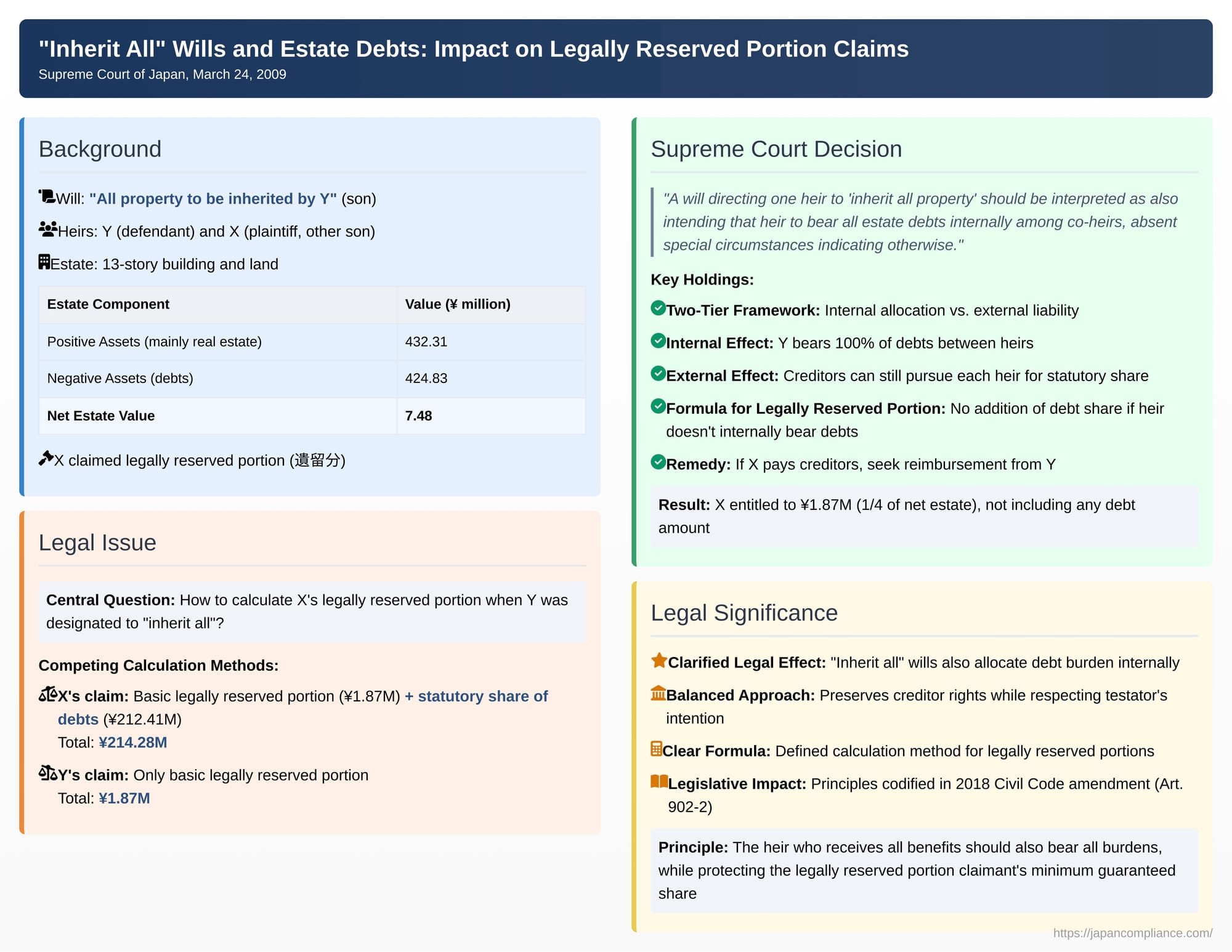

When a testator in Japan uses a common testamentary phrase such as "I have [a specific heir] inherit all my property" (財産全部を相続させる - zaisan zenbu o sōzoku saseru), it raises crucial questions about the treatment of the deceased's debts. Does the designated heir also automatically assume all estate debts, at least as far as the internal relationship between co-heirs is concerned? And how does this allocation of debts affect the calculation of the legally reserved portion (遺留分 - iryūbun) for other heirs who might have been largely disinherited by such a will? The Supreme Court of Japan provided significant clarification on these interconnected issues in its decision on March 24, 2009.

Facts of the Case: An "Inherit All" Will, Substantial Debts, and a Legally Reserved Portion Claim

The dispute arose from the estate of A, who passed away on November 14, 2003.

- The Testator and Heirs: A's legal heirs were his two children, X (the plaintiff/appellant) and Y (the defendant/appellee).

- The Will: On July 23, 2003, A had executed a formal notarized will (the "Will"). The key provision of this Will stated that A's entire estate was "to be inherited by Y."

- Composition of the Estate: At the time of A's death, his estate consisted of:

- Positive Assets: Valued at approximately ¥432.31 million, the vast majority of which was comprised of real estate (a 13-story building and its land) valued at around ¥427 million.

- Negative Assets (Debts): A also had substantial debts totaling approximately ¥424.83 million.

This left a relatively small net positive value for the estate, around ¥7.48 million.

- Effect of the Will: In accordance with established case law regarding "相続させる" (to have inherit) wills, all rights to A's entire estate were deemed to have passed directly and immediately to Y upon A's death.

- X's Claim for Legally Reserved Portion: On April 4, 2004, X, being largely disinherited by the Will, formally notified Y of his intention to claim his legally reserved portion (遺留分減殺請求権 - iryūbun gensai seikyūken). The legally reserved portion is a share of the estate guaranteed by law to certain close relatives (like children), even if a will attempts to give them less. Y subsequently completed the inheritance registration for the real estate in his sole name in May 2004.

- The Lawsuit and the Core Dispute: X filed a lawsuit against Y, seeking the transfer of a co-ownership share in the inherited real estate, corresponding to the value of his infringed legally reserved portion. Y expressed an intention to satisfy X's claim, if valid, by a monetary payment (価額弁償 - kagaku benshō) rather than by transferring a physical share of the property.

The central legal battle revolved around the method of calculating the value of X's infringed legally reserved portion, particularly concerning the treatment of A's substantial debts:- X's Argument (Add Statutory Share of Debts): X argued that A's divisible debts were, by law, automatically divided and inherited by both him and Y according to their statutory inheritance shares (which would be 1/2 each, as they were A's two children). Based on this, X asserted that his legally reserved portion infringement should be calculated as follows:

- X's basic legally reserved portion is 1/4 of the net value of the estate (A's total statutory share would be 1/2, and the legally reserved portion for a child is half of their statutory share, so 1/2 * 1/2 = 1/4 of the total estate to be considered for iryūbun). This amounted to approximately ¥1.87 million (¥7.48 million / 4).

- To this ¥1.87 million, X claimed that his statutory share of A's inherited debts (1/2 of approx. ¥424.83 million = approx. ¥212.41 million) must be added. X contended that this addition was necessary because he remained externally liable to A's creditors for this amount.

Thus, X claimed his total infringed legally reserved portion was approximately ¥214.28 million.

- Y's Argument (No Addition of Debts for X): Y argued that the Will, by directing Y to "inherit all property," also implicitly meant that Y would bear all of A's debts, at least in terms of the internal relationship between X and Y. Therefore, X had no internal burden of estate debts that should be factored into the legally reserved portion calculation by way of addition. Consequently, Y asserted that X's legally reserved portion infringement was simply 1/4 of the net estate value (approx. ¥1.87 million).

- X's Argument (Add Statutory Share of Debts): X argued that A's divisible debts were, by law, automatically divided and inherited by both him and Y according to their statutory inheritance shares (which would be 1/2 each, as they were A's two children). Based on this, X asserted that his legally reserved portion infringement should be calculated as follows:

- Lower Court Rulings: Both the Fukuoka District Court (first instance) and the Fukuoka High Court (on appeal) largely adopted Y's method of calculation. They awarded X approximately ¥1.87 million (or a corresponding property share if Y failed to make the monetary payment). Their reasoning was that a will directing one heir "to inherit all property" should be interpreted as a designation of inheritance shares (100% to Y, 0% to X) and also as a designation of the method of estate division. They held that while external estate creditors could still pursue each heir for repayment of debts according to their statutory shares, internally between the co-heirs X and Y, the estate debts should be considered to have been succeeded to by Y in accordance with his 100% designated share of the assets. Thus, X was deemed to bear no internal burden of A's debts, and no amount for debts should be added to his legally reserved portion calculation.

- X's Appeal to the Supreme Court: X, significantly disadvantaged by this calculation, appealed to the Supreme Court.

The Supreme Court's Decision: Debts Follow Assets Internally

The Supreme Court dismissed X's appeal, thereby affirming the lower courts' approach to the calculation of the legally reserved portion in this context.

The Court laid down key principles regarding the effect of an "inherit all" will on the allocation of estate debts and the subsequent calculation of legally reserved portions:

I. Effect of an "Inherit All Property to One Heir" Will on the Allocation of Estate Debts Among Co-Heirs:

- When a will directs that one specific heir is "to inherit all property" (which effectively designates that heir's share of the estate as 100%), it should generally be interpreted that the testator also intended for that designated heir to inherit all of the estate debts, at least as far as the internal relationship between the co-heirs is concerned. This interpretation applies unless there are special circumstances clearly indicating a contrary intention in the will or surrounding context (e.g., if the will explicitly states that debts are to be shared differently or borne by another).

- This means that, internally among the co-heirs, the heir designated to receive all assets (Y, in this case) is also deemed to have succeeded to all of the estate debts in accordance with their 100% designated share of the positive assets.

- Effect on External Estate Creditors: However, this internal allocation of debt burdens based on the will's designation does not, by itself, bind the estate creditors. Creditors were not parties to the will and their rights to pursue repayment are generally governed by statutory rules.

- Each co-heir (including X) remains liable to the estate creditors for the repayment of the deceased's debts up to the extent of their statutory inheritance share of those debts. An heir cannot use the internal debt allocation stipulated or implied by the will as a defense against a creditor who demands repayment based on statutory shares.

- Nevertheless, the Court also acknowledged that estate creditors may choose to recognize the will's designation of debt responsibility. If they do so, they can demand payment from the heirs according to the shares and responsibilities outlined or implied in the will (e.g., a creditor could choose to pursue Y for the full amount of a debt, recognizing Y as the designated successor to all debts).

II. Calculating Legally Reserved Portion Infringement When Debts are Internally Allocated to One Heir:

- The Supreme Court referenced its prior decision (Heisei 8.11.26 - November 26, 1996) for the general formula used in calculating the monetary value of an infringed legally reserved portion. This formula generally is:

Value of Legally Reserved Portion Infringement = Amount of Legally Reserved Portion (calculated based on net assets plus certain lifetime gifts) – Value of Assets Actually Inherited by the Claimant + Amount of Estate Debts to be Borne by the Claimant. - The Court emphasized that the purpose of this calculation is to determine the net value of the estate that the legally reserved portion claimant should ultimately recover to satisfy their guaranteed minimum share.

- Therefore, when a will directs one heir to inherit all assets, and this is interpreted (as per Point I above) to mean that this designated heir also internally succeeds to all of the estate debts, then in calculating another heir's (X's) legally reserved portion infringement:

- It is NOT permissible to add that other heir's (X's) statutory share of the estate debts to their basic legally reserved portion amount. This is because, under the internal allocation established by the will, that other heir (X) effectively bears no portion of the estate debts.

- If the Legally Reserved Portion Claimant (X) is Compelled by an Estate Creditor to Pay a Portion of an Estate Debt: What if an estate creditor, exercising their right to claim against any heir based on statutory shares, forces X to pay a part of A's debts? The Supreme Court clarified that even in such a scenario, X cannot add the amount of the debt they were forced to pay to their legally reserved portion infringement claim against Y.

- Instead, X's remedy for having paid a debt that was internally Y's responsibility (according to the will) is to seek reimbursement (求償 - kyūshō) from Y (the heir who was designated by the will to bear all debts internally).

Application to the Present Case:

- The Supreme Court found no "special circumstances" in A's Will or the surrounding facts to suggest that A did not intend for Y (the recipient of all assets) to also bear all of A's debts internally.

- Therefore, as between X and Y, all of A's estate debts were deemed to have been succeeded to by Y. X, for the purposes of their internal relationship and the calculation of his iryūbun against Y, was considered to bear no share of these debts.

- Consequently, in calculating X's legally reserved portion infringement, there was no amount of "inherited debt to be borne by X" that could be added to X's basic legally reserved portion (which was 1/4 of the net estate). The lower courts' calculation, limiting X's claim to approximately ¥1.87 million, was thus upheld.

Legal Principles and Significance

This 2009 Supreme Court decision provides crucial clarifications regarding the interplay of "相続させる" (to have inherit) wills, the allocation of estate debts, and the calculation of legally reserved portions:

- Dual Framework for Debt Liability with "Inherit All" Wills: The judgment establishes a two-tier understanding of debt liability:

- Internal Allocation (Among Co-Heirs): When a will directs all assets to one heir, it is generally presumed that the testator also intended for that heir to bear all estate debts internally. Other heirs are, as between themselves and the designated heir, relieved of the debt burden.

- External Liability (Towards Estate Creditors): This internal allocation does not bind estate creditors. Creditors retain the right to seek repayment from any of the co-heirs up to their respective statutory inheritance shares of the debt. However, creditors also have the option to accept the will's internal allocation and pursue the heir designated to receive all assets (and thus bear all debts).

- Nature of "相続させる" Wills Confirmed: The decision implicitly confirms the understanding from previous Supreme Court rulings (e.g., Heisei 3.4.19) that a will "to have a specific heir inherit" specific property (or all property) acts as both a designation of inheritance shares and a designation of the method of estate division, leading to direct and immediate succession by the named heir at the time of the testator's death.

- Significant Impact on Legally Reserved Portion (Iryūbun) Calculations: This ruling has a direct and significant impact on how the "plus inherited debt" component of the iryūbun infringement formula is applied. If an heir is deemed to be internally relieved of their share of estate debts by the terms or interpretation of a will, they cannot then add their statutory share of those debts to their iryūbun claim against the heir who received the bulk of the assets. Their recourse, if they are nonetheless forced by an external creditor to pay a portion of those debts, is a separate claim for reimbursement against the heir who was internally designated to bear those debts.

- Consistency with Principles of Divisible Debts (for Creditor Claims): While establishing the internal allocation, the ruling also implicitly upholds the general principle (from cases like Showa 34.6.19) that, for the purpose of creditor claims, divisible estate debts are considered to be divided among heirs according to their statutory shares. This is why creditors can still pursue any heir for their statutory portion.

- Foundation for Subsequent Legislative Codification (Civil Code Article 902-2): The principles regarding the internal and external effects of a testator's designation of inheritance shares concerning debts, as articulated in this 2009 Supreme Court judgment, were influential and largely codified in the 2018 amendments to the Japanese Civil Code through the introduction of the new Article 902-2. This article now provides a clearer statutory basis for how such designations affect co-heirs internally versus how they affect estate creditors. The PDF commentary discusses some of the theoretical debates surrounding whether a testator truly "disposes" of debts or merely directs their internal allocation, a discussion that Article 902-2 now helps to settle by statute.

- Aiming for Substantive Fairness: The overall outcome is designed to achieve a form of substantive fairness. The heir who receives all the benefits of the estate (Y) is also, at least internally, made to bear all of its burdens (the debts). The legally reserved portion claimant (X) is guaranteed their minimum share of the net estate value, and if they are compelled to pay estate debts to external creditors, they have a right of recourse against the heir who was designated to carry those debts.

Conclusion

The Supreme Court's 2009 decision provides essential clarity on the complex issue of estate debt allocation when a will directs the entirety of an estate to a single heir using the "相続させる" (to have inherit) formulation. It establishes that while estate creditors can still pursue any heir based on their statutory share of debts, the internal relationship among co-heirs is governed by the testator's (explicit or implied) designation of who should bear those debts – typically the heir who receives all the assets. This internal allocation then directly influences the calculation of any legally reserved portion claims, preventing an heir who is internally shielded from debts from artificially inflating their iryūbun claim by adding a notional debt burden. This judgment, now supported by subsequent legislative changes, plays a critical role in ensuring a more predictable and equitable resolution of such inheritance scenarios.