Mandatory Human-Capital Disclosure in Japan: FIEA Rules, Labor-Law Metrics & Strategic Risks for US Companies

TL;DR

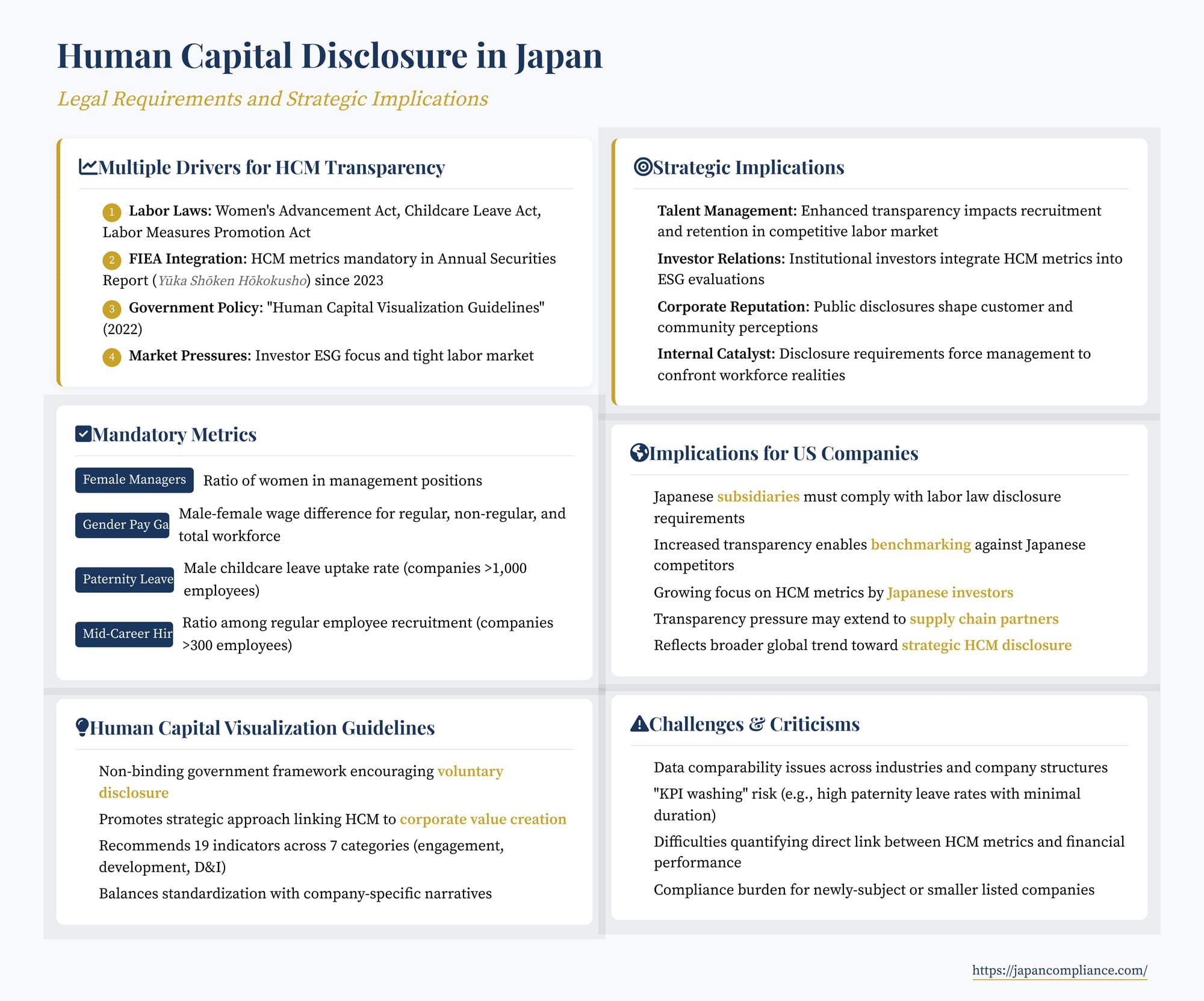

- Since FY 2023, listed firms in Japan must disclose gender-pay gaps, female-manager ratios and other labor-law metrics in the “Sustainability Information” section of the Annual Securities Report.

- Government “Human Capital Visualization Guidelines” urge broader, strategy-linked disclosures across 19 indicators.

- US companies with Japanese units must ensure legal compliance, prepare narrative context and leverage the data for investor and talent engagement.

Table of Contents

- Multiple Drivers Pushing for HCM Transparency

- A Closer Look at the Mandatory Metrics

- Beyond Compliance: The Human Capital Visualization Guidelines

- Strategic Implications and Business Impact

- Challenges and Criticisms

- Implications for US Companies

- Conclusion

Beyond environmental concerns and governance structures, the "S" in ESG – the social dimension – is rapidly gaining prominence in corporate reporting globally. Within this broad category, human capital management (HCM) has emerged as a critical focus area for investors, regulators, and society at large. Japan, facing unique demographic challenges like a declining birthrate, an aging population, and persistent labor shortages, alongside a renewed push for gender equality and diverse work styles, has placed a significant emphasis on enhancing transparency around how companies manage their workforce.

Recent legislative and regulatory developments have moved Japan towards a system where specific human capital metrics are not just encouraged but are mandatory disclosures for many companies, integrated directly into core financial reporting. For US companies with operations, investments, or significant business relationships in Japan, understanding this evolving landscape of human capital disclosure is essential for compliance, risk management, and strategic positioning.

Multiple Drivers Pushing for HCM Transparency

The increased focus on human capital disclosure in Japan stems from several interconnected factors:

- Specific Labor Laws Mandating Disclosure: Over the past decade, Japan has enacted or amended several labor laws that require companies exceeding certain employee thresholds to publicly disclose specific workforce metrics. Key examples include:

- Act on Promotion of Women's Participation and Advancement in the Workplace (女性活躍推進法 - josei katsuyaku suishin hō): Requires companies (currently over 300 employees, potentially expanding to >100) to disclose the gender pay gap and encourages disclosure of metrics like the ratio of female managers. Companies with over 100 employees must formulate and disclose action plans regarding female participation.

- Act on Childcare Leave, Caregiver Leave, and Other Measures for the Welfare of Workers Caring for Children or Other Family Members (育児介護休業法 - ikuji kaigo kyūgyō hō): Requires companies with over 1,000 employees to disclose the uptake rate of male paternity/childcare leave annually (with potential future expansion of this requirement).

- Labor Measures Comprehensive Promotion Act (労働施策総合推進法 - rōdō shisaku sōgō suishin hō): Requires companies with over 300 employees to disclose the ratio of mid-career hires among their regular employee hires annually.

- Integration into FIEA Reporting: A major catalyst for elevating the importance of these metrics was their integration into mandatory corporate reporting under the Financial Instruments and Exchange Act (FIEA). Since the fiscal year ending March 31, 2023, companies subject to FIEA reporting and the relevant labor law disclosure threshold must include these specific human capital metrics within the newly established "Sustainability Information" section of their Annual Securities Report (Yūka Shōken Hōkokusho). This brings HCM data directly into the purview of investors and financial regulators.

- Government Policy and Guidelines: Beyond specific metrics, the Japanese government actively promotes broader "human capital management" (人的資本経営 - jinteki shihon keiei) as a strategic priority. The Cabinet Secretariat published influential "Human Capital Visualization Guidelines" (人的資本可視化指針 - jinteki shihon kashika shishin) in August 2022. These non-binding guidelines encourage companies to voluntarily disclose a wider range of information across seven categories (e.g., human resource development, employee engagement, health and safety, diversity) using 19 example indicators, aligning with international frameworks like ISO 30414. They emphasize linking HCM strategy to corporate value creation and balancing comparability with company-specific narratives.

- Investor Pressure and Market Dynamics: Both domestic and international institutional investors are increasingly incorporating HCM factors into their ESG analysis and engagement activities. Furthermore, in Japan's highly competitive and shrinking labor market, transparency around workplace practices, diversity, and employee well-being is becoming a critical factor in attracting and retaining talent ("Employer Branding").

A Closer Look at the Mandatory Metrics

The integration of specific labor law metrics into FIEA reporting means certain data points are now under heightened scrutiny:

- Female Manager Ratio (女性管理職比率 - josei kanrishoku hiritsu): Mandated disclosure for certain companies under the Women's Advancement Act action plans, and now incorporated into FIEA filings where applicable. This metric directly addresses Japan's long-standing challenge of underrepresentation of women in leadership roles.

- Gender Pay Gap (男女間の賃金格差 - danjo-kan no chingin kakusa): This has perhaps garnered the most attention. Required for companies with over 300 employees, the disclosure must break down the gap between average male and female wages for (1) regular full-time employees, (2) non-regular employees (part-time, fixed-term), and (3) the total workforce. As highlighted in practitioner discussions, this multi-faceted disclosure can starkly reveal structural inequalities, often showing significant overall gaps even if gaps within the regular employee category are smaller, due to the high concentration of women in lower-paid non-regular roles. While companies can add explanatory notes, justifying large gaps is proving challenging.

- Male Paternity/Childcare Leave Uptake Rate (男性の育児休業取得率 - dansei no ikuji kyūgyō shutoku-ritsu): Required for companies with over 1,000 employees under the Childcare Leave Act. While intended to promote shared parental responsibility, this metric faces criticism for potential "washing." Some companies report high uptake rates, but these may be based on employees taking only a few days of leave, arguably not fulfilling the spirit of longer-term parental involvement. This highlights the limitation of the metric without accompanying data on leave duration (which is not currently mandatory for FIEA disclosure).

- Mid-Career Hire Ratio (正規雇用労働者の中途採用比率 - seiki koyō rōdōsha no chūto saiyō hiritsu): Required for companies with over 300 employees under the Labor Measures Promotion Act. This aims to encourage labor market fluidity and the utilization of experienced talent beyond traditional lifetime employment models.

Beyond Compliance: The Human Capital Visualization Guidelines

While the specific metrics above are legally mandated for certain companies, the government's broader vision is outlined in the 2022 Human Capital Visualization Guidelines. These guidelines encourage a more strategic and narrative approach to HCM disclosure, urging companies to:

- Identify Material HCM Issues: Determine which aspects of human capital are most critical to their specific business strategy and long-term value creation.

- Disclose Strategy: Explain how HCM initiatives (in areas like talent development, diversity & inclusion, well-being) connect to overall business goals.

- Report on a Wider Range of Indicators: Provide disclosures (voluntarily) across areas such as employee mobility, engagement, learning and development hours/costs, health and safety metrics, diversity characteristics beyond gender, fair wages, etc.

- Balance Comparability and Uniqueness: While encouraging reference to common indicators (like those in the guidelines or international standards) for comparability, also emphasize disclosing company-specific KPIs and narratives that reflect unique strategies and circumstances.

These guidelines represent the government's desired direction, pushing companies beyond minimum compliance towards strategically integrating HCM into their management and reporting.

Strategic Implications and Business Impact

The increased transparency around human capital has tangible consequences for businesses in Japan:

- Talent Management: In a competitive labor market, positive disclosures on diversity, pay equity, work-life balance, and career development are powerful tools for attracting and retaining employees, particularly younger workers who prioritize these factors. Conversely, poor metrics or lack of transparency can be a significant disadvantage in recruitment. The information disclosed under labor laws and FIEA is readily accessible to potential employees via government databases (like the "Shokuba Raifu" platform) and company websites.

- Investor Relations: Institutional investors are increasingly integrating HCM into their ESG evaluations. Companies demonstrating strong HCM practices and clear links to strategy may be viewed more favorably. Engagement dialogues increasingly include questions about gender pay gaps, diversity pipelines, and employee turnover.

- Corporate Reputation: Public disclosures shape perceptions among customers, local communities, and the broader public. Addressing issues like gender inequality proactively can enhance brand image, while large, unexplained gaps can attract negative attention.

- Catalyst for Internal Change: The mandatory disclosure requirements, particularly for the gender pay gap, have reportedly acted as a significant catalyst within many Japanese companies. The process of collecting, analyzing, and preparing to publicly disclose the data has forced management to confront potentially uncomfortable realities about workforce structure and pay equity, often leading to internal reviews and initiatives aimed at improvement. This "visualization" transforms HCM from a purely HR function into a strategic management issue requiring board-level attention.

Challenges and Criticisms

Despite the positive intentions, the implementation of HCM disclosure faces challenges:

- Data Accuracy and Comparability: Ensuring data is collected consistently and accurately across different employee categories and group companies can be complex. Comparing metrics like pay gaps across different industries or company structures can also be difficult.

- "KPI Washing": As seen with the paternity leave metric, there's a risk that companies focus on metrics that look good on the surface but lack substance (e.g., achieving a high leave uptake rate through minimally short leaves). Stakeholders need to look beyond headline numbers.

- Linking to Value: While conceptually linked, demonstrating a clear, quantifiable causal link between specific HCM metrics (like diversity ratios or engagement scores) and long-term financial performance remains a challenge for many companies, sometimes making it difficult to fully convince skeptical investors of their strategic importance.

- Burden vs. Benefit: Especially for companies newly subject to these requirements or smaller listed entities, the cost and effort involved in data collection, analysis, reporting, and potentially implementing related initiatives can be substantial. Balancing this burden against the perceived benefits is an ongoing consideration.

Implications for US Companies

These developments in Japanese human capital disclosure are relevant for US businesses in several ways:

- Subsidiary Compliance: US companies with Japanese subsidiaries exceeding the relevant employee thresholds must ensure compliance with both the underlying labor law disclosure requirements and their integration into FIEA reporting if the subsidiary is subject to it.

- Benchmarking: The increased transparency allows US companies to benchmark their own HCM practices and those of their Japanese operations against local peers and competitors.

- Investor Expectations: US companies operating in Japan or seeking investment from Japanese institutions should be aware of the growing focus on HCM metrics by the local investment community.

- Supply Chain Considerations: While not yet a widespread mandatory requirement, pressure for transparency may eventually extend down the supply chain, potentially requiring US suppliers to provide HCM-related data to their large Japanese customers.

- Global Trend: Japan's approach reflects a broader global trend towards greater HCM transparency. Understanding the Japanese model provides insights into how similar requirements might evolve in other jurisdictions.

Conclusion

Japan has significantly advanced its corporate reporting landscape by mandating specific human capital disclosures and integrating them into its primary financial reporting framework under FIEA. Driven by specific labor laws aimed at promoting equality and work-life balance, and supported by broader government guidelines encouraging strategic human capital management, this push for transparency impacts companies' relationships with investors, employees, and the public. While practical challenges around data, comparability, and demonstrating value linkage remain, the mandatory nature of key disclosures, particularly the gender pay gap, is forcing companies to confront workforce issues and acting as a catalyst for internal change. For US companies connected to the Japanese market, understanding these legal requirements and their strategic implications is crucial for ensuring compliance, managing reputation, competing for talent, and aligning with evolving global expectations for human capital transparency.

- Mandatory Sustainability Reporting in Japan: FIEA Rules & ISSB Alignment for Global Companies

- Director Liability and Corporate Donations in Japan: Balancing Philanthropy and Fiduciary Duty

- ESG and Shareholder Value in Japan: The Enlightened Shareholder-Value Approach

- Cabinet Secretariat “Human Capital Visualization Guidelines” (Japanese)

- “Shokuba Raifu” Database of Mandatory Labor-Law Metrics (MHLW)