Hostile Takeovers and Defense Measures in Japan: Empirical Insights and Strategic Considerations

TL;DR

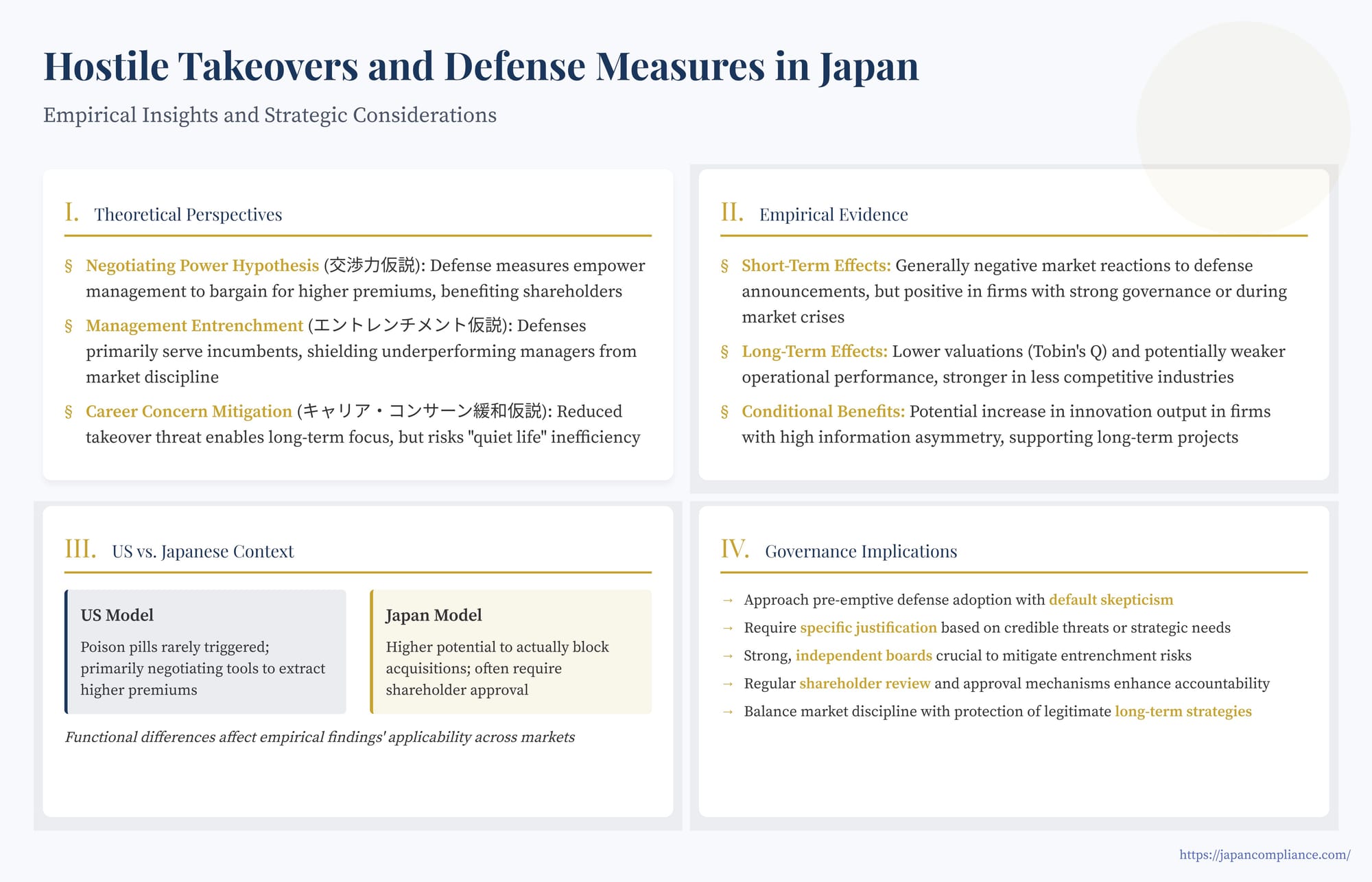

- Hostile takeovers are still rare in Japan, yet debate over takeover defenses remains intense.

- Empirical research—mainly US but informative for Japan—shows defenses can raise bid premiums but also risk entrenching management and lowering long-term value.

- Tokyo practice differs: pills are often designed to block, not just negotiate, which may heighten entrenchment concerns.

- Best practice: adopt defenses only with clear justification, pair them with robust, independent governance, and seek periodic shareholder approval.

Table of Contents

- Theoretical Perspectives on Takeover Defenses

- The Strategic Role of Toeholds

- Empirical Evidence: Do Defenses Deter Takeovers?

- Empirical Evidence: Impact on Shareholder Value and Performance

- Comparing US and Japanese Contexts

- Implications for Governance and Strategy in Japan

- Conclusion

Hostile takeovers (敵対的買収 - tekitai-teki baishuu) and the defensive measures (買収防衛策 - baishuu bouei-saku) companies employ against them are enduring topics in corporate finance and governance globally. In Japan, while hostile bids have historically been less frequent than in markets like the US, the debate surrounding the purpose and effect of takeover defenses remains highly relevant for companies, investors, and potential acquirers. Do these measures protect shareholder value by enhancing management's negotiating power or enabling long-term strategy, or do they primarily serve to entrench incumbent managers, hindering market discipline and potentially destroying value? A substantial body of empirical research, primarily from the US but with relevant insights for Japan, sheds light on these complex questions.

Theoretical Perspectives on Takeover Defenses

Before diving into the empirical evidence, it's helpful to understand the main theoretical arguments regarding the economic effects of takeover defenses:

- Negotiating Power Hypothesis (交渉力仮説 - koushouryoku kasetsu): This theory posits that defense measures empower the target company's management to act as effective bargaining agents for dispersed shareholders. In the face of a takeover bid, individual shareholders face a collective action problem – they might accept a suboptimal offer fearing that if they hold out and the bid fails, their shares will be worth even less (structural coercion). Defenses give management the leverage to resist lowball offers and negotiate for a higher premium, ultimately benefiting shareholders. This perspective often views defenses not as deal-killers, but as tools to extract better terms.

- Management Entrenchment Hypothesis (エントレンチメント仮説 - entorenchimento kasetsu): This opposing view argues that defense measures primarily serve the interests of incumbent managers and boards, allowing them to insulate themselves from the disciplinary force of the market for corporate control. By making takeovers more difficult or costly, defenses can protect inefficient or underperforming managers from being replaced, thereby harming long-term shareholder value. Managers essentially "dig trenches" to protect their positions, even at the expense of the company's owners.

- Career Concern Mitigation Hypothesis (キャリア・コンサーン緩和仮説 - kyaria konsaan kanwa kasetsu): This theory offers a potential upside to reduced takeover threats. Managers constantly facing high takeover risk might become overly risk-averse or focus excessively on short-term results to appease the market, potentially sacrificing valuable long-term investments or innovative projects due to concerns about their own job security ("career concerns"). By providing some insulation from the immediate threat of removal, defense measures might free managers to pursue strategies with longer payoff horizons that ultimately maximize firm value. A related concept extends this to employees – if defenses protect employment stability, employees might be more willing to invest firm-specific human capital. However, a potential downside, sometimes termed the "quiet life hypothesis," is that protected managers might avoid necessary but difficult decisions, like restructuring or shedding underperforming assets.

These theories are not mutually exclusive, and the net effect of defense measures likely depends on the specific context, the type of defense, the company's governance structure, and the competitive environment.

The Strategic Role of Toeholds

The discussion of defenses, particularly poison pills (ポイズンピル - poizun piru), is often linked to the bidder's strategy of acquiring a "toehold" stake (ブロック株取得 - burokku kabu shutoku) before launching a full bid. Poison pills are typically triggered when an unwelcome bidder acquires shares exceeding a certain threshold (e.g., 15-20%).

Why do bidders acquire toeholds despite the risk of triggering defenses? Theoretical models and empirical evidence suggest toeholds can provide bidders with strategic advantages. Possessing a significant pre-bid stake can potentially deter rival bidders (who face a "winner's curse" risk if they overpay for the remaining shares) and allow the toeholder to bid more aggressively, increasing their probability of winning the auction, often at a lower overall premium compared to bidders without toeholds.

However, acquiring a large block of shares publicly signals potential hostile intent and increases the bidder's risk if the takeover attempt ultimately fails. Research indicates a declining trend in significant toehold acquisitions in US M&A since the 1980s. This may be partly due to the effectiveness of defenses like poison pills making large, overt accumulations riskier, and the fact that such accumulations themselves can provoke stronger resistance from target management. Hostile bids are more likely than friendly bids to involve pre-bid toeholds, suggesting bidders acquire them strategically when they anticipate strong management opposition but believe the potential value creation justifies the risk. In Japan, where management resistance to unsolicited approaches can be culturally strong, the very act of acquiring a toehold without prior consultation is often viewed negatively by incumbent management, potentially framing the subsequent defense activation as a response to perceived "inappropriate" bidder behavior, even if the toehold was a rational strategic move given anticipated opposition.

Empirical Evidence: Do Defenses Deter Takeovers?

A key question is whether defense measures actually prevent takeovers. The evidence is somewhat mixed and has evolved.

- Early US Studies: Seminal work in the 1990s suggested that while poison pills did not significantly reduce the probability of a company being taken over, they were associated with higher takeover premiums when a deal occurred. This supported the Negotiating Power Hypothesis – pills were bargaining tools, not deal-blockers.

- Controlling for Endogeneity: Later research recognized that companies adopting defenses are often those already perceived as likely takeover targets (endogeneity). Studies attempting to control for this self-selection found that stronger defense profiles (often measured by indices like the G-Index or E-Index, which aggregate multiple defense provisions) were correlated with a lower likelihood of receiving and completing takeover bids. This lent support to the Entrenchment Hypothesis, suggesting defenses do have a deterrent effect on potential M&A activity.

- The "Poison Pill Shadow": In the US context, the ease with which boards could adopt poison pills quickly (often without prior shareholder approval, unlike in Japan) created a "shadow effect." Even companies without a pill formally in place might benefit from the threat of adopting one if faced with an unwanted bid. This makes it harder to isolate the deterrent effect of formally adopted pills, as the mere possibility of their adoption could influence bidder behavior across the market.

- Japanese Context: While US poison pills have rarely been triggered to actually block a deal (serving more as negotiation triggers), the situation in Japan may differ. Defenses in Japan, often requiring shareholder approval and structured as pre-warned share subscription rights (事前警告型新株予約権 - jizen keikoku-gata shinkabu yoyaku-ken), might be perceived and intended more as actual blocking mechanisms if triggered. The lower overall frequency of hostile bids in Japan compared to the US also shapes this landscape.

Overall, while the direct impact of specific measures like poison pills on takeover completion rates is debated (especially in the US due to the shadow effect), evidence suggests that a portfolio of strong defenses likely does have some deterrent effect on potential acquisitions.

Empirical Evidence: Impact on Shareholder Value and Performance

Beyond deterrence, research has extensively examined the impact of defense measures on firm value and operating performance.

Short-Term Effects (Event Studies):

- Average Effect: Studies examining stock price reactions around the announcement of adopting defense measures (particularly poison pills) in the US generally found a small but statistically significant negative average reaction. This is often interpreted as the market anticipating potential management entrenchment. Similar negative findings were reported for early adoptions in Japan.

- Conditional Effects: However, the market reaction isn't uniformly negative.

- Governance Quality: Studies found that the negative reaction was concentrated in firms with weaker governance (e.g., fewer independent directors). Firms with strong board independence sometimes showed positive or neutral reactions, suggesting the market trusted independent boards to use defenses for shareholder benefit (negotiating power).

- Market Crises: Research examining pill adoptions during market crises (like the 2008 financial crisis or the 2020 COVID-19 shock) found instances where adoption announcements by vulnerable firms led to positive stock price reactions. This suggests the market may view defenses favorably as a tool to fend off opportunistic, lowball bids when share prices are temporarily depressed, again supporting a conditional negotiating power role. However, other studies looking at broad market performance during the pandemic found that firms with strong pre-existing defenses experienced larger stock price declines, complicating the interpretation.

Long-Term Effects (Performance & Valuation):

- Valuation and Performance: Seminal studies using indices that aggregate various defense provisions (like the Gompers, Ishii, and Metrick "G-Index" or the Bebchuk, Cohen, and Ferrell "E-Index") found strong correlations in the 1990s and early 2000s. Firms with more defenses (higher G or E scores, indicating weaker shareholder rights) tended to have lower firm valuations (e.g., lower Tobin's Q), lower stock returns, and potentially poorer operating performance or excessive, value-destroying acquisitions. These findings strongly supported the Entrenchment Hypothesis.

- Market Learning and Persistence: Some later studies argued that while the link to lower valuation persisted, the link to poorer future stock returns diminished over time, suggesting the market learned to price in the negative effects of entrenchment. However, proponents of the indices maintain that the negative link to valuation and operating performance remains significant, indicating defenses continue to have real economic consequences.

- Industry Competition: The negative impact of defenses appears stronger in industries with low product market competition. In competitive industries where market forces already discipline managers, defenses have less negative (or potentially even positive) impact. This suggests defenses are particularly conducive to entrenchment when external market discipline is weak.

- Innovation and Long-Term Investment: Conversely, some studies find positive effects in specific contexts. Defenses have been linked to increased innovation output (measured by patents and citations) in firms operating in competitive industries or those with high information asymmetry (where the market may undervalue long-term R&D). This supports the Career Concern Mitigation Hypothesis – defenses may shield managers from short-term market pressures, allowing them to undertake valuable but risky long-term innovation.

- "Quiet Life" Hypothesis: Evidence also supports the downside of reduced pressure. Studies examining the impact of state-level anti-takeover laws in the US found that protected firms were slower to restructure inefficient plants and exhibited declines in productivity and profitability, consistent with managers enjoying a "quiet life" and avoiding difficult operational decisions when shielded from takeover threats. Similar findings regarding lower investment and risk-taking have been observed for Japanese firms traditionally insulated by cross-shareholdings.

In sum, while the average long-term effect appears negative (supporting entrenchment), the impact is highly context-dependent. Defenses can potentially support long-term value creation (e.g., innovation) in specific environments, but often come at the cost of reduced market discipline and potential operational inefficiency.

Comparing US and Japanese Contexts

A crucial point highlighted in related commentary is the potential difference in the primary function of defense measures, particularly poison pills, between the US and Japan.

- US: Historically, poison pills have rarely been triggered to block a deal. They function primarily as a tool to force bidders to negotiate with the board, effectively giving the board a veto over hostile bids but ultimately serving as a powerful lever in price and term negotiations.

- Japan: Takeover defenses, especially those requiring shareholder votes and structured as pre-warned rights issues, may be perceived by both management and bidders as having a higher potential to actually block an acquisition if activated. The focus might be less on extracting a higher premium through negotiation and more on preventing the takeover altogether.

This potential difference means that empirical findings, largely based on the US experience, must be interpreted cautiously when applied to Japan. If defenses in Japan are primarily viewed as blocking mechanisms rather than negotiating tools, the arguments supporting the Negotiating Power Hypothesis may be weaker, and the risks of entrenchment potentially higher.

Implications for Governance and Strategy in Japan

The accumulated empirical evidence offers several implications for corporate strategy and governance regarding takeover defenses in Japan:

- Default Skepticism: Given the average negative findings related to entrenchment and value, companies and shareholders should approach the adoption of strong, pre-emptive takeover defenses with a degree of skepticism. Their benefits are often conditional and context-specific, while the risks of insulating management are general.

- Justification Required: Adopting or maintaining defenses should be justified based on specific, credible threats or strategic needs (e.g., protecting a crucial long-term project, documented evidence of opportunistic lowball threats during market downturns), rather than adopted as a standard governance feature.

- Governance Matters: The effectiveness and impact of defenses are heavily influenced by the overall governance environment. Strong, independent boards are better positioned to mitigate entrenchment risks and ensure defenses are used, if at all, in the shareholders' best interests (e.g., negotiating better terms). Weakly governed firms adopting strong defenses present the highest risk profile.

- Shareholder Voice: Transparency and shareholder engagement are critical. In Japan, many defense measures require periodic shareholder approval for renewal. This provides a mechanism for shareholders, guided by institutional investors and proxy advisors (who are often critical of defenses without compelling justification), to regularly assess the trade-offs and hold boards accountable.

- Economic Dynamism: From a broader economic perspective, overly potent or widespread defense measures could potentially impede value-enhancing M&A and necessary corporate restructuring, which are seen as important for Japan's economic revitalization. Finding a balance that allows for market discipline while protecting legitimate long-term strategies remains a key policy challenge.

Conclusion

The debate over hostile takeover defenses is complex, and empirical research reveals a multifaceted picture. While defenses can theoretically provide negotiating leverage or shield valuable long-term projects under specific circumstances, the weight of the evidence, particularly concerning long-term value and performance, points towards significant risks associated with management entrenchment. The negative effects appear more pronounced when corporate governance is weak or market competition is limited. In Japan, where defenses might be perceived more as blocking mechanisms than negotiating tools, the potential downsides warrant careful consideration. Ultimately, decisions regarding the adoption, maintenance, or evaluation of takeover defenses require a nuanced analysis of the specific company's situation, its governance framework, the competitive landscape, and the prevailing expectations of its shareholders and the broader investment community. A one-size-fits-all approach is unlikely to serve companies or the market well.