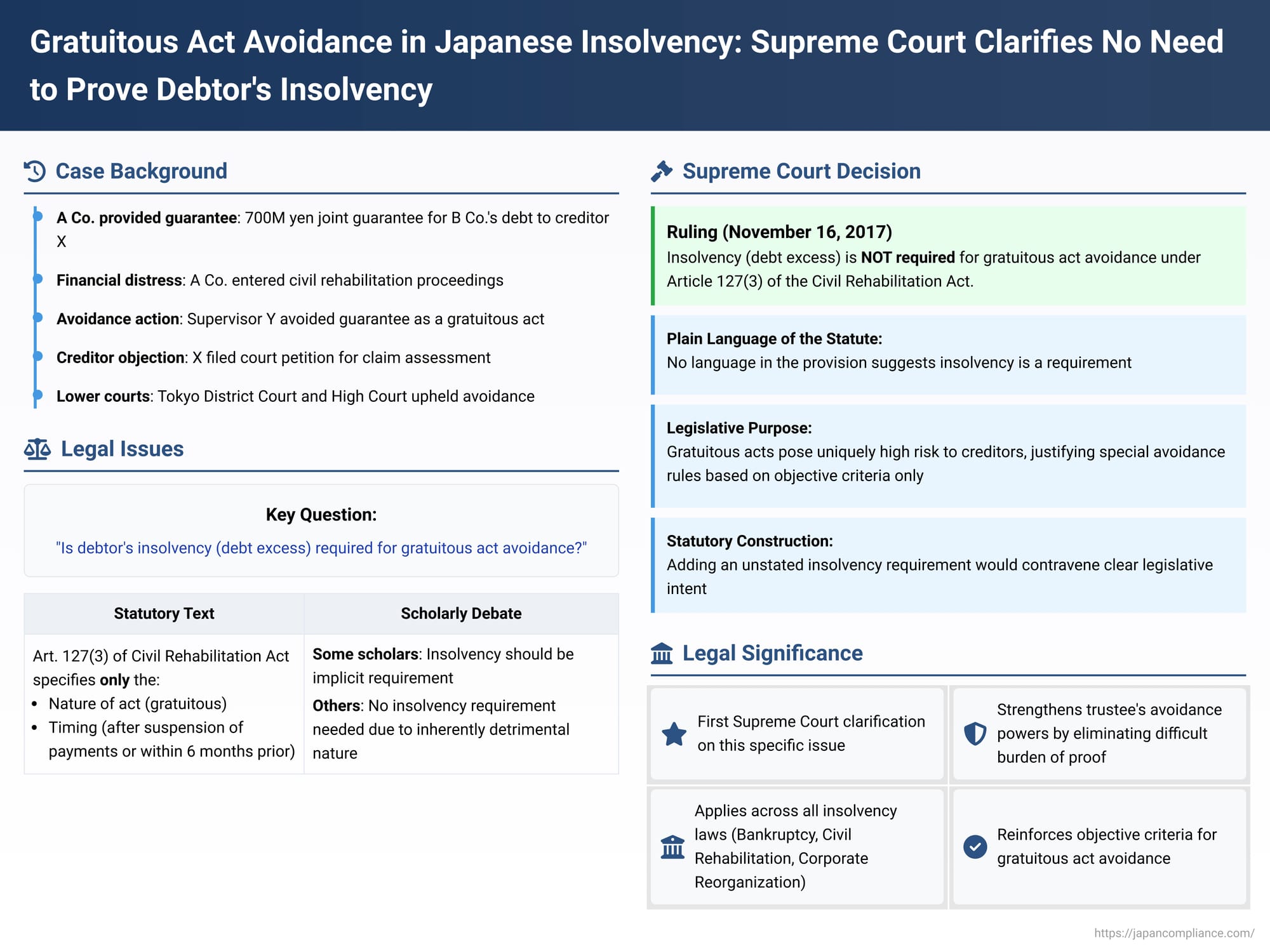

Gratuitous Act Avoidance in Japanese Insolvency: Supreme Court Clarifies No Need to Prove Debtor's Insolvency

A crucial tool for supervisors and trustees in Japanese insolvency proceedings (such as civil rehabilitation, bankruptcy, or corporate reorganization) is the power to avoid "gratuitous acts" (無償否認 - mushō hinin). This power allows for the recovery of assets transferred by the debtor without receiving fair value in return, thereby protecting the collective interests of creditors. A key feature of this type of avoidance is that it generally allows action based on objective criteria—the gratuitous nature of the act and its timing relative to the debtor's financial distress—without the often difficult burden of proving the debtor's fraudulent intent or the recipient's knowledge of such intent.

However, a point of legal debate had persisted: for a gratuitous act to be avoidable, was it an additional, unstated requirement that the debtor must have been insolvent (e.g., in a state of excess liabilities over assets, 債務超過 - saimu chōka) at the precise time the gratuitous act occurred, or to have become insolvent as a direct result of it? On November 16, 2017, the First Petty Bench of the Supreme Court of Japan delivered a landmark judgment that provided a clear and definitive answer to this question.

Factual Background: A Company Guarantee and Subsequent Rehabilitation

The case involved A Co., which had entered into a joint guarantee agreement with a creditor, X. Under this agreement, A Co. guaranteed a substantial 700 million yen loan debt owed by another company, B Co., to X. Some time after providing this guarantee, A Co. found itself in financial distress and filed a petition for the commencement of civil rehabilitation proceedings under the Civil Rehabilitation Act (民事再生法 - Minji Saisei Hō).

The court granted the commencement of rehabilitation proceedings for A Co. and, importantly, issued a management order, appointing Y to act as A Co.'s supervisor/trustee (管財人 - kanzainin). In the course of these proceedings, the creditor X filed a proof of rehabilitation claim against A Co., based on the joint guarantee A Co. had provided for B Co.'s debt.

Y, in their capacity as supervisor/trustee for A Co., reviewed this claim and decided to exercise the power of avoidance against the original joint guarantee agreement. Y contended that A Co.'s act of providing the joint guarantee for B Co.'s debt was a "gratuitous act" (無償行為 - mushō kōi) because A Co. had received no direct economic benefit or consideration in return for undertaking this significant liability. Consequently, Y disputed the full amount of X's filed rehabilitation claim.

X disagreed with the supervisor/trustee's position and petitioned the court for an assessment (査定 - satei) of the claim. The court, however, sided with Y, upholding the validity of the avoidance of the guarantee agreement as a gratuitous act. It, therefore, issued an assessment decision stating that the value of X's rehabilitation claim was zero.

Dissatisfied with this outcome, X filed a formal action in court objecting to the assessment decision, seeking its modification. Both the Tokyo District Court (first instance) and the Tokyo High Court (second instance) upheld the supervisor/trustee's exercise of the avoidance power and affirmed the assessment decision that X's claim was nil. X then successfully petitioned the Supreme Court for acceptance of their appeal, bringing the critical question of the requirements for gratuitous act avoidance to Japan's highest court. X's primary argument on appeal was that for a gratuitous act to be avoidable under the Civil Rehabilitation Act, it was necessary for the debtor (A Co.) to have been insolvent (specifically, in a state of excess debts) at the time it provided the guarantee, or to have become insolvent as a direct result of providing it.

The Legal Question: Is Debtor's Insolvency a Prerequisite for Gratuitous Act Avoidance?

Article 127, paragraph 3, of the Civil Rehabilitation Act (which has very similar counterparts in the Bankruptcy Act at Article 160, paragraph 3, and the Corporate Reorganization Act at Article 86, paragraph 3) outlines the conditions under which a gratuitous act can be avoided. It generally provides that if a rehabilitation debtor has performed a gratuitous act, or an onerous act that should be deemed equivalent to a gratuitous act (e.g., where any consideration received was merely nominal), either after a "suspension of payments, etc." (shiharai no teishi tō) or within six months prior to such an event, the supervisor/trustee can avoid that act.

The statutory text clearly specifies the nature of the act (it must be gratuitous or its equivalent) and its timing (in relation to the debtor's financial crisis, as marked by suspension of payments or a petition for insolvency proceedings). However, the text does not explicitly state that the debtor must also have been insolvent (e.g., in a state where liabilities exceeded assets) at the moment the gratuitous act was performed, or that the act itself must have pushed the debtor into such a state of insolvency.

This legislative silence had led to a divergence in legal scholarship.

- Some scholars argued that debtor insolvency should be considered an implicit requirement. Their reasoning was often based on the idea that gratuitous act avoidance is fundamentally a sub-category of "fraudulent act avoidance" in a broader sense (acts detrimental to creditors). General fraudulent act avoidance typically requires, or at least strongly implies, that the act caused harm to creditors, which is most evident when the debtor has insufficient assets to cover their liabilities.

- Other scholars contended that insolvency was not a necessary element. They pointed to the uniquely detrimental nature of gratuitous transfers (where the debtor's estate is diminished without any corresponding value received) and the lower need to protect the recipient of such a benefit (who, by definition, gave no value in return). This, they argued, justified the relaxed objective criteria for avoiding gratuitous acts, focusing solely on the nature of the act and its timing.

The Supreme Court's Clear Answer: Insolvency Not Required

The Supreme Court, in its judgment of November 16, 2017, dismissed X's appeal and provided a definitive answer to this long-debated question. It held that:

For a supervisor/trustee to avoid a gratuitous act under Article 127, paragraph 3, of the Civil Rehabilitation Act, it is NOT a requirement that the rehabilitation debtor was insolvent (e.g., in a state of excess debts) at the time the act was performed, nor is it a requirement that the act caused the debtor to become insolvent.

The Court's reasoning was direct and rooted in statutory interpretation and legislative purpose:

- Plain Language of the Statute: The Supreme Court first looked at the text of Article 127, paragraph 3. It noted that while the provision clearly sets out the content of the act (gratuitous or equivalent) and its timing (after suspension of payments or within six months prior) as conditions for avoidance, there is simply no language in the provision that would suggest that the debtor's concurrent insolvency (such as being in a state of excess debts) or becoming insolvent as a result of the act, is an additional requirement.

- Legislative Purpose of Gratuitous Act Avoidance: The Court then considered the underlying purpose of this specific avoidance rule. It explained that the legislative intent behind creating a special category for avoiding gratuitous acts stems from the recognition that such actions by the debtor—because they inherently lack consideration flowing back to the debtor's estate—pose a particularly conspicuous and significant risk of harming the interests of the general body of creditors. Due to this heightened risk, the legislature established a distinct type of avoidance that focuses solely on the objective nature of the act (its gratuitousness) and its timing in relation to the debtor's financial decline. This allows for a more straightforward and effective means of recovering assets dissipated through such transfers.

- Adding an Insolvency Requirement Would Contravene Legislative Intent: The Supreme Court concluded that to judicially read into the statute an additional, unstated requirement of debtor insolvency at the time of the act would not align with this clear legislative purpose. It would complicate the avoidance of acts that the law specifically intended to make easier to challenge due to their inherently detrimental nature to the creditor pool.

Significance and Implications of the Judgment

This 2017 Supreme Court decision is of considerable importance for several reasons:

- First Supreme Court Clarification on This Point: It was the first time Japan's Supreme Court had directly and definitively ruled on the necessity (or lack thereof) of debtor insolvency as a prerequisite for gratuitous act avoidance under any of the country's major insolvency statutes (Civil Rehabilitation Act, Bankruptcy Act, or Corporate Reorganization Act). It thus settled a significant and long-standing point of legal debate among scholars and practitioners.

- Strengthens Supervisor/Trustee's Avoidance Powers: The decision significantly bolsters the ability of supervisors in civil rehabilitation proceedings (and, by extension, trustees in bankruptcy and corporate reorganization proceedings) to recover assets for the benefit of creditors. They are relieved of the potentially difficult and resource-intensive burden of reconstructing the debtor's precise balance sheet and proving a state of excess liabilities at the exact historical moment the gratuitous act occurred. As long as the act was gratuitous in nature and falls within the statutory critical timeframes, it can be challenged.

- Broad Applicability Across Insolvency Laws: Given the nearly identical wording and shared purpose of the gratuitous act avoidance provisions in the Bankruptcy Act (Article 160, paragraph 3) and the Corporate Reorganization Act (Article 86, paragraph 3), this Supreme Court interpretation concerning the Civil Rehabilitation Act is highly influential and is generally understood to apply with equal force to those other insolvency contexts as well.

- Reinforces Objective Criteria for Gratuitous Act Avoidance: The judgment reinforces the character of gratuitous act avoidance as a system grounded in objective elements—the lack of consideration flowing to the debtor and the timing of the act in relation to financial distress. This distinguishes it from other types of avoidance that might require proof of the debtor's subjective fraudulent intent or specific knowledge on the part of the beneficiary.

The provided PDF commentary also notes that while this judgment decisively settles the issue of whether insolvency is required at the time of the gratuitous act, it does not explicitly address whether the debtor's financial condition at the time the avoidance power is actually exercised by the trustee/supervisor might have any bearing on the matter, though this is a less commonly debated point for this type of avoidance.

Concluding Thoughts

The Supreme Court's November 16, 2017, judgment provides a clear and impactful clarification of Japanese insolvency law: proving debtor insolvency (such as an excess of liabilities over assets) at the time a gratuitous act was committed is not a necessary condition for a supervisor or trustee to avoid that act under Article 127, paragraph 3, of the Civil Rehabilitation Act (and by strong implication, under the corresponding provisions of the Bankruptcy Act and Corporate Reorganization Act). This ruling simplifies and strengthens the legal tools available to protect the collective body of creditors from the gratuitous dissipation of a debtor's assets when that debtor is facing financial collapse. The decision underscores the legislative intent to create a potent, objectively based remedy against transfers that, by their very nature, deplete the estate without any corresponding benefit, thereby ensuring a more effective means of preserving assets for fair distribution.