Going Public in Japan: IPO, Direct Listing & SPAC Compared – 2025 Practical Guide

Compare IPOs, direct listings and SPAC mergers for entering Japan’s capital markets: process, costs, timing, dilution and the latest regulatory status in 2025.

TL;DR

Going public in Japan still revolves around the traditional IPO, but direct listings and foreign‑listed SPAC mergers are gathering interest. This article compares each path in terms of capital‑raising ability, speed, cost, dilution, and current regulatory readiness so that founders and cross‑border investors can choose the option that best matches their strategic goals.

Table of Contents

- The Traditional IPO: The Established Route in Japan

- Direct Listing (Chokusetsu Jōjō): A Less Trodden Path in Japan

- Special Purpose Acquisition Companies (SPACs): An Emerging Consideration

- Comparing the Paths: Strategic Considerations for Businesses

- The Japanese Context: A Cautious Evolution

- Conclusion: Selecting the Optimal Route

For companies eyeing the Japanese capital markets, the journey to becoming a publicly traded entity offers several paths, each with distinct characteristics, advantages, and challenges. While the traditional Initial Public Offering (IPO) remains the most well-trodden route, alternative methods like Direct Listings and Special Purpose Acquisition Companies (SPACs) have garnered global attention, prompting discussions about their viability and role in Japan. Understanding these options is crucial for businesses, including U.S. companies or those with significant international ties, looking to tap into Japan's investor base and enhance their market presence.

The Traditional IPO: The Established Route in Japan

The traditional IPO is the conventional method for companies to offer their shares to the public and list on an exchange like the Tokyo Stock Exchange (TSE).

Process Overview:

The process involves engaging underwriting securities firms (with a lead manager, or 主幹事証券会社 - shukanji shōken gaisha, playing a pivotal role) who assist in preparing the company for public scrutiny, managing regulatory filings, and marketing the shares to investors. A key part of this is the book-building (ブックビルディング - bukku birudingu) process, where underwriters gauge investor demand to determine the offer price. This involves extensive due diligence, preparation of a detailed prospectus (目論見書 - mokuromisho), and roadshows to institutional investors.

Benefits:

- Capital Raising: IPOs are primarily designed to raise fresh capital for the company's growth, research and development, or debt repayment.

- Established Process: The procedures and regulatory expectations for traditional IPOs are well-established in Japan, providing a degree of predictability.

- Underwriter Support: Underwriters provide valuation expertise, marketing support, and often aftermarket stabilization.

Common Challenges: The IPO Underpricing Phenomenon

A significant and persistent challenge in the Japanese IPO market is underpricing, where the initial trading price of a newly listed stock substantially exceeds its offer price. While this can create a positive "pop" on the first day of trading, it also means the company potentially raised less capital than it could have. Discussions around refining the book-building process to achieve fairer pricing are ongoing. Suggested improvements have included allowing for more flexible pricing ranges based on demand and shortening the time between pricing and listing to reduce market risk exposure. Ensuring participation from sophisticated institutional investors, including those overseas, is also seen as crucial for more accurate price discovery.

Direct Listing (直接上場 - Chokusetsu Jōjō): A Less Trodden Path in Japan

A Direct Listing involves a company listing its existing shares on a stock exchange without conducting a traditional, underwritten public offering to raise new capital. Employees and early investors can sell their shares directly to the public. This method has gained prominence in the U.S. with high-profile tech companies opting for this route to avoid underwriter fees, lock-up periods, and potentially achieve fairer price discovery based on direct market supply and demand.

Status and Challenges in Japan:

In Japan, Direct Listings remain rare. A notable historical instance dates back to 1999 on the TSE's Second Section, but it hasn't become a common practice. Several factors contribute to this:

- Regulatory Requirements: A primary hurdle, especially for growth-stage companies eyeing the TSE Growth Market, has been the exchange's general requirement for a public offering of shares (i.e., new share issuance or secondary offering by existing shareholders through underwriters) at the time of listing. This rule is intended to ensure a minimum level of liquidity, establish a broad shareholder base, and often, to provide the company with growth capital. A pure Direct Listing, where only existing shares become tradable without a concurrent offering, doesn't align neatly with this traditional expectation.

- Lack of Underwriter Gatekeeping: The absence of underwriters in a Direct Listing means the company bears more responsibility for pricing, investor communication, and ensuring regulatory compliance. This lack of a traditional "gatekeeper" raises questions for regulators regarding investor protection and information asymmetry, particularly for retail investors.

- Price Discovery Concerns: While one of the purported benefits is fairer price discovery, the initial trading in a Direct Listing can be volatile without the price stabilization mechanisms often employed by underwriters in traditional IPOs.

Potential Benefits (if obstacles are overcome):

- Fairer Price Discovery: Direct interaction of supply and demand could theoretically lead to a market price that more accurately reflects the company's value, potentially mitigating underpricing.

- Lower Costs: Avoiding underwriting fees could result in significant cost savings.

- Liquidity for Existing Shareholders: Provides an immediate path to liquidity for employees and early investors without the restrictions of traditional lock-up agreements.

While discussions on adapting listing rules to better accommodate Direct Listings have taken place, the structural and regulatory environment in Japan has meant that it is not yet a mainstream option.

Special Purpose Acquisition Companies (SPACs) (特別買収目的会社 - Tokubetsu Baishū Mokuteki Kaisha): An Emerging Consideration

SPACs are shell companies formed by sponsors with the sole purpose of raising capital through an IPO to acquire or merge with an existing private operating company (the "de-SPAC" transaction), effectively taking the target company public.

The U.S. SPAC Boom and Subsequent Scrutiny:

SPACs experienced a surge in popularity in the U.S. markets, offering private companies a potentially faster route to public markets with upfront price certainty (through the negotiated merger with the SPAC). However, this boom was followed by increased regulatory scrutiny and concerns about investor protection, dilution from sponsor "promote" shares and warrants, and the quality of some target companies.

Status and Challenges in Japan:

As of late 2022, Japan had not established a dedicated domestic framework for SPAC IPOs on its exchanges. While regulatory bodies like the Financial Services Agency (FSA) and the TSE had been studying the SPAC model and engaging in discussions, the approach was cautious, heavily influenced by the investor protection issues observed in the U.S. market. Key concerns included:

- Sponsor Conflicts of Interest: The sponsor's incentive (the "promote," typically 20% of the SPAC's equity for a nominal investment) could lead to acquisitions that are not necessarily in the best interest of public shareholders.

- Dilution: Warrants issued alongside SPAC shares and the sponsor promote can lead to significant dilution for public investors who remain through the de-SPAC.

- Valuation and Due Diligence: The pressure for a SPAC to complete an acquisition within its typical two-year timeframe could lead to rushed due diligence or overvaluation of target companies.

- High Redemption Rates: In the U.S. market, high redemption rates (where SPAC shareholders choose to get their money back rather than participate in the merger) often necessitated significant PIPE (Private Investment in Public Equity) financing to complete de-SPAC transactions, altering the deal dynamics.

Despite the absence of a domestic SPAC IPO framework, Japanese private companies have become targets for SPACs listed on foreign exchanges (e.g., in the U.S.), achieving a public listing through a de-SPAC merger.

Potential Benefits (if a robust framework is established):

- Speed and Price Certainty for Targets: Compared to a traditional IPO, a merger with a SPAC can offer a faster timeline and more certainty on valuation for the target company, as terms are negotiated directly.

- Access to Public Markets for Certain Companies: May provide a path for companies that might find a traditional IPO challenging due to their stage or industry.

The primary challenge for Japan, if it were to introduce a domestic SPAC market, would be to design a framework that balances the potential benefits with robust investor protections to avoid the pitfalls seen elsewhere. The emphasis would likely be on transparency, quality of sponsors, and fair treatment of public shareholders.

Comparing the Paths: Strategic Considerations for Businesses

Choosing the right path to public markets depends on a company's specific circumstances, goals, and risk appetite.

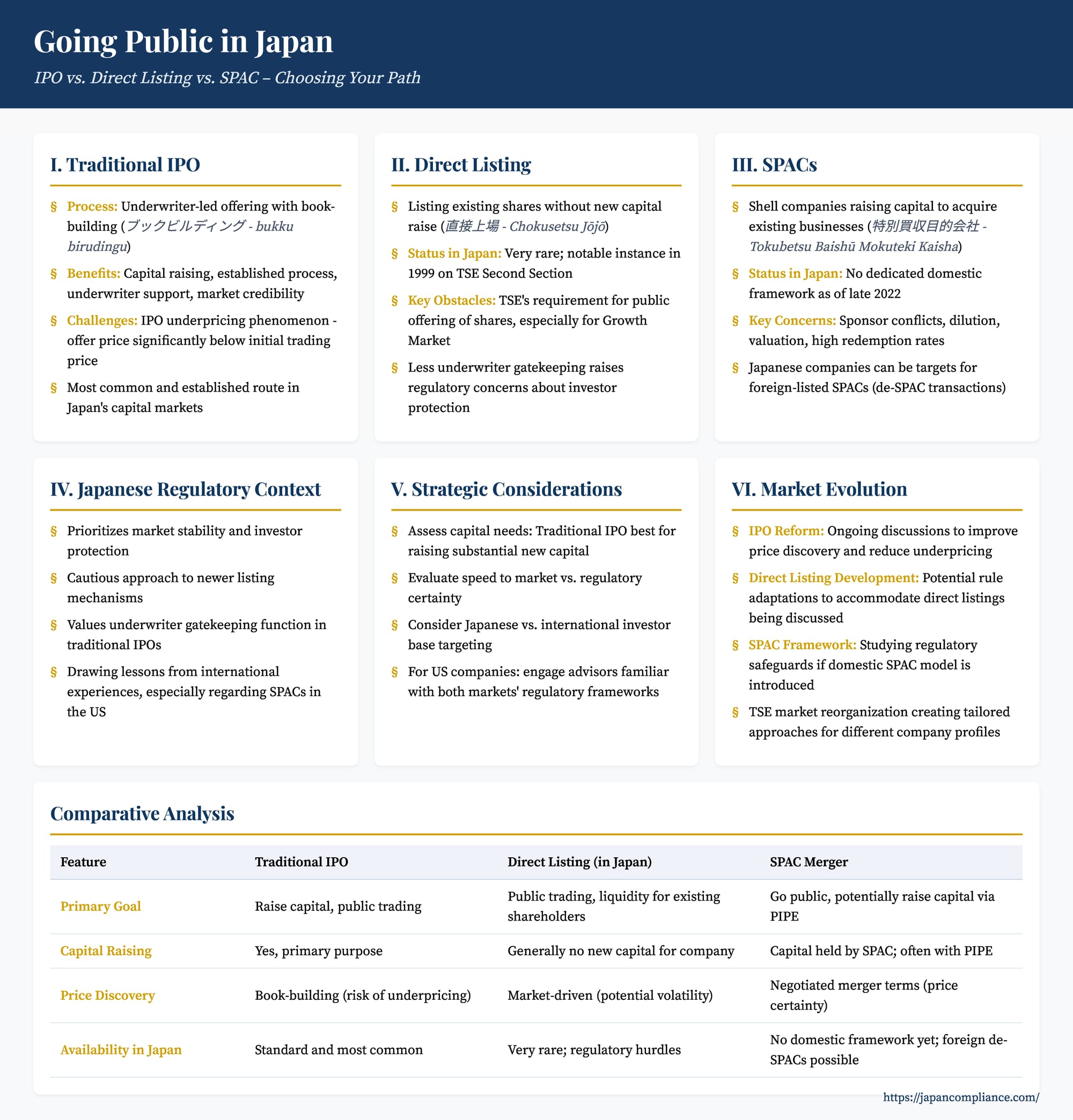

| Feature | Traditional IPO | Direct Listing (in Japan) | SPAC Merger (Target's Perspective) |

|---|---|---|---|

| Primary Goal | Raise capital, public trading | Public trading, liquidity for existing shareholders | Go public, potentially raise capital via PIPE |

| Capital Raising | Yes, primary purpose | Generally no new capital for the company | Capital held by SPAC; often supplemented by PIPE |

| Price Discovery | Book-building (risk of underpricing) | Market-driven (potential for volatility) | Negotiated merger terms (price certainty pre-deal) |

| Underwriter Role | Central (due diligence, marketing, stabilization) | Minimal or advisory only | SPAC IPO has underwriters; target negotiates with SPAC |

| Speed to Market | Lengthy preparation and execution | Potentially faster if company is ready | Can be faster than IPO once SPAC identifies target |

| Costs | Underwriting fees, other offering expenses | Lower direct offering costs, but advisory fees | Complex; includes SPAC sponsor promote, potential PIPE discounts |

| Control & Dilution | Dilution from new shares | No new share dilution for the company | Dilution from SPAC sponsor, warrants, PIPE shares |

| Regulatory Scrutiny | High (established process) | Evolving in Japan; disclosure is key | High for SPAC IPO; scrutiny on de-SPAC transaction |

| Availability in Japan | Standard and most common | Very rare; regulatory hurdles for growth companies | No domestic SPAC IPO framework yet; foreign de-SPACs possible |

The Japanese Context: A Cautious Evolution

The Japanese regulatory environment prioritizes market stability and investor protection. While there is an acknowledgment of the need for dynamic capital markets that can support growth companies, the adoption of newer listing mechanisms like Direct Listings and SPACs has been approached with caution. The focus has been on learning from international experiences and considering how such methods can be adapted to fit the Japanese market structure and regulatory philosophy without compromising investor safeguards.

Traditional IPOs, despite challenges like underpricing, benefit from a well-understood framework and strong underwriter involvement, which regulators and many market participants view as providing important gatekeeping functions.

Conclusion: Selecting the Optimal Route

The decision of how to go public in Japan—whether via a traditional IPO, or exploring the potential future avenues of Direct Listing or engaging with a SPAC (likely foreign-listed for the time being)—is a complex one. It requires a thorough assessment of the company's capital needs, growth stage, shareholder objectives, tolerance for market volatility, and readiness for the rigors of public company life in Japan.

While traditional IPOs remain the default and most accessible path in Japan, particularly for companies seeking to raise significant growth capital, the ongoing global evolution of listing methods ensures that discussions around Direct Listings and SPACs will continue. For U.S. companies or those with U.S. investors, staying informed about these developments and engaging with experienced advisors familiar with both U.S. and Japanese capital markets is essential to making the strategic choice that best aligns with their long-term objectives.

- What are “Policy‑Shareholdings” in Japan and How Does the Corporate Governance Code Address Them?

- How to Establish a Kabushiki Kaisha in Japan? Differences in Procedures for Promotive vs. Subscription‑Based Incorporation

- Delegating Director Pay in Japan: Shareholder Oversight and Board Discretion in Severance Allowances

- Financial Services Agency – Laws & Regulations Portal

- FSA Weekly Review No. 533 – IPO Price‑Setting Process Reforms

- Financial Instruments and Exchange Act – Unofficial English Translation (PDF)