Garnishee's "Double Payment" and Preferential Act Avoidance in Bankruptcy: A 2017 Japanese Supreme Court Ruling

Date of Judgment (A6): December 19, 2017 (Heisei 29)

Case Name (A6): Claim for Exercise of Avoidance Power

Court (A6): Supreme Court of Japan, Third Petty Bench

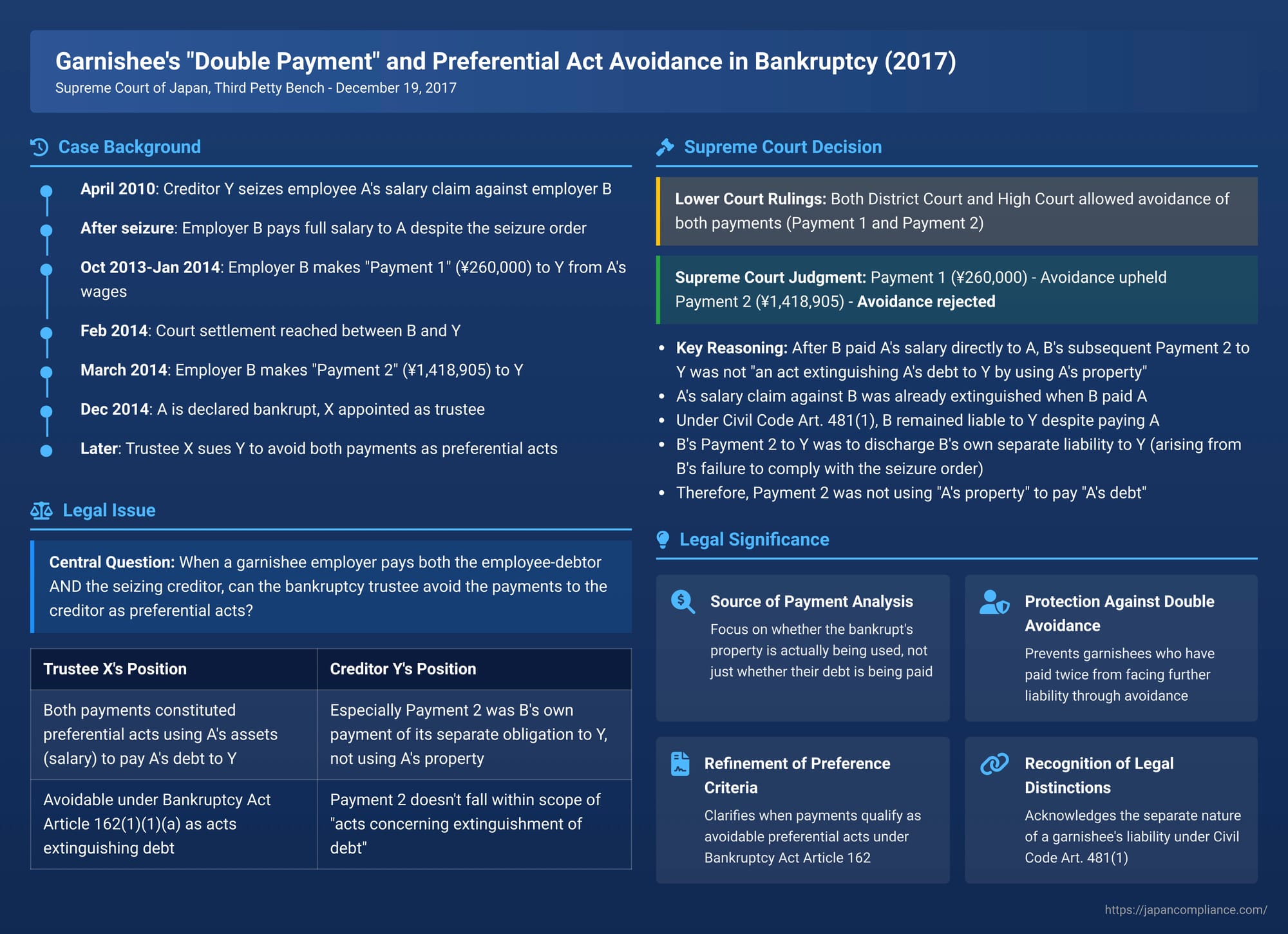

This blog post explores a 2017 Supreme Court of Japan decision (referred to as A6 based on the provided source material). The case delves into a complex scenario involving wage garnishment, a garnishee employer making payments to both the employee-debtor and the seizing creditor, and the subsequent bankruptcy of the employee-debtor. The core issue was whether payments made by the garnishee employer to the seizing creditor, after the employer had already (mistakenly) paid the full wages to the bankrupt employee, could be avoided by the employee's bankruptcy trustee as preferential acts.

Facts of the Case (A6)

Creditor Y (appellant before the Supreme Court) held a final and binding judgment for a loan claim against A (the debtor). Based on this judgment, Y obtained a court order in April 2010 seizing A's salary claim against A's employer, company B (the third-party garnishee). This seizure order was duly served on B Co..

Despite the valid seizure order, B Co. continued to pay A the full amount of A's salary directly to A.

Around October 2013, Y initiated "payment order" (支払督促 - shiharai tokusoku, a summary debt collection proceeding) proceedings against B Co., seeking payment of the portion of A's salary that had been seized by Y's earlier order. While B Co. filed an objection to the payment order (which typically transitions the case to ordinary litigation), between October 2013 and January 2014, B Co. deducted a total of 260,000 yen from wages payable to A and paid this sum to Y as partial satisfaction of the seized portion of A's salary. This series of payments is referred to as "Payment 1".

Subsequently, in the litigation that followed B Co.'s objection to the payment order, a court settlement was reached in February 2014. Under this settlement, B Co. agreed to pay Y a further 1,418,905 yen as satisfaction of the seized portion of A's salary. B Co. made this payment to Y in March 2014. This payment is referred to as "Payment 2".

In December 2014, A (the employee-debtor) was declared bankrupt, and X was appointed as A's bankruptcy trustee (respondent before the Supreme Court). X then filed a lawsuit against Y (the seizing creditor), seeking to avoid both Payment 1 and Payment 2, totaling 1,678,905 yen, plus statutory interest. X argued that these payments constituted preferential acts voidable under Article 162, Paragraph 1, Item 1(a) of the Bankruptcy Act, as they extinguished A's debt to Y using A's assets (the salary) shortly before A's bankruptcy.

Both the first instance court and the High Court ruled in favor of the trustee X, allowing the avoidance of both Payment 1 and Payment 2. Y filed a petition for acceptance of appeal to the Supreme Court.

The Supreme Court's Decision (A6)

The Supreme Court partially modified the High Court's judgment. It effectively upheld the avoidance of Payment 1 (as the grounds for appeal concerning this part had been excluded in the Supreme Court's decision to accept the appeal) but overturned the avoidance of Payment 2. X's claim regarding Payment 2 was dismissed [Judgment Text].

The Court's reasoning was as follows:

- "Act Concerning the Extinguishment of Debt" under Bankruptcy Act Article 162(1):

The Court began by affirming the general principle that an "act concerning the extinguishment of debt" subject to avoidance under Article 162, Paragraph 1 of the Bankruptcy Act includes not only acts based on the bankrupt's volition but also acts performed under an enforceable title of indebtedness (like a court order), provided that such acts have the effect of extinguishing the bankrupt's debt by using the bankrupt's property (citing a 1964 Supreme Court precedent). - The Effect of a Garnishee's Payment to the Debtor After Seizure:

The critical part of the Court's reasoning concerned the legal consequences when a third-party garnishee (like B Co.), after being served with a valid seizure order, nevertheless pays the seized debt (A's salary) directly to the principal debtor (A) instead of to the seizing creditor (Y).- When B Co. paid A, this payment effectively extinguished A's salary claim against B Co. for that period.

- However, under Article 481, Paragraph 1 of the Civil Code, a third-party garnishee who pays the principal debtor after receiving notice of a seizure cannot set up that payment as a defense against the seizing creditor. This means B Co. remained liable to Y for the seized amount, despite having already paid A.

- The Nature of the Garnishee's Subsequent Payment to the Seizing Creditor:

When B Co. (the garnishee) subsequently made Payment 2 to Y (the seizing creditor) – this payment occurred after B Co. had already paid the corresponding wages to A – the Supreme Court held that this Payment 2 did not constitute an act that extinguished A's debt to Y by using A's property.

The reasoning is that A's property (the specific salary claim against B Co. for that period) had already been "used up" or extinguished when B Co. made the initial payment to A. B Co.'s subsequent Payment 2 to Y was, therefore, a payment made by B Co. to discharge its own, separate liability that it incurred towards Y because of its failure to comply with the seizure order (i.e., its inability to use the payment to A as a defense against Y). It was not a payment depleting A's remaining assets or estate in the manner contemplated by the avoidance provisions for preferential acts. - Conclusion on Payment 2:

Since Payment 2 was not deemed to be an act extinguishing A's debt with A's property, it did not fall within the scope of "acts concerning the extinguishment of debt" under Bankruptcy Act Article 162, Paragraph 1, and was therefore not subject to avoidance by A's bankruptcy trustee, X.

The Supreme Court therefore modified the lower court judgments to reflect that only Payment 1 (the 260,000 yen) was subject to avoidance (or rather, its avoidance was not overturned), while the claim to avoid Payment 2 (1,418,905 yen) was dismissed [Judgment Text].

Commentary and Elaboration

1. Preferential Act Avoidance: General Principles

Under Japanese bankruptcy law, the trustee has the power to avoid certain "preferential acts" (偏頗行為否認 - henpa kōi hinin) made by or concerning the debtor shortly before bankruptcy that unfairly benefit one creditor over others. Article 162, Paragraph 1, Item 1(a) of the Bankruptcy Act specifically targets acts "concerning the extinguishment of debt" (e.g., making a payment on an existing debt) if they meet certain conditions (such as being made when the debtor was insolvent or had suspended payments, and being harmful to other creditors).

The scope of such avoidable acts is not limited to the bankrupt's voluntary actions; it can include payments or transfers made under the compulsion of an enforceable title of indebtedness (like a court judgment or seizure order). The key test, as affirmed by the Supreme Court, is whether the act in question had the effect of "extinguishing the bankrupt's debt with the bankrupt's property".

2. Standard Garnishment vs. the "Double Payment" Scenario

- Standard Garnishment: If a seizing creditor (like Y) collects a seized monetary claim directly from a third-party garnishee (like B Co.), and B Co. has not already paid the debtor (A), this payment by B Co. to Y typically would be considered an act using A's property (A's claim against B Co.) to extinguish A's debt to Y. If other conditions for a preference are met, this payment could be avoidable in A's subsequent bankruptcy.

- The "Double Payment" Scenario: The present case involved a more complex "double payment" situation. B Co. (garnishee) first paid A (debtor), and then, because that first payment didn't discharge its obligation to Y (seizing creditor) due to Civil Code Article 481(1), B Co. paid Y.

3. Rationale for the Supreme Court's Distinction Regarding Payment 2

The Supreme Court's decision not to allow avoidance of Payment 2 appears to be based on a substantive consideration of whose assets were truly used and whose liability was being discharged.

- When B Co. made the initial payment of wages to A, A's claim against B Co. for those wages was satisfied and extinguished. At that point, that specific asset (A's wage claim for that period) was gone from A's potential estate from B Co.'s perspective, although A received the cash.

- B Co.'s subsequent Payment 2 to Y was not made directly from any remaining asset of A's held by B Co. (since that specific wage claim of A against B Co. had already been paid to A). Instead, Payment 2 was made by B Co. to satisfy its own statutory liability to Y, a liability that arose because B Co. failed to honor the garnishment and mistakenly paid A.

- The commentary suggests that the funds for this "further payment" (Payment 2) were not sourced from assets that were, at that point, considered part of A's property earmarked for A's general creditors. While B Co. might have used its general funds (which indirectly might have been healthier because it hadn't initially paid Y), the direct link to A's specific asset being used to pay A's debt to Y was broken by the first payment to A. The Supreme Court effectively viewed Payment 2 as B Co. settling its own distinct obligation to Y.

Therefore, Payment 2 did not diminish A's bankruptcy estate in the direct way that a preferential payment of an existing debt by the bankrupt normally would.

Conclusion

The Supreme Court's 2017 decision provides a nuanced interpretation of preferential act avoidance in the context of wage garnishments where the garnishee employer mistakenly pays the debtor employee before paying the seizing creditor. The ruling clarifies that a subsequent "second" payment by the garnishee to the seizing creditor, made to fulfill the garnishee's own liability arising from its failure to comply with the seizure order, is not considered an act that extinguishes the bankrupt debtor's debt using the bankrupt debtor's property. Consequently, such a second payment is not subject to avoidance as a preferential act in the debtor's later bankruptcy. This decision highlights the importance of carefully analyzing the source of funds and the nature of the liability being discharged when applying avoidance rules in complex multi-party payment scenarios.