Japan's Hydrogen Economy: Legal & Regulatory Roadmap to 2050 Carbon Neutrality

Japan is betting on hydrogen to reach net‑zero by 2050; explore the laws, safety standards and incentives shaping this transition and the opportunities for global investors.

TL;DR

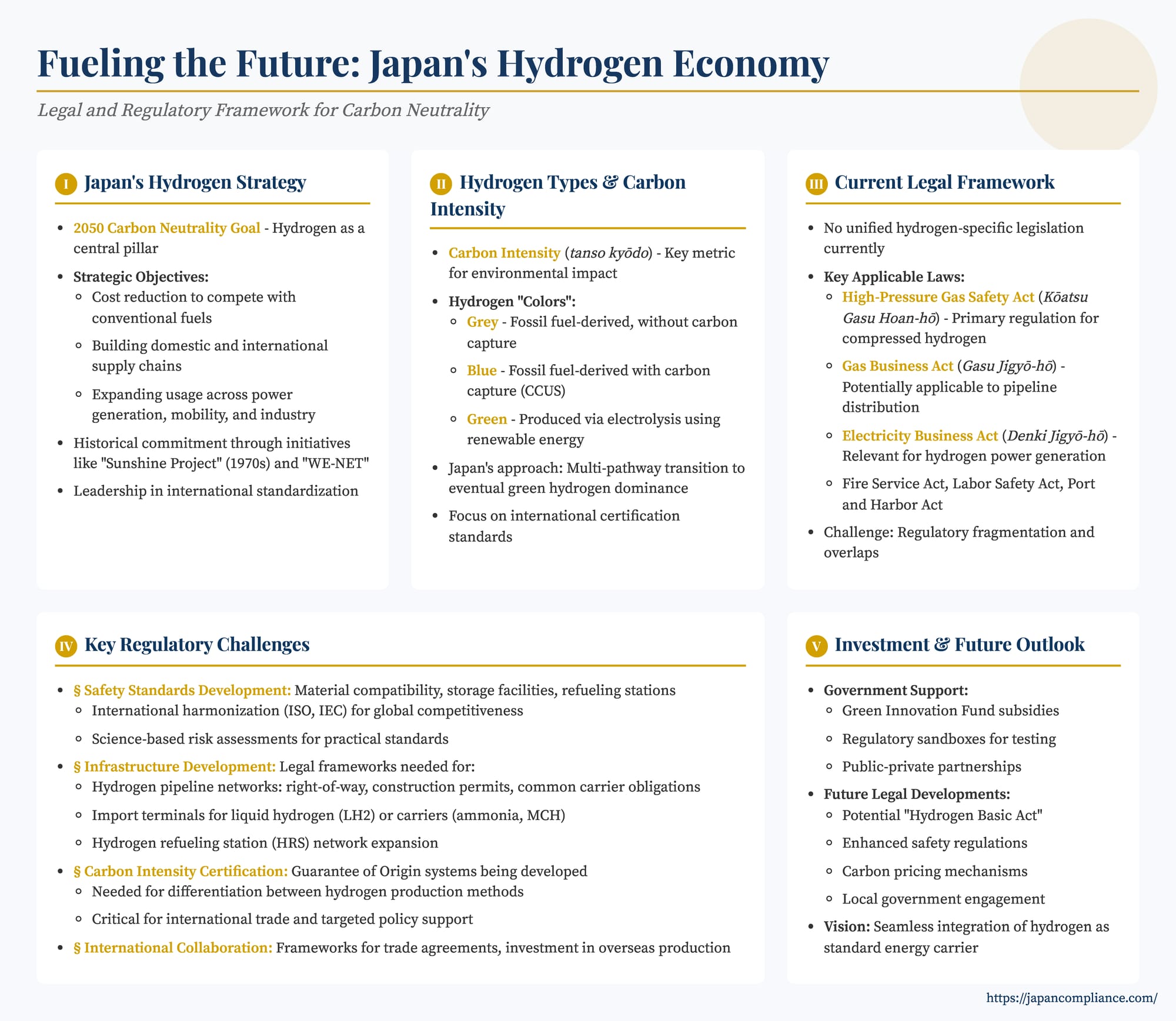

Japan aims for carbon neutrality by 2050 and positions hydrogen as a cornerstone. This article explains Japan’s hydrogen strategy, the current fragmented legal framework, key safety and infrastructure rules, and the upcoming reforms that will open significant investment opportunities for global businesses.

Table of Contents

- Japan's Hydrogen Ambition: A Historical and Strategic Perspective

- Understanding Hydrogen: "Colors" and Carbon Intensity

- The Current Legal and Regulatory Framework for Hydrogen in Japan

- Key Regulatory Areas and Emerging Challenges

- Investment Opportunities and the Business Environment

- Future Outlook: Towards a Cohesive Hydrogen Legal Framework

Japan has firmly committed to achieving carbon neutrality by 2050, a bold ambition that positions the nation at the forefront of the global decarbonization effort. Central to this strategy is the widespread adoption of hydrogen technology, envisioned as a clean energy carrier with the potential to transform power generation, transportation, and industrial processes. For U.S. businesses and investors in the green technology and energy sectors, understanding Japan's evolving legal and regulatory landscape for hydrogen is key to unlocking significant opportunities in this burgeoning market.

Japan's Hydrogen Ambition: A Historical and Strategic Perspective

Japan's interest in hydrogen is not new. The nation has a long history of research and development in hydrogen and fuel cell technologies, dating back to initiatives like the "Sunshine Project" in the 1970s and later the "World Energy Network (WE-NET)" project which explored hydrogen production from overseas renewable sources for import. This long-term engagement has provided Japan with a solid technological foundation.

Driven by the Paris Agreement and its own 2050 carbon neutrality goal, contemporary Japanese hydrogen strategy focuses on:

- Cost Reduction: Making green and blue hydrogen economically competitive with conventional fuels.

- Building Secure Supply Chains: Establishing both domestic production capabilities (leveraging renewable energy - 再エネ sai-ene) and international partnerships for stable hydrogen import.

- Promoting Widespread Utilization: Expanding hydrogen use across various sectors, including power generation (co-firing and dedicated hydrogen turbines), mobility (fuel cell vehicles - FCVs, ships, trains), and heavy industry (e.g., steelmaking, chemicals).

- International Leadership: Spearheading international rulemaking and standardization for hydrogen to facilitate global trade and adoption.

The Japanese government has backed these goals with significant investment in research and development, demonstration projects, and policy support.

Understanding Hydrogen: "Colors" and Carbon Intensity

While often categorized by "colors" based on production methods, the more critical factor from a decarbonization perspective is the carbon intensity (炭素強度 - tanso kyōdo) of the hydrogen produced – i.e., the amount of greenhouse gas emitted throughout its lifecycle.

- Grey Hydrogen: Currently the most common form, produced from fossil fuels (primarily natural gas) via steam methane reforming, with associated CO2 emissions released into the atmosphere.

- Blue Hydrogen: Also produced from fossil fuels, but with carbon capture, utilization, and storage (CCUS) technologies applied to mitigate CO2 emissions. Often seen as a transitional technology.

- Green Hydrogen: Produced through electrolysis of water using renewable electricity (e.g., solar, wind). This is the ultimate goal for a truly decarbonized hydrogen economy.

- Other "colors" like turquoise (from methane pyrolysis, producing solid carbon) or pink/purple/red (from nuclear power) are also part of the global discussion.

Japan's approach acknowledges the need for various production pathways in the near to medium term, with a long-term emphasis on scaling up green hydrogen. The immediate focus is often on utilizing existing infrastructure and technologies to build demand and experience, even if it initially involves hydrogen with higher carbon intensity, while simultaneously investing heavily in green hydrogen production and import value chains. Measuring and certifying the carbon intensity across the entire supply chain is becoming an international priority, and Japan is actively involved in these discussions.

The Current Legal and Regulatory Framework for Hydrogen in Japan

Unlike some jurisdictions that are moving towards dedicated hydrogen legislation, Japan currently regulates hydrogen activities under a framework of existing laws, primarily designed for other substances or industries. This can present complexities for new hydrogen projects.

Key applicable laws include:

- High-Pressure Gas Safety Act (高圧ガス保安法 - Kōatsu Gasu Hoan-hō): This is arguably the most central piece of legislation for many current hydrogen applications. It governs the production, storage, sale, transportation, and handling of high-pressure gases, including hydrogen. Hydrogen fueling stations for FCVs, high-pressure hydrogen storage tanks, and industrial uses of compressed hydrogen fall squarely under its purview. Compliance involves permits, technical standards for equipment, safety management systems, and qualified personnel. Much of the deregulation efforts for hydrogen stations over the past decade have involved specific amendments or interpretations under this Act.

- Gas Business Act (ガス事業法 - Gasu Jigyō-hō): This Act primarily regulates the supply of utility gas (like natural gas) to general consumers via pipelines. It can apply to hydrogen if it is supplied through pipelines to meet general demand. However, the Act was designed with methane-based city gas in mind. While safety standards for gas facilities under this Act could apply to hydrogen pipelines, crucial aspects like third-party access rules for hydrogen-dedicated pipelines are still developing. Current interpretations suggest that hydrogen-only pipelines may not automatically be subject to the same common carrier obligations as natural gas pipelines.

- Electricity Business Act (電気事業法 - Denki Jigyō-hō): If hydrogen is used as a fuel for power generation within the managed area of a power plant (e.g., in dedicated hydrogen turbines or co-fired with other fuels), the facilities may be regulated under this Act as part of the power generation infrastructure.

- Other Relevant Laws:

- Fire Service Act (消防法 - Shōbō-hō): Regulates the handling and storage of hazardous materials, which can include hydrogen depending on its state and quantity.

- Labor Safety and Health Act (労働安全衛生法 - Rōdō Anzen Eisei-hō): Mandates measures to ensure workplace safety, relevant for facilities producing or using hydrogen.

- Building Standard Act (建築基準法 - Kenchiku Kijun-hō): Applies to the construction of facilities housing hydrogen equipment.

- Port and Harbor Act (港湾法 - Kōwan-hō): Relevant for import terminals for liquid hydrogen.

- Environmental Laws: Air pollution control, water pollution control, and environmental impact assessment laws may apply depending on the scale and nature of the hydrogen project.

The primary challenge with this fragmented approach is the potential for regulatory overlaps, gaps, or interpretations that are not perfectly suited for novel hydrogen applications. Businesses often need to navigate multiple statutes and ministerial ordinances, which can increase compliance costs and project lead times. There is an ongoing discussion in Japan about the need for a more unified or hydrogen-specific legal framework to streamline development.

Key Regulatory Areas and Emerging Challenges

As Japan advances its hydrogen economy, several regulatory areas are critical:

- Safety Standards: Public acceptance and safe deployment of hydrogen technologies hinge on robust safety standards. This includes:

- Standards for hydrogen production facilities (electrolyzers, reformers).

- Transportation and storage of gaseous and liquid hydrogen (pipelines, tankers, storage tanks). Material compatibility (e.g., hydrogen embrittlement of metals) is a key concern.

- Hydrogen refueling stations for FCVs and other mobility applications.

- End-use equipment (fuel cells, turbines, industrial burners).

Japan is actively involved in developing and refining these standards, often looking towards international harmonization (e.g., through ISO, IEC, and UN GTR for FCVs) to ensure its technologies are globally competitive and to facilitate international trade in hydrogen and related equipment. Science-based risk assessments and practical demonstration projects are crucial for evolving these standards.

- Infrastructure Development: Building out a hydrogen infrastructure is a massive undertaking.

- Pipelines: Legal frameworks for right-of-way, construction permits, safety, and potentially third-party access (common carrier obligations) for hydrogen pipelines are needed. The current Gas Business Act may not fully address the unique aspects of a widespread hydrogen pipeline network.

- Import Terminals and Storage: For liquid hydrogen (LH2) or hydrogen carriers like ammonia or methylcyclohexane (MCH), dedicated port facilities and large-scale storage will be required.

- Hydrogen Refueling Stations (HRS): While progress has been made in deregulating HRS construction and operation, expanding the network to support FCV adoption remains a priority.

- Carbon Intensity Certification: To ensure that hydrogen contributes to genuine decarbonization, robust systems for certifying its carbon intensity (often referred to as "Guarantee of Origin" or "Certificates of Origin" systems internationally) are essential. This will allow for differentiation between green, blue, and grey hydrogen and enable targeted policy support for low-carbon varieties. Currently, Japanese law does not formally distinguish hydrogen by its production method or carbon intensity for most regulatory purposes, but this is anticipated to be a key area for future legal development, especially as international hydrogen trade grows.

- International Collaboration and Trade: Given Japan's resource constraints, importing low-carbon hydrogen is a core part of its strategy. This necessitates:

- Bilateral and multilateral agreements on hydrogen trade.

- International alignment on standards and certification.

- Legal frameworks for investment in overseas hydrogen production projects.

The modernization of instruments like the Energy Charter Treaty to explicitly include hydrogen is an example of efforts to create a stable international legal environment for hydrogen investment and trade.

- Competition Law and Collaboration: The development and deployment of new hydrogen technologies often require significant investment and collaboration among companies (e.g., for joint R&D, infrastructure development, or creating initial demand). Competition authorities in Japan, like elsewhere, are exploring how to assess such collaborations to ensure they promote innovation without unduly restricting competition.

Investment Opportunities and the Business Environment

The Japanese government is actively fostering a conducive environment for hydrogen investment through:

- Subsidies and Financial Incentives: Programs like the Green Innovation Fund provide substantial funding for R&D, demonstration, and commercial-scale deployment of hydrogen technologies.

- Regulatory Sandboxes: Allowing companies to test new hydrogen business models and technologies under relaxed regulatory conditions.

- Public-Private Partnerships: Facilitating collaboration between government entities, research institutions, and private companies.

Major Japanese industrial players across sectors like energy, automotive, steel, chemicals, and heavy engineering are deeply involved in hydrogen initiatives. There is also a growing role for startups specializing in niche hydrogen technologies or services.

Future Outlook: Towards a Cohesive Hydrogen Legal Framework

While Japan has made significant strides, the path to a full-fledged hydrogen economy requires ongoing legal and regulatory evolution. Key future developments may include:

- A More Unified Hydrogen Law: Potentially a dedicated "Hydrogen Basic Act" or significant amendments to existing energy laws to create a clearer, more comprehensive framework specifically for hydrogen, addressing issues like pipeline regulation, third-party access, and clear definitions for low-carbon hydrogen.

- Enhanced Safety Regulations: Continuously updating safety standards based on technological advancements and operational experience.

- Carbon Pricing and Green Finance: Implementing mechanisms that further incentivize the production and use of low-carbon hydrogen.

- Role of Local Governments: Local authorities are expected to play a crucial role in zoning, permitting for hydrogen infrastructure, and promoting local hydrogen utilization projects tailored to regional needs and renewable energy resources.

Ultimately, the vision is for hydrogen to become an seamlessly integrated part of Japan's energy system, no longer viewed as a "special" or niche fuel but as a common, clean, and reliable energy carrier. Achieving this will require sustained policy commitment, technological innovation, significant investment, and a legal and regulatory framework that is both robust and adaptive. For U.S. businesses with expertise in hydrogen technology, project development, or green finance, Japan's ambitious transition offers a landscape rich with potential.

- Japan's Digital Transformation: Key Legal Reforms Shaping the Business Landscape

- Thinking of Entering Japan's Crypto Market? What US Businesses Must Know

- Japan’s Data Privacy & Cybersecurity Rules (2025): APPI, Breach Reporting, and Cross‑Border Transfers Explained

- Interim Report for the Hydrogen Safety Strategy Released

- Hydrogen Society Promotion Act Enacted

- Climate Change Policy Portal – METI