Fair Share in Synergy: Japanese Supreme Court on "Fair Price" in Arm's-Length Corporate Reorganizations

Judgment Date: February 29, 2012

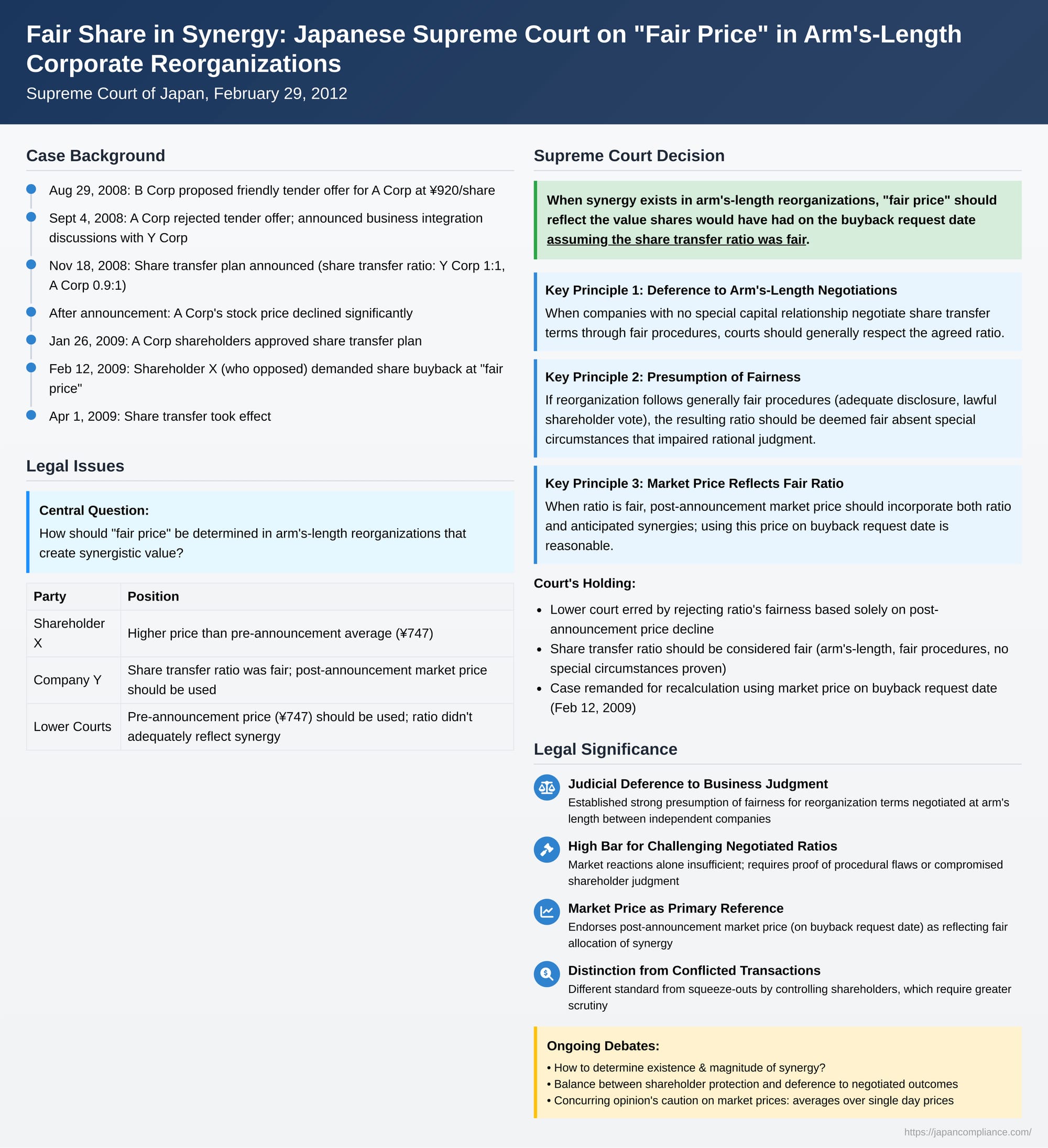

When Japanese companies undergo major structural changes like mergers or share transfers (株式移転 - kabushiki iten, often used to create a holding company structure), shareholders who dissent from such transactions are typically granted "appraisal rights" (株式買取請求権 - kabushiki kaitori seikyūken). This right allows them to demand that the company purchase their shares at a "fair price." A critical and often contentious issue is how this "fair price" should be determined, especially when the reorganization is expected to create synergistic value and the companies involved negotiated the terms at arm's length. A 2012 Supreme Court of Japan decision provided significant guidance on this matter, particularly concerning the deference courts should give to a share exchange ratio agreed upon by independent companies following fair procedures.

The Business Integration and Shareholder Dissent

The case involved A Corp, a company listed on the First Section of the Tokyo Stock Exchange, engaged in the manufacture and sale of game amusement equipment. The events leading to the dispute were:

- Initial Takeover Proposal: On August 29, 2008, an unrelated company, B Corp (which also operated in a similar business sector), announced a proposal for a friendly tender offer for A Corp's shares at ¥920 per share, contingent on A Corp's board approval.

- Rejection and New Negotiations: On September 4, 2008, A Corp's board rejected B Corp's tender offer proposal. Simultaneously, A Corp announced that it would commence discussions with Y Corp (the appellant in the Supreme Court, whose trade name was also B at that time, indicating a potential identity or close relation with the initial TO proposer, though the judgment treats them as the negotiating partner for the share transfer) regarding a business integration. Critically, A Corp and Y Corp had no special existing capital relationship, meaning they were independent entities negotiating at arm's length.

- Share Transfer Plan Announced: On November 18, 2008, after their respective board approvals, A Corp and Y Corp announced a share transfer plan to create a new, wholly-owning parent company, C Corp. Under this plan, both A Corp and Y Corp would become wholly-owned subsidiaries of C Corp.

- The Share Transfer Ratio: The plan stipulated the following exchange ratio:

- Shareholders of Y Corp would receive 1 common share of the new holding company C Corp for each common share of Y Corp.

- Shareholders of A Corp would receive 0.9 common shares of C Corp for each common share of A Corp.

This ratio (the "Share Transfer Ratio") was determined after both A Corp and Y Corp independently commissioned third-party institutions to calculate valuation assessments, followed by negotiations and mutual agreement between the two companies.

- Shareholder Approval: On January 26, 2009, A Corp's general shareholders' meeting approved the share transfer plan. Subsequently, A Corp's shares were delisted on March 26, 2009, and the share transfer took effect on April 1, 2009.

- Dissent and Appraisal Demand: X, a shareholder of A Corp, opposed the share transfer. Prior to the shareholder meeting, X notified A Corp of this opposition and voted against the resolution. Subsequently, on February 12, 2009 (within the statutory period), X formally demanded that A Corp purchase X's shares at a "fair price," exercising appraisal rights under Article 806, Paragraph 1 of the Companies Act.

A significant market reaction followed the November 18, 2008, announcement of the share transfer plan: A Corp's stock price experienced a sharp decline, hitting the lower limit of its permissible trading range on the following day, and continued to underperform the general market trend thereafter. This price movement became a major point of contention in determining the "fair price."

The Lower Courts' Approaches

When A Corp and X could not agree on a price, X petitioned the Tokyo District Court for a determination.

- Tokyo District Court: Ruled that the "fair price" should be the nakariseba kakaku (the "as-if-not" price, i.e., the value A Corp's shares would have had if the share transfer had not occurred). It set this price at ¥747 per share, based on the volume-weighted average of A Corp's closing share prices for the one-month period preceding the November 18, 2008, public announcement of the share transfer plan.

- Tokyo High Court: On appeal, the High Court opined that for a shareholder like X, who may have acquired shares anticipating a business integration, the "fair price" should appropriately reflect the increase in enterprise value resulting from such integration (synergy). However, it then controversially found that the Share Transfer Ratio in this specific case did not adequately reflect this increase in enterprise value, largely influenced by the significant post-announcement drop in A Corp's stock price. Despite this reasoning, the High Court ultimately arrived at the same ¥747 per share as the District Court, also using the one-month pre-announcement average price.

Both X (seeking a higher price) and Y Corp (which had succeeded A Corp through a subsequent merger and sought a lower price or affirmation of the ratio) appealed to the Supreme Court.

The Supreme Court's Decision: A Framework for Fairness in Arm's-Length Reorganizations

The Supreme Court, in its decision dated February 29, 2012, reversed the High Court's determination and remanded the case for recalculation. The Court laid down a critical framework for assessing "fair price" when a reorganization involves synergy and is negotiated between independent companies.

1. Purpose of Appraisal Rights and Valuation Date (Reiteration)

The Court first reiterated principles from its earlier April 19, 2011 decision (Case 84 in the user's context):

- The appraisal right serves to provide dissenting shareholders an exit opportunity, ensure they receive a value economically equivalent to what they would have had if the reorganization didn't happen (nakariseba kakaku), and allow them to appropriately share in any synergy or other increase in enterprise value created by the reorganization.

- The valuation date for determining "fair price" is, in principle, the date the shareholder makes their share buyback request.

2. "Fair Price" When Synergy/Enterprise Value Increase Is Expected

The Court then addressed the scenario specific to this case – where an increase in enterprise value (synergy) is anticipated from the reorganization:

- In a share transfer, the post-reorganization enterprise value (including synergy) is distributed to the shareholders of the original companies through the Share Transfer Ratio, which dictates how many shares of the new parent company they receive.

- Therefore, when synergy is expected, the "fair price" for a dissenting shareholder's shares should, in principle, be the value those shares would have had on the date of the buyback request, assuming the Share Transfer Ratio itself was fair.

3. Assessing the Fairness of the Share Transfer Ratio – The Core Holding

This was the central contribution of the decision. The Court established a general principle for when a Share Transfer Ratio should be considered fair by the courts:

- Arm's-Length Negotiations: When a share transfer plan is formulated between companies that have no special capital relationship (i.e., they are independent entities negotiating at arm's length):

- It is generally expected that the directors of each company, fulfilling their duty of loyalty, will strive to create a plan that is in the best interests of their respective company and its shareholders.

- Furthermore, shareholders will typically vote to approve the share transfer only if they, after considering how their interests will be affected, judge the Share Transfer Ratio to be fair.

- Consequently, the judgment of these directors and shareholders regarding the fairness of the Share Transfer Ratio should, as a general rule, be respected by the courts.

- Presumption of Fairness from Fair Procedures: If the share transfer comes into effect through procedures that are generally recognized as fair – such as adequate disclosure of relevant information to shareholders as a basis for their decision, and lawful approval by the shareholders' meeting – then, absent special circumstances demonstrating that the shareholders' rational judgment was impaired, the Share Transfer Ratio agreed upon in such a share transfer should be deemed fair.

4. Using Market Price When the Ratio is Fair and Synergy Exists

Building on this, the Court addressed the use of market share prices:

- If the Share Transfer Ratio is deemed fair (according to the principles above), then the market price of the shares of the company becoming a subsidiary (A Corp in this case), after the public announcement of the ratio, should – absent special circumstances – be presumed to have factored in this fair ratio and the anticipated effects of the share transfer, including synergy.

- Therefore, in such cases (excluding situations where no enterprise value increase is expected from the reorganization), using the market share price on the date of the share buyback request (or an average of market prices over a proximate period to mitigate the impact of accidental fluctuations) as a basis for calculating the "fair price" is within the reasonable discretion of the court.

Application to the Facts and Reason for Remand

Applying these principles to the A Corp and Y Corp share transfer:

- A Corp and Y Corp were independent, having no special capital relationship.

- The share transfer process (including board approvals, shareholder resolutions, and information disclosure) was found to have followed generally fair procedures. No issues with the information provided to shareholders prior to the vote were apparent from the record.

- Regarding the crucial question of "special circumstances impairing rational shareholder judgment," the Supreme Court directly addressed the post-announcement decline in A Corp's stock price. It stated that market share prices fluctuate due to various factors, and the mere fact that A Corp's market price dropped significantly after the announcement, or its subsequent trajectory, cannot, by itself, immediately lead to the conclusion that such "special circumstances" existed.

- No other evidence of such special circumstances was found.

- Therefore, the Supreme Court concluded that the Share Transfer Ratio between A Corp and Y Corp should be considered fair.

The High Court had erred by:

- Concluding that the Share Transfer Ratio was not fair (and not reflective of the enterprise value increase) primarily based on the post-announcement decline in A Corp's stock price.

- Consequently resorting to A Corp's market share price from before the announcement of the share transfer plan to calculate the "fair price."

The Supreme Court found this approach to be a violation of law with a clear impact on the judgment, reversed the High Court's decision, and remanded the case for a recalculation of the "fair price." This recalculation was to be based on the premise that the Share Transfer Ratio was fair, and thus the "fair price" should be determined by reference to the market price of A Corp's shares as of the date X made the buyback request (February 12, 2009), potentially using an average over a proximate period to smooth out accidental fluctuations, reflecting the fair ratio and expected synergy.

Justice Sudo's Concurring Opinion

Justice Masahiko Sudo issued a concurring opinion, agreeing with the majority's outcome but offering additional thoughts, particularly on the use of market prices and the difficulty of objectively measuring enterprise value and synergy.

- He acknowledged that while courts form the fair price within their discretion, it should be grounded in objective enterprise value.

- He noted the theoretical approach of calculating pre-reorganization values, adding estimated synergy, allocating it, and then deriving a theoretical share price. However, he stressed the immense practical difficulty and inherent uncertainty in accurately measuring future cash flows and synergistic effects. Such valuations are complex, costly, time-consuming, and still predictive rather than definitive.

- He endorsed the majority's view that if a share transfer ratio is determined through fair procedures between independent parties, the post-announcement market price (reflecting that ratio) is a reasonable proxy for a price that incorporates a fair allocation of synergy. Using market prices is more practical, less costly, and allows for quicker price determinations.

- He cautioned that market prices are not always perfect reflections of intrinsic value due to information asymmetry, speculation, or other random factors. Therefore, courts should use market data carefully, perhaps considering price averages over a reasonable period rather than a single day's price, especially if there's suspicion of distortion.

- In situations where fair procedures were not followed, or the ratio is demonstrably unfair, or for unlisted shares, market prices lose their reliability. In such instances, courts might have to engage with more direct (though complex) valuation methodologies.

- Regarding the specific decline in A Corp's stock price, Justice Sudo suggested it could be attributed to various factors, including market disappointment after initial high expectations or specific industry conditions, and did not necessarily prove the Share Transfer Ratio itself was unfair, especially given the fair procedures that were followed.

Analysis and Implications

This 2012 Supreme Court decision provides crucial guidance for determining "fair price" in arm's-length corporate reorganizations where synergies are expected:

- Deference to Arm's-Length Agreements: The ruling signals a significant degree of judicial deference to the terms (specifically, the share exchange ratio) negotiated by independent companies, provided that the process leading to the agreement and its approval was procedurally fair (adequate disclosure, lawful shareholder vote). This aligns with leading scholarly opinions that advocate for respecting business judgment and shareholder democracy in such non-conflicted transactions.

- High Bar for "Special Circumstances": The Court set a high bar for challenging a negotiated ratio. A significant adverse market reaction (like a stock price drop) post-announcement is not, in itself, sufficient to prove that the ratio was unfair or that shareholders' rational judgment was impaired. Parties seeking to challenge the ratio would need to demonstrate more specific flaws in the process or information that demonstrably vitiated rational shareholder decision-making.

- Market Price as a Key Reference (with caveats): When the exchange ratio is deemed fair due to proper procedures, the post-announcement market price of the shares of the company becoming a subsidiary (as of the date of the buyback request) becomes a primary reference point for the court in determining the "fair price" for dissenting shareholders. This price is presumed to reflect the fair allocation of expected synergies. Courts retain discretion to use averages or make adjustments for market volatility.

- Distinction from Conflicted Transactions: It is vital to distinguish the principles in this case from those applicable in conflicted transactions, such as squeeze-outs by a controlling shareholder (as discussed in user's Case 86 context). In arm's-length deals between unrelated parties, the presumption is that each side negotiates to maximize its own shareholders' value, leading to a greater willingness by courts to respect the outcome if procedures are fair. In conflicted transactions, the risk of unfairness to minority shareholders is inherently higher, warranting more intensive judicial scrutiny of the substantive fairness of the price. The "generally fair procedures" standard likely has a different, more deferential meaning in the arm's-length context than in a conflicted one.

- Determining the Existence and Magnitude of Synergy: This decision proceeded on the High Court's premise that the share transfer would generate an increase in enterprise value. However, the Supreme Court itself did not lay down a specific framework for how a court should initially determine whether synergy is likely or how to quantify it. This remains an area for further development in practice and jurisprudence. The remanded High Court decision in this very case did subsequently find positive synergy.

Conclusion

The February 29, 2012, Supreme Court decision offers a significant framework for determining the "fair price" in share buyback claims arising from arm's-length corporate reorganizations that are expected to generate synergies. By emphasizing deference to a share exchange ratio agreed upon through procedurally fair means between independent companies, and by clarifying that a negative market reaction alone does not invalidate such a ratio, the Court has provided greater predictability for such transactions. The "fair price" for dissenting shareholders in these situations should, in principle, reflect this fairly determined ratio as of the date of their buyback request, typically by reference to the post-announcement market price of their shares. This approach seeks to balance the protection of dissenting shareholders with respect for the negotiated outcomes of fairly conducted business combinations.