Fair Price in Squeeze-Outs: Japanese Supreme Court on Tender Offer Price and Subsequent Market Changes

Judgment Date: July 1, 2016

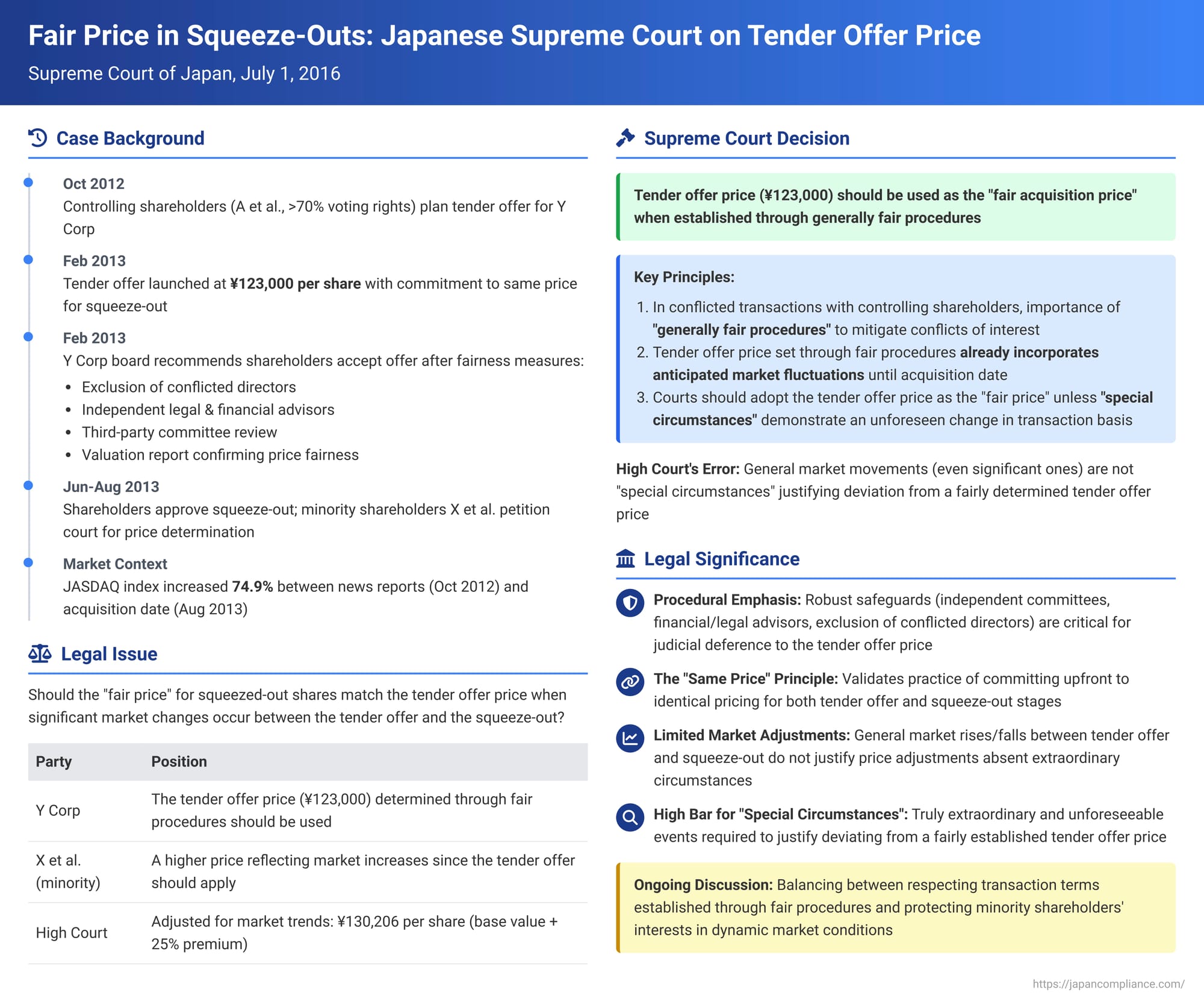

In Japan, when majority shareholders aim to acquire 100% ownership of a company, often through a two-step process involving a tender offer followed by a squeeze-out of remaining minority shareholders, the question of "fair price" for those squeezed-out shares becomes paramount. Minority shareholders are granted a statutory right to demand that the company (or the acquirer) purchase their shares at a "fair price," and if no agreement is reached, to petition a court for a price determination. A 2016 Supreme Court of Japan decision provided significant guidance on how this "fair price" should be assessed, particularly when a tender offer price was established through procedures designed to ensure fairness, and whether subsequent general market movements should lead to an adjustment of that price.

The Squeeze-Out Saga: From Tender Offer to Court

The case involved Y Corp, a company whose shares were listed on the JASDAQ market. The controlling interest, exceeding 70% of voting rights, was held collectively by A and B (referred to as "A et al." when including another entity involved in the tender offer). These majority shareholders orchestrated a plan to take Y Corp private.

- Tender Offer Plan and Announcement:

- On October 20, 2012, news reports surfaced about A and B planning a tender offer (TO) for Y Corp shares.

- On October 24, 2012, A et al. publicly announced their intention to conduct a TO to acquire all shares of Y Corp, to be followed by a squeeze-out of any remaining shares.

- On February 26, 2013, A et al. formally launched the TO for all of Y Corp's common stock and share acquisition rights. The tender offer price was set at ¥123,000 per share ("the Tender Offer Price").

- Crucially, the TO announcement explicitly stated that if not all shares were acquired through the TO, Y Corp would implement measures (such as converting all common stock into shares with a class-wide call provision – zenbu shutoku jōkō tsuki shurui kabushiki) to acquire all remaining shares at a price identical to the Tender Offer Price (i.e., ¥123,000 per share). This upfront commitment to an equal price for the second-step squeeze-out is a common practice aimed at mitigating the potentially coercive nature of tender offers.

- Y Corp's Board Response and Fairness Measures:

- On the same day the TO was launched (February 26, 2013), Y Corp's board of directors issued an opinion recommending that its shareholders tender their shares.

- Prior to this recommendation, Y Corp had implemented several measures to address the inherent conflict of interest arising from A et al. being controlling shareholders:

- Directors with close affiliations to A et al. were excluded from the board's decision-making process regarding the TO. Decisions were made by the unanimous resolution of the remaining three directors who had no or limited ties to A et al.

- Y Corp appointed C Law Firm as its legal advisor.

- It engaged D Securities Co., Ltd. as its financial advisor, from whom it received a share valuation report. This report indicated that the value of Y Corp's shares was below ¥123,000 per share. D Securities also provided a fairness opinion stating that the Tender Offer Price of ¥123,000 was appropriate.

- Furthermore, Y Corp established an independent third-party committee composed of knowledgeable individuals. This committee reviewed the TO and concluded that the Tender Offer Price was reasonable and that recommending shareholders to tender was appropriate, noting no particular deficiencies in terms of information disclosure to shareholders.

- Shareholder Approval for Squeeze-Out Mechanism:

- On June 28, 2013, Y Corp held a general shareholders' meeting and a class shareholders' meeting (for common stock). These meetings approved the necessary resolutions for the second-step squeeze-out:

- Amendments to the articles of incorporation to authorize the issuance of new Class A shares (with priority in residual asset distribution).

- Amendments to convert all existing common stock of Y Corp into shares with a class-wide call provision, effective August 2, 2013. The terms stipulated that upon the exercise of the call, 1 Class A share would be delivered for every 694,478 common shares with the call provision. (This high ratio for Class A shares effectively meant that minority shareholders holding fewer than 694,478 common shares would receive only fractional Class A shares, entitling them to a cash payment for those fractions – the cash-out mechanism).

- A resolution for Y Corp to acquire all such shares with a class-wide call provision on August 2, 2013 (the "Acquisition Date").

- On June 28, 2013, Y Corp held a general shareholders' meeting and a class shareholders' meeting (for common stock). These meetings approved the necessary resolutions for the second-step squeeze-out:

- Appraisal Right Petition and Market Movement:

- X et al., a group of minority shareholders in Y Corp, opposed these resolutions. They duly notified Y Corp of their opposition prior to the meetings and voted against the proposals. Subsequently, within the statutory period, they filed a petition with the court under Article 172, Paragraph 1 of the Companies Act (as it then stood) for a judicial determination of the acquisition price of their shares.

- A significant external factor was the performance of the stock market: between October 20, 2012 (when the TO plans were first reported) and August 2, 2013 (the Acquisition Date), the JASDAQ stock index experienced a substantial increase of 74.9%.

The Lower Court's Approach: Adjusting for Market Trends

The High Court (which effectively handled the substantive price determination appeal) acknowledged that the Tender Offer Price of ¥123,000 per share had been determined through procedures that were fundamentally fair and that this price could be considered fair at the time the TO was announced.

However, the High Court then noted the significant upward trend in general stock market indices during the period between the TO announcement and the final Acquisition Date. It concluded that this subsequent market rally necessitated an upward adjustment to the price. The High Court reasoned that the acquisition price should reflect market-wide movements up to the Acquisition Date. Consequently, it rejected the ¥123,000 Tender Offer Price as the final acquisition price. Instead, it calculated a base objective value for Y Corp's shares at ¥104,165 (derived from Y Corp's market share price before the initial October 20, 2012 news report, adjusted using regression analysis for market movements). To this, it added a 25% premium, described as an "increased value distribution price" (implicitly accounting for synergy or control premium aspects), arriving at a final acquisition price of ¥130,206 per share.

Both X et al. (presumably seeking an even higher price or challenging the methodology) and Y Corp (arguing for the original Tender Offer Price of ¥123,000) sought permission to appeal this decision to the Supreme Court.

The Supreme Court's Decision: Deference to a Fairly Set Tender Offer Price

The Supreme Court, in its decision dated July 1, 2016, reversed the High Court's ruling. It quashed the High Court's determined price and, in a relatively rare move of self-determination (jihan), set the acquisition price for X et al.'s shares at ¥123,000 per share – the original Tender Offer Price.

The Supreme Court's reasoning was as follows:

- Acknowledging Conflict of Interest: The Court began by recognizing that in transactions where majority shareholders (like A et al.) orchestrate a complete acquisition of a company's shares (e.g., through a TO followed by a squeeze-out using shares with a class-wide call provision), an inherent conflict of interest exists between these majority shareholders (or the company acting at their behest) and the remaining minority shareholders.

- The Importance of "Generally Fair Procedures": Despite this conflict, the Court emphasized that if the TO is conducted through "generally fair procedures" (一般に公正と認められる手続 - ippan ni kōsei to mitomerareru tetsuzuki), the resulting Tender Offer Price should be viewed as a reflection of an appropriate adjustment of interests between the majority and minority shareholders, made in contemplation of the entire two-step transaction.

- The Court considered procedures such as:

- The company obtaining opinions from independent third-party committees and financial/legal experts.

- Implementing measures to exclude arbitrary decision-making that could arise from the conflict of interest (e.g., excluding conflicted directors from the decision process).

- Explicitly stating at the outset of the TO that any shares not tendered would subsequently be acquired at the same price as the TO price.

- The Court considered procedures such as:

- Tender Offer Price Incorporates Expected Market Fluctuations: When such fair procedures are meticulously followed, the Supreme Court stated that the Tender Offer Price can be considered to have been determined with an anticipation of general market price fluctuations that might reasonably be expected to occur during the period leading up to the final Acquisition Date of the shares in the second-step squeeze-out. The period until the acquisition date is generally predictable.

- Judicial Deference to the Tender Offer Price (Absent Exceptional Circumstances): Based on the above, the Court established a key principle:

When majority shareholders conduct a TO, followed by a squeeze-out where the company acquires the remaining shares (e.g., as shares with a class-wide call provision) at a price identical to the TO price, and that TO was conducted through "generally fair procedures" designed to mitigate the conflict of interest, then:- Courts should, as a rule, adopt the TO price as the "fair acquisition price" for the shares in the squeeze-out.

- An exception to this rule would apply only if there are "special circumstances demonstrating that an unforeseen change occurred in the conditions that formed the basis of said transaction" (上記取引の基礎となった事情に予期しない変動が生じたと認めるに足りる特段の事情 - jōki torihiki no kiso to natta jijō ni yoki shinai hendō ga shōjita to mitomeru ni tariru tokudan no jijō).

- High Court's Error: The Supreme Court found that the High Court erred. Once the High Court determined that the TO procedures were generally fair and the Tender Offer Price was appropriate at the time of the TO, it should not have proceeded to make adjustments for subsequent general market movements unless it found the presence of such "special circumstances" (unforeseen changes). The general rise in the JASDAQ index did not, in the Supreme Court's view, constitute such an unforeseen fundamental change in the basis of the transaction. Making such an adjustment without finding these special circumstances was deemed an overreach of the court's reasonable discretion, as it involved "failing to fully consider matters that should naturally be considered [i.e., the fairly determined TO price intended to cover the entire process], and considering factors that should not properly be considered [i.e., ordinary post-TO market fluctuations already implicitly accounted for]."

Applying this to the facts, the Supreme Court noted that Y Corp had implemented robust fairness measures. There was no evidence of "special circumstances" indicating an unforeseen shift in the transaction's underlying conditions. Therefore, the acquisition price for X et al.'s shares should be the Tender Offer Price of ¥123,000 per share.

Justice Koike's Concurring Opinion

Justice Hiroshi Koike provided a concurring opinion, agreeing with the majority's conclusion and reasoning. He further elaborated on the court's role in determining acquisition prices under Article 172 of the Companies Act.

- He emphasized that while courts exercise reasonable discretion, they must assess the fairness of the process by which the transaction terms, including price, were established.

- In conflicted transactions like majority shareholder squeeze-outs, if substantial measures are taken to ensure procedural fairness and an appropriate adjustment of interests, the court should, in principle, respect the price determined through such procedures. This is analogous to the deference shown to terms agreed in arm's-length transactions between independent parties if fair procedures are followed (referencing the Supreme Court's 2012.2.29 decision – Case 85 in the user's context).

- The court's primary function in such cases is to accurately determine whether genuinely fair procedures were followed. If they were, then absent unforeseen changes, the resulting price should be upheld. If the procedures were found to be unfair, the court would then need to determine the price itself, potentially using market analysis but with an awareness of its limitations in capturing all value aspects.

- Justice Koike opined that in this specific case, the procedures were fair, and the High Court's decision to adjust the price based on subsequent general market trends, despite the fairness of the initial TO price determination, exceeded its reasonable discretion. He also suggested that the broad acceptance of the Tender Offer Price by most minority shareholders and the market could further support the finding that no "special circumstances" warranted a deviation.

Analysis and Implications

This 2016 Supreme Court decision provides significant guidance for structuring and litigating two-step squeeze-outs initiated by majority shareholders in Japan:

- Emphasis on Procedural Fairness in Conflicted Transactions: The ruling underscores the critical importance of implementing robust procedural safeguards when majority shareholders conduct squeeze-outs. Measures like forming independent committees, obtaining advice from qualified financial and legal experts, excluding conflicted directors from decision-making, and ensuring transparency are key to having the negotiated price respected by the courts.

- The "Same Price" Principle: The decision implicitly validates the practice of majority shareholders committing upfront in a TO to acquire remaining shares in a subsequent squeeze-out at the same price. This practice is seen as mitigating coercion and providing a basis for the TO price to be considered fair for the entire transaction.

- Limited Scope for Post-Tender Offer Price Adjustments due to General Market Movements: This is a major takeaway. If a TO price is set through "generally fair procedures" in a conflicted squeeze-out context (and is intended to apply to the second step), courts will generally not adjust this price upwards (or downwards) simply because of general stock market fluctuations that occur between the TO and the final share acquisition date. Such fluctuations are not, by themselves, considered "unforeseen changes in the conditions that formed the basis of the transaction."

- Deterring Opportunistic Appraisal Petitions: By limiting adjustments for general market trends, the decision may discourage minority shareholders from strategically filing appraisal petitions solely in the hope of benefiting from a rising market after a fair TO price has been established. This addresses concerns that such petitions could unduly increase the costs and uncertainties of legitimate squeeze-out transactions.

- High Bar for "Special Circumstances": The threshold for demonstrating "special circumstances" that would warrant deviating from a fairly established TO price appears to be very high. It implies a need for truly extraordinary and unforeseeable events that fundamentally alter the basis upon which the original TO price was determined.

- Consistency in Supreme Court Jurisprudence: This decision builds upon previous Supreme Court rulings on "fair price" (like Cases 84 and 85 in the user's context). While Case 85 dealt with an arm's-length reorganization where deference was given to the negotiated terms due to the independence of the parties, this Case 86 adapts that principle to conflicted transactions by emphasizing that robust procedural safeguards can create a similar basis for judicial deference to the price agreed upon (in this case, the TO price applied to the squeeze-out).

Conclusion

The July 1, 2016, Supreme Court decision sends a clear message regarding the determination of "fair acquisition price" in two-step squeeze-outs orchestrated by majority shareholders. When such transactions are conducted with demonstrable procedural fairness – including independent oversight, expert advice, transparency, and a commitment to an equal price for both stages – the tender offer price will generally be upheld by the courts as the fair price for the subsequent squeeze-out. Subsequent general market upswings will not typically justify an upward revision of this price, unless truly exceptional and unforeseen circumstances that alter the fundamental basis of the transaction can be proven. This ruling emphasizes that in conflicted scenarios, meticulous attention to procedural fairness is paramount for the resulting transaction terms to gain judicial acceptance.