"Excess Dividends" in Japanese Bankruptcy: A 2017 Supreme Court Ruling on Allocation When Sureties Pay Post-Commencement

In Japanese bankruptcy law, the "principle of the amount existing at the time of commencement" (開始時現存額主義 - kaishi-ji genzongaku shugi), particularly as enshrined in Article 104 of the Bankruptcy Act, plays a crucial role in determining a creditor's claim when co-obligors or sureties are involved. A key aspect of this principle is the "non-deduction rule," which generally states that if a co-obligor or surety makes a payment to the creditor after the principal debtor's bankruptcy proceedings have commenced, that payment usually does not reduce the amount of the creditor's claim for the purpose of calculating dividends from the bankrupt's estate, unless the entire claim is thereby extinguished. This is designed to uphold the value of having multiple sources of repayment.

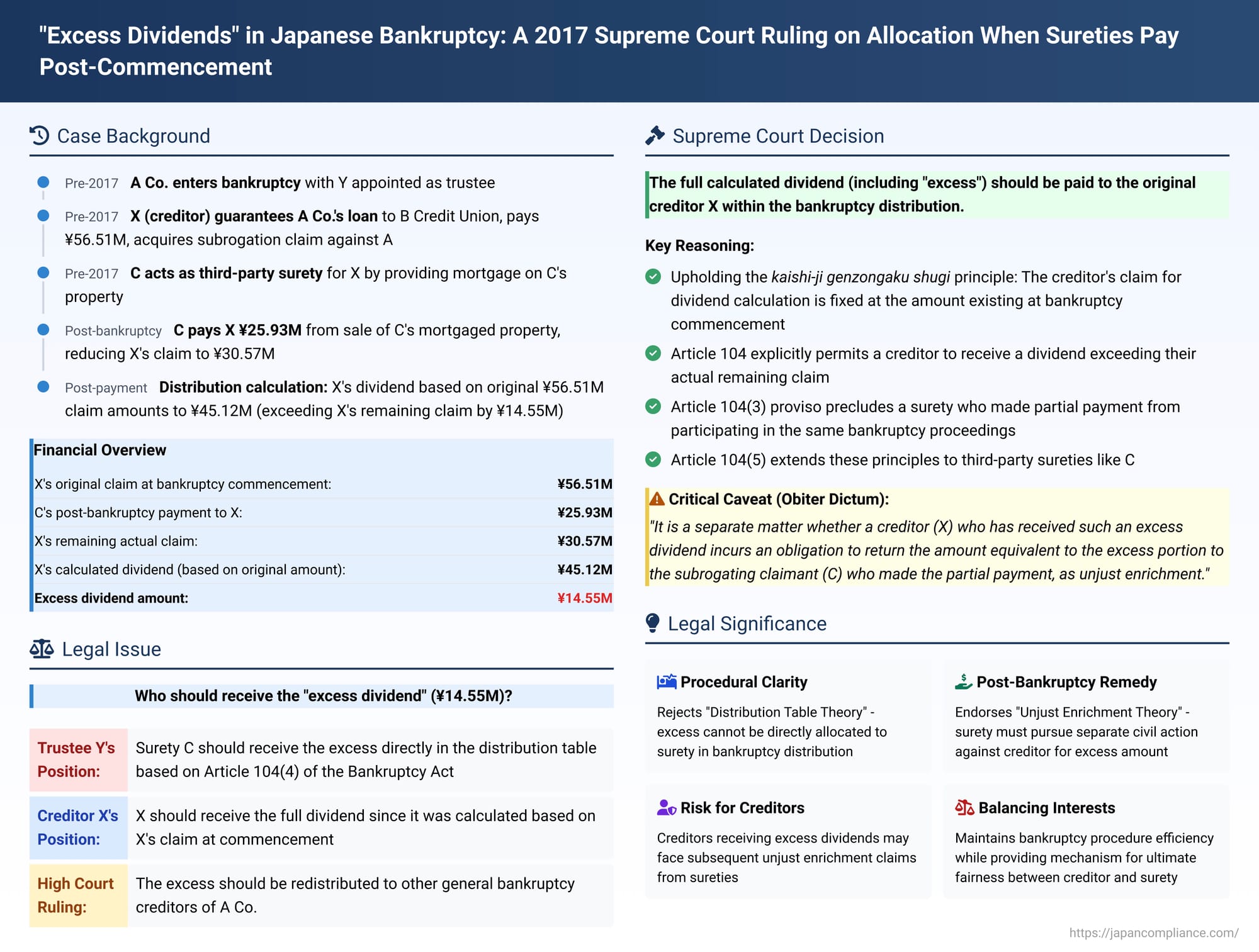

However, this rule can lead to a scenario where the calculated dividend payable to the creditor (based on their full claim amount at the start of bankruptcy) actually exceeds the creditor's remaining real-world debt after accounting for the surety's post-commencement payment. This difference is often termed an "excess dividend" (超過配当 - chōka haitō). A Supreme Court of Japan decision on September 12, 2017, provided significant clarification on how such excess dividends should be handled within the bankruptcy distribution process.

Factual Background: Guarantee, Subrogation, Third-Party Surety, and an "Excess Dividend" Scenario

The case involved A Co., which had entered bankruptcy proceedings, with Y appointed as its bankruptcy trustee. The creditor, X, had previously guaranteed A Co.'s loan debt to B Credit Union. X fulfilled this guarantee by making a substantial subrogation payment (代位弁済 - dai-i bensai) to B Credit Union, amounting to over 56.51 million yen (covering principal, pre-commencement interest, and some delay damages). Consequently, X acquired a subrogation claim (求償権 - kyūshōken) of this amount against A Co., which X duly filed as a bankruptcy claim in A Co.'s proceedings ("the subject bankruptcy claim").

Further complicating matters, an individual, C, had acted as a third-party surety (butsujō hoshōnin) for X. Specifically, C had provided a basic mortgage over C's own real estate to X as security for A Co.'s subrogation debt to X.

After A Co.'s bankruptcy proceedings had commenced, C's mortgaged property was sold. From these sale proceeds, C paid over 25.93 million yen directly to X in partial satisfaction of "the subject bankruptcy claim" (A Co.'s debt to X). This payment by surety C reduced X's actual outstanding claim against A Co. to approximately 30.57 million yen. Following this payment, C also filed a "preliminary" proof of claim in A Co.'s bankruptcy for the 25.93 million yen subrogation right C had acquired against A Co. by virtue of paying X.

When trustee Y prepared the distribution table (配当表 - haitōhyō):

- For X's "subject bankruptcy claim," the dividend was calculated based on the full ~56.51 million yen that X was owed at the commencement of A Co.'s bankruptcy. This calculation resulted in a potential dividend for X of approximately 45.12 million yen.

- However, since X's actual remaining claim against A Co. (after receiving C's payment) was only about 30.57 million yen, there was an "excess" of approximately 14.55 million yen (~45.12M - ~30.57M).

- Trustee Y's proposed distribution table allocated the ~30.57 million yen (X's actual remaining claim) to X. For the "excess" of ~14.55 million yen, the trustee proposed to pay this directly to C, the surety who had made the post-bankruptcy payment to X. The trustee's rationale for C's portion was that it represented a distribution on C's subrogation right under Bankruptcy Act Article 104, paragraph 4, arising because X's claim would be fully satisfied by the ~30.57M payment.

Creditor X objected to this distribution plan, arguing that the "excess" portion should not be paid to C in this manner. The court of first instance rejected X's objection, siding with the trustee's plan to pay the excess to C. However, the High Court reversed this. It ruled that if a creditor's actual remaining claim is less than the dividend calculated on their commencement-date claim, the "excess" portion of that calculated dividend should not be paid to that creditor (X) nor directly to the subrogating surety (C) via the distribution table. Instead, the High Court concluded, this excess amount should be redistributed among the other general bankruptcy creditors of A Co. and remanded the case for the distribution table to be revised accordingly. Trustee Y, wishing to uphold the original plan to pay C, then brought a permission-to-appeal motion to the Supreme Court, which was granted.

The Legal Issue: Allocation of "Excess Dividends" Under Article 104 of the Bankruptcy Act

The central legal question was: When the "non-deduction rule" of Bankruptcy Act Article 104, paragraph 2 (and paragraph 5 for third-party sureties), results in a situation where the dividend calculated for a creditor (X), based on their full claim amount as it existed at the start of bankruptcy, exceeds the actual remaining amount that creditor is substantively owed (due to a post-commencement payment from a surety like C), how should this "excess dividend" be allocated within the bankruptcy distribution process?

- Should the original creditor (X) receive the full calculated dividend, including the "excess" portion?

- Should the paying surety (C) be entitled to receive this "excess" portion directly from the bankruptcy estate as part of the distribution?

- Or, as the High Court held, should this "excess" be reallocated to the other general bankruptcy creditors of the bankrupt debtor (A Co.)?

The Supreme Court's Ruling: Excess Dividend Paid to Original Creditor (with a Significant Caveat)

The Supreme Court dismissed trustee Y's appeal. This meant it upheld the High Court's result (which was to overturn the first instance court's plan to pay the excess directly to surety C via the distribution table and remand for a new distribution plan). However, the Supreme Court's reasoning for how the excess should be handled, and its ultimate implication for who benefits, differed notably from the High Court's.

The Supreme Court held that: If the calculated dividend for the original creditor (X), based on their claim amount as it existed at the commencement of bankruptcy proceedings, exceeds their actual remaining substantive claim (due to a post-commencement payment from a third-party surety like C), that entire calculated dividend, including the "excess" portion, should still be distributed to that original creditor (X) as part of their dividend allocation.

The Court's reasoning for this included:

- Upholding the Kaishi-ji Genzongaku Shugi: The Court began by affirming the core tenets of Article 104, paragraphs 1 and 2, of the Bankruptcy Act. These provisions establish the kaishi-ji genzongaku shugi. This principle allows for a deliberate discrepancy between the creditor's claim amount used for dividend calculation purposes (which is fixed at the amount existing at the commencement of bankruptcy) and their actual, subsequently reduced, substantive claim amount (if a co-obligor or surety makes a payment after commencement but before the claim is fully extinguished). The law, the Court stated, explicitly permits a situation where the creditor (X in this case) receives a dividend payment that might exceed their actual remaining substantive claim. This is a consequence of prioritizing the credit-enhancing function of having multiple recourse parties.

- Limitations on the Subrogating Surety's (C's) Direct Participation in Dividends: The Supreme Court then addressed why the surety, C, could not directly receive this "excess" amount through the bankruptcy distribution plan:

- It pointed to the proviso in Article 104, paragraph 3, of the Bankruptcy Act. This proviso states that if the original creditor (X) has participated in the bankruptcy proceedings based on the claim as it existed at the time of commencement, then a subrogating claimant (like surety C, who only paid part of that debt and thus acquired a partial subrogation right) cannot also participate in the bankruptcy proceedings for their subrogated portion of the claim. Thus, C's preliminary filing of a subrogation claim specifically to capture the "excess dividend" directly from the estate was not permissible under this rule.

- Furthermore, Article 104, paragraph 4, deals with the situation where the original creditor's claim is fully extinguished only upon receiving a dividend from the bankrupt's estate. In such a scenario, a subrogating claimant (who typically acquires rights of recourse against the bankrupt only when the original creditor is fully satisfied) cannot exercise the original creditor's rights as a bankruptcy creditor at that particular stage of distribution.

- Application to Third-Party Sureties (Butsujō Hoshōnin): The Court confirmed that Article 104, paragraph 5, makes these principles applicable to payments made by third-party sureties (like C, who provided property as security) in the same way they apply to payments by personal co-obligors or guarantors.

- Conclusion on Distribution within Bankruptcy: Therefore, the correct procedure under the Bankruptcy Act, according to the Supreme Court, is to calculate creditor X's dividend based on X's full, commencement-date claim amount, and to pay X that full calculated amount, even if it happens to exceed what X is now substantively owed due to surety C's intervening payment. The High Court's approach of reallocating this "excess" portion to other general bankruptcy creditors of A Co. was therefore based on an incorrect interpretation of Article 104.

The Crucial Obiter Dictum Regarding Unjust Enrichment:

While the Supreme Court ruled that the full calculated dividend (including any "excess") should be paid to the original creditor X within the bankruptcy distribution, it added a highly significant statement, albeit as an obiter dictum (a judicial comment that is not essential to the decision itself but provides insight into the Court's thinking):

"It is a separate matter whether a creditor (X) who has received such an excess dividend incurs an obligation to return the amount equivalent to the excess portion to the subrogating claimant (C) who made the partial payment, as unjust enrichment."

Implications: The "Unjust Enrichment" Solution for Sureties

This obiter dictum is key to understanding the practical outcome of the Supreme Court's decision:

- Rejection of Direct Distribution to Surety within Bankruptcy: The Supreme Court effectively rejected the "Distribution Table Theory" (配当説 - haitō setsu) which had been adopted by the first instance court and was argued for by trustee Y. This theory proposed that the bankruptcy trustee could or should directly allocate the "excess dividend" to the paying surety (C) as part of the bankruptcy distribution plan.

- Endorsement of an "Unjust Enrichment Theory" (不当利得説 - futō ritoku setsu) for Resolution Outside Bankruptcy: By suggesting that the original creditor (X) might subsequently owe the excess amount back to the surety (C) as unjust enrichment—a claim to be pursued in a separate civil action outside the bankruptcy proceedings—the Supreme Court indicated its preference for this alternative approach to ensure ultimate fairness between the creditor and the surety.

- Rationale for the Unjust Enrichment Approach (from PDF Commentary): Legal commentary suggests that this approach aligns more closely with a literal reading of Article 104, paragraphs 3 and 4 (which limit the surety's direct participation in bankruptcy if the original creditor is fully participating). It also simplifies the bankruptcy trustee's role by not requiring them to adjudicate complex subrogation rights and payment allocation disputes within the already complicated dividend distribution process, thereby avoiding potential delays to the overall bankruptcy.

- Practical Consequences:

- Creditors in X's position, who receive bankruptcy dividends calculated on their full commencement-date claims despite having also received partial satisfaction from a surety post-commencement, must be aware that they might subsequently face an unjust enrichment claim from those sureties for any "excess" portion of the dividend received.

- Sureties in C's position, who make post-commencement payments to a creditor of a bankrupt, cannot expect to directly recover any resulting "excess dividend" from the bankrupt debtor's estate through the distribution table itself. Their likely remedy for this "excess" portion will be a separate unjust enrichment claim against the original creditor who received it.

Justice Kiuchi's Supplementary Opinion

Justice Michiyoshi Kiuchi, in a supplementary opinion, concurred with the majority's legal reasoning. He particularly emphasized the formal application of Article 104. He noted that creditor X's bankruptcy claim was fixed at a certain amount at the commencement, and the dividend should be calculated on that basis. Surety C's claim, being characterized by the trustee as conditional upon X's claim being fully paid off by the dividend, could not have met its condition before the dividend to X was actually determined and paid. Therefore, C could not participate directly in that specific dividend distribution to claim the excess amount. This reinforces the idea that the adjustment between X and C regarding the excess is a matter to be resolved between them, likely after X has received the full calculated dividend.

Concluding Thoughts

The Supreme Court's September 12, 2017, decision provides crucial clarification on the procedural handling of "excess dividends" that can arise under Japan's kaishi-ji genzongaku shugi when a surety makes a payment after bankruptcy proceedings have begun. The ruling dictates that the full dividend, calculated on the creditor's claim as it existed at the commencement of bankruptcy, should be paid to that creditor, even if it exceeds the creditor's actual remaining debt due to the surety's intervening payment. However, the Court strongly signaled, through its obiter dictum, that the paying surety likely has a subsequent claim for unjust enrichment against the creditor for this "excess" amount. This approach maintains the formal integrity of the bankruptcy distribution process based on established claim amounts while pointing towards separate civil litigation as the appropriate avenue for ultimately ensuring that the surety who bore part of the loss is not unfairly disadvantaged relative to the original creditor. This balances the protection of creditors who have secured co-obligation or surety arrangements with the procedural efficiency of the bankruptcy system.