Estate Division and Tax Debts: Japanese Supreme Court on Secondary Tax Liability for Benefiting Heirs

Judgment Date: December 10, 2009

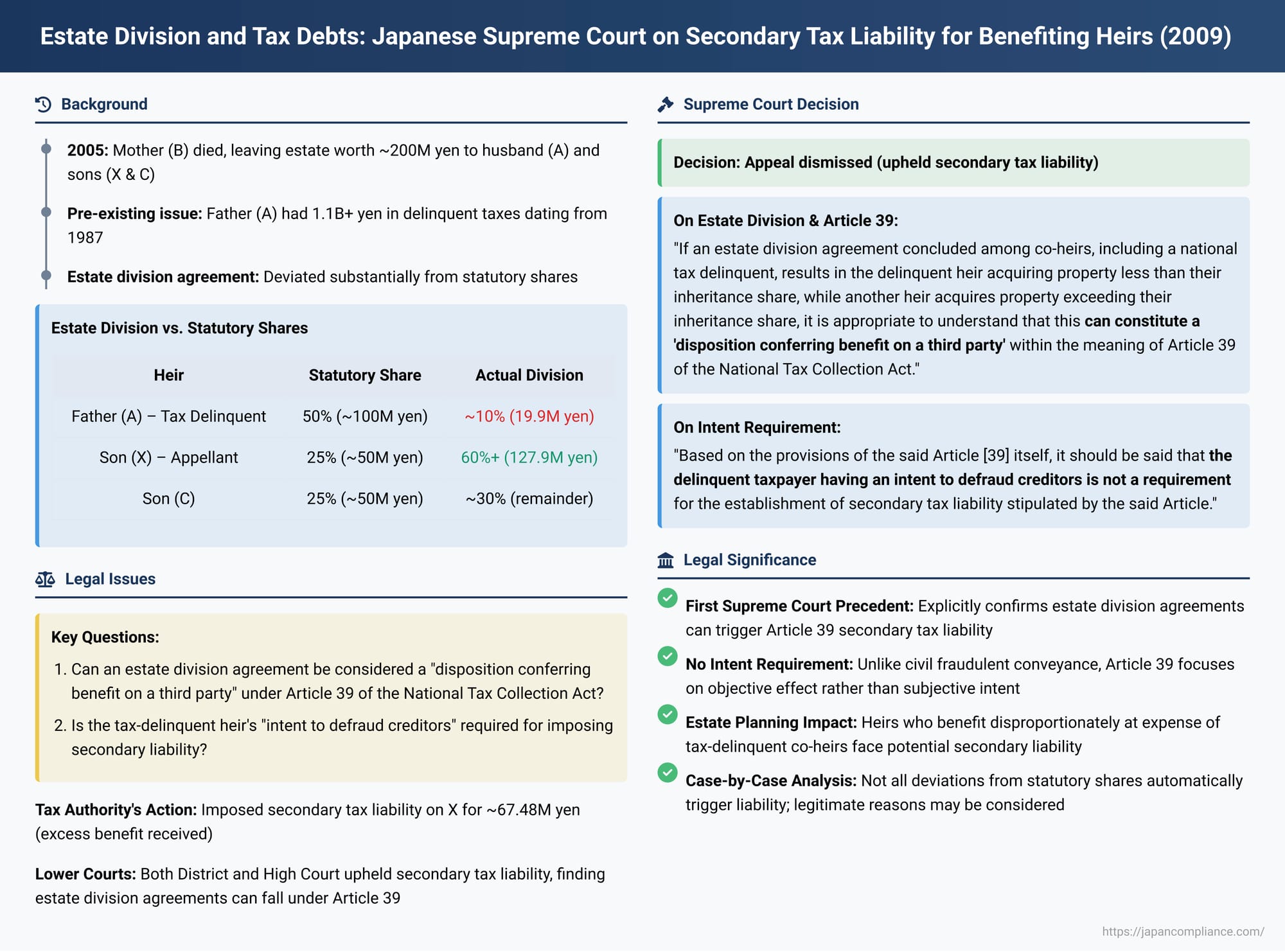

In a significant decision clarifying the reach of tax collection powers into estate settlements, the First Petty Bench of the Supreme Court of Japan ruled that an estate division agreement can trigger secondary tax liability for an heir who benefits at the expense of a co-heir with outstanding national tax debts. The Court affirmed that such an agreement can constitute a "disposition conferring benefit on a third party" under Article 39 of the National Tax Collection Act, and notably, that the delinquent heir's subjective "intent to defraud creditors" is not a necessary requirement for this secondary liability to arise.

Background: An Inheritance, Tax Delinquency, and a Skewed Estate Division

The appellant, X, was involved in an estate division following the death of his mother, B, in 2005. B's legal heirs were her husband, A (X's father), and their two sons, X and C (X's brother). A, however, had substantial outstanding national tax liabilities, exceeding 1.1 billion yen, primarily from income tax dating back to 1987.

B's estate was valued at approximately 200 million yen. Under Japan's statutory inheritance shares, A (as the surviving spouse) was entitled to one-half of the estate, while X and C were each entitled to one-quarter. However, the estate division agreement reached by A, X, and C deviated significantly from these statutory shares:

- X, whose statutory share was one-quarter (approx. 50 million yen), received assets valued at over 127.9 million yen (more than 60% of the estate).

- A, the tax-delinquent father whose statutory share was one-half (approx. 100 million yen), received assets valued at only about 19.9 million yen (around 10% of the estate).

It was factually determined by the lower courts that in agreeing to this division, A had two intentions: first, to evade the collection of his substantial delinquent national taxes, and second, to ensure that his son X, who lived nearby and provided care for him, would receive a larger portion of the inheritance.

The Tax Authority's Action

The Kanto-Shin'etsu Regional Tax Bureau Chief (D, representing the tax authority) concluded that this estate division agreement constituted a "disposition conferring benefit on a third party [X]" within the meaning of Article 39 of the National Tax Collection Act. This article is designed to counter asset-stripping by delinquent taxpayers. It allows the tax authorities to impose a "secondary tax liability" on a third party who:

- Receives property from a delinquent taxpayer for no consideration or for a remarkably low price, or

- Benefits from other dispositions made by the delinquent taxpayer that confer a benefit on the third party,

provided such disposition occurred within a certain period (on or after one year before the statutory due date of the delinquent tax) and collection from the primary delinquent taxpayer is insufficient. The secondary liability is limited to the value of the benefit received (or the existing value of that benefit if the recipient is not a specially related person to the taxpayer).

The tax authority calculated that X had received a benefit of approximately 67.48 million yen (the value of the property X received exceeding his statutory share, after accounting for certain deductions like debts, funeral costs, inheritance tax, and registration tax). Accordingly, D issued a notice of secondary tax liability to X for this amount to cover A's tax debts.

X, after pursuing unsuccessful administrative appeals, filed a lawsuit to cancel this secondary tax liability notice.

The Legal Issues and Lower Court Rulings

The core legal questions were:

- Can an estate division agreement, a process rooted in family and inheritance law, be considered a "disposition conferring benefit on a third party" subject to Article 39 of the National Tax Collection Act?

- Is it necessary for the tax-delinquent heir (A, in this case) to have an "intent to defraud creditors" (sagai no ishi - 詐害の意思) for secondary liability under Article 39 to be imposed on the benefiting heir (X)?

Lower Court Decisions:

- Tokyo District Court (First Instance): Dismissed X's claim.

- The court acknowledged that estate division agreements have aspects of "status-related acts" (身分行為 - mibun kōi, acts concerning family status). However, it also held that they possess the substantive character of transferring property that has, upon inheritance, become part of the heirs' general assets. Citing a 1999 Supreme Court decision concerning the application of fraudulent conveyance rules (Civil Code Article 424) to estate division agreements, the District Court found that such agreements are "juridical acts concerning property rights."

- Therefore, an estate division agreement involving a tax-delinquent heir could indeed fall under the scope of "disposition conferring benefit on a third party" in Article 39 of the National Tax Collection Act.

- The District Court then distinguished Article 39 from the civil law concept of fraudulent conveyance (Civil Code Art. 424). While fraudulent conveyance aims to recover assets for the benefit of all creditors and generally requires proof of the debtor's intent to defraud, Article 39 is a specific tax collection tool. It has a more limited scope (e.g., specific timing for the disposition, types of dispositions) and its effect is to impose secondary tax liability on the beneficiary, not to annul the disposition itself. Furthermore, Article 39 liability is established by an administrative notice, not necessarily through a court lawsuit.

- Given these differences and the fact that the National Tax Act on General Rules (Article 42) separately provides for the application of fraudulent conveyance principles to tax collection, the District Court concluded that the "intent to defraud creditors" is not an implicit requirement for Article 39. The text of Article 39 does not mention such intent.

- Tokyo High Court (Appellate Court): Upheld the District Court's decision, largely adopting its reasoning. It added that applying Article 39 to estate division agreements does not compel all inheritances to strictly follow statutory shares, nor does it negate the possibility of divisions based on various factors considered under Civil Code Article 906 (which calls for concrete division considering the type and nature of assets, and the age, occupation, mental and physical condition, and life circumstances of the heirs).

X appealed to the Supreme Court.

The Supreme Court's Judgment: Upholding Secondary Liability

The Supreme Court dismissed X's appeal, thereby affirming the decisions of the lower courts and the legality of the secondary tax liability imposed on X.

Estate Division Agreements Can Trigger Article 39 Liability

The Court provided a clear statement on the primary issue:

"An estate division agreement determines the attribution of inherited property which, upon the commencement of inheritance, became the joint property of the co-heirs, by making all or part of it the sole property of individual heirs or by transitioning it to a new co-ownership relationship. Therefore, if an estate division agreement concluded among co-heirs, including a national tax delinquent, results in the delinquent heir acquiring property less than their inheritance share, while another heir acquires property exceeding their inheritance share, it is appropriate to understand that this can constitute a 'disposition conferring benefit on a third party' within the meaning of Article 39 of the National Tax Collection Act."

"Intent to Defraud Creditors" Not a Requirement for Article 39

Regarding the necessity of proving the delinquent taxpayer's "intent to defraud creditors," the Supreme Court addressed X's argument directly:

"The appellant argues that for secondary tax liability stipulated by Article 39 to be established, it is necessary for the delinquent taxpayer to have a so-called 'intent to defraud creditors.' However, according to the aforementioned factual circumstances, it is clear that A [the delinquent father] did have an intent to defraud. Moreover, based on the provisions of the said Article [39] itself, it should be said that the delinquent taxpayer having an intent to defraud creditors is not a requirement for the establishment of secondary tax liability stipulated by the said Article."

While the Court noted that A's fraudulent intent was evident in this specific case, its subsequent statement clearly indicates that such intent is not a statutory prerequisite for invoking Article 39. This distinguishes Article 39 from the civil law action for fraudulent conveyance.

Affirmation of the Lower Court's Judgment

The Supreme Court concluded:

"Under the aforementioned factual circumstances, the High Court's determination that the subject estate division agreement constituted a disposition conferring benefit on a third party, and its affirmation of the establishment of secondary tax liability for X, are correct and can be upheld."

Significance and Implications of the Ruling

This 2009 Supreme Court decision is highly significant for several reasons:

- First Supreme Court Confirmation on Estate Divisions and Article 39: This was the first time the Supreme Court explicitly ruled that an estate division agreement can fall within the scope of National Tax Collection Act Article 39 if it shifts assets away from a tax-delinquent heir to the benefit of other heirs, thereby impairing tax collection.

- No "Intent to Defraud" Prerequisite for Article 39: The judgment strongly supports the interpretation (already prevalent in lower court decisions) that, unlike the civil law fraudulent conveyance action, Article 39 does not require the tax authority to prove that the delinquent taxpayer acted with a specific "intent to defraud creditors." The focus of Article 39 is more on the objective effect of the asset transfer and the benefit received by the third party, within the statutory conditions. This makes Article 39 a more direct and administratively streamlined tool for tax authorities compared to initiating fraudulent conveyance proceedings.

- Impact on Estate Planning: The decision has important implications for estate planning, particularly in families where one or more heirs have significant outstanding tax liabilities. Heirs who benefit from an estate division that disproportionately reduces the share of a tax-delinquent co-heir may face secondary liability for those unpaid taxes, up to the value of the excess benefit they received.

- Balancing Tax Collection and Inheritance Norms: While the Supreme Court affirmed that estate divisions can trigger Article 39, the phrasing "can constitute" (当たり得る - atariuru) suggests a case-by-case analysis. Legal commentators generally agree that not every deviation from strict statutory inheritance shares will automatically lead to secondary liability. Factors legitimately considered in estate division under the Civil Code, such as a particular heir's special contributions to the deceased's estate (kiyobun - 寄与分), lifetime gifts received by heirs (tokubetsu jueki - 特別受益), and other circumstances outlined in Civil Code Article 906, would likely be relevant in determining whether an estate division is "necessary and reasonable" and thus potentially outside the scope of what Article 39 aims to counter. The Supreme Court did not delve into these specific balancing factors in this judgment, as A's intent to evade taxes was clear.

This ruling reinforces the broad reach of tax collection mechanisms in Japan, extending scrutiny to private family arrangements like estate divisions when they have the effect of shielding a delinquent taxpayer's assets from legitimate tax claims. It highlights the distinct nature of Article 39 of the National Tax Collection Act as a tool focused on the objective consequences of asset transfers rather than the subjective intent of the delinquent taxpayer.