Engaging Japan's Freelance Workforce: The New Freelance Protection Act and Best Practices for Contracting

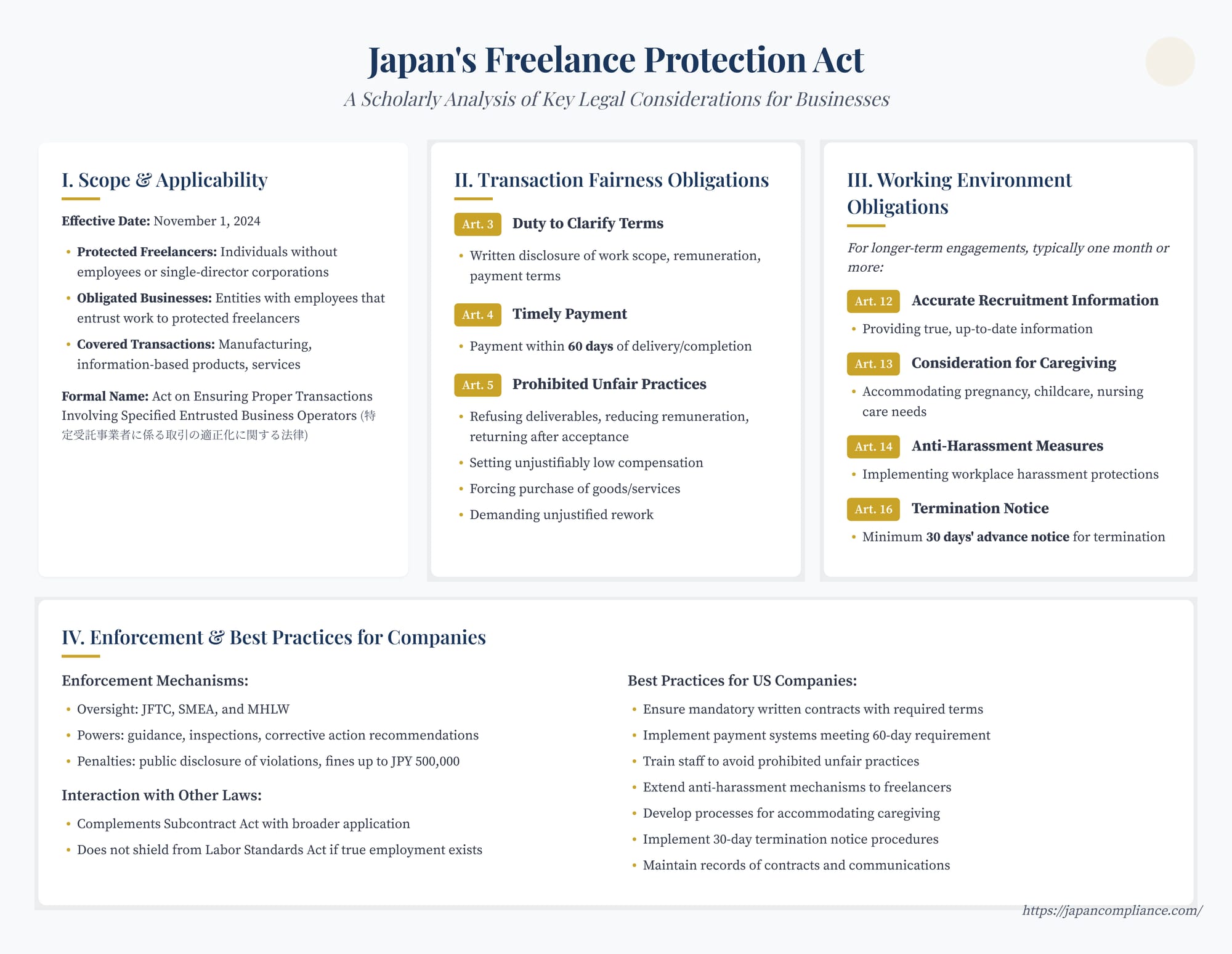

TL;DR: Japan’s Freelance Protection Act (effective 1 Nov 2024) mandates written terms, 60-day payment, and bans unfair practices toward solo contractors. Businesses must overhaul onboarding, payment tracking, and harassment prevention to stay compliant and competitive.

Table of Contents

- The Freelance Landscape in Japan: Context and Challenges

- Precursors to the Act: Laying the Groundwork

- The Freelance Protection Act: Key Provisions

- Interaction with Other Laws

- Best Practices for US Companies Engaging Japanese Freelancers

- Conclusion: Towards Fairer Freelance Engagements

The rise of the freelance economy is a global phenomenon, reshaping labor markets and corporate structures. Japan is no exception, with a significant and growing number of professionals choosing independent work styles across diverse sectors, from creative fields like entertainment and design to highly specialized technical and consulting roles. For businesses operating in Japan, leveraging this flexible talent pool – often referred to as freelance (フリーランス) – offers numerous advantages. However, engaging freelancers has historically involved navigating a somewhat ambiguous legal landscape, often leaving these independent workers with fewer protections than traditional employees.

Recognizing the need for greater clarity and fairness, Japan has taken significant steps to bolster the rights and working conditions of its freelance population. Culminating these efforts is the Act on Ensuring Proper Transactions Involving Specified Entrusted Business Operators (Act No. 25 of 2023), commonly known as the Freelance Protection Act, which came into full effect on November 1, 2024. This landmark legislation introduces comprehensive rules governing the relationship between businesses and the freelancers they engage, aiming to create a more stable, transparent, and equitable environment. Understanding the provisions of this Act and adapting contracting practices accordingly is now essential for any company, foreign or domestic, that utilizes freelance talent in Japan.

The Freelance Landscape in Japan: Context and Challenges

Freelancing has long been a feature of Japan's economy, but its visibility and significance have grown with digitalization and changing work preferences. Professionals in fields like translation, IT, design, writing, and even specialized roles within the entertainment industry often operate on a freelance or contract basis (gyōmu itaku keiyaku - 業務委託契約, typically meaning a service or independent contractor agreement).

Historically, the primary legal challenge stemmed from the classification of these workers. Japan's core labor laws, such as the Labor Standards Act (Rōdō Kijun Hō), primarily protect "workers" (employees) defined by factors indicating subordination to the employer (e.g., control over work hours and methods, economic dependency). Many freelancers, by virtue of their independence, did not meet this threshold, leaving them outside the scope of protections regarding working hours, minimum wages, paid leave, and dismissal restrictions.

This lack of clear employee status often led to practical difficulties:

- Contractual Ambiguity: Agreements were sometimes verbal or lacked crucial details regarding scope, deliverables, and payment.

- Unfair Practices: Issues like last-minute cancellations, unilateral changes in scope or remuneration, and delayed payments were not uncommon.

- Limited Social Safety Net: Access to social insurance programs like employment insurance and health insurance through the engaging company was typically unavailable. While Workers' Compensation Insurance (Rōsai Hoken) was gradually expanded via special enrollment (tokubetsu kanyū) to cover certain freelancers (including those in entertainment/media from April 2021 and broadly under the new Act), gaps remained.

- Dispute Resolution: Resolving conflicts could be challenging without the framework of labor law protections.

It's worth noting that even individuals operating under service agreements could sometimes be deemed "workers" under Japan's Trade Union Act (Rōdō Kumiai Hō) if they exhibited strong economic dependency on a particular client and were integrated into the client's business operations. This status grants rights related to collective bargaining but doesn't confer the full range of protections under the Labor Standards Act. The new Freelance Protection Act operates alongside these existing frameworks, providing a specific set of protections for independent contractors without altering their fundamental classification unless the factual circumstances warrant it.

Precursors to the Act: Laying the Groundwork

The Freelance Protection Act did not emerge in a vacuum. Several governmental initiatives in recent years signaled growing recognition of the need to support independent workers:

- Cross-Agency Guidelines: In March 2021, the Cabinet Secretariat, Japan Fair Trade Commission (JFTC), Small and Medium Enterprise Agency (SMEA), and Ministry of Health, Labour and Welfare (MHLW) jointly released the "Guidelines for Creating a Secure Working Environment for Freelancers." These guidelines clarified the application of existing laws like the Antimonopoly Act (regarding abuse of superior bargaining position) and the Subcontract Act (Shitauke Hō), and provided best practice recommendations.

- Consultation Services: The "Freelance Troubles 110" hotline was established as a government-commissioned service offering free consultations with lawyers for freelancers facing issues with clients.

- Workers' Compensation Expansion: As mentioned, eligibility for voluntary enrollment in the Rōsai Hoken system was progressively broadened for freelancers.

These measures, while helpful, lacked comprehensive legislative backing and consistent enforcement mechanisms, paving the way for the dedicated Freelance Protection Act.

The Freelance Protection Act: Key Provisions

Taking effect in November 2024, the Act aims to ensure freelancers "can stably engage in services with which they have been entrusted as enterprises," thereby contributing to Japan's economic development amidst diversifying work styles.

Scope and Applicability:

- Protected Freelancers ("Specified Entrusted Business Operators"): The Act protects individuals operating without employees (occasional, temporary help or cohabiting family assistance generally doesn't disqualify) and corporations with only a single representative director and no employees.

- Obligated Businesses ("Specified Entrusting Business Operators"): Obligations fall on businesses (corporations or individuals) that do have employees and entrust work to the protected freelancers. Crucially, unlike the Subcontract Act which has capital thresholds, the Freelance Protection Act applies regardless of the size of the commissioning business if they have employees.

- Covered Transactions ("Business Entrustment"): The Act covers the entrustment of manufacturing, creation of information-based products (software, content, designs, etc.), and provision of services.

The Act imposes two main categories of obligations on commissioning businesses: ensuring transaction fairness and improving the working environment.

Pillar 1: Transaction Fairness Obligations (Applicable to all covered transactions):

- Duty to Clarify Terms (Art. 3): Upon entrusting work, the business must immediately provide the freelancer with clear, written (physical or electronic, e.g., email) disclosure of key terms, including:

- Content/scope of the work

- Amount of remuneration

- Payment date and method

- Other specific matters required by JFTC rules.

This is a fundamental requirement designed to prevent disputes arising from ambiguity.

- Timely Payment (Art. 4): Remuneration must be paid within 60 days of the delivery of the work/completion of the service, and as promptly as possible within that period. For sub-entrustments where the commissioning business itself is paid by an original client, slightly different rules can apply, but the 60-day principle is central.

- Prohibition of Unfair Practices (Art. 5): The Act explicitly prohibits several detrimental actions by the commissioning business, unless the freelancer is at fault:

- Refusing to receive deliverables.

- Reducing agreed-upon remuneration.

- Returning deliverables after acceptance.

- Unjustifiably setting remuneration significantly lower than comparable work.

- Coercing the freelancer to purchase designated goods or use designated services.

- Forcing the freelancer to provide economic benefits (e.g., discounts, contributions) that disadvantage them.

- Demanding rework or changes without grounds attributable to the freelancer.

These prohibitions mirror protections found in the Subcontract Act but apply more broadly under the Freelance Act.

Pillar 2: Working Environment Obligations (Applicable for longer-term engagements, typically one month or more):

- Accurate Recruitment Information (Art. 12): When advertising or offering opportunities, businesses must provide accurate, up-to-date information and avoid false or misleading representations.

- Consideration for Caregiving, etc. (Art. 13): Businesses must make efforts to accommodate freelancer requests related to balancing work with pregnancy, childbirth, childcare, or nursing care needs.

- Anti-Harassment Measures (Art. 14): Businesses must implement necessary measures regarding workplace harassment (power harassment, sexual harassment, etc.), including establishing consultation systems and responding appropriately to freelancer concerns. This aligns protections more closely with those for employees under anti-harassment laws.

- Notice for Mid-Term Termination/Non-Renewal (Art. 16): For continuous contracts (defined by relevant ordinances, often relating to contracts of a month or longer), the commissioning business must generally provide at least 30 days' advance notice if they intend to terminate the contract mid-term or not renew it upon expiry, unless there are grounds attributable to the freelancer.

Enforcement:

The JFTC, SMEA, and MHLW share oversight. They can provide guidance and advice, request reports, conduct inspections, issue recommendations for corrective action, and issue orders if recommendations aren't followed. Non-compliance with orders can lead to public disclosure of the violation and potentially fines (up to JPY 500,000). Freelancers can also report violations or seek mediation.

Interaction with Other Laws

The Freelance Protection Act adds a new layer of regulation but doesn't replace existing laws:

- Subcontract Act: The Freelance Act often applies where the Subcontract Act doesn't (e.g., due to the commissioning business's smaller capital size or the nature of the service). Where both potentially apply, the stricter provisions generally prevail or specific guidance clarifies the relationship.

- Labor Laws (Labor Standards Act, Trade Union Act): As noted, the Freelance Act protects independent contractors as independent contractors. If a freelancer's actual working conditions meet the legal tests for "worker" status (indicating employment), then standard labor laws apply, offering potentially greater protections. Misclassifying an employee as a freelancer remains a significant legal risk for businesses. The Freelance Act doesn't shield businesses from labor law obligations if an employment relationship truly exists. Discussions in case law regarding the potential for service agreement workers to have a "reasonable expectation" of contract continuation, particularly in the context of dismissal for union activities, also highlight the nuances surrounding long-term freelance relationships, even if standard labor law doesn't fully apply.

Best Practices for US Companies Engaging Japanese Freelancers

Given this new legal framework, US companies engaging freelancers in Japan should proactively review and adapt their practices:

- Mandatory Written Contracts: Ensure all engagements with freelancers covered by the Act are formalized with written agreements (physical or electronic) before work commences. Verbal agreements are insufficient and non-compliant.

- Compliant Contract Terms: Contracts must clearly state, at minimum:

- Detailed scope of work/deliverables.

- Remuneration amount and calculation method.

- Specific payment date (within 60 days of delivery/completion) and payment method.

- Any other terms required by specific JFTC rules.

Using templates (like those offered by the Cultural Affairs Agency for creative work) can be a starting point, but customization and legal review are crucial.

- Payment Discipline: Establish internal processes to ensure payments are made strictly within the 60-day timeframe specified in the contract.

- Fair Dealing Protocols: Train relevant staff (procurement, project managers) on the prohibited practices under Article 5 to avoid inadvertent violations like demanding unreasonable rework or imposing unfair conditions.

- Working Environment Policies (for longer engagements):

- Extend existing anti-harassment reporting and investigation mechanisms to cover freelancers.

- Develop a process for fairly considering freelancer requests related to caregiving needs.

- Implement procedures for providing the required 30-day notice for mid-term termination or non-renewal of continuous contracts.

- Intellectual Property: Clearly define the ownership, licensing, and usage rights of any IP created by the freelancer within the contract. Do not rely on default assumptions.

- Record Keeping: Maintain clear records of contracts, communications, deliverables, and payments.

- Review Classification: Periodically review the nature of engagements with long-term or highly integrated freelancers to assess any risk of potential reclassification as "workers" under standard labor law, considering factors like control, exclusivity, and economic dependency.

Conclusion: Towards Fairer Freelance Engagements

The enactment of Japan's Freelance Protection Act marks a significant development in recognizing and addressing the vulnerabilities historically faced by independent workers. By mandating clear terms, prohibiting unfair practices, ensuring timely payment, and requiring consideration for the working environment, the law aims to foster more equitable and stable relationships between businesses and the growing freelance workforce.

For US companies and other international businesses engaging Japanese freelancers, compliance is not merely a legal obligation but a foundation for building trust and accessing talent effectively. Adapting contracting procedures, internal policies, and operational workflows to align with the Act's requirements is crucial. While adding new compliance steps, the Act ultimately promotes greater transparency and predictability, potentially reducing disputes and contributing to a healthier, more sustainable freelance ecosystem in Japan – a vital component of its modern economy.

- Understanding Japan's New Freelance Protection Act: What US Companies Need to Know

- Workforce Management in Japan: Tackling Indirect Discrimination and the New Freelance Act

- When Accidents Happen: Workers' Compensation for Non-Traditional Employees in Japan

- Cabinet Office — Overview of the Freelance Protection Act

https://www.cas.go.jp/jp/seisaku/atarashii_sihonsyugi/freelance/index.html