Can Employers Sue Over Workers’ Comp Benefits? Japan’s Top Court Says No (Sup.Ct. July 4 2024)

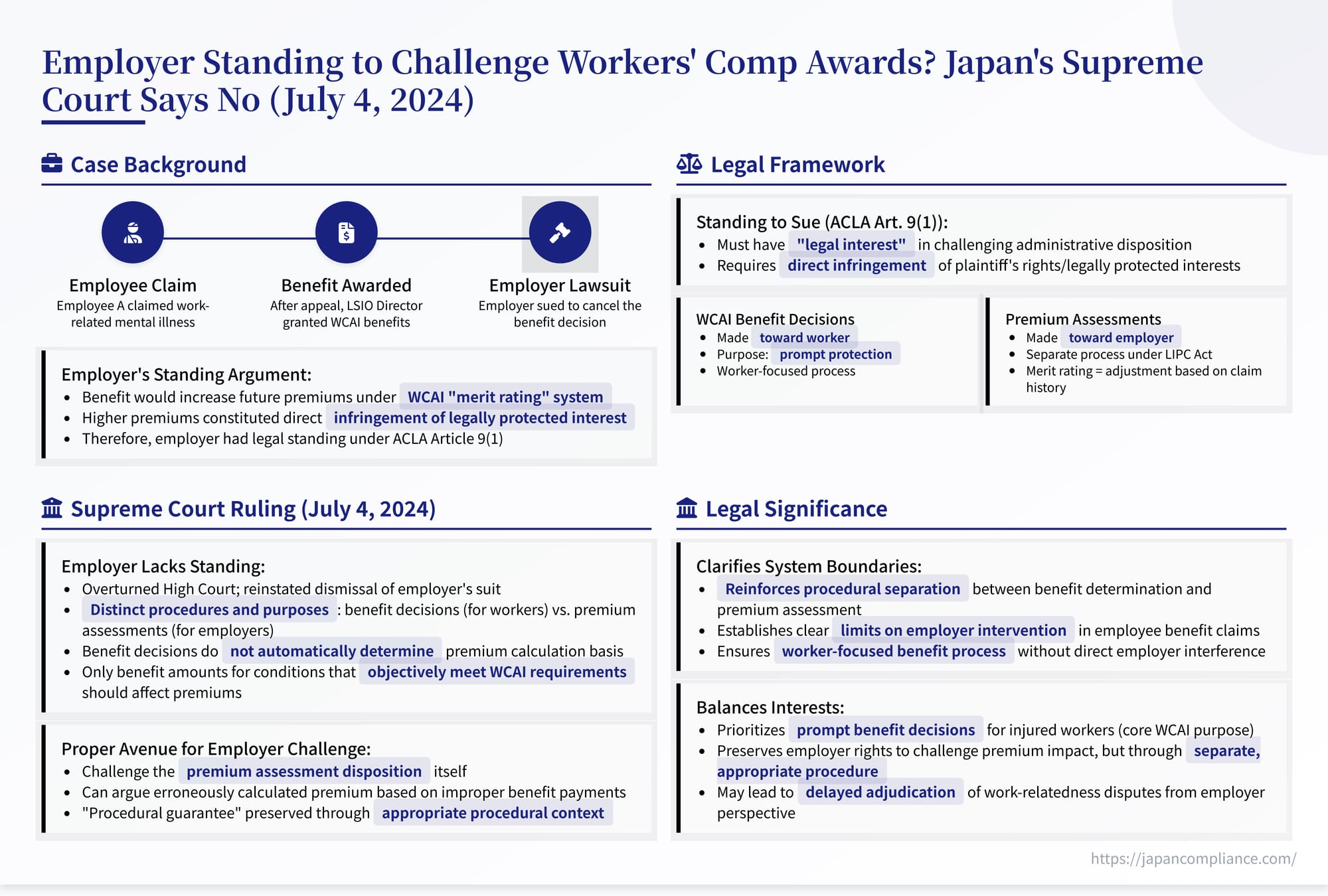

Japan's Supreme Court ruled employers lack standing to sue on workers' comp benefit awards; challenges must target premium assessments instead.

TL;DR

- Supreme Court (4 Jul 2024): employers generally lack standing to cancel workers’‑comp benefit decisions granted to employees.

- Reason: the benefit order does not directly set the employer’s future premium; proper challenge is against the later premium assessment.

- Key takeaway: clearly separates worker‑protection procedures from employer premium disputes, limiting corporate intervention in benefit awards.

Table of Contents

- Factual Background: Mental Illness Claim, Benefit Award, and Employer Challenge

- Legal Framework: Standing, WCAI Benefits, and Premium Determination

- Lower Court Rulings: Conflicting Views on Employer Standing

- The Supreme Court's Analysis (July 4 2024): No Direct Legal Impact on Employer

- Implications and Significance: Separating Benefit and Premium Disputes

- Conclusion

On July 4, 2024, the First Petty Bench of the Supreme Court of Japan delivered a significant judgment concerning administrative procedure and the scope of legal standing in the context of the Workers' Accident Compensation Insurance Act (WCAI Act, or Rōsai Hoken Hō - 労災保険法) (Case No. 2023 (Gyo-Hi) No. 108, "Revocation of Medical/Temporary Absence Comp. Benefit Decisions Case"). The Court addressed whether an employer has the legal right (standing, or genkoku tekkaku) to directly challenge a WCAI benefit decision made in favor of its employee, based solely on the potential indirect financial consequence that the benefit payment might lead to an increase in the employer's future WCAI premiums under the "merit rating" system. The Supreme Court concluded that employers generally lack such standing, holding that the benefit decision directed at the employee does not directly infringe upon the employer's legally protected interests regarding future premium rates. This decision clarifies the distinct nature of benefit determinations and premium assessments and limits employers' ability to intervene directly in their employees' WCAI benefit claims.

Factual Background: Mental Illness Claim, Benefit Award, and Employer Challenge

The case involved a dispute triggered by a WCAI claim for a mental health condition:

- The Employee and the Claim: Employee A, who worked for the appellee Employer (Y), suffered from a mental illness. A filed a claim with the Sapporo Central Labour Standards Inspection Office Director (B, the LSIO Director) for benefits under the WCAI Act, asserting the illness was work-related.

- Administrative Decisions: The LSIO Director initially denied the claim. However, this denial was overturned through the administrative appeal process (first by the Labour Insurance Referee and then confirmed by the Labour Insurance Appeal Committee). Following the final appeal decision finding the illness to be work-related, the LSIO Director (B) subsequently issued formal administrative dispositions ("the Benefit Decisions") granting Employee A both Medical Compensation Benefits (療養補償給付 - ryōyō hoshō kyūfu) and Temporary Absence Compensation Benefits (休業補償給付 - kyūgyō hoshō kyūfu).

- Employer's Lawsuit: The Employer (Y) disagreed with the underlying finding that A's mental illness was work-related. Seeking to overturn this determination and prevent the associated benefit payments from potentially impacting its future WCAI premiums, Y filed a lawsuit against the State (the government, appellant X) demanding the cancellation (torikeshi) of the Benefit Decisions that had been issued to Employee A.

- Employer's Argument for Standing: Y argued that it had legal standing to bring this cancellation suit under Article 9, Paragraph 1 of the Administrative Case Litigation Act (ACLA). Its reasoning was based on the WCAI merit rating system (メリット制 - meritto sei) established by Article 12, Paragraph 3 of the Labour Insurance Premiums Collection Act (LIPC Act). Under this system, an employer's WCAI premium rate in a future year can be increased if the amount of WCAI benefits paid out for its employees in preceding years exceeds a certain threshold relative to premiums paid. Y claimed that the Benefit Decisions, by authorizing payments to A, created a risk that Y's merit rating would worsen, leading to higher future premiums. This potential financial detriment, Y argued, constituted an infringement or inevitable threat of infringement to its legally protected interests, thereby granting it standing to challenge the Benefit Decisions directly.

Legal Framework: Standing, WCAI Benefits, and Premium Determination

The case required navigating several distinct legal frameworks:

- Standing to Sue (ACLA Art. 9(1)): To bring a lawsuit seeking the cancellation of an administrative disposition, the plaintiff must have "legal interest" (hōritsu-jō no rieki). This is generally interpreted to mean that the plaintiff's own "rights or legally protected interests" must be directly infringed or inevitably threatened with infringement by the disposition itself. Merely having an economic or factual interest is typically insufficient.

- WCAI Act Benefit Decisions: Governs the determination and payment of benefits directly to injured workers or their survivors for work-related injuries/illnesses. The process involves an application by the claimant, investigation, and a decision (disposition) by the relevant Labour Standards Inspection Office Director. The primary purpose is prompt and fair protection for workers. Appeals follow a specialized administrative tribunal system before potential judicial review.

- LIPC Act Premium Determination: Governs the collection of WCAI and Employment Insurance premiums from employers. Premiums are calculated based on factors like industry risk and total wages paid.

- Merit Rating System (LIPC Act Art. 12(3)): An experience rating system applicable to certain qualifying employers ("specified businesses"). It adjusts the future WCAI premium rate based on the employer's past three-year record of benefit payments relative to premiums paid (the "merit balance ratio"). Its purpose is to ensure fairness among employers and incentivize workplace safety efforts. The premium rate itself is ultimately determined through the employer's declaration or a formal premium assessment disposition (hokenryō nintei shobun) by the government.

Lower Court Rulings: Conflicting Views on Employer Standing

The lower courts disagreed on whether the potential impact on future premiums gave the employer standing to challenge the employee's benefit award:

- First Instance Court (Tokyo District Court): Dismissed the employer's lawsuit, finding it lacked standing. It likely viewed the connection between the employee's benefit decision and the employer's future premiums as too indirect.

- Second Instance Court (Tokyo High Court): Reversed the first instance decision, finding the employer did have standing. It reasoned that the Benefit Decisions directly impacted the calculation of the merit balance ratio, which in turn could inevitably lead to increased premiums, thus directly affecting the employer's legally protected financial interests. The High Court remanded the case for a decision on the merits (i.e., whether A's illness was actually work-related).

The government (X) appealed the High Court's finding of standing to the Supreme Court.

The Supreme Court's Analysis (July 4, 2024): No Direct Legal Impact on Employer

The Supreme Court overturned the High Court's decision and reinstated the first instance court's dismissal of the employer's suit, definitively ruling that the employer lacked standing to challenge the WCAI benefit decision made in favor of its employee.

1. Clarifying the Test for Standing: The Court reiterated the standard definition under ACLA Art. 9(1): standing requires that the administrative disposition in question directly infringes, or inevitably threatens to infringe, the plaintiff's own rights or legally protected interests. The core question was whether the Benefit Decisions directed at Employee A had such a direct legal impact on Employer Y's interest related to its premium payments.

2. Distinct Purposes and Procedures: Benefit Decisions vs. Premium Assessments:

The Court emphasized the fundamental separation between the process for determining WCAI benefits for workers and the process for determining WCAI premiums for employers:

- Benefit Decisions: These are administrative dispositions made towards the claimant (worker/survivor) following their application. The primary goal, rooted in WCAI Act Art. 1, is "prompt and fair protection" for the worker, achieved through "prompt determination of the numerous legal relationships concerning WCAI benefits" and specialized appeal routes for the claimant. This system is not designed to simultaneously finalize the legal basis for the employer's future premium calculations.

- Premium Assessments: These involve separate procedures under the LIPC Act, resulting in declarations or premium assessment dispositions directed at the employer. The merit rating adjustment under LIPC Act Art. 12(3) is part of this distinct premium determination process.

3. Benefit Decision Does Not Legally Determine Premium Basis:

The Court reasoned that the Benefit Decision made for the employee does not automatically and legally dictate the basis for calculating the employer's future merit-rated premium.

- Merit System Goals: The merit system aims for fairness among employers and incentivizing accident prevention based on actual workplace risk and outcomes. Basing premium increases on benefit payments made pursuant to a decision that objectively failed to meet statutory requirements (e.g., if the illness was, in fact, not work-related) would "contravene the purpose" (shushi ni hansuru) of the merit system.

- Objective Requirements Matter for Premiums: The Court stated that, logically, only benefit amounts paid for conditions that objectively meet the WCAI Act's requirements should form the basis for adjusting premiums under the merit system. Just because a benefit was paid (perhaps erroneously) doesn't mean that payment must legally be factored into the employer's merit rating.

- No Need for Early Finality for Premiums: Premium amounts only need to be finalized when declared or assessed under the LIPC Act procedures. There is no inherent legal necessity to finalize the underlying basis (like the work-relatedness of the injury that led to benefit payments) through the employee's benefit decision process itself.

4. Conclusion: No Direct Legal Interest for Employer in Benefit Decision:

Based on this separation of procedures and legal effects, the Court concluded:

- The amount of WCAI benefits paid based on a Benefit Decision directed at the employee "does not automatically affect the determination of the amount of labour insurance premiums payable by the specified employer." (tōzen ni jōki no kettei ni eikyō o oyobosu mono de wa nai).

- Therefore, the employer (Y) is not a person whose "rights or legally protected interests are infringed or inevitably threatened with infringement" by the Benefit Decision itself.

- Consequently, the employer lacks standing (genkoku tekkaku o yūshinai) to bring a lawsuit seeking the cancellation of the WCAI Benefit Decision issued to its employee.

5. Employer's Proper Avenue for Challenge:

The Court explicitly addressed how the employer can protect its interests regarding potentially incorrect premium increases:

- The employer can challenge the premium assessment disposition (hokenryō nintei shobun) itself, which is directed at the employer and directly affects its financial obligations.

- In an administrative appeal or cancellation lawsuit against the premium assessment, the employer can argue, as a ground for the assessment's illegality, that the premium was wrongly calculated because it was based on WCAI benefit payments that should not have been made (i.e., where the objective requirements for the benefit, such as work-relatedness, were not met).

- This ensures the employer's "procedural guarantee" (tetsuzuki hoshō) is preserved, allowing them to contest the work-relatedness finding indirectly as it pertains to their premium liability, but within the appropriate procedural context (challenging the premium assessment, not the employee's benefit award).

Implications and Significance: Separating Benefit and Premium Disputes

This 2024 Supreme Court ruling provides significant clarification on the procedural rights of employers in the WCAI system:

- Employers Lack Standing for Benefit Decisions: It definitively establishes that employers generally cannot directly challenge WCAI benefit decisions made in favor of their employees, even if those decisions have potential downstream financial consequences for the employer via the merit rating system.

- Reinforces Procedural Separation: The decision strongly reinforces the legal and procedural separation between the determination of benefits for workers and the assessment of premiums for employers. Challenges related to premiums must be brought against the premium assessment itself.

- Limits Employer Intervention: This limits the ability of employers to become directly involved in disputing the work-relatedness findings in their employees' WCAI benefit claims through judicial review of the benefit decision. The focus of the benefit determination process remains squarely on the claimant worker or survivor.

- Potential for Delayed Adjudication of Work-Relatedness: While preserving the employer's right to challenge the premium impact later, this may lead to situations where the substantive issue of work-relatedness is only fully litigated (from the employer's perspective) potentially years after the initial benefit decision, when challenging a subsequent premium assessment. This could raise practical issues regarding evidence availability and timely resolution.

- Balancing Interests: The ruling strikes a balance: it prioritizes the prompt finalization of benefit decisions for injured workers (a core purpose of WCAI) while ensuring employers retain a legal avenue to challenge the fairness of their premium calculations, albeit through a separate, later procedure.

Conclusion

The Supreme Court's July 4, 2024, judgment holds that an employer generally does not have legal standing under Japan's Administrative Case Litigation Act to seek the cancellation of a Workers' Accident Compensation Insurance benefit decision granted to its employee, even if the decision could potentially lead to increased future WCAI premiums for the employer under the merit rating system. The Court reasoned that the benefit decision directed at the employee does not automatically or directly infringe the employer's legally protected interests concerning premiums. The employer's proper recourse for challenging the financial impact of allegedly improper benefit payments is to contest the subsequent premium assessment disposition itself, where the underlying issue of work-relatedness (as relevant to the premium calculation) can be raised. This decision clarifies the procedural boundaries between worker benefit claims and employer premium assessments within the Japanese WCAI system.

- Workers’ Comp vs. Consolation Money — Japan’s Supreme Court Separates Financial and Non‑Financial Damages

- Employer Liability for Overwork Suicide (Karō Jisatsu): Japan’s Landmark Dentsu Ruling (2000)

- Japan Supreme Court 2023 Pension‑Cut Ruling: Balancing Sustainability and Recipient Rights

- Outline of the Merit Rating System for Workers’ Accident Compensation Insurance – MHLW

- Guide to the “Merit Rating System” of Workers’ Accident Compensation Insurance – MHLW

- Purpose and Mechanism of the Merit System – MHLW