Effect of Rent Attachment After Property Sale: A 1998 Japanese Supreme Court Ruling

Case Name: Claim for Confirmation of Entitlement to Deposited Funds, etc.

Court: Supreme Court of Japan, Third Petty Bench

Case Number: Heisei 7 (O) No. 514

Date of Judgment: March 24, 1998

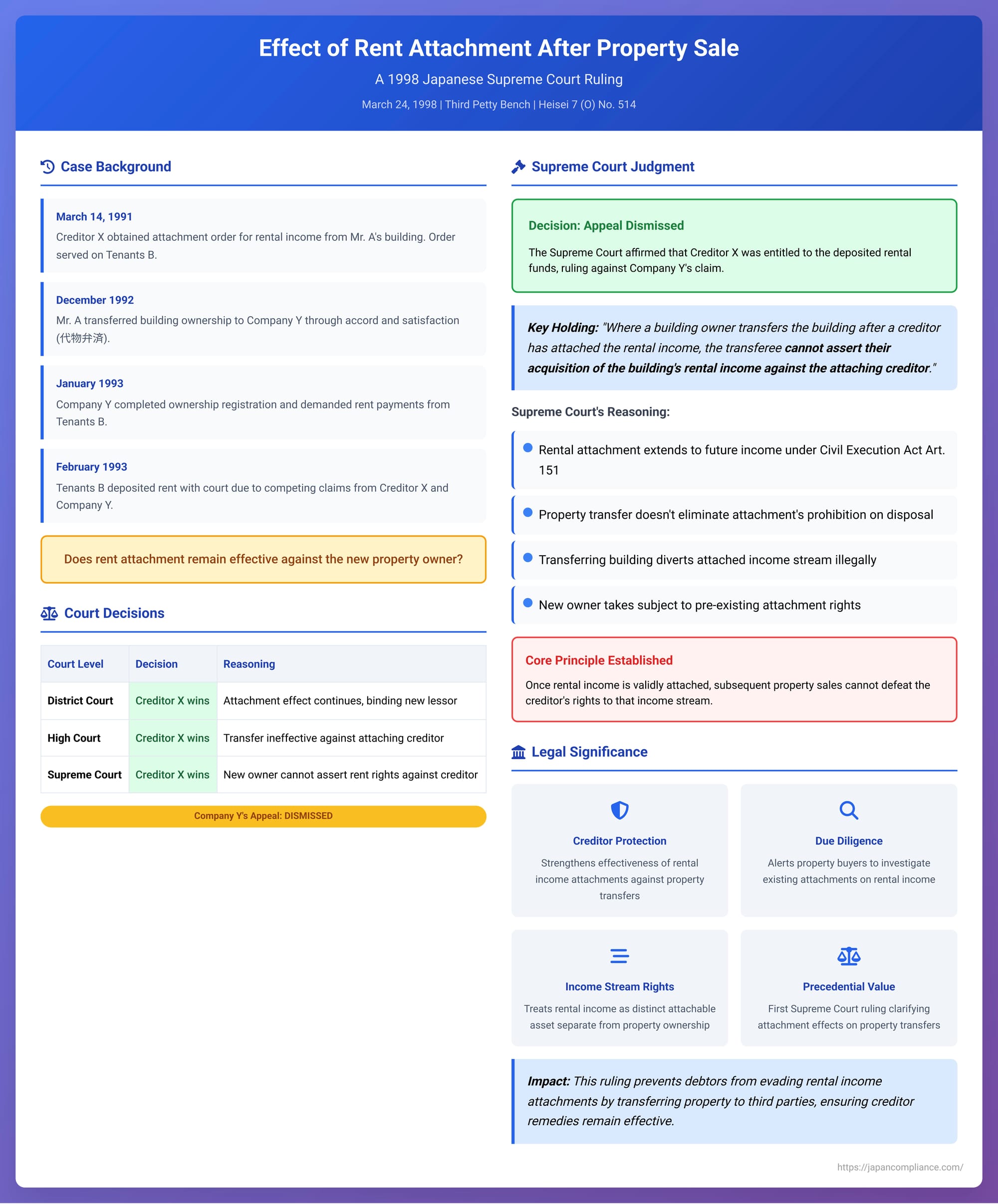

This article examines a significant Japanese Supreme Court judgment from March 24, 1998. The decision clarifies the enduring effect of a creditor's prior attachment of rental income when the landlord subsequently sells the leased property to a new owner. This ruling has important implications for creditors, debtors, and purchasers of tenanted real estate in Japan.

Factual Background: Rent Attachment Followed by Property Transfer

The case unfolded as follows:

- Rent Attachment: Creditor X, holding an enforceable notarized document for a debt owed by Mr. A, obtained a court order attaching the rental income (chinryō saiken) that Mr. A was receiving from tenants (collectively referred to as "Tenants B") of a building owned by Mr. A ("the Building"). This attachment order was duly served on Tenants B by March 14, 1991.

- Property Transfer: Around December 1992, Mr. A transferred ownership of the Building to Company Y. This transfer was effected by way of accord and satisfaction (daibutsu bensai), meaning the property was given to Company Y to settle a different debt Mr. A owed to Company Y.

- New Owner's Claim and Tenants' Action: In January 1993, Company Y completed the ownership transfer registration for the Building and subsequently demanded that Tenants B pay rent to Company Y as the new owner and lessor. Faced with competing claims—Creditor X's prior attachment of rent from Mr. A, and new owner Company Y's demand for rent—Tenants B, from February 1993 onwards, deposited the rental payments with the court. They cited uncertainty as to the rightful creditor (a provision under Article 494 of the Civil Code) and the existing attachment (as per Article 156, Paragraph 1 of the Civil Execution Act) as reasons for the deposit (kyōtaku).

- Lawsuit for Deposited Funds: Creditor X then filed a lawsuit seeking a declaratory judgment that X was entitled to receive the deposited rental funds.

The Legal Conundrum: Does the New Owner Take Rent Free of Prior Attachment?

The central legal issue was: If a creditor attaches a landlord's future rental income, and the landlord thereafter sells the property, does the new owner acquire the right to receive rental income free and clear of the prior attachment? Or does the attachment remain effective against the rental income stream, binding the new owner (who has stepped into the lessor's shoes)?

Lower Courts' Rulings in Favor of the Attaching Creditor

- Urawa District Court (First Instance): The District Court ruled in favor of Creditor X. It reasoned that while the sale of a leased property is permissible even if its rental income has been attached, and the lessor's status generally transfers to the new owner upon registration of the ownership transfer, the effect of the prior rental income attachment continues and is binding on the new lessor (Company Y).

- Tokyo High Court (Appellate Court): The High Court also found for Creditor X, though with a slightly different rationale. It held that the transfer of the lessor's status, specifically concerning the attached rental income, was ineffective against the attaching creditor (X). For the purposes of the attachment, the rental income was deemed to still belong to the original lessor (Mr. A), and thus the attachment by Creditor X remained fully effective.

Company Y appealed to the Supreme Court.

The Supreme Court's Landmark Decision

On March 24, 1998, the Supreme Court dismissed Company Y's appeal, thereby affirming the lower courts' conclusions that Creditor X was entitled to the rent.

The Supreme Court's key holding was:

"Where a building owner leases their building to another and subsequently transfers said building to a third party, the lessor's status generally transfers to the third party (see Supreme Court, Second Petty Bench, Aug. 28, 1964, Minshū Vol. 18, No. 7, p. 1354). However, if a creditor of the building owner has attached the rental income and this attachment has taken effect, and thereafter the owner transfers the building and the lessor's status shifts to the transferee, the said transferee cannot assert their acquisition of the building's rental income against the attaching creditor."

The Court provided the following reasoning:

- Effect of Rent Attachment on Future Income: The attachment of rental income where the building owner is the debtor does not prevent the owner from disposing of the building itself. However, the effect of such an attachment, by virtue of Article 151 of the Civil Execution Act (which deals with attachment of claims for continuous performance like rent), extends to the future rent that the building owner is to receive, limited to the amount of the attaching creditor's claim and execution costs.

- Transfer of Building as Disposal of Attached Rent: The act of transferring the building, insofar as it entails a change in the party to whom the rental income belongs (i.e., the right to future rent moves from the old owner to the new owner), necessarily conflicts with the attachment's prohibition on the disposition of that future rental income.

In essence, the Supreme Court viewed the transfer of the property (and the concomitant right to future rents) to Company Y as an attempt to dispose of an income stream that had already been effectively captured by Creditor X's prior attachment. Therefore, Company Y, the new owner, could not claim this rental income in defiance of Creditor X's pre-existing attachment.

Analysis and Significance

This 1998 Supreme Court decision was a significant development, clarifying an area where previous execution practice had sometimes leaned the other way (often assuming the new owner would receive the rent, and the attachment on the former owner's right to rent would become ineffective).

- Scope of Rental Income Attachment (Civil Execution Act Art. 151): Article 151 allows for the attachment of "claims for continuous performance," such as rent, to extend to future installments. This is intended to provide an effective remedy for creditors by allowing a one-time attachment to capture an ongoing income stream, avoiding the need for repeated attachments and preventing the debtor from disposing of income as it accrues. The Supreme Court's decision reinforces the power of this type of attachment.

- "Prohibition on Disposal" Effect: A key effect of an attachment order is that it prohibits the debtor from disposing of the attached claim (Civil Execution Act Art. 145(1)). This ruling extends this prohibition to acts (like selling the property) that would divert the attached future income stream away from the attaching creditor.

- Balancing Interests: The decision implicitly balances the interests of the attaching creditor against those of a subsequent purchaser of the property. The commentary suggests that while a purchaser might suffer a disadvantage by not receiving rent they expected, they often have means to investigate potential encumbrances or claims against rental income before purchasing, or seek remedies against the seller for defects in title or encumbrances. Conversely, an attaching creditor, having taken legal steps to secure their claim against the rental income, would have limited recourse if a subsequent property sale automatically defeated their attachment.

- Conceptualization of Rental Income: The Supreme Court's reasoning treats the future rental income stream as an asset that, once attached, is subject to the attaching creditor's claim, even if the underlying source of that income (the property) changes hands. This can be seen as viewing the right to receive rent as a distinct, attachable component of the property owner's rights, capable of being "frozen" by an attachment order for the benefit of a creditor. The commentary suggests this approach aligns with trends that support the liquidity and transferability of claims as distinct assets.

- Contrast with Tenant Acquiring Ownership (A Later Case): It is interesting to note a subsequent Supreme Court decision (September 4, 2012), mentioned in the commentary. In that case, a tenant whose rental obligations had been attached subsequently acquired ownership of the leased property. The Court held that the lease terminated due to merger (confusion of rights of landlord and tenant in the same person), and consequently, the prior attachment of rental income became ineffective for rent accruing after the merger. This highlights that if the obligation to pay rent itself ceases to exist (as opposed to merely the identity of the recipient changing), the attachment of that rent stream will also end. The commentary indicates an ongoing scholarly discussion on whether the 2012 ruling represents a "reasonable distinction" or if it might prompt a re-evaluation of the broader principles laid down in the 1998 decision.

Conclusion

The Supreme Court's March 24, 1998, judgment firmly established that a creditor's prior attachment of rental income remains effective against that income stream even if the landlord subsequently sells the leased property. The new owner cannot claim the future rent in defiance of the pre-existing attachment. This ruling provides significant protection to creditors who attach rental income and serves as a caution to purchasers of tenanted properties to conduct thorough due diligence regarding any existing attachments or encumbrances on the rental income stream. It underscores the principle that once an income stream is validly attached, its diversion through subsequent acts like property sales is generally not permissible against the attaching creditor.