Collecting Debt & Navigating Bankruptcy in Japan: A Practical Guide for US Creditors

TL;DR

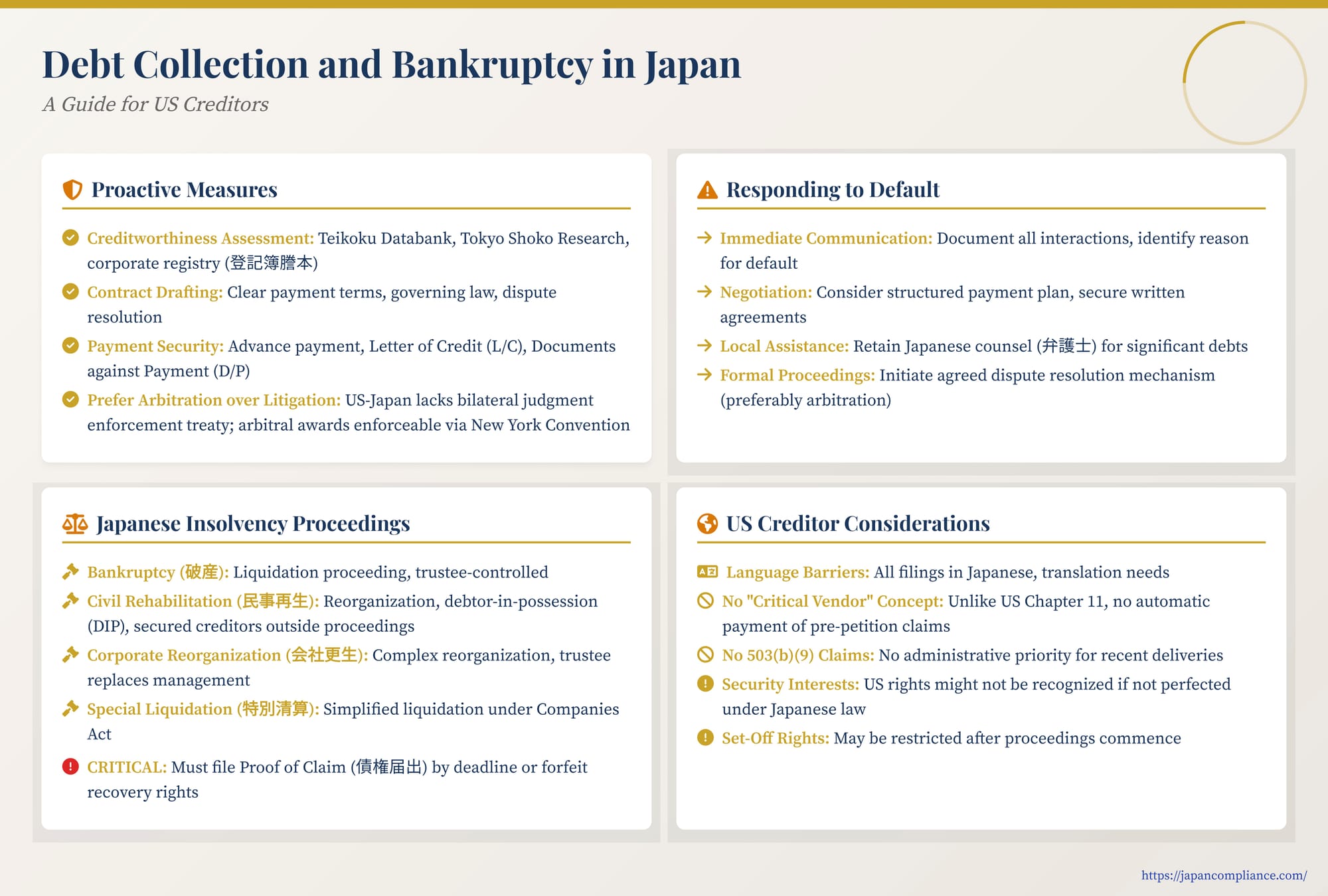

- Minimise risk up-front: run credit checks, draft contracts with arbitration clauses, and secure payment terms.

- On default, act fast—document demands, consider payment plans, and engage Japanese counsel before value erodes.

- In insolvency, know your place in Japan’s hierarchy: file proofs of claim on time and expect different treatment of secured debt than in US Chapter 11.

Table of Contents

- Part 1: Proactive Measures – Preventing Payment Issues

- Part 2: Responding to Default (Pre-Insolvency)

- Part 3: Navigating Japanese Corporate Insolvency Proceedings

- Part 4: Specific Considerations for US Creditors

- Conclusion

As economic ties between the United States and Japan continue to strengthen, US companies increasingly engage in transactions with Japanese counterparties. While these relationships offer significant opportunities, they also carry inherent risks, particularly concerning payment defaults and potential insolvency. Navigating debt collection and bankruptcy processes in a foreign jurisdiction presents unique challenges due to differences in legal systems, business practices, and language. For US creditors, understanding the landscape of Japanese law in these areas is crucial for managing risk and maximizing recovery prospects.

This guide provides an overview of key considerations for US companies when dealing with debt collection and potential bankruptcy scenarios involving Japanese business partners, focusing on preventative strategies, actions upon default, and navigating Japan's formal insolvency procedures.

Part 1: Proactive Measures – Preventing Payment Issues

The most effective way to handle debt collection issues is to minimize the risk of default from the outset. Robust preventative measures are essential when engaging in cross-border transactions with Japanese entities.

1. Creditworthiness Assessment

Before extending significant credit, conduct thorough due diligence on your Japanese counterparty's financial health and reputation. Resources include:

- Official Government Sources: Japan's National Tax Agency provides a corporate number publication site, which can be a starting point. The Japan External Trade Organization (JETRO) may also offer resources for companies involved in international trade.

- Private Credit Reporting Agencies: Reputable Japanese agencies like Teikoku Databank and Tokyo Shoko Research provide detailed corporate information, including financial data and credit ratings. International agencies such as Coface and Creditsafe also operate in Japan and offer reports.

- Direct Inquiries: Request financial information and trade references directly from the potential counterparty as part of your onboarding process. Contacting their listed banks or other trading partners can provide valuable insights into their payment history and credit standing, a common practice in some Western business environments, though perhaps less customary in Japan.

- Publicly Available Information: Review the company's website, official corporate registry information (登記情報 - tōki jōhō), and, for listed companies, publicly disclosed financial reports.

Based on this investigation, establish appropriate credit limits and payment terms. Importantly, credit assessment should not be a one-time event. Regularly monitor existing customers for signs of financial distress, such as repeated payment delays or requests for modified terms, and update credit limits accordingly.

2. Robust Contract Drafting

A clear, comprehensive written contract is non-negotiable in international trade. It serves to prevent misunderstandings arising from different legal or commercial norms and provides essential evidence if disputes arise. Ideally, the US company should prepare the initial draft to incorporate favorable terms. Key provisions include:

- Precise Payment Terms: Specify the currency, exact due dates, method of payment, and any applicable interest for late payments.

- Governing Law: Explicitly state the law governing the contract. Be mindful of the potential automatic application of the UN Convention on Contracts for the International Sale of Goods (CISG) unless expressly excluded. Consult local counsel regarding the implications of choosing US vs. Japanese law.

- Dispute Resolution: This is critical. As discussed below, strongly consider an arbitration clause over agreeing to litigation in either US or Japanese courts.

- Retention of Title (if applicable): For sales of goods, consider including a clause retaining title until full payment is received, though enforceability under Japanese law requires careful consideration and specific perfection steps.

3. Securing Payment

The chosen payment method significantly impacts collection risk:

- Advance Payment: The most secure option for the seller, requiring payment before shipment. Often resisted by buyers. Partial advance payments can be a compromise.

- Letter of Credit (L/C): Offers high security as payment is guaranteed by a bank upon presentation of conforming documents. Reduces buyer credit risk significantly but involves bank fees and strict documentation requirements.

- Documents against Payment (D/P) / Documents against Acceptance (D/A): Less secure than L/C. In D/P, the buyer receives shipping documents (needed to claim goods) only upon paying the associated draft. In D/A, documents are released upon the buyer's acceptance of a time draft, meaning payment occurs later. Risk remains if the buyer defaults on payment (D/P) or acceptance/later payment (D/A).

- Open Account / Wire Transfer: Carries the highest risk for the seller, relying entirely on the buyer's willingness and ability to pay after shipment. Should only be used with highly trusted, creditworthy counterparties.

4. Collateral and Guarantees

While common in the US, requesting collateral (security interests over assets like inventory or receivables) or third-party guarantees may be less customary in standard Japanese commercial transactions and could face resistance. If obtained, ensure any security interest is valid and properly perfected under Japanese law (e.g., through registration systems for movable assets or claims) to be effective against third parties and in bankruptcy.

5. Dispute Resolution Clause: Arbitration vs. Litigation

This is a crucial strategic decision.

- Litigation: Agreeing to jurisdiction in Japanese courts means navigating a foreign legal system. Agreeing to US court jurisdiction creates significant enforcement challenges in Japan. There is no bilateral treaty ensuring reciprocal enforcement of court judgments between the US and Japan. Enforcing a US judgment in Japan requires filing a new lawsuit seeking an enforcement judgment (執行判決 - shikkō hanketsu) under Article 118 of the Code of Civil Procedure, which involves hurdles like confirming the US court's jurisdiction under Japanese standards, proper service, public policy checks, and reciprocity. Reciprocity is often difficult to establish, making enforcement of US judgments uncertain and complex.

- Arbitration: Both the US and Japan are signatories to the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards. This means arbitral awards rendered in one country are generally readily enforceable in the other, subject to limited exceptions. Including a well-drafted arbitration clause (specifying the seat of arbitration, applicable rules like JCAA, ICC, SIAC, AAA/ICDR, and language) is highly recommended for cross-border contracts with Japanese parties to ensure a more streamlined path to enforcement if disputes arise.

Part 2: Responding to Default (Pre-Insolvency)

If a Japanese counterparty defaults on payment before any formal insolvency proceedings begin:

- Initial Communication: Promptly contact the debtor via methods that create a record (email, formal letters) demanding payment and stating the basis for the claim. Follow up with phone calls or meetings if necessary, but always document these interactions (dates, participants, substance).

- Understand the Reason: Determine why payment hasn't been made. Is it a temporary cash flow issue, a dispute over the goods/services, or a sign of deeper financial trouble?

- Negotiation: If the debtor acknowledges the debt but faces temporary difficulty, consider negotiating a structured payment plan. Any agreement should be documented in writing, clearly stating amounts and revised due dates. Be wary of extending deadlines significantly without receiving partial payment or additional security.

- Engage Local Assistance: If initial demands are ignored or negotiations fail:

- Collection Agencies: While available in Japan, their effectiveness can vary, and they may lack the legal authority for more forceful measures.

- Japanese Counsel (Bengoshi): For significant debts or complex situations, retaining a Japanese lawyer experienced in commercial debt collection is usually necessary. They can assess the situation under Japanese law, send formal demands with legal weight, and advise on initiating formal proceedings.

- Formal Dispute Resolution: If negotiation and demands fail, initiate the agreed-upon dispute resolution mechanism – typically arbitration or, if no arbitration agreement exists, litigation in the appropriate Japanese court (or US court, bearing in mind the enforcement issues).

Part 3: Navigating Japanese Corporate Insolvency Proceedings

If a Japanese debtor enters formal insolvency proceedings, the landscape changes significantly. An automatic stay generally halts individual creditor collection efforts, and recovery typically occurs through participation in the collective process. Understanding the types of proceedings is key:

Types of Proceedings

Japan has several court-supervised corporate insolvency procedures:

- Bankruptcy (破産 - hasan): This is a liquidation proceeding, similar in objective to US Chapter 7. A court-appointed bankruptcy trustee (hasan kanzainin) takes control of the debtor's assets, liquidates them, and distributes the proceeds to creditors according to statutory priorities. The company ceases to exist afterward.

- Civil Rehabilitation (民事再生 - minji saisei): This is a reorganization proceeding where, typically, the debtor remains in possession (DIP) and continues operating under court supervision (though a supervisor is usually appointed, and in rare cases, a trustee). The goal is to create a rehabilitation plan to restructure debts (primarily unsecured) and continue the business. Secured creditors generally retain their rights to enforce their security outside the main proceedings unless they agree otherwise. It shares some features with US Chapter 11 but treats secured debt differently.

- Corporate Reorganization (会社更生 - kaisha kōsei): This is a more complex reorganization proceeding, often used for larger companies. A court-appointed trustee typically displaces management and takes control of the business and assets. Unlike Civil Rehabilitation, this procedure can restructure secured debt and equity interests alongside unsecured debt under the reorganization plan. It offers stronger protection for the debtor's business but is more intensive and costly.

- Special Liquidation (特別清算 - tokubetsu seisan): A simpler, often debtor-influenced liquidation process under the Companies Act, typically used for liquidating subsidiaries with the parent company's cooperation when there's no significant dispute among creditors.

Key Steps and Considerations for Creditors

- Automatic Stay: Upon commencement of most proceedings (hasan, minji saisei, kaisha kōsei), actions by creditors to collect pre-petition debts (lawsuits, enforcement, set-offs) are generally stayed.

- Filing Proof of Claim (債権届出 - saiken todokede): This is CRITICAL. To receive any distribution or participate in the process (e.g., vote on a plan), creditors must file a proof of claim with the court or trustee by the specified deadline. Failure to file on time usually results in losing the right to recovery. Deadlines can be relatively short (sometimes within weeks or a few months of commencement). Foreign creditors are typically notified but must act diligently.

- Treatment of Claims: Claims are generally categorized and paid according to statutory priority: secured claims (to the extent of collateral value, though treatment varies by procedure type), administrative expenses (costs of the proceeding itself), certain priority claims (like taxes and employee wages), and finally general unsecured claims. Unsecured creditors often receive only a small percentage of their claim value in liquidation, or restructured (reduced) payments under a reorganization plan.

- Executory Contracts: The trustee (in hasan, kaisha kōsei) or DIP (usually in minji saisei) generally has the right to either assume (continue) or reject ongoing contracts. If assumed, the debtor must cure defaults and perform future obligations. If rejected, the counterparty typically gets an unsecured claim for rejection damages.

- Local Counsel: Navigating the procedures, meeting deadlines, understanding Japanese documentation, and effectively asserting rights almost always requires retaining experienced Japanese insolvency counsel.

Part 4: Specific Considerations for US Creditors

Beyond the general framework, US creditors should be aware of:

- Language and Documentation: All filings and communications will generally be in Japanese. Supporting documentation (contracts, invoices) may need translation.

- Enforcement of Pre-Insolvency Rights: Security interests granted under US law might not be recognized or enforceable if not properly perfected under Japanese law before the insolvency filing.

- Set-Off: Rights of set-off against pre-petition mutual debts may be restricted or subject to avoidance after proceedings commence.

- US Bankruptcy Concepts vs. Japanese Law: US creditors should be cautious about assuming remedies available under the US Bankruptcy Code exist in Japan. Notably:

- "Critical Vendor" Payments: While US Chapter 11 allows court-approved payments of pre-petition claims to essential suppliers to ensure continued operations, Japanese law lacks a direct statutory equivalent. Ensuring payment for post-petition supply requires negotiation and potentially court approval, but automatic payment of pre-petition debts for "critical" status is not standard.

- Reclamation Rights / §503(b)(9) Claims: The US Bankruptcy Code provides specific rights for sellers to reclaim goods delivered shortly before bankruptcy (§546(c)) or assert an administrative priority claim for goods received within 20 days pre-petition (§503(b)(9)). Japanese law does not have these specific statutory rights. While a seller might have certain rights over goods in transit under specific circumstances, there is no general right to reclaim goods already delivered to an insolvent debtor based solely on the timing of delivery, nor an automatic administrative priority for recent deliveries. Recovery for delivered goods typically falls under a general unsecured claim unless secured or subject to a valid retention of title clause.

Conclusion

Successfully managing credit risk and recovering debts from Japanese counterparties requires a proactive and informed approach. Preventative measures, including thorough credit checks, carefully drafted contracts with appropriate governing law and dispute resolution clauses (preferably arbitration), and secure payment methods, are paramount. Should default occur, prompt communication, negotiation, and engagement with local legal counsel are key. If the debtor enters formal insolvency proceedings in Japan, understanding the different procedures (hasan, minji saisei, kaisha kōsei), diligently filing a proof of claim by the deadline, and navigating the process with local expertise are essential for maximizing potential recovery. While Japanese law provides a structured framework for dealing with insolvency, US creditors must be aware that it differs significantly from US bankruptcy law, particularly regarding certain creditor protections and remedies common in the US.

- What Types of Supervisory Actions Can Be Taken Against Non-Compliant Japanese Servicers?

- Director Liability and Corporate Donations in Japan: Balancing Philanthropy and Fiduciary Duty

- Debt Collection and Bankruptcy in Japan: A Guide for US Creditors

- JETRO – Credit Management & Debt Collection in Japan (Guide)

- Ministry of Justice – Overview of Bankruptcy and Rehabilitation Procedures