Director Retirement Bonuses in Japan: When Can Boards Cut the Payout?

TL;DR

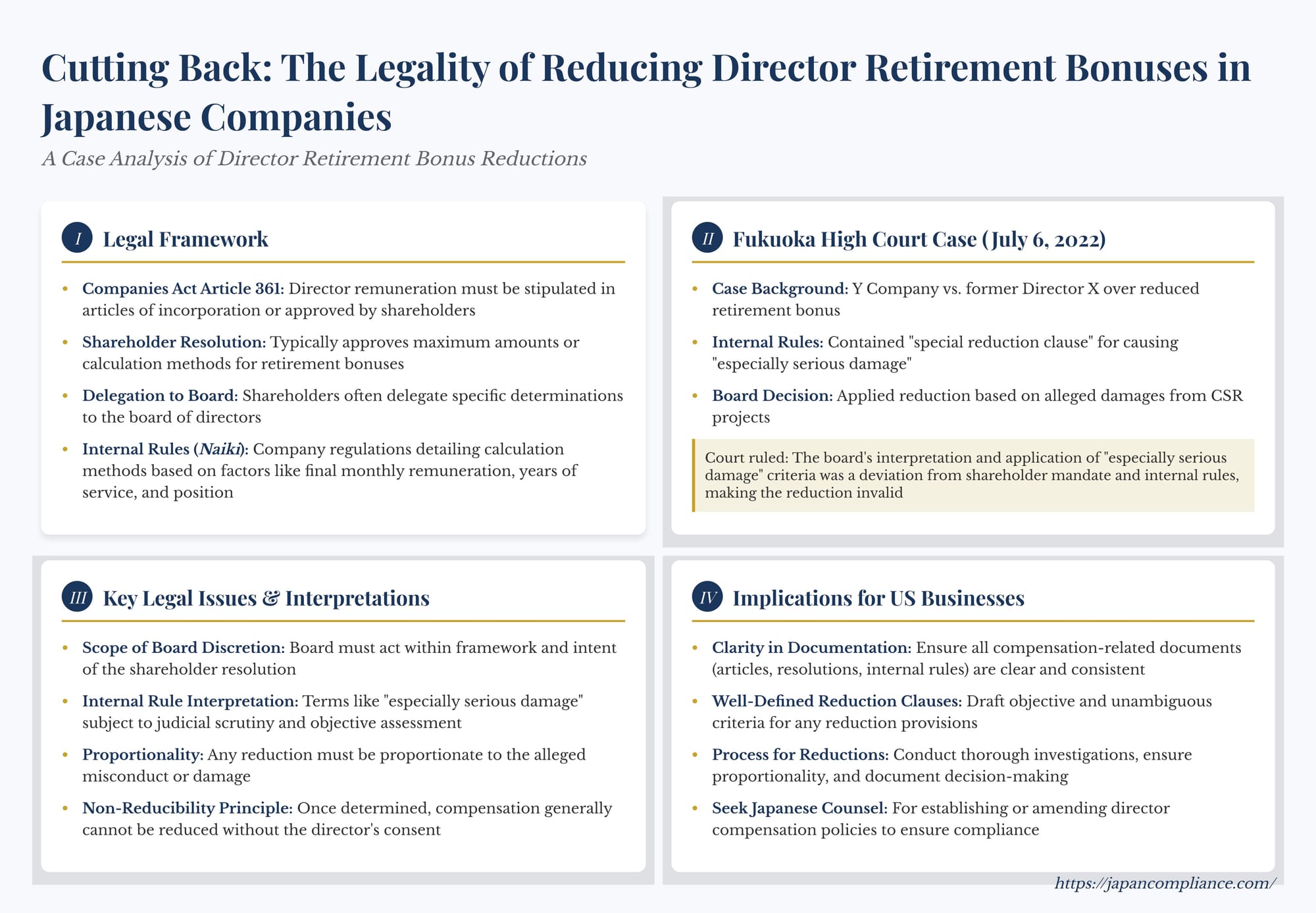

Japanese boards may trim a director’s retirement bonus only within shareholder-approved parameters and company rules. A 2022 Fukuoka High Court case voided a drastic cut because the board mis-applied its “special reduction” clause; later Supreme Court guidance (2024) confirms boards need clear rules and solid evidence before slashing payouts.

Table of Contents

- The Legal Framework for Director Retirement Bonuses

- The Fukuoka High Court (Miyazaki Branch) Case: July 6 2022

- Key Legal Issues and Interpretations

- Primacy of Shareholder Resolution and Board Discretion

- Interpreting Special Reduction Clauses

- Subsequent Shareholder Actions

- Non-Reducibility Principle and Its Limits

- Misconduct & Clawback Considerations

- Implications for U.S. Businesses with Operations in Japan

- Conclusion

Retirement allowances or bonuses for directors (yakuin taishoku irōkin) are a common feature of executive compensation in many Japanese companies. These payments, often substantial, are generally considered deferred compensation for services rendered during a director's tenure. However, situations can arise where a company, through its board of directors, decides to reduce a previously anticipated or internally calculated retirement bonus amount. This raises complex legal questions about the authority of the board, the rights of the director, and the proper interpretation of shareholder mandates and internal company rules.

A judgment by the Fukuoka High Court, Miyazaki Branch, on July 6, 2022 (Reiwa 4), sheds light on these issues, particularly concerning the scope of discretion afforded to a board of directors when reducing such payments, especially in circumstances involving alleged damage caused by the retiring director. While a subsequent Supreme Court decision on July 8, 2024, in a related case (concerning a different company but similar issues of retirement bonus reduction for a former president) ultimately found in favor of the company, emphasizing broader board discretion based on internal rules and a thorough investigation, the High Court case provides a useful framework for understanding the interplay of shareholder resolutions, board authority, and internal company regulations.

This article analyzes the legal principles surrounding the reduction of director retirement bonuses in Japan, drawing insights from the Fukuoka High Court (Miyazaki Branch) July 6, 2022 decision.

The Legal Framework for Director Retirement Bonuses

Under Japan's Companies Act (Kaisha Hō), the remuneration of directors, which includes retirement allowances, must generally be stipulated in the articles of incorporation or approved by a resolution of a shareholders' meeting (Article 361). This requirement is primarily to prevent directors from arbitrarily setting their own excessive compensation ("self-dealing").

- Shareholder Resolution as the Starting Point: Typically, shareholders will approve a total maximum amount for director retirement bonuses, or a specific calculation method. They may also delegate the authority to the board of directors (or, in some cases, to a compensation committee or representative director, depending on the company's governance structure) to determine the specific amounts for individual directors, the timing of payment, and the method of payment, within the shareholder-approved framework.

- Internal Company Rules (Naiki): Many companies establish internal rules or regulations (naiki) that detail the calculation method for retirement bonuses. These rules often base the bonus on factors such as the director's final monthly remuneration, years of service, and a multiplier based on their position (e.g., president, managing director). These internal rules, while not overriding shareholder resolutions, provide a more concrete basis for calculating expected retirement allowances.

- Board of Directors' Role: When authority is delegated by shareholders, the board of directors (or its delegee) makes the final determination of the specific retirement bonus for a departing director. This decision must be made within the scope of the authority granted by the shareholder resolution and in accordance with any applicable internal rules.

The Fukuoka High Court (Miyazaki Branch) Case: July 6, 2022

The case before the Fukuoka High Court, Miyazaki Branch, involved a company (referred to as "Y Company") and its former representative director and president ("Director X").

- Background: Y Company had internal rules for calculating director retirement bonuses. These rules included a "special reduction clause" (tokubetsu gengaku jōkō) allowing for a reduction in the bonus amount if a retiring director had caused "especially serious damage" (toku ni jūdai na songai) to the company during their tenure.

- The Dispute: Upon Director X's resignation, the company's board of directors, citing alleged damages caused by Director X (related to expenditures on certain corporate social responsibility (CSR) projects), resolved to significantly reduce his retirement bonus from the amount calculated under the standard internal rules. This reduction was based on a report by an investigation committee. Director X sued, claiming the full, unreduced amount.

- Shareholder Resolution: A key element was a prior shareholder resolution that approved the payment of retirement bonuses to Director X and another director "in accordance with Y Company's established standards, within a reasonable amount," and delegated the determination of the specific amount, timing, and method to the board of directors. During that shareholder meeting, Director X, acting as chairman, had stated that while the other retiring director's bonus would be paid according to the internal rules, his own would be determined by the board after a neutral investigation, and he would abide by that decision.

- Lower Court (Miyazaki District Court): The district court found in favor of Director X. It ruled that the shareholder resolution intended for the board to apply the company's internal rules appropriately. It concluded that the CSR-related expenditures did not constitute "especially serious damage" as envisioned by the special reduction clause, and therefore, the board's decision to make a substantial reduction based on these expenditures was an abuse or deviation from the discretion granted by the shareholders.

- Fukuoka High Court (Miyazaki Branch) Decision (July 6, 2022): The High Court upheld the district court's decision, dismissing Y Company's appeal. The High Court affirmed that the shareholder resolution's intent was for the board to apply the internal rules, including the special reduction clause, in a proper manner. It agreed that the board's interpretation and application of the "especially serious damage" criteria in this instance, leading to the drastic reduction, was a deviation from the shareholder mandate. The court emphasized that Director X's statements at the shareholder meeting about accepting the board's decision after an investigation did not alter the fundamental requirement that the board act within the parameters of the internal rules as intended by the shareholder resolution.

Key Legal Issues and Interpretations

The Fukuoka High Court (Miyazaki Branch) decision highlights several important legal considerations:

1. Primacy of Shareholder Resolution and Scope of Board Discretion:

The case underscores the principle that the board of directors, even when delegated authority to determine specific retirement bonus amounts, must act within the framework and intent of the overarching shareholder resolution. If the shareholder resolution refers to "established standards" or internal rules, the board's discretion is not unfettered. It must interpret and apply those standards and rules reasonably and in good faith.

The High Court found that Director X's general agreement to accept a board-determined amount post-investigation did not grant the board unlimited power to deviate from the substantive criteria laid out in the company's internal rules, which the shareholders had implicitly endorsed by referencing "established standards."

2. Interpretation of Internal Rules and "Special Reduction Clauses":

Internal company rules regarding retirement bonuses, especially clauses allowing for reduction due to misconduct or damage, are subject to judicial scrutiny. The interpretation of terms like "especially serious damage" is critical.

- Objective Assessment: Courts will likely assess whether the director's actions objectively meet the criteria for reduction as defined in the internal rules. A mere disagreement by the board with past business decisions, if those decisions were made in good faith and within the bounds of reasonable business judgment, might not suffice for a "special reduction," unless clear and substantial harm directly attributable to culpable conduct is demonstrated.

- Proportionality: Even if some grounds for reduction exist, the extent of the reduction must be proportionate to the alleged misconduct or damage. A disproportionately large reduction might be viewed as punitive rather than a fair application of the rules, potentially constituting an abuse of discretion.

3. Subsequent Shareholder Actions:

In the Fukuoka High Court case, Y Company argued that subsequent shareholder resolutions – one approving financial statements that included the reduced payment to Director X, and another (after litigation began) confirming that the board's decision was appropriate and within its discretion – should validate the board's initial action.

The High Court, however, was not persuaded that these later shareholder actions could retroactively alter the interpretation or cure a flaw in the board's original exercise of delegated authority if that original action was itself a deviation from the initial shareholder mandate. This suggests that while subsequent shareholder ratification can be relevant in some contexts, it may not automatically legitimize a board decision that was ab initio flawed in its application of delegated powers concerning director compensation already subject to specific internal standards.

4. The Principle of Non-Reducibility of Determined Compensation (and its Limits):

A long-standing principle in Japanese case law (stemming from a Supreme Court decision on December 18, 1992, Minshū Vol. 46, No. 9, p. 3006) holds that once a director's remuneration (including, by extension, a retirement allowance if its calculation basis is clearly determined) is fixed, it cannot generally be reduced by a subsequent shareholder resolution without the director's consent.

The commentary surrounding the Fukuoka High Court case (and the later Supreme Court case) touches upon this principle. While the 1992 Supreme Court case dealt with ongoing remuneration, its spirit can influence discussions about vested or clearly calculable retirement benefits. The key question in reduction cases often becomes whether the retirement bonus was already "determined" in a way that created a right for the director, or whether the board still retained legitimate discretion to modify it based on specific conditions (like a special reduction clause).

If a company's internal rules provide a clear formula for calculating a retirement bonus, and a shareholder resolution approves payments based on these rules, there's a strong argument that the director has a legitimate expectation to receive that amount, barring clear grounds for reduction under a specific, validly invoked clause.

5. Director Misconduct and "Clawback" Considerations:

The discussion around "special reduction clauses" for causing "especially serious damage" brings to mind the concept of "clawback provisions," which are more formally developed in some other jurisdictions. While Japan does not have a widespread statutory framework for clawbacks of executive compensation in the same way as, for example, the U.S. post-financial crisis, the idea of recouping or reducing compensation due to severe misconduct or causing significant harm to the company is present.

The special reduction clause in Y Company's internal rules can be seen as a form of company-specific, pre-agreed mechanism that functions similarly to a clawback, allowing the company to adjust a final payment based on adverse events or director failings. The legal challenge then revolves around whether the conditions for triggering such a clause have been met and whether the process of determination was fair and reasonable.

If a director's actions amount to a breach of their duty of care or loyalty, potentially leading to grounds for dismissal with cause (under Article 339, Paragraph 2 of the Companies Act, which would negate the right to claim damages for dismissal), the company's ability to reduce or deny a retirement bonus, even one based on internal rules, would likely be strengthened. The commentary on the Fukuoka case suggests that if Director X's actions in the CSR-related expenditures had indeed constituted serious misconduct or a breach of duty leading to significant, demonstrable damage, the argument for a substantial reduction under the internal rules might have been viewed more favorably by the courts.

Implications for U.S. Businesses with Operations in Japan

The intricacies of Japanese company law regarding director compensation and retirement bonuses have several implications for U.S. companies with subsidiaries or significant operations in Japan:

- Clarity in Compensation Structures: Ensure that articles of incorporation, shareholder resolutions, board resolutions, and internal company rules regarding director compensation (including retirement allowances) are clear, consistent, and meticulously documented.

- Well-Defined Internal Rules: If internal rules for calculating retirement bonuses are in place, they should be carefully drafted, particularly any clauses allowing for reduction or forfeiture (e.g., for misconduct, causing damage to the company). The criteria for triggering such clauses should be as objective and unambiguous as possible.

- Scope of Delegated Authority: When shareholder resolutions delegate authority to the board to determine retirement bonuses, the scope and limits of that discretion should be clearly understood and respected. If the delegation refers to existing internal rules, those rules generally must be followed.

- Process for Reduction Decisions: If a company contemplates reducing a director's retirement bonus based on a special reduction clause, it is crucial to:

- Conduct a thorough, fair, and objective investigation into the alleged misconduct or damage.

- Ensure that the facts clearly meet the criteria stipulated in the internal rules.

- Document the decision-making process meticulously, including the board's reasoning.

- Consider the proportionality of any proposed reduction.

- Director Consent for Reductions: Be mindful of the principle that determined compensation generally cannot be reduced without the director's consent, unless there are clear contractual or internal rule-based grounds for such reduction that are validly invoked (e.g., proven gross misconduct directly linked to a specific reduction clause).

- Legal Counsel: Seek advice from Japanese legal counsel when establishing or amending director compensation policies, particularly concerning retirement allowances and any provisions for reduction or forfeiture, to ensure compliance with the Companies Act and relevant case law.

Conclusion

The determination and payment of director retirement bonuses in Japanese companies operate within a framework defined by the Companies Act, shareholder resolutions, board discretion, and internal company rules. As illustrated by cases like the Fukuoka High Court (Miyazaki Branch) decision of July 6, 2022, while boards may be delegated authority to finalize these payments, their discretion is not absolute and must be exercised in accordance with the shareholder mandate and applicable internal standards.

Reductions to anticipated retirement bonuses, especially those based on discretionary clauses related to director misconduct or damage caused to the company, will be closely scrutinized by courts. A clear basis in shareholder-approved frameworks, fair and objective application of internal rules, and demonstrable justification for any significant deviation from standard calculations are essential to withstand legal challenges. For U.S. companies, a thorough understanding of these principles is vital for sound corporate governance and managing executive compensation effectively in their Japanese operations. While the later Supreme Court ruling of July 8, 2024, in a different but related context, affirmed broader board discretion when internal rules and proper investigative procedures are followed, the underlying need for decisions to be justifiable and within the scope of shareholder delegation remains a constant.