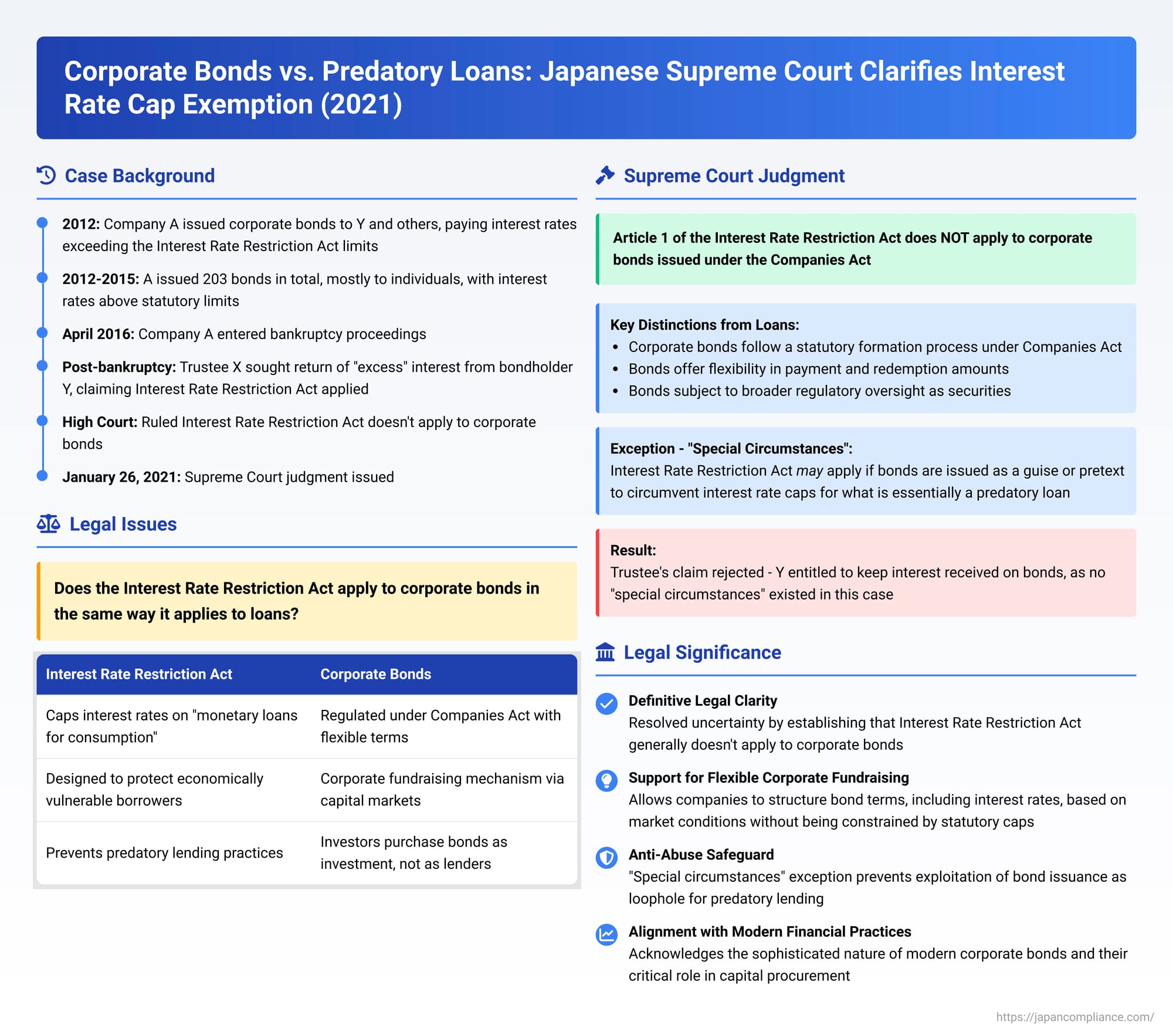

Corporate Bonds vs. Predatory Loans: Japanese Supreme Court Clarifies Interest Rate Cap Exemption

Date of Judgment: January 26, 2021

Court: Supreme Court of Japan, Third Petty Bench

Introduction

Japan's Interest Rate Restriction Act (利息制限法 - Risoku Seigen Hō) plays a crucial role in consumer and borrower protection by imposing statutory caps on interest rates for monetary loans. Its primary aim is to prevent lenders from charging excessively high interest, particularly to those in vulnerable economic positions. However, a significant question lingered in Japanese financial law: Does this Act, designed primarily for traditional lending, also apply to the interest paid on corporate bonds (社債 - shasai) issued by companies to raise capital from investors?

This area of uncertainty was addressed by the Third Petty Bench of the Supreme Court of Japan in a landmark decision on January 26, 2021, providing much-needed clarity on the relationship between corporate bond financing and statutory interest rate limitations.

The Legal Landscape: Interest Rate Restriction Act and Corporate Bonds

- The Interest Rate Restriction Act: This Act sets maximum permissible interest rates for "monetary loans for consumption" (金銭を目的とする消費貸借 - kinsen o mokuteki to suru shōhi taishaku). Interest charged above these statutory limits is generally void, and any payments made towards such excess interest can often be reallocated to the principal loan amount, potentially leading to claims for unjust enrichment if the principal is overpaid. The core purpose of the Act is to shield debtors, especially those who are economically weaker, from the hardship of usurious interest rates.

- Corporate Bonds (Shasai): Under Japan's Companies Act, corporate bonds are a vital instrument for companies to raise funds directly from the capital markets. Companies issue these debt securities to investors, promising to repay the principal at a future maturity date and typically making periodic interest payments (coupons). The terms of these bonds, including interest rates, are set out in "offering particulars" (募集事項 - boshū jikō) determined by the issuing company.

The question was whether the interest payable on these corporate bonds should be considered "interest on a monetary loan" for the purposes of the Interest Rate Restriction Act, thereby subjecting it to the statutory caps.

The Case of A Company (C Co.) and Bondholder Y

The case brought before the Supreme Court involved A Company (referred to as C Co. in the judgment text), which had issued corporate bonds, and one of its bondholders, Y.

- A Company, engaged in developing investment systems, issued corporate bonds to raise necessary funds.

- Y subscribed to these bonds, paying the required amount (20 million yen in 2012) as per the bond's offering particulars. Over the subsequent years until 2015, Y received regular interest payments from A Company. These interest payments were made at rates that exceeded the maximum levels permitted by Article 1 of the Interest Rate Restriction Act. Y also received redemption payments for the bonds.

- Between 2012 and 2015, A Company had made numerous such bond issuances (203 in total, including those to Y), mostly to individual bondholders, and the vast majority of these bonds carried interest rates that were above the limits prescribed by the Interest Rate Restriction Act.

- A Company subsequently entered bankruptcy proceedings in April 2016.

- The bankruptcy trustee for A Company (X) filed a lawsuit against Y. X argued that the interest Y had received in excess of the statutory limits under the Interest Rate Restriction Act was unlawful. X claimed that these excess interest payments should be reallocated to the principal amount of the bonds. Doing so, X alleged, would reveal that Y had effectively been overpaid, and X sought the return of this overpayment (過払金 - kabaraikin) as unjust enrichment.

- The High Court had previously ruled against the bankruptcy trustee, holding that Article 1 of the Interest Rate Restriction Act does not apply to corporate bonds, and therefore Y was entitled to keep the interest received.

The bankruptcy trustee appealed this decision to the Supreme Court.

The Supreme Court's Decision (January 26, 2021)

The Supreme Court, in a unanimous decision, upheld the High Court's conclusion and dismissed the bankruptcy trustee's appeal. The Court laid out a detailed reasoning for why corporate bonds are generally not subject to the Interest Rate Restriction Act.

Acknowledging Similarities and Key Differences Between Bonds and Loans

The Court began by noting that corporate bonds do share some superficial similarities with ordinary monetary loans: an investor (lender) provides funds to the company (borrower), and the company repays the principal at maturity, often with periodic interest payments.

However, the Supreme Court emphasized several crucial distinctions:

- Statutory Formation Process: The issuance of corporate bonds is governed by a detailed and specific statutory process outlined in the Companies Act. This involves the company defining "offering particulars" (including the bond amount, interest rate, redemption date, etc.), formally soliciting subscribers, processing applications, and making allotments. This is a more structured and regulated process than typical private loan agreements.

- Flexibility in Terms: Unlike many standard loans where the amount borrowed is the amount repaid (plus interest), the Companies Act allows for flexibility in bond terms. For instance, the "payment amount" (the sum paid by the investor at issuance) and the "amount of the solicited bond" (the face value to be repaid at maturity) do not have to be identical. It is legally permissible for the redemption amount to be set lower than the initial payment amount (e.g., in the case of certain structured bonds or zero-coupon bonds issued at a significant discount).

- Broader Regulatory Oversight: Corporate bonds are typically classified as "securities" under Japan's Financial Instruments and Exchange Act. This means their issuance and trading are subject to an additional layer of regulation aimed at ensuring market fairness, transparency, and investor protection.

Purpose of the Interest Rate Restriction Act Not Directly Applicable to Bonds

The Supreme Court then focused on the underlying purpose of the Interest Rate Restriction Act. It reiterated that while parties are generally free to contract for any interest rate, the Act imposes restrictions primarily to prevent predatory lending practices that exploit the financial distress of economically weaker debtors.

The Court reasoned that this primary protective purpose does not directly apply to the context of corporate bond issuances:

- Companies typically issue bonds as a strategic management decision to raise necessary business funds, taking into account their operational needs, overall funding scale, creditworthiness, and prevailing market conditions. They are generally not in the position of distressed, economically weak individuals that the Act primarily seeks to protect.

- The Court also noted that modern corporate finance involves a wide variety of sophisticated bond structures and designs, playing a crucial role in ensuring companies have access to diverse and flexible funding sources. Applying the rigid interest rate caps of the Act to all such bonds could stifle financial innovation and hinder the smooth operation of capital markets, which would run contrary to the Companies Act's intention of facilitating corporate fundraising through the bond system.

The Crucial Holding: General Inapplicability of the Act to Corporate Bonds

Based on these considerations, the Supreme Court concluded as a general rule: Article 1 of the Interest Rate Restriction Act does not apply to corporate bonds.

The "Special Circumstances" Exception – A Safeguard Against Abuse

While establishing this general rule of inapplicability, the Supreme Court astutely carved out an important exception to prevent abuse. The Court stated that the Interest Rate Restriction Act could still apply to a transaction structured as a bond issuance if "special circumstances" (特段の事情 - tokudan no jijō) exist. Such circumstances would arise if:

- A creditor, when essentially providing a loan to a company, instigates the company to issue bonds merely as a guise or pretext to secure an unfairly high interest rate that would otherwise be illegal under the Act.

- The overall purpose of the bond issuance, the specific content of its offering particulars, or the process by which those terms were decided, clearly indicate a deliberate intention to circumvent or evade the regulations of the Interest Rate Restriction Act.

In such cases where the bond issuance framework is misused to disguise what is effectively a predatory loan, the Supreme Court indicated that the protective rationale of the Interest Rate Restriction Act would indeed become relevant, and its provisions could be applied.

Application to A Company's Bonds

In the specific case of A Company and bondholder Y, the Supreme Court found no evidence of such "special circumstances" that would suggest the bond issuance was a sham designed to evade interest rate caps. Therefore, it concluded that the Interest Rate Restriction Act did not apply to the bonds held by Y.

Outcome: The Supreme Court dismissed the bankruptcy trustee's appeal, thereby upholding the High Court's conclusion that Y was entitled to the interest paid, and the trustee's claim for recovery of "excess" interest was unfounded.

Significance of the Ruling

This 2021 Supreme Court decision is a landmark for corporate finance and law in Japan:

- Definitive Legal Clarity: It provides clear and authoritative guidance from Japan's highest court, resolving previous uncertainty by establishing that the Interest Rate Restriction Act generally does not apply to standard corporate bonds issued under the Companies Act.

- Support for Flexible Corporate Fundraising: The ruling is seen as supportive of the flexibility companies need in the bond market. It allows them to structure bond terms, including interest rates, based on prevailing market conditions, their credit risk, and specific funding requirements, without being unduly constrained by the Act's caps, provided the issuance is bona fide.

- The "Special Circumstances" Safeguard: The carefully articulated exception for "special circumstances" is crucial. It acts as an important anti-abuse provision, ensuring that the bond issuance framework cannot be exploited as a loophole for what are essentially predatory loans disguised as bond financing. This requires an examination of the substance and intent behind a transaction, not just its form.

- Alignment with Modern Financial Practices: The decision acknowledges the sophisticated and diverse nature of modern corporate bonds and their critical role in corporate capital procurement.

Conclusion

The 2021 Supreme Court decision offers significant clarification for the Japanese financial market. It establishes that corporate bonds, as distinct financial instruments regulated under the Companies Act and the Financial Instruments and Exchange Act, are generally exempt from the interest rate ceilings imposed by the Interest Rate Restriction Act. This approach provides greater certainty and flexibility for companies utilizing the bond market for legitimate fundraising purposes. Simultaneously, the "special circumstances" exception ensures that the protective aims of the Interest Rate Restriction Act are not undermined by attempts to use the bond issuance mechanism as a pretext for usurious lending. The judgment reflects a carefully balanced approach, recognizing the unique characteristics of corporate bond financing while maintaining safeguards against potential abuses.