Clearing the Deck: Japanese Supreme Court Affirms Set-Off Rights Against Corporate Bonds

Date of Judgment: February 21, 2003

Court: Supreme Court of Japan, Second Petty Bench

Introduction

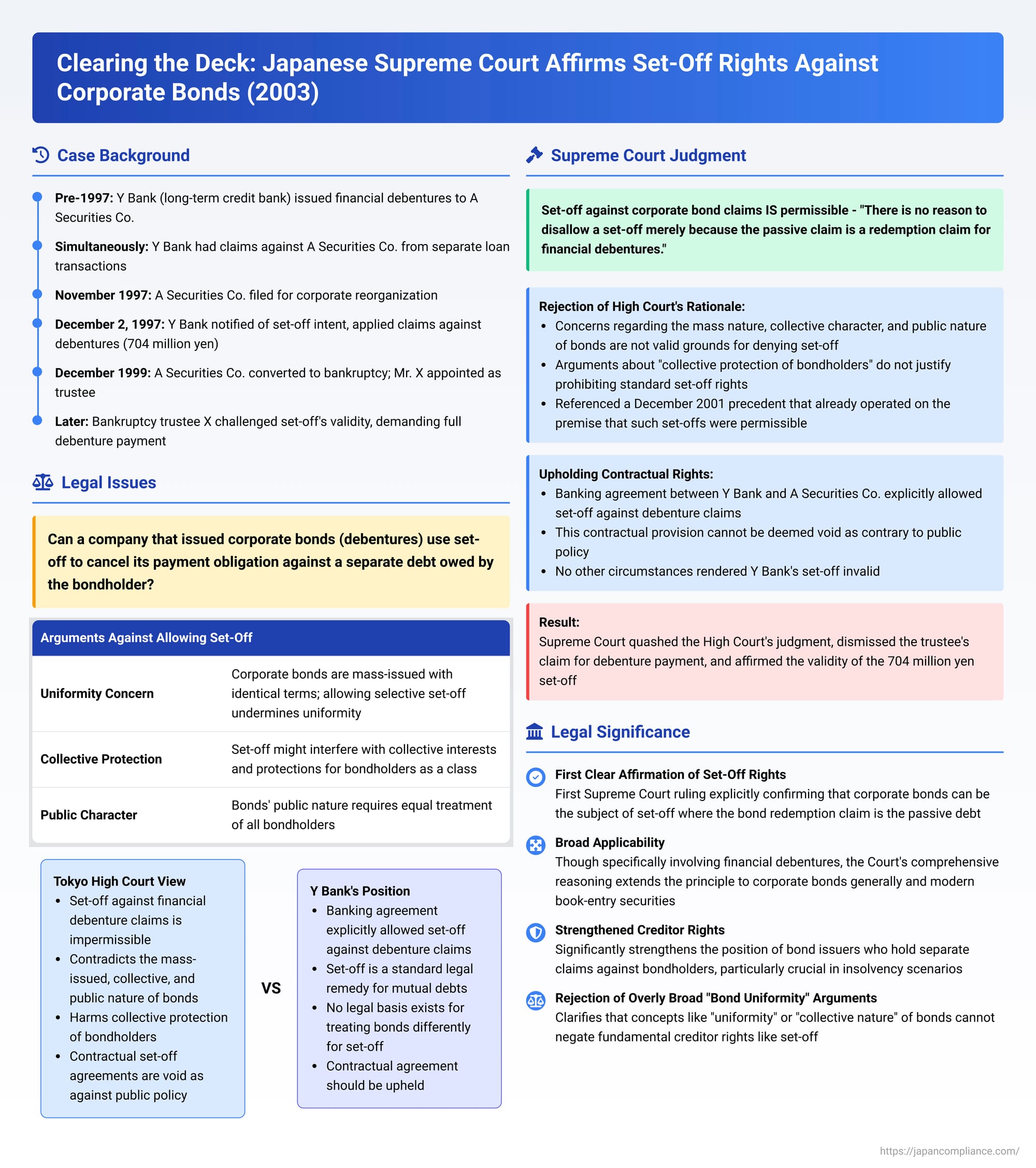

The legal mechanism of "set-off" (相殺 - sōsai) allows two parties who owe debts to each other to cancel out their mutual obligations up to the amount of the smaller debt. It's a common and efficient way to settle accounts. However, a significant legal question arose in Japan concerning corporate bonds: Can a company that has issued bonds, and also happens to be a creditor to one of its bondholders for a separate debt, use its claim against that bondholder to offset (set off) its own obligation to pay the bondholder when the bond matures or when interest payments are due?

This issue became particularly pertinent when the bondholding entity faced insolvency. The Tokyo High Court had previously ruled against such set-offs involving corporate bonds, citing concerns about the unique nature of these instruments. However, the Supreme Court of Japan, in its decision on February 21, 2003, provided a definitive clarification, affirming the general permissibility of such set-offs.

The Nature of Corporate Bonds and Set-Off Concerns

Corporate bonds, including "financial debentures" (金融債 - kin'yūsai, a specific type issued by certain financial institutions under special laws), are debt securities issued by companies to raise capital. They represent a promise by the issuer to repay principal at a specified maturity date and usually to make periodic interest payments.

The debate over allowing set-off where a corporate bond obligation was the "passive claim" (受働債権 - judō saiken, i.e., the debt owed by the party wishing to exercise the set-off) stemmed from several arguments raised, particularly by the lower court in this case:

- Uniformity and Mass Nature of Bonds: It was argued that corporate bonds are issued en masse, often to the public, with identical terms for each bond within a series. Allowing an issuer to set off its claims against only some bondholders (those who also happened to be debtors to the issuer) could be seen as creating a situation where one bond is treated differently from another, thereby undermining the principle of uniformity inherent in mass-issued securities.

- Collectivity and Public Character: Bonds are often held by a diverse group of investors. The argument was that allowing individual set-offs might interfere with the collective interests and protections afforded to bondholders as a class, especially in situations like the issuer's or bondholder's insolvency.

The Case of Y Bank and A Securities Co.

The specific case before the Supreme Court involved Y Bank (a long-term credit bank that had issued financial debentures) and A Securities Co. (which held some of these debentures and later went bankrupt).

- The Debts: A Securities Co. was a registered holder of financial debentures issued by Y Bank. Simultaneously, Y Bank had significant claims against A Securities Co., arising from separate loan transactions and guarantee obligations.

- The Banking Agreement: Y Bank and A Securities Co. had a longstanding general banking transaction agreement. This agreement contained a clause stipulating that if A Securities Co. defaulted on its obligations to Y Bank (for example, by entering corporate reorganization proceedings or bankruptcy), Y Bank had the right to set off any debts owed by A Securities Co. against any deposits or other claims (like matured bonds) that A Securities Co. held against Y Bank.

- Insolvency and Set-Off: A Securities Co. filed for corporate reorganization in November 1997, which was later converted to bankruptcy in December 1999. Mr. X was appointed as the bankruptcy trustee for A Securities Co.

- Y Bank's Action: On December 2, 1997 (after A Securities Co. had filed for reorganization), Y Bank formally notified A Securities Co.'s then-conservator of its intention to exercise its right of set-off. Y Bank set off a portion of its large claims against A Securities Co. against the full amount of principal and accrued unpaid interest then due on the financial debentures held by A Securities Co. (totaling approximately 704 million yen).

- The Trustee's Lawsuit: The bankruptcy trustee (X) for A Securities Co. challenged the validity of this set-off. The trustee filed a lawsuit against Y Bank, primarily demanding full payment of the redemption principal and interest on the financial debentures, arguing that the set-off was illegal.

- The Tokyo High Court's Ruling: The Tokyo High Court sided with the bankruptcy trustee. It ruled that set-off using financial debenture redemption claims as the passive claim was impermissible, regardless of whether the bonds had reached their maturity date. The High Court reasoned that allowing such set-offs would contradict the mass-issued, collective, and public nature of bonds and would ultimately harm the collective protection of bondholders. It further stated that any contractual agreement permitting such a set-off by the issuer would be void as against public policy.

Y Bank appealed this adverse decision to the Supreme Court.

The Supreme Court's Decision (February 21, 2003)

The Supreme Court, in a unanimous decision, overturned the Tokyo High Court's ruling and affirmed the validity of Y Bank's set-off.

Direct Rejection of the High Court's Rationale

The Supreme Court directly addressed and rejected the High Court's reasoning:

"There is no reason to disallow a set-off merely because the passive claim (the debt owed by the party seeking set-off) is a redemption claim for financial debentures."

Reliance on Recent Precedent

In its reasoning, the Supreme Court referenced one of its own very recent decisions (from December 18, 2001). In that earlier case, while dealing with a slightly different procedural point (whether physical possession of bond certificates was necessary to effect a set-off), the Court had operated on the underlying premise that set-off against financial debenture claims was generally permissible.

Grounds Cited by High Court for Denying Set-Off Were Unfounded

The Supreme Court explicitly stated that the reasons provided by the High Court for disallowing set-off when the passive claim is a financial debenture redemption claim—namely, concerns regarding the mass nature, collective character, public nature of bonds, or the collective protection of bondholders—"cannot be considered valid grounds for denying set-off."

Validity of Contractual Set-Off Agreements

Flowing from this, the Supreme Court concluded that the provision within the general banking transaction agreement between Y Bank and A Securities Co., which expressly allowed Y Bank to set off its claims against financial debenture redemption claims held by A Securities Co., could not be deemed void as being contrary to public policy. The Court found no other circumstances that would render Y Bank's set-off invalid.

Set-Off Upheld as Valid

Therefore, the Supreme Court held that Y Bank's set-off was valid. This meant that Y Bank's obligation to pay A Securities Co. on the financial debentures was legitimately extinguished (up to the equivalent amount of Y Bank's claims against A Securities Co.).

Outcome: The High Court's judgment, which had ordered Y Bank to pay the bankruptcy trustee the full amount of the debentures, was quashed by the Supreme Court. The trustee's primary claim for payment on the debentures was dismissed, and the trustee's appeal regarding an alternative claim (for tort damages, if the set-off was invalid but had made the bonds unmarketable) was also dismissed as the set-off was found to be lawful.

Significance and Implications

This 2003 Supreme Court decision was a landmark for Japanese commercial and bankruptcy law:

- First Clear Supreme Court Affirmation of Set-Off Against Bonds: It was the first time the Supreme Court explicitly and directly affirmed that corporate bonds (specifically financial debentures in this instance, but with broader implications) can be the subject of a set-off where the bond redemption or interest claim constitutes the passive debt.

- Broad Scope of Application: As noted by legal commentators, although the case specifically involved "financial debentures," the Supreme Court's comprehensive refutation of the High Court's general reasoning—which had been framed in terms of "corporate bonds" broadly—indicates that the principles of this ruling extend to corporate bonds in general, not just the particular type of financial debentures at issue.

- Relevance to Modern Bond Forms: The underlying principles are also considered applicable to contemporary forms of debt securities, including book-entry corporate bonds which do not involve physical certificates.

- Strengthening Creditor Rights (for Issuers with Cross-Claims): The decision significantly strengthens the legal position of bond issuers (such as banks or other corporations) who also hold separate financial claims against their bondholders. It confirms their ability to utilize the powerful remedy of set-off, which is particularly crucial for mitigating losses when a bondholder becomes insolvent.

- Rejection of Overly Broad "Bond Uniformity" Arguments: The ruling implicitly critiques an overly expansive interpretation of concepts like the "uniformity" or "collective nature" of bonds if such concepts are used to negate fundamental creditor rights like set-off. While bonds certainly possess collective features and are often issued on standardized terms, they remain, at their core, bilateral debt obligations between an issuer and each individual holder.

Conclusion

The February 21, 2003, Supreme Court decision provided crucial legal certainty in Japan by unequivocally confirming that financial debentures (and by strong implication, corporate bonds generally) held by a debtor can be used by the issuing institution as the passive claim in a set-off against debts owed by that bondholder to the issuer. The Court firmly dismissed arguments that the inherent characteristics of bonds, such as their mass issuance or collective nature for investor protection, should preclude the application of the standard legal remedy of set-off. This ruling reinforces the contractual nature of bond obligations and supports the use of set-off as a legitimate and effective means of settling mutual debts, even when one of those debts is a claim on a corporate bond.